OSI Systems SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OSI Systems Bundle

What is included in the product

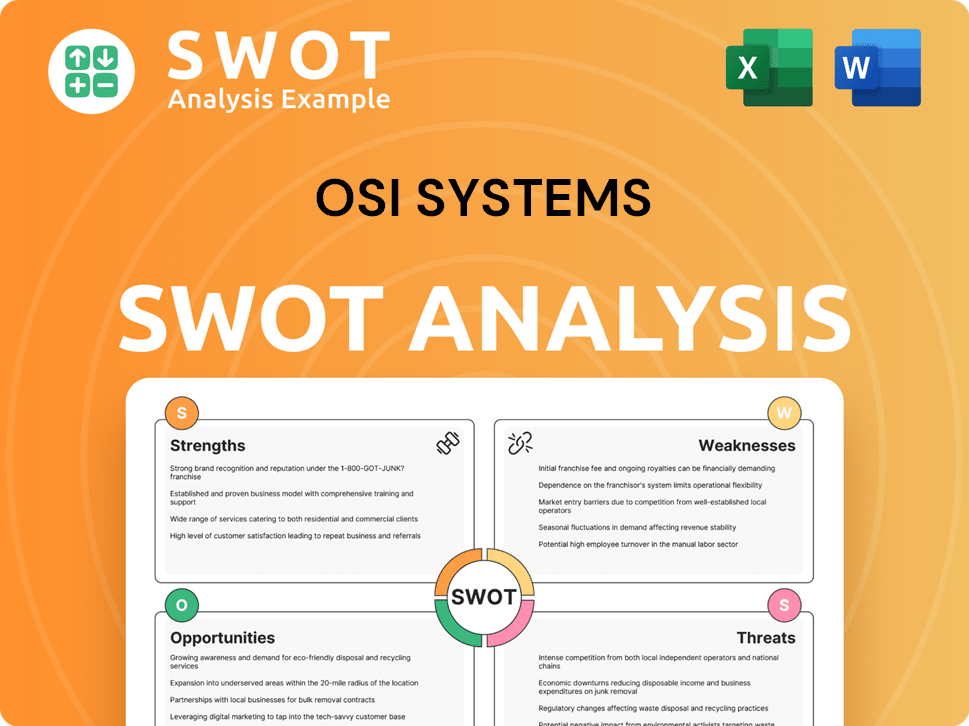

Analyzes OSI Systems’s competitive position through key internal and external factors

Delivers structured insights for clear SWOT presentations.

What You See Is What You Get

OSI Systems SWOT Analysis

You're seeing a direct preview of the complete OSI Systems SWOT analysis.

The formatting and content shown are exactly what you'll get after your purchase.

This ensures clarity and professional quality.

No surprises here—only the full report, ready to be used.

SWOT Analysis Template

Explore the strengths and weaknesses of OSI Systems with a glance. This snippet highlights key market opportunities and potential threats. See how OSI Systems navigates its competitive landscape.

Uncover hidden strategic insights and the full story behind OSI Systems's strategy. The full SWOT analysis is your all-in-one resource. Get detailed strategic insights. Invest smarter - instantly accessible!

Strengths

OSI Systems' diversified business model spans Security, Healthcare, and Optoelectronics. This broad approach reduces dependence on any single market. Security is the main revenue driver, offering stability. In fiscal year 2024, OSI Systems reported revenues of $1.3 billion, with Security contributing significantly.

OSI Systems benefits from a strong reputation in the industry, particularly for its specialized electronic systems. This has led to a revenue of $1.3 billion in fiscal year 2024. Innovation is a key strength, with significant investment in R&D, totaling $65 million in 2024. This focus on innovation is supported by patents and the development of advanced screening solutions.

OSI Systems has shown consistent revenue growth. In fiscal year 2024, revenue reached $1.45 billion, a 9% increase. This growth reflects strong demand for their offerings. It highlights effective market strategies.

Robust Backlog and Pipeline

OSI Systems benefits from a substantial order backlog, which stood at over $1.8 billion as of March 2025. This robust backlog signals strong future revenue potential and underlines sustained market demand for their offerings. The Security division, in particular, is experiencing high demand, contributing significantly to this positive outlook. This financial health offers stability.

- $1.8B+ Backlog: Provides revenue visibility.

- Security Division: Key driver of demand.

- March 2025 Data: Latest financial snapshot.

- Future Revenue: Indicates growth potential.

Operational Efficiency and Financial Health

OSI Systems demonstrates operational efficiency, as seen in improved cash flow and margin expansion. The company's financial health is robust, indicated by a healthy current ratio. For example, in FY2024, OSI reported an operating cash flow of $271.5 million, a 20% increase. Furthermore, the current ratio stands at approximately 2.8, reflecting strong liquidity.

- Operating Cash Flow: $271.5 million (FY2024)

- Current Ratio: ~2.8 (as of latest financial reports)

OSI Systems has a diversified business model across Security, Healthcare, and Optoelectronics. A strong industry reputation supports a focus on innovation, shown by $65M in R&D in 2024. They have consistent revenue growth, reaching $1.45 billion in 2024, plus an order backlog exceeding $1.8 billion.

| Strength | Details | FY2024 Data |

|---|---|---|

| Diversified Business | Spans Security, Healthcare, Optoelectronics | Reduces market dependency |

| Strong Reputation | Specialized electronic systems | Supports market position |

| Innovation Focus | Significant R&D Investment | $65M (R&D spending) |

| Revenue Growth | Consistent growth trends | $1.45B revenue |

| Order Backlog | Robust, Future Revenue | $1.8B+ as of March 2025 |

Weaknesses

OSI Systems heavily relies on government contracts, especially in its Security division. In fiscal year 2024, approximately 60% of OSI Systems' revenue came from government and public sector contracts. This reliance makes the company vulnerable to shifts in government spending and geopolitical tensions.

OSI Systems' profitability and efficiency metrics have fluctuated recently. For instance, the operating margin decreased to 11.4% in fiscal year 2024, from 12.6% in 2023. This decline reflects increased operating expenses. An unfavorable price mix in its Security division also impacted profitability.

OSI Systems faces cash flow challenges. Historically, the company has shown weak free cash flow margins. This could restrict share buybacks or dividend payouts. For example, in fiscal year 2024, OSI Systems' free cash flow was $135.7 million.

Competitive Market Landscape

OSI Systems faces significant challenges due to a competitive market landscape. The company competes with larger, more established players. This includes major competitors like GE Healthcare and Medtronic. These companies have substantial resources and broader product portfolios. OSI Systems' market share, while strong in some areas, is pressured by these rivals.

- GE Healthcare's revenue in 2024 was approximately $19.4 billion.

- Medtronic's revenue in fiscal year 2024 was about $32.3 billion.

- OSI Systems' revenue for fiscal year 2024 was roughly $1.3 billion.

Potential Impact of Tariffs

OSI Systems' global manufacturing footprint exposes it to tariff-related risks, especially with shifting trade policies. Increased tariffs could raise production costs, squeezing profit margins. The company must navigate these uncertainties, potentially facing supply chain disruptions and reduced competitiveness. For instance, in 2024, tariffs on certain components have already increased costs by up to 5% for some manufacturers.

- Increased Production Costs: Tariffs can raise the cost of raw materials and components.

- Supply Chain Disruptions: Trade wars may disrupt the flow of goods.

- Reduced Competitiveness: Higher costs can make products less competitive.

OSI Systems' heavy dependence on government contracts introduces vulnerability to budget cuts. The declining operating margin, down to 11.4% in 2024, indicates profitability concerns. Additionally, its weaker free cash flow may restrict financial flexibility.

| Weakness | Details | Impact |

|---|---|---|

| Government Dependence | 60% of revenue from gov't contracts in 2024. | Sensitivity to policy changes. |

| Profitability Issues | Operating margin dropped to 11.4% in 2024. | Reduced financial returns. |

| Cash Flow Concerns | 2024 free cash flow was $135.7 million. | Limited investments or dividends. |

Opportunities

Heightened global instability fuels demand for robust security. OSI Systems' Security division benefits from this. The need for advanced inspection systems grows, especially in aviation and critical infrastructure. In Q1 2024, Security revenue reached $277.3 million, up 10.9% YoY. This reflects increased demand.

The healthcare technology market is expanding, driven by demand for advanced patient monitoring and diagnostics. OSI Systems' Healthcare division can leverage this growth, offering innovative solutions. The global healthcare IT market is projected to reach $779.9 billion by 2028. OSI's focus on these areas positions it well for future opportunities.

OSI Systems' Optoelectronics and Manufacturing division provides components for internal use and external clients. Expansion is possible through new OEM contracts and tech advancements. For fiscal year 2024, the Security segment, which includes optoelectronics, saw a revenue increase. The company is investing in R&D to capitalize on growth opportunities. This strategic focus aims to boost market share.

Strategic Acquisitions and Partnerships

OSI Systems has a history of strategic acquisitions, which can be a significant growth driver. In fiscal year 2024, OSI Systems completed several acquisitions. Strategic acquisitions or partnerships could facilitate entry into new markets. They can also boost its technology portfolio and increase market share.

- Fiscal Year 2024 Acquisitions: Several acquisitions were completed.

- Market Expansion: Potential to enter new markets.

- Technology Enhancement: Acquisitions can improve technology offerings.

Growth in Service Revenue

OSI Systems can boost revenue and margins by offering ongoing service and support for its installed systems. This recurring revenue stream provides stability and can lead to higher profitability. Expanding service offerings is a key opportunity for sustained growth. In fiscal year 2024, service revenue accounted for a significant portion of OSI Systems' total revenue, demonstrating its importance.

- Increased service revenue can improve profitability.

- Recurring revenue streams offer financial stability.

- Expansion of service offerings supports long-term growth.

OSI Systems' strategic acquisitions and market expansions drive growth and enhance its tech portfolio. Their focus on recurring service revenue boosts profitability and provides financial stability. Investments in R&D position the company for future growth in security, healthcare, and optoelectronics.

| Opportunity | Details | 2024 Data Point |

|---|---|---|

| Strategic Acquisitions | Growth via new market entries and tech enhancements | Completed several acquisitions. |

| Market Expansion | Growth through new OEM contracts and tech advancements. | Security segment revenue increased. |

| Service Revenue | Focus on service and support for financial stability. | Service revenue was a significant portion. |

Threats

Regulatory shifts, such as updates to security standards, pose a threat. Trade policies, like tariffs, can increase costs and reduce market access. Geopolitical tensions, for instance, conflicts, can disrupt supply chains. OSI Systems' revenue for fiscal year 2024 was $1.3 billion, with government contracts being a significant portion.

OSI Systems faces the risk of its existing technologies becoming outdated due to rapid advancements, especially in AI-driven screening. Competitors are constantly innovating, potentially offering superior solutions. For instance, the global AI in medical imaging market is projected to reach $8.8 billion by 2025. If OSI fails to adapt, it risks losing market share.

OSI Systems faces supply chain threats due to its global manufacturing footprint, making it vulnerable to disruptions that can hinder production. Recent industry reports highlight persistent supply chain issues, with potential for increased costs and delays. For instance, the Institute for Supply Management's 2024 data shows a 15% rise in delivery times for some components. These disruptions can directly affect OSI's ability to meet deadlines. This can also increase operational costs.

Economic Downturns

Economic downturns pose a significant threat to OSI Systems. Reduced government spending and decreased commercial demand during economic slowdowns can directly hit revenue and profitability. For instance, during the 2008 financial crisis, many companies experienced significant drops in sales. This could lead to lower stock valuation and reduced market capitalization.

- Decreased Government Spending

- Reduced Commercial Demand

- Impact on Revenue and Profitability

Reputational Risks

Reputational risks pose a significant threat to OSI Systems. Product malfunctions or security breaches can erode customer trust. Involvement in compliance issues can damage the company's image. For example, a major product recall could lead to a sharp decline in stock value.

- OSI Systems' stock price has shown volatility, reflecting market sensitivity to reputational issues.

- Recent cybersecurity incidents in the industry highlight the vulnerability of technology companies.

- Compliance failures can result in hefty fines and legal battles.

OSI Systems faces various threats. Regulatory changes and trade policies may raise costs and cut market access, as seen in 2024 with global trade tensions. Stiff competition, especially with AI advancements, could render their tech obsolete. Supply chain disruptions and economic downturns present operational and financial challenges.

| Threat | Impact | Example |

|---|---|---|

| Regulatory/Trade Changes | Increased costs/reduced access | Tariffs/security standard updates |

| Technological Obsolescence | Loss of market share | AI screening innovations |

| Supply Chain Disruptions | Production delays/increased costs | Component delivery delays, 15% rise |

| Economic Downturn | Revenue/profit drop | Reduced spending by gov. |

SWOT Analysis Data Sources

This SWOT analysis uses reliable data: financial reports, market trends, expert evaluations, and verified reports to deliver reliable insights.