OSI Systems Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OSI Systems Bundle

What is included in the product

Tailored exclusively for OSI Systems, analyzing its position within its competitive landscape.

Instantly highlight threats & opportunities with dynamic force-level visual aids.

What You See Is What You Get

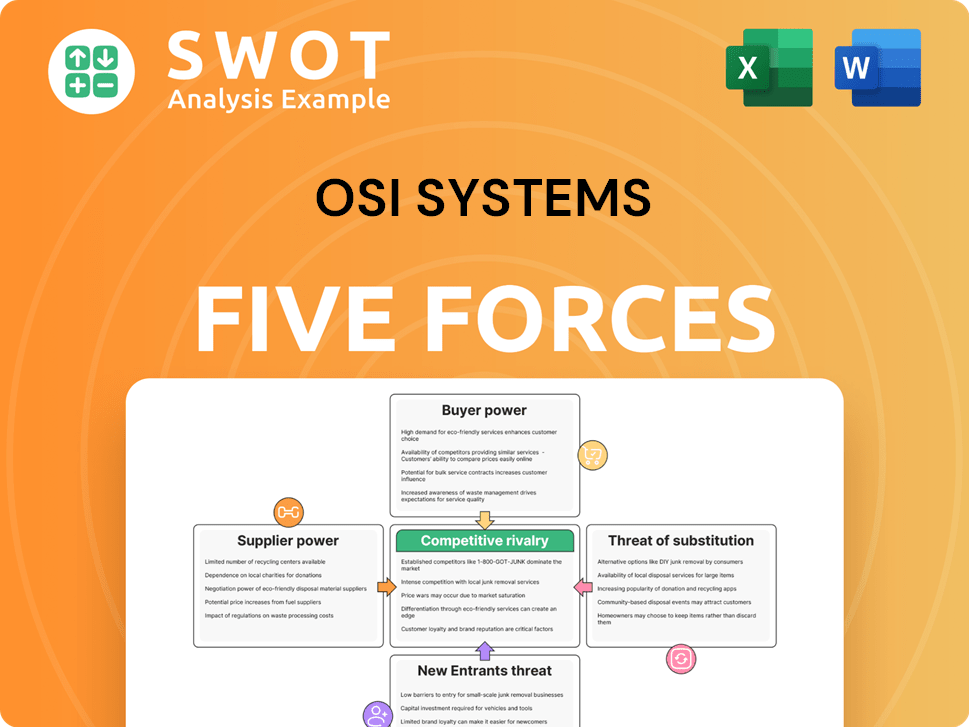

OSI Systems Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis of OSI Systems. The insights you see here are the same detailed analysis you will download after your purchase.

Porter's Five Forces Analysis Template

OSI Systems faces varying competitive pressures. Supplier power is moderate due to specialized component needs. Buyer power is somewhat concentrated due to government contracts. New entrants pose a moderate threat. Substitute products present a manageable challenge. Competitive rivalry is intense.

Unlock key insights into OSI Systems’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

OSI Systems' reliance on specialized components heightens supplier power. With fewer suppliers, they can set prices and terms. For instance, in 2024, the cost of certain semiconductors rose by up to 15%. This impacts OSI's profitability directly. Limited supplier options mean less negotiation leverage for OSI.

OSI Systems' supplier concentration is a key factor. If few suppliers provide most components, their power grows. This can lead to higher costs and supply chain vulnerabilities. In 2024, OSI Systems' cost of revenues was $1.25 billion, showing the impact of supplier costs. Diversifying suppliers is crucial to manage this risk.

OSI Systems faces significant supplier power due to high switching costs, especially for specialized components. For instance, in 2024, the security division's reliance on unique sensor technology limits alternatives. The healthcare segment's regulatory hurdles, like FDA approvals, further cement existing supplier relationships. High switching costs, such as the time and money for new supplier validation, strengthen supplier leverage.

Impact of Tariffs

Recent tariffs on electronics and metal components have increased manufacturing costs, impacting sourcing strategies for U.S. firms like OSI Systems. Suppliers that can navigate these tariffs or offer tariff-exempt components gain increased bargaining power. For example, in 2024, the U.S. imposed an average tariff of 7.5% on Chinese-made electronics. This forces companies to find alternative suppliers or absorb higher costs. OSI Systems might become more reliant on suppliers offering tariff-free options.

- Tariffs on Chinese electronics averaged 7.5% in 2024.

- OSI Systems' sourcing costs are directly affected.

- Suppliers with tariff advantages gain leverage.

- Alternative sourcing strategies become critical.

Vertical Integration

OSI Systems, while vertically integrated, sources components from external suppliers, affecting supplier power. This reliance is a key factor in assessing how much control suppliers have. Less reliance on external sources means lower supplier bargaining power for OSI. For 2024, OSI's cost of revenues was $1.1 billion, indicating significant external component sourcing. Vertical integration strategies aim to mitigate supplier influence.

- OSI's vertical integration partially insulates it from supplier power.

- External suppliers provide specialized components.

- Reliance on these suppliers influences their bargaining power.

- In 2024, cost of revenues was $1.1 billion.

OSI Systems faces supplier power due to specialized components and limited alternatives. Tariffs, like the 7.5% average on Chinese electronics in 2024, boost supplier leverage. Vertical integration and diversification are key to mitigating these risks and costs.

| Factor | Impact | 2024 Data |

|---|---|---|

| Supplier Concentration | Higher costs & supply chain risk | Cost of Revenues: $1.25B |

| Switching Costs | Limits alternatives, boosts leverage | Security division relies on unique sensors |

| Tariffs | Increase costs, affect sourcing | Average 7.5% on Chinese electronics |

Customers Bargaining Power

OSI Systems could face strong customer bargaining power if a few key clients dominate its sales. For example, government contracts, which made up 45% of its revenue in 2024, can exert pressure. Large customers can demand discounts. They might seek specific product customizations, thus impacting profitability.

OSI Systems' security division, with its airport security systems, faces customer bargaining power due to large order sizes. Customers, like government agencies, can negotiate favorable pricing and contract terms. For instance, in 2024, major contracts with large airports influenced profit margins. This bargaining power can pressure OSI to offer discounts to win these significant deals.

If OSI Systems' products stand out significantly, offering unique features, customer influence weakens. Conversely, if products seem similar to those of competitors, customers gain leverage, able to easily switch. In 2023, OSI Systems reported strong product sales, with revenues reaching $1.3 billion, indicating a degree of product differentiation. This differentiation allows OSI Systems to maintain pricing power, thus curbing customer bargaining strength.

Price Sensitivity

Price sensitivity significantly impacts OSI Systems' customer bargaining power, especially within the healthcare device segment. Customers, facing budget constraints or competitive market options, gain leverage to negotiate lower prices. This pressure compels OSI Systems to strategically manage pricing to maintain market share and profitability. This is seen in 2024, where healthcare spending is projected to increase but with cost-containment measures.

- Healthcare spending grew by 4.2% in 2023, reaching $4.8 trillion.

- Price sensitivity is heightened in markets with several competitors.

- OSI Systems must balance pricing with innovation.

Multi-Year Framework Agreements

Multi-year framework agreements, such as the one OSI Systems had with a North American customer for cargo and vehicle inspection systems, offer both advantages and disadvantages. These agreements, while ensuring a degree of order stability, can also strengthen the customer's bargaining position. For instance, a customer might use this leverage to negotiate better pricing or adjust order quantities within the agreement's framework. The dynamics of these agreements significantly impact OSI Systems' profitability and market strategy.

- Revenue from security and detection systems in 2024 was approximately $800 million.

- The company's total backlog as of Q2 2024 was around $1.2 billion.

- OSI Systems' gross profit margin for the security segment was about 40% in 2024.

Customer bargaining power significantly influences OSI Systems' profitability, particularly from large government contracts. Their ability to negotiate is influenced by product differentiation and the presence of competitors in the market. For example, price sensitivity within healthcare, coupled with multi-year agreements, influences pricing strategies.

| Factor | Impact | Data |

|---|---|---|

| Government Contracts | High Bargaining Power | 45% Revenue (2024) |

| Product Differentiation | Reduces Bargaining Power | $1.3B Revenue (2023) |

| Price Sensitivity | Increases Bargaining Power | Healthcare spending rose 4.2% (2023) |

Rivalry Among Competitors

OSI Systems operates in highly competitive markets across its three divisions. Competitors like Coherent and Itron challenge OSI in security, healthcare, and optoelectronics. This rivalry drives price competition, potentially squeezing profit margins. In 2024, the security market saw a 7% increase in competitive pricing pressure. Increased innovation is crucial for OSI to maintain its market position.

OSI Systems faces intense competition in the security and medical device markets, where companies aggressively vie for market share. This rivalry necessitates sustained investment in research and development, marketing, and customer service to stay competitive. For instance, in 2024, the security market saw significant shifts, with key players like ADT and Allied Universal battling for dominance. This increased pressure impacts profitability.

OSI Systems faces intense competition due to fast-paced tech in medical devices & security. Continuous innovation is vital for survival, fueling rivalry. This includes developing new and improved products. In 2024, the medical device market was worth over $500 billion, showing the stakes. Companies spend billions on R&D, intensifying competition.

Profitability Comparison

OSI Systems demonstrates stronger profitability metrics than some competitors. In 2024, OSI Systems reported a net margin of approximately 10%, and a return on equity of around 18%. For instance, Coherent's net margin was about 5%, and ROE was about 10%. This indicates a competitive advantage. However, consistent outperformance is essential.

- OSI Systems' net margin is about twice Coherent's.

- OSI Systems has a higher return on equity than Coherent.

- Maintaining this advantage requires continuous effort.

- Profitability comparisons reflect competitive dynamics.

Geographic Expansion

Geographic expansion intensifies competitive rivalry for OSI Systems. Entering new markets, especially in emerging economies, forces the company to contend with existing local competitors. OSI Systems must adjust its strategies to navigate diverse regulatory environments and consumer preferences successfully. This often involves increased investment in marketing, distribution, and local partnerships to gain market share. In 2024, OSI Systems' international sales accounted for approximately 45% of its total revenue, highlighting the importance of global presence and the associated competitive pressures.

- Increased Competition: Expansion brings OSI Systems into direct competition with established local businesses.

- Strategic Adaptation: The company needs to tailor its strategies to suit different market conditions.

- Investment Requirements: Entering new markets often demands significant financial investments.

- Revenue Diversification: International sales contribute significantly to overall revenue, as seen in 2024.

OSI Systems competes fiercely with firms like Coherent and Itron in security and healthcare. Competitive dynamics drive price competition, potentially impacting margins. For example, the security market saw a 7% rise in competitive pricing in 2024. Sustained innovation is crucial for OSI.

| Metric | OSI Systems (2024) | Coherent (2024) |

|---|---|---|

| Net Margin | ~10% | ~5% |

| Return on Equity | ~18% | ~10% |

| International Sales % | ~45% | - |

SSubstitutes Threaten

Alternative security solutions, such as advanced video surveillance and robust cybersecurity, can serve as substitutes for OSI Systems' inspection systems. Their availability and effectiveness present a threat to OSI Systems. For instance, in 2024, the global video surveillance market was valued at approximately $50 billion, reflecting the growing adoption of alternatives. The rising investment in cybersecurity, with global spending projected to exceed $200 billion, further highlights the potential of substitutes.

The threat of substitutes in OSI Systems' market includes alternative diagnostic methods. Non-invasive monitoring, for instance, can lessen the need for some devices. In 2024, the global market for non-invasive monitoring was valued at approximately $25 billion, showing strong growth. This indicates a potential shift toward substitutes.

In the optoelectronics and manufacturing sector, the threat of substitutes is real for OSI Systems. Alternative display technologies pose a risk to their optoelectronic components. For instance, the global display market, valued at $140 billion in 2024, sees constant innovation.

Cost Considerations

The threat of substitutes for OSI Systems hinges on cost. If alternatives offer similar functionality at a lower price, they become a significant concern. OSI Systems must continuously assess the cost-effectiveness of competing products and services. This necessitates a focus on value and differentiation to maintain a competitive edge. For example, in 2024, the company's net sales were $1.3 billion.

- Price Sensitivity

- Technological Advancements

- Market Dynamics

- Competitive Analysis

Technological Advancements

Technological advancements pose a significant threat to OSI Systems by potentially making their existing products obsolete. New innovations in security, healthcare, and optoelectronics could disrupt OSI's market position. To counter this, continuous monitoring of technological trends is crucial. Investing heavily in research and development is also vital to staying ahead of the curve. For instance, in 2024, OSI Systems allocated a substantial portion of its revenue to R&D, reflecting this commitment.

- Obsolescence Risk: New tech can quickly make existing products outdated.

- Market Disruption: Innovations can reshape the competitive landscape.

- Strategic Response: Continuous tech monitoring is essential.

- R&D Investment: Crucial for staying ahead of technological shifts.

Substitutes like advanced video surveillance and cybersecurity challenge OSI Systems. The global video surveillance market was worth $50 billion in 2024. Alternatives in diagnostics and displays also pose threats. The availability and affordability of substitutes impact OSI Systems' market position.

| Area | Substitute | 2024 Market Value |

|---|---|---|

| Security | Video Surveillance | $50 Billion |

| Healthcare | Non-invasive Monitoring | $25 Billion |

| Manufacturing | Display Technologies | $140 Billion |

Entrants Threaten

OSI Systems faces a high threat from new entrants due to substantial capital requirements. These industries demand considerable investment in areas like research and development, manufacturing, and adherence to regulations. For instance, in 2024, the healthcare sector saw R&D spending reaching new highs. This financial burden makes it difficult for new competitors to enter the market. Thus, the need for large capital significantly limits the potential for new companies.

OSI Systems faces significant regulatory hurdles in both medical devices and security. The medical device industry demands rigorous approvals, increasing costs for new entrants. For instance, in 2024, the FDA's review times for medical devices averaged several months, delaying market entry. Security markets also have complex certifications, adding to the challenges.

OSI Systems, with its established brand, benefits from customer loyalty, a significant barrier for new entrants. New companies struggle to build this recognition, facing higher marketing costs and customer acquisition challenges. OSI Systems' brand strength, supported by a market cap of $2.2 billion as of late 2024, gives it a competitive edge.

Economies of Scale

OSI Systems, with its established presence, benefits from economies of scale, a significant barrier for new entrants. Its size and vertically integrated operations enable cost efficiencies that new competitors may find difficult to match. For example, OSI's large-scale manufacturing allows for lower per-unit production costs compared to smaller firms. This cost advantage is crucial in a competitive market. New entrants often face higher initial investments and operational costs, hindering their ability to compete on price.

- OSI Systems reported revenues of $1.38 billion in fiscal year 2023.

- Vertical integration reduces reliance on external suppliers, potentially lowering costs.

- New entrants face the challenge of replicating OSI's established infrastructure.

- Economies of scale can create a price barrier to entry.

Technological Expertise

OSI Systems faces challenges from new entrants due to the need for specialized technical knowledge. This expertise is crucial in fields like optoelectronics, medical imaging, and security systems. Newcomers struggle to compete without attracting and retaining skilled personnel. The complexity of these technologies creates significant barriers.

- OSI Systems' 2023 revenue was approximately $1.3 billion, indicating the scale new entrants must target.

- The medical imaging market, a key area for OSI, is projected to reach $40.5 billion by 2027.

- Attracting and retaining skilled engineers can cost a startup millions.

- The time to develop and commercialize new medical imaging tech averages 3-5 years.

OSI Systems faces a high barrier from new entrants due to substantial capital demands, regulatory hurdles, and established brand loyalty. New competitors must overcome significant financial investment in R&D, manufacturing, and regulatory compliance. The company's brand strength also gives it a competitive edge. These factors limit the ease with which new players can enter the market.

| Factor | Impact | 2024 Data/Example |

|---|---|---|

| Capital Requirements | High Initial Investment | R&D spending in healthcare reached new highs. |

| Regulatory Hurdles | Lengthy Approvals | FDA's review for medical devices took months. |

| Brand Loyalty | Customer Recognition | OSI's market cap was $2.2B (late 2024). |

Porter's Five Forces Analysis Data Sources

OSI Systems' Five Forces analysis leverages financial reports, industry analysis, and competitor insights. Regulatory filings and market data also inform our assessment.