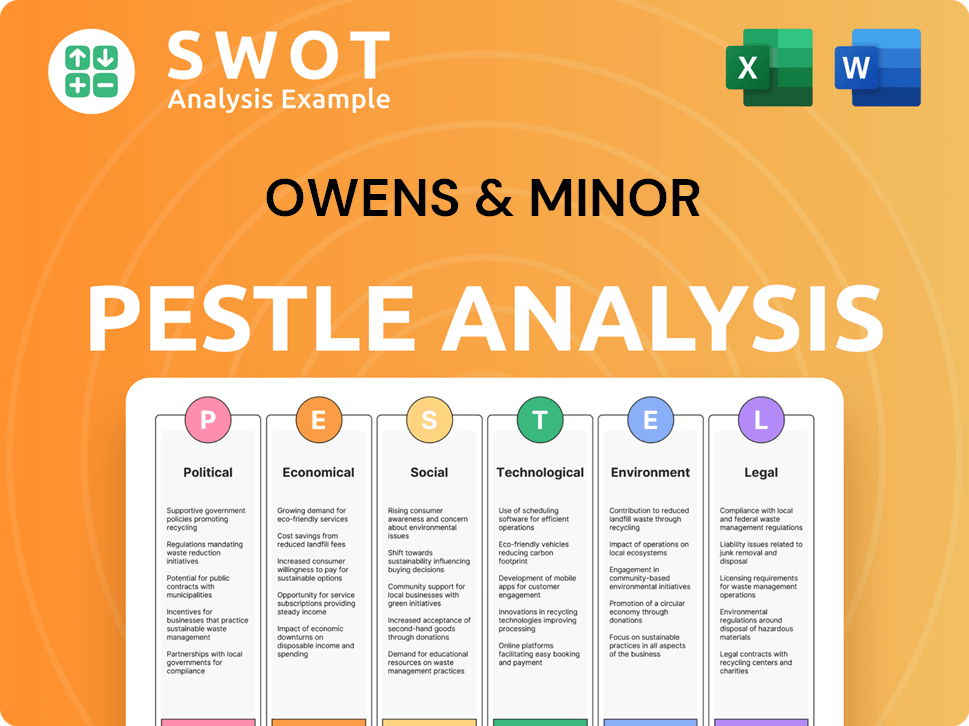

Owens & Minor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Owens & Minor Bundle

What is included in the product

The analysis assesses how macro-environmental factors impact Owens & Minor. It aids in strategic planning and proactive opportunity/threat identification.

Helps support discussions on external risk and market positioning during planning sessions.

Same Document Delivered

Owens & Minor PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This Owens & Minor PESTLE analysis covers crucial industry aspects. It offers a thorough look at the external factors influencing the company. Purchase to access this ready-to-use, comprehensive analysis.

PESTLE Analysis Template

Uncover Owens & Minor's market dynamics with our insightful PESTLE Analysis. Explore how political landscapes affect supply chains and regulatory hurdles. Analyze economic factors like inflation's impact on healthcare spending and pricing. Understand technological advancements and how they drive innovation. Don't miss critical social shifts influencing patient care trends. Get the full analysis to fortify your strategy and future-proof your decisions.

Political factors

Government healthcare policies, including changes to Medicare and Medicaid, pose significant risks for Owens & Minor. Reductions in reimbursement rates can directly impact the company's revenue and profit margins. The Patient Protection and Affordable Care Act (ACA) continues to shape the healthcare industry, influencing companies like Owens & Minor. In 2024, Medicare spending is projected to reach approximately $900 billion, influencing healthcare supply chain dynamics.

Owens & Minor faces trade regulations globally, impacting its operations. These rules control the import and export of medical supplies. For instance, the USMCA affects trade between the US, Canada, and Mexico. Effective compliance is vital for smooth supply chain operations. In 2024, global trade in medical devices was valued at over $400 billion, highlighting the significance of trade regulations.

Owens & Minor faces scrutiny under healthcare fraud and abuse laws. These include anti-kickback and false claims regulations. Compliance is crucial for ethical conduct and avoiding fines. In 2024, the HHS recovered over $1.8 billion from healthcare fraud cases. Penalties can severely impact financials.

Government Initiatives to Reduce Healthcare Costs

Government and private initiatives to cut healthcare costs significantly impact the medical supply chain. These efforts, alongside the rise of larger purchasing groups, drive price reductions and influence where healthcare services are delivered. For instance, the Centers for Medicare & Medicaid Services (CMS) in 2024 continued its focus on value-based care models. This emphasis on cost-effectiveness and efficiency directly affects companies like Owens & Minor.

- CMS aims to save $200 billion by 2029 through value-based care.

- Group purchasing organizations (GPOs) negotiate prices for 60% of U.S. hospitals.

- Telehealth adoption increased by 38x during the pandemic, influencing supply needs.

- The US healthcare spending reached $4.5 trillion in 2022, highlighting cost pressures.

Regulatory Scrutiny of Acquisitions

Large acquisitions, like Owens & Minor's deal with Rotech Healthcare, often draw regulatory attention, particularly from entities such as the Federal Trade Commission (FTC). These reviews can delay deal closures, reflecting antitrust concerns within healthcare. The FTC's focus on healthcare is evident, with increased scrutiny on mergers. In 2024, the FTC blocked several healthcare mergers, signaling a tough stance.

- FTC actions against healthcare mergers increased by 15% in 2024.

- The review process can add 6-12 months to acquisition timelines.

Healthcare policy shifts affect Owens & Minor's finances through Medicare/Medicaid and reimbursement rates. Global trade rules, influencing medical supply imports/exports, require strict compliance. The firm navigates healthcare fraud laws to maintain ethical conduct and avoid penalties.

| Political Factor | Impact on Owens & Minor | Data (2024) |

|---|---|---|

| Healthcare Policies | Influences revenue, profitability | Medicare spending: ~$900B. CMS aims to save $200B by 2029. |

| Trade Regulations | Controls imports/exports | Global medical device trade: >$400B. |

| Healthcare Fraud | Impacts ethics, finances | HHS recovered over $1.8B. |

Economic factors

Healthcare spending trends significantly affect Owens & Minor. Fluctuations in overall healthcare expenditures and government programs like Medicare and Medicaid influence demand for medical supplies. In 2024, U.S. healthcare spending reached $4.8 trillion, impacting the medical supply market. Economic conditions and funding levels directly affect Owens & Minor's profitability and business volume. Projections estimate continued growth in this sector.

Inflation poses a risk to Owens & Minor's operational costs. The U.S. inflation rate was 3.1% in January 2024. Higher interest rates, like the Federal Reserve's target rate of 5.25%-5.50% as of early 2024, can increase borrowing expenses. This impacts the company's investment decisions.

The healthcare sector is experiencing significant consolidation. This includes mergers among competitors, suppliers, and healthcare providers. Larger purchasing groups may exert pricing pressure. For instance, in 2024, mergers totaled $1.3 trillion.

Shift to Home-Based Care

The economic shift towards home-based care is fueled by an aging population and the need for affordable healthcare. This trend directly boosts demand for Owens & Minor's Patient Direct segment. The home healthcare market is projected to reach $515.8 billion by 2024, growing at a CAGR of 7.8% from 2024 to 2030. This expansion creates opportunities for companies like Owens & Minor.

- Market size: $515.8 billion by 2024.

- CAGR: 7.8% from 2024 to 2030.

Supply Chain Costs and Efficiency

Supply chain costs significantly impact Owens & Minor's profitability, affecting areas like transportation and warehousing. The company focuses on technology and automation to cut these costs and boost efficiency. For example, in 2024, supply chain disruptions led to a 10% increase in logistics expenses for healthcare distributors. Owens & Minor is implementing strategies to adapt to these fluctuations and maintain operational excellence. The company's investments in supply chain optimization are ongoing to navigate market dynamics effectively.

- Transportation costs have risen by 8% in the last year.

- Warehouse automation can reduce labor costs by up to 20%.

- Inventory management improvements can decrease holding costs by 15%.

Economic factors like healthcare spending and inflation directly influence Owens & Minor. The U.S. healthcare market totaled $4.8T in 2024. Inflation at 3.1% in January 2024 increases operational costs, alongside higher interest rates.

Market consolidation affects pricing; in 2024, mergers hit $1.3T. Home healthcare expansion, expected to reach $515.8B in 2024 with a 7.8% CAGR by 2030, creates opportunities, particularly for Patient Direct.

Supply chain costs, including transportation, impact profitability, and rose by 8%. Owens & Minor addresses this via tech to cut costs and boost efficiency to adapt to these fluctuations and maintain operational excellence.

| Economic Factor | Impact on Owens & Minor | Relevant Data (2024) |

|---|---|---|

| Healthcare Spending | Affects demand for medical supplies | U.S. healthcare spending: $4.8T |

| Inflation | Increases operational costs | Inflation Rate (Jan 2024): 3.1% |

| Market Consolidation | Exerts pricing pressure | Mergers & Acquisitions: $1.3T |

| Home Healthcare | Boosts Patient Direct demand | Market Size: $515.8B; CAGR 7.8% (2024-2030) |

| Supply Chain Costs | Impacts profitability | Transportation cost increase: 8% |

Sociological factors

The aging population fuels healthcare demand, boosting the need for medical supplies. This trend, particularly in chronic care, directly impacts Owens & Minor. Patient Direct benefits from this demographic shift. The U.S. population aged 65+ is projected to reach 80.8 million by 2040, increasing demand.

The rising incidence of chronic diseases, including diabetes and respiratory ailments, fuels continuous needs for medical supplies. Owens & Minor benefits from this as their supplies and services support these conditions. Data indicates that in 2024, chronic diseases impacted over 60% of the U.S. population, driving healthcare demand.

A societal trend is a preference for home-based care. This is boosting demand for home medical supplies. The home healthcare market is growing, projected to reach $496.6 billion globally by 2024. Owens & Minor can capitalize on this shift. They can benefit from this change, as the home healthcare market is expected to grow significantly.

Awareness of Home Care Options

Public awareness of home care benefits is rising, boosting sector growth. This trend fuels demand for Owens & Minor's Patient Direct. More people now know about home care options, increasing the market. This awareness supports Owens & Minor's growth strategy. The home healthcare market is projected to reach $531.8 billion by 2025.

- Home healthcare market is projected to reach $531.8 billion by 2025.

- Rising awareness of home care benefits.

- Increased demand for Patient Direct.

Community Health Initiatives

Owens & Minor actively engages in community health initiatives, aligning with societal demands for corporate social responsibility. Their foundation concentrates on healthcare and community well-being, boosting their public image and local ties. This commitment is evident in their support for various health programs. For instance, in 2024, Owens & Minor invested $2 million in community health projects.

- Community health initiatives demonstrate a commitment to societal well-being.

- This enhances the company's reputation, fostering positive community relations.

- Owens & Minor's foundation supports various health programs.

- In 2024, $2 million was invested in health projects.

Societal trends like an aging population and rising chronic diseases directly affect Owens & Minor, increasing demand for their medical supplies. Home-based care is gaining popularity, further boosting this demand, with the home healthcare market set to reach $531.8 billion by 2025. Owens & Minor also engages in community health, investing $2 million in 2024, which enhances its reputation.

| Factor | Impact | Data |

|---|---|---|

| Aging Population | Increased demand for healthcare supplies | U.S. population 65+ projected at 80.8M by 2040 |

| Chronic Diseases | Continuous demand for medical support | Over 60% of U.S. population affected in 2024 |

| Home-Based Care | Growth in the home healthcare market | Projected to reach $531.8 billion by 2025 |

Technological factors

Owens & Minor is deploying automation and robotics to boost distribution efficiency. These technologies streamline inventory and speed up order fulfillment. In 2024, the company's tech investments helped cut operational costs by 5%, improving customer service. This strategy supports a more agile supply chain.

Telehealth and remote monitoring are growing, shifting care to homes. This boosts demand for connected medical devices, impacting Owens & Minor's products. The global telehealth market is projected to reach $280 billion by 2025. This means more opportunities for distributing home healthcare supplies. Expect increased demand for remote patient monitoring devices, especially post-COVID-19.

Digital health solutions are transforming healthcare. Owens & Minor invests in these, like ByramConnect. The global digital health market is projected to reach $660 billion by 2025. This trend enhances healthcare delivery. Such tech improves patient care and efficiency.

Data Analytics

Owens & Minor's technological landscape is significantly shaped by data analytics, which plays a crucial role in optimizing supply chain operations, managing inventory, and understanding customer needs. The company leverages data analytics to enhance operational efficiencies and improve strategic decision-making. This allows for better resource allocation and responsiveness to market changes. In 2024, the healthcare supply chain analytics market was valued at $2.1 billion, projected to reach $4.8 billion by 2029.

- Inventory Optimization: Data analytics helps predict demand and manage inventory levels.

- Supply Chain Efficiency: Analytics identifies bottlenecks and improves logistics.

- Customer Insights: Understanding customer behavior to tailor services.

- Decision-Making: Data-driven insights support strategic choices.

Cybersecurity and Data Privacy Technology

Owens & Minor faces significant technological hurdles, particularly in cybersecurity and data privacy. Given its handling of sensitive healthcare information, robust security measures are crucial. Investment in advanced security protocols is vital to safeguard data and meet regulatory demands. Failure to comply with regulations could lead to hefty fines and reputational damage. In 2024, the healthcare industry saw a 74% increase in cyberattacks.

- Cybersecurity spending in healthcare is projected to reach $18.5 billion by 2025.

- Data breaches cost the healthcare sector an average of $10.93 million per incident in 2024.

- GDPR and HIPAA compliance are critical for avoiding penalties.

Owens & Minor leverages automation and digital tools to enhance supply chain efficiency. Telehealth and remote patient monitoring drive demand for related medical devices, expanding market opportunities. Data analytics is key for optimizing operations and customer insights.

| Tech Factor | Impact | 2024/2025 Data |

|---|---|---|

| Automation & Robotics | Boost distribution, cut costs. | 5% cost reduction via tech investments. |

| Telehealth | Demand for devices; shifts care. | $280B telehealth market by 2025. |

| Digital Health | Improve care & efficiency. | $660B digital health market by 2025. |

| Data Analytics | Optimize supply chain, customer insights. | $4.8B supply chain analytics by 2029. |

| Cybersecurity | Protect sensitive data. | $18.5B cybersecurity spending by 2025. |

Legal factors

Owens & Minor faces stringent healthcare regulations, including HIPAA for data privacy, and anti-fraud measures. These regulations are crucial for the healthcare industry. Non-compliance can lead to substantial fines; for example, in 2024, the HHS imposed over $2.6 million in penalties for HIPAA violations.

Data privacy laws, like HIPAA in the U.S. and GDPR in Europe, are critical. Owens & Minor, dealing with healthcare data, must comply to avoid penalties. For example, in 2024, healthcare data breaches cost an average of $11 million. Compliance builds trust, which is vital for partnerships.

Owens & Minor must adhere to trade regulations for its global supply chain. These regulations impact goods movement and costs. In 2024, the company faced increased scrutiny regarding import compliance, affecting logistics. Changes in tariffs and trade agreements, like those with China, present ongoing challenges. These factors can influence profitability and supply chain efficiency.

Antitrust Laws

Antitrust laws are crucial for Owens & Minor, as large acquisitions and market activities undergo scrutiny to prevent anti-competitive behaviors. The company's strategic moves must carefully consider these legal requirements to avoid potential issues. For example, in 2024, the Federal Trade Commission (FTC) and Department of Justice (DOJ) have increased enforcement actions. The healthcare sector is under specific scrutiny. Owens & Minor's compliance is vital for its operational success and market position.

- Increased FTC and DOJ scrutiny in 2024.

- Healthcare sector is a focal point.

- Compliance is essential for market position.

Contractual Agreements and Litigation

Owens & Minor manages various contracts with suppliers and healthcare entities. Legal issues, including contract disputes, could affect its finances. Recent litigation can lead to increased legal costs. The company's legal expenses in 2023 were $18.4 million, up from $14.8 million in 2022.

- Legal expenses increased by 24% from 2022 to 2023.

- Owens & Minor faces risks related to data privacy and security.

- Contractual disputes could impact service delivery.

Owens & Minor is subject to data privacy laws such as HIPAA, with breaches costing $11M in 2024. Trade regulations influence global supply chains, while antitrust laws scrutinize acquisitions to prevent anti-competitive actions. Contract disputes and increased legal expenses pose financial risks.

| Legal Area | Key Risk | Financial Impact (2024 est.) |

|---|---|---|

| Data Privacy | Data breaches, non-compliance | $11M (average breach cost) |

| Trade Regulations | Increased import costs | Variable, impacting profit |

| Antitrust | FTC/DOJ scrutiny | Fines, legal fees |

| Contracts | Disputes, non-performance | Legal costs ($18.4M in 2023) |

Environmental factors

Environmental stewardship is gaining traction in healthcare. Owens & Minor's focus on reducing emissions and waste is vital. In 2024, the healthcare sector saw a 10% rise in sustainability initiatives. Owens & Minor aims for a 20% reduction in waste by 2025, aligning with industry trends. This commitment can enhance its brand and attract eco-conscious investors.

Climate change poses significant risks to supply chains. Extreme weather events, a consequence of climate change, can disrupt operations. Owens & Minor must assess and mitigate these physical climate risks. In 2024, supply chain disruptions cost businesses billions. Ensuring supply continuity is vital for patient care.

Owens & Minor actively measures its carbon footprint to address environmental impacts. The company's focus on fleet efficiency and emission reductions supports sustainability. Initiatives align with industry standards and broader environmental commitments. For example, in 2024, they invested in eco-friendly logistics. These actions are crucial for long-term environmental responsibility.

Waste Reduction and Recycling

Waste reduction and recycling are crucial for Owens & Minor's environmental sustainability. Minimizing operational waste, enhancing packaging, and establishing recycling partnerships are key. These actions improve the supply chain's sustainability profile, reflecting positively on the company. Owens & Minor's commitment to these practices can attract environmentally conscious investors and customers.

- In 2024, the healthcare sector saw a 15% increase in waste reduction initiatives.

- Sustainable packaging adoption grew by 20% in the medical device industry.

- Recycling partnerships can reduce waste disposal costs by up to 10%.

- Companies with robust sustainability programs often experience a 5% higher customer loyalty.

Water Management

Water management is crucial for Owens & Minor, especially in its manufacturing and distribution operations. This involves responsible practices like wastewater treatment and improving water efficiency. Such actions reflect Owens & Minor's dedication to conserving vital resources. They are likely working on reducing water consumption across their facilities.

- Water scarcity impacts supply chains, increasing operational risks.

- Efficient water use reduces environmental impact and lowers costs.

- Wastewater treatment helps prevent pollution and supports sustainability.

Owens & Minor prioritizes environmental stewardship through emissions and waste reduction, aiming for a 20% waste reduction by 2025, aligned with industry trends where the healthcare sector saw a 15% increase in waste reduction in 2024.

Climate risks require mitigation for supply chain resilience, particularly with disruptions costing businesses billions. Implementing strategies that emphasize waste reduction initiatives can yield cost savings while increasing client satisfaction. Sustainable packaging adoption increased by 20% in the medical device industry by the end of 2024.

Water management is crucial, focusing on wastewater treatment and efficiency to conserve resources, a strategy becoming increasingly important given the increasing impact of water scarcity in the medical supply chain, with recycling partnerships potentially reducing disposal costs by up to 10%.

| Initiative | Metric | Impact |

|---|---|---|

| Waste Reduction | 20% reduction by 2025 | Cost savings, improved brand perception. |

| Sustainable Packaging | 20% adoption in the medical device industry (2024) | Reduced environmental footprint. |

| Water Management | Wastewater treatment & efficiency | Cost reduction, supply chain reliability. |

PESTLE Analysis Data Sources

The Owens & Minor PESTLE draws from government reports, financial news, and healthcare industry publications, to ensure insights.