Owens & Minor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Owens & Minor Bundle

What is included in the product

Strategic portfolio assessment of Owens & Minor's units across BCG matrix quadrants.

Clean, distraction-free view optimized for C-level presentation for Owens & Minor's strategic vision.

Preview = Final Product

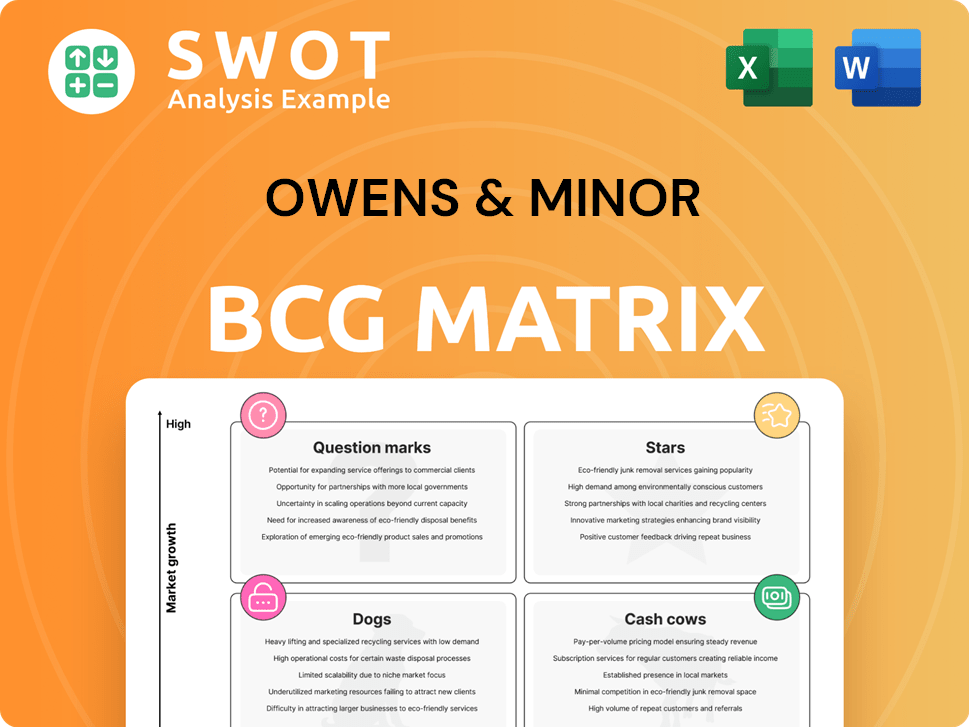

Owens & Minor BCG Matrix

The displayed BCG Matrix preview is identical to the purchased document. Expect a complete, ready-to-use analysis of Owens & Minor's strategic portfolio, featuring clear categorization and insights. The downloaded file is fully customizable and formatted for your professional presentations. This version is optimized for immediate integration into your strategic plans.

BCG Matrix Template

Owens & Minor's BCG Matrix reveals its product portfolio's strategic landscape. This simplified view categorizes products into Stars, Cash Cows, Dogs, and Question Marks. Understanding these positions is key to informed decisions. This preview offers a glimpse into the company's potential. Unlock the complete BCG Matrix for in-depth analysis and actionable strategies.

Stars

The Patient Direct segment at Owens & Minor shows robust expansion, spurred by the rising need for home healthcare. This segment is well-positioned, considering the aging population and the growth of home treatment options. Strategic moves, like the Rotech acquisition, are crucial. In 2024, this segment's revenue hit $1.8B, a 15% increase.

Owens & Minor's acquisition of Rotech Healthcare in July 2024 for $1.36 billion is a strategic move. This strengthens its foothold in the growing home-based care market. Rotech's specializations align well with Owens & Minor's current services. Integrating Rotech should create cost savings and improve services, boosting its market leadership.

Owens & Minor's ByramConnect is a digital health platform. This platform, launched in 2024, targets diabetes and chronic conditions. It boosts patient engagement, which is expected to increase revenue. The digital health market is projected to reach $600 billion by 2025.

Debt Reduction

Owens & Minor has strategically focused on debt reduction. They've cut debt by $647 million in the last two years, boosting their financial flexibility. This allows for strategic moves like acquisitions and investments in growth sectors. Further debt reduction is projected to strengthen the company's financial position.

- Debt reduction enhances financial flexibility.

- Deleveraging supports strategic investments.

- Improved financial health attracts investors.

New Distribution Centers

Owens & Minor's investment in new distribution centers, such as those in West Virginia and South Dakota, positions them as a "Star" in the BCG Matrix. These centers leverage cutting-edge technology like robotics and augmented reality to boost supply chain efficiency. This strategic move is designed to enhance service quality while cutting operational expenses. The company's 2024 financial reports reflect these improvements, with a projected increase in profitability.

- West Virginia and South Dakota centers enhance supply chain efficiency.

- Advanced tech like robotics and AR streamline operations.

- Expected to improve service and cut costs.

- Boost in 2024 profitability projected.

Owens & Minor's new distribution centers are "Stars" in the BCG Matrix. These centers use advanced tech for supply chain efficiency. They are expected to enhance service and profitability.

| Category | Details |

|---|---|

| Centers | West Virginia, South Dakota |

| Technology | Robotics, AR |

| Impact | Improved service, reduced costs; projected profit increase in 2024 |

Cash Cows

Owens & Minor's medical/surgical distribution services are a cash cow. They hold a large market share, generating consistent revenue. These services support many healthcare providers, ensuring a solid customer base. Although growth is moderate, it provides a reliable cash flow. In 2024, these services contributed significantly to the company's revenue.

Owens & Minor's diverse product offerings, such as HALYARD and MediChoice, consistently produce revenue. These products, crucial for healthcare, align with industry standards. In 2024, focus on quality should help maintain market share. The company's 2024 revenue was $10.1 billion.

Owens & Minor's healthcare supply chain solutions are a cash cow, offering crucial services to healthcare providers. These services optimize inventory and cut costs, boosting efficiency. In 2024, the healthcare supply chain market was valued at approximately $125 billion. Strong provider-manufacturer ties ensure consistent revenue.

Strategic Partnerships

Owens & Minor's strategic alliances with prominent healthcare entities and manufacturers are pivotal. These collaborations broaden its customer reach and fortify its market presence. According to the 2024 data, partnerships account for a significant portion of their revenue. Maintaining and growing these partnerships is crucial for maintaining income and financial health.

- Expanded market access through alliances.

- Revenue bolstered by strategic collaborations.

- Partnerships are key to sustaining profitability.

- Data from 2024 confirms partnership impact.

Wide Geographic Reach

Owens & Minor's expansive geographic footprint is a key strength, acting as a cash cow. Their wide distribution network across the U.S. and international markets offers a significant advantage. This reach lets them serve a broad customer base and seize new market opportunities effectively. In 2024, the company's global presence supported over $10 billion in revenue.

- Extensive network boosts market access.

- Global presence fuels revenue generation.

- Expanded reach supports customer diversity.

- Strategic expansion is key for sustaining growth.

Owens & Minor's cash cows include medical distribution and supply chain solutions, generating consistent revenue. Their diverse product offerings and geographic footprint also contribute. Strategic alliances strengthen market presence, supporting profitability. 2024 data confirms their impact.

| Cash Cow | Description | 2024 Revenue Contribution (approx.) |

|---|---|---|

| Medical/Surgical Distribution | Large market share, consistent revenue | Significant portion of total revenue |

| Healthcare Supply Chain Solutions | Optimized inventory, cost reduction | $125 billion market (2024) |

| Diverse Product Offerings (HALYARD, MediChoice) | Crucial for healthcare, quality focus | Contributed to $10.1 billion total revenue |

Dogs

Commodity PPE, like gloves, faces price drops & lower demand post-COVID. These items likely have low profit margins. Owens & Minor should limit investment in this area. The company's Q3 2023 earnings showed a decline in PPE sales. Focusing on higher-margin products is key.

Lower-margin contracts at Owens & Minor can drag down profitability because of unfavorable terms. Renegotiating or exiting these contracts is essential to boost financial health. In 2024, focusing on contracts with sustainable margins is crucial. For example, Owens & Minor's gross profit margin was 11.2% in Q1 2024.

Owens & Minor's reliance on outdated technology, especially in areas like supply chain management, leads to inefficiencies and higher operational costs. For example, outdated inventory systems might cause delays. Upgrading tech can boost productivity and cut expenses. In 2024, Owens & Minor's net sales were $9.8 billion; modernizing tech is crucial for competitiveness.

Regions with Low Market Share

Owens & Minor's "Dogs" in the BCG matrix likely include regions where it struggles to gain market share. This could be due to strong competitors or limited market opportunities. Focusing on high-growth regions is crucial for improvement.

Divesting or forming partnerships in underperforming areas could be a strategic move. For instance, in 2024, Owens & Minor's revenue in certain international markets lagged behind the US.

This highlights the need for strategic reallocation. To succeed, Owens & Minor must analyze its regional performance thoroughly.

- Geographic Limitations: Limited presence in specific areas.

- Growth Focus: Prioritize regions with higher growth potential.

- Strategic Options: Consider divesting or partnering.

- Performance: Evaluate regional revenue and market share.

Products & Healthcare Services (P&HS) Segment (Potentially)

Owens & Minor is contemplating the sale of its Products & Healthcare Services (P&HS) segment. This strategic move suggests the segment might be categorized as a 'Dog' in its portfolio. The P&HS segment could be facing slower growth and potentially lower profits than other areas like Patient Direct. By selling this segment, the company aims to concentrate on its higher-growth opportunities. In 2024, the healthcare services market saw varied performance, with some segments experiencing slower growth.

- Owens & Minor's strategic shift indicates a focus on more profitable areas.

- The divestiture aligns with optimizing resource allocation.

- Market analysis reveals growth disparities within healthcare.

- Focusing on core strengths is key for business success.

Owens & Minor's "Dogs" include underperforming segments and regions facing challenges. These areas experience slow growth and low market share. Strategic moves involve divesting or partnering to focus on high-growth opportunities. Consider the P&HS segment sale.

| Category | Details | 2024 Data |

|---|---|---|

| Market Share | Regions with low presence. | US vs. International Revenue Growth |

| Growth Rate | Slow-growing segments. | P&HS Segment Performance |

| Strategic Actions | Divestiture/Partnerships | Focus on core strengths |

Question Marks

Owens & Minor is venturing into digital health, a potentially lucrative area. However, its current market share is modest, indicating a "Question Mark" in the BCG Matrix. To succeed, Owens & Minor must rapidly increase its presence. Strategic alliances and purchases are key for faster expansion, especially given the digital health market's projected growth. The digital health market is expected to reach $660 billion by 2025.

Specialized medical supply management services are a question mark for Owens & Minor. Demand is rising, yet market share is nascent. Investment in expertise and capabilities is crucial. Focused marketing can boost both share and brand recognition. In 2024, the medical supplies market was valued at $150 billion, with a 6% annual growth.

Owens & Minor's move into critical care represents a question mark within the BCG matrix. The market is competitive, demanding substantial investment for product development and market entry. Success hinges on a rigorous evaluation of growth potential and profitability, critical in 2024. Differentiation through innovative, high-quality products is key; in 2023, the global critical care market was valued at $28.4 billion.

International Expansion

International expansion offers significant growth opportunities for Owens & Minor, but also introduces risks. The company must carefully evaluate market potential and regulatory landscapes. Strategic partnerships and acquisitions can ease market entry and mitigate risks. For instance, in 2024, Owens & Minor's international sales contributed to overall revenue growth.

- Market assessment is key before entering any new market.

- Partnerships can help navigate local regulations and market dynamics.

- Acquisitions can provide immediate market presence.

- Diversification reduces reliance on any single market.

Blockchain Integration

Blockchain integration presents both opportunities and challenges for Owens & Minor. The company can enhance supply chain transparency and security by leveraging blockchain, but this technology is still in its infancy. Owens & Minor needs to invest in developing its blockchain capabilities. Successful adoption could significantly improve efficiency and reduce risks related to counterfeiting.

- Blockchain market is projected to reach $94.8 billion by 2024.

- Healthcare blockchain market is expected to grow.

- Blockchain can reduce counterfeit risks.

- Owens & Minor needs to invest in blockchain.

Digital health presents a "Question Mark" for Owens & Minor, with a modest market share in a growing sector. The market is projected to reach $660 billion by 2025. Strategic moves are vital to enhance Owens & Minor's position.

| Market | ||

|---|---|---|

| Digital Health | ||

| Market Size (2024) | $590B | |

| Projected Growth (2025) | $660B |

BCG Matrix Data Sources

This Owens & Minor BCG Matrix utilizes data from financial statements, market analysis, and expert opinions.