Paycom Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Paycom Bundle

What is included in the product

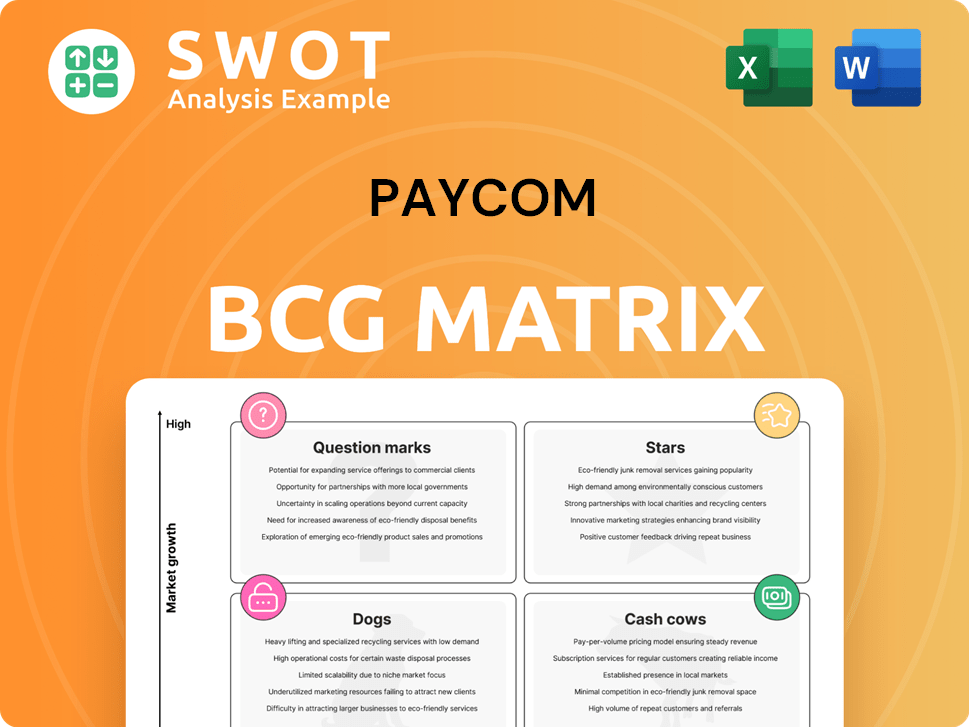

Paycom's BCG Matrix analysis reveals investment, hold, and divestiture strategies for its product portfolio.

Clear BCG matrix simplifies complex data, streamlining C-level presentations. Optimized for a distraction-free view!

What You’re Viewing Is Included

Paycom BCG Matrix

This preview is identical to the Paycom BCG Matrix you’ll receive after buying. It's a ready-to-use strategic tool for your business, offering actionable insights.

BCG Matrix Template

Paycom's BCG Matrix offers a snapshot of its product portfolio's competitive landscape. This analysis reveals which products drive growth, which generate steady cash flow, and which pose strategic challenges. Understanding these dynamics is crucial for informed decision-making. The preliminary overview only scratches the surface.

Purchase the full BCG Matrix to get detailed quadrant placements, strategic recommendations, and a clear path for optimized resource allocation.

Stars

Paycom's "Stars" include GONE and Beti, automating HR tasks. These tools streamline time-off and payroll, boosting efficiency. Automation cuts costs and lifts productivity for clients. In Q3 2024, Paycom's revenue grew 19% to $502.7 million, demonstrating the value of its automation.

Paycom's financial health shines, with impressive revenue growth and adjusted EPS exceeding forecasts in recent periods. The company's strategic focus on organic sales growth is evident, as they achieved $499.4 million in revenue in Q1 2024. Operational efficiencies, fueled by AI, enhance their financial success. This strong financial standing enables Paycom to invest in innovation and broaden its market presence.

Paycom excels with a high customer retention rate, signaling robust customer satisfaction. In 2024, Paycom's customer retention was approximately 93%, showing strong loyalty. This is thanks to their dedicated customer service and valuable HCM solutions. Customers value Paycom's integrated platform and automated features.

Market Leadership in HCM

Paycom excels as a market leader in the Human Capital Management (HCM) sector. They offer a comprehensive, cloud-based software solution, mainly serving small to mid-sized U.S. businesses. Their integrated platform and focus on automation set them apart, boosting market share and revenue.

- 2024 revenue reached approximately $1.8 billion, reflecting strong growth.

- Paycom's market capitalization exceeded $20 billion.

- The company's client base includes thousands of businesses nationwide.

AI-Driven Efficiency Gains

Paycom's AI integration, particularly with Beti and GONE, boosts client productivity. Their AI agent, launched six months ago, decreased service tickets and improved response times. This enhances client satisfaction and operational efficiency. It's a significant differentiator, attracting new clients and fueling revenue. In 2023, Paycom's revenue reached $1.7 billion, reflecting this AI-driven success.

- AI Agent Impact: Reduced service tickets and improved response rates.

- Revenue Growth: Paycom's 2023 revenue was $1.7 billion.

- Key Differentiator: AI-driven efficiency attracts new clients.

- Product Integration: AI is integrated in products like Beti and GONE.

Paycom's Stars, like GONE and Beti, automate HR tasks, enhancing efficiency. These tools, key to Paycom's success, saw 19% revenue growth in Q3 2024, reaching $502.7 million. This strong performance is boosted by AI, improving client satisfaction and cutting costs.

| Feature | Details | Impact |

|---|---|---|

| Revenue Growth (Q3 2024) | 19% | Demonstrates product value and market adoption. |

| 2024 Revenue | Approximately $1.8B | Reflects strong market position and effective sales. |

| Customer Retention (2024) | Approximately 93% | Shows high customer satisfaction and loyalty. |

Cash Cows

Paycom's strength lies in its recurring revenue, a cornerstone of its financial stability. This predictable income comes from its subscription model, ensuring a consistent revenue flow. For example, in 2024, subscription revenue accounted for over 98% of Paycom's total revenue, demonstrating its reliability. This allows for strategic investments in areas like product development.

Paycom's expansive client network, boasting over 37,543 clients as of 2024, ensures consistent revenue streams. Its strategic focus on U.S. small to mid-sized businesses has solidified its market position. This established base offers dependable revenue and strong potential for upselling and cross-selling its services. Paycom's 2024 revenue reached $1.7 billion, which reflects its client base's financial strength.

Paycom's HCM platform is a cash cow, offering payroll, talent management, and benefits. Its integrated nature simplifies HR, boosting efficiency. In 2024, Paycom's revenue grew, reflecting its platform's value. This comprehensive approach solidifies its cash cow position. The platform's wide adoption fuels its continued financial success.

Operational Efficiency

Paycom excels in operational efficiency, focusing on automation and streamlined processes. Their AI-driven solutions and integrated platform boost efficiency. This efficiency leads to robust profit margins and strong cash flow generation. Paycom's commitment to operational excellence is key to its financial health.

- In 2024, Paycom reported a gross profit of $805.5 million.

- Paycom's adjusted EBITDA for 2024 was $612.9 million.

- The company's operating income for 2024 reached $457.9 million.

- Paycom's net income for 2024 was $355.4 million.

Strong Brand Reputation

Paycom's robust brand reputation in the HCM sector is a key cash cow attribute. They are known for innovative solutions and excellent customer service, fostering strong client loyalty. Awards and accolades, like being a top HCM provider, boost their image, attracting new business. This positive brand perception directly supports Paycom's financial stability.

- Market Recognition: Paycom has been consistently recognized as a leader in the HCM space by various industry analysts.

- Customer Retention: High customer retention rates, indicating satisfaction with Paycom's services.

- Revenue Growth: Steady revenue growth, reflecting the brand's ability to attract and retain clients.

- Brand Value: Paycom's brand value is a significant asset, contributing to its market position.

Paycom's "Cash Cow" status stems from its financial strength and market position. Recurring subscription revenue, making up over 98% of 2024's total revenue, provides stability. Its client base, including over 37,543 clients as of 2024, fuels consistent revenue streams. Paycom's 2024 revenue was $1.7 billion.

| Financial Metric (2024) | Amount (USD in Millions) | Notes |

|---|---|---|

| Gross Profit | $805.5 | Generated from core operations. |

| Adjusted EBITDA | $612.9 | Reflects strong profitability. |

| Operating Income | $457.9 | Demonstrates efficient operations. |

| Net Income | $355.4 | Highlights overall financial health. |

Dogs

Paycom's client growth has decelerated. In 2024, the total client count rose by only 2%. This slowdown suggests difficulties in attracting new clients. Increased competition within the HCM market is likely a contributing factor. Paycom must tackle these challenges to regain client growth momentum.

Paycom's flat client retention rate of 90% signals a potential issue. This stagnation requires attention despite the high overall rate. In 2024, Paycom's revenue growth, while strong, could be hindered by this flat retention. Identifying churn causes and boosting satisfaction are crucial for sustained growth.

Macroeconomic headwinds and geopolitical uncertainty led to workforce reductions for Paycom's clients, affecting transaction volumes and new client additions. External factors can negatively impact Paycom's revenue and profitability. For example, in Q1 2024, Paycom's revenue growth slowed to 10.7%, a decrease from 2023's growth. The company must diversify its client base and target resilient industries to mitigate these impacts.

Competition from Larger Players

Paycom encounters tough competition from giants like ADP and Workday in the HCM and payroll automation market. These larger firms are boosting their AI-powered payroll features, directly challenging Paycom's customer base. To stand out, Paycom must emphasize its unique advantages and keep innovating its products.

- ADP's revenue in 2024 was around $18.05 billion.

- Workday's revenue in 2024 was approximately $7.48 billion.

- Paycom's 2024 revenue was about $1.8 billion, showing its smaller scale relative to competitors.

Potential Profitability Pressure

Paycom faces profitability challenges. Rising costs and a projected EBITDA margin dip in 2025 indicate pressure. The company must manage costs and boost efficiency to maintain profitability. This could limit investments and market expansion. For instance, Paycom's operating expenses grew by 26% in 2024.

- Rising operational costs.

- Slight EBITDA margin dip in 2025.

- Need for cost management.

- Potential investment limitations.

Paycom's "Dogs" status is evident due to its decelerating client growth, stagnant retention, and profitability challenges. The company's small scale relative to competitors like ADP and Workday, with their greater resources, further compounds these issues. Strategic cost management and efficiency improvements are essential for Paycom's survival.

| Aspect | Description | 2024 Data |

|---|---|---|

| Client Growth | Slowdown in attracting new clients | 2% increase |

| Client Retention | Stagnant retention rate | 90% |

| Profitability | Rising costs and margin pressure | Operating expenses +26% |

Question Marks

Paycom's limited international presence signifies growth potential. Focusing on global markets could boost revenue and diversify clients. Yet, expansion poses execution risks and competition. In 2024, Paycom's international revenue was minimal compared to its U.S. earnings.

Paycom consistently develops new features for its HCM platform, aiming to draw in new clients and boost revenue. New products are considered question marks in the BCG matrix due to uncertain success, demanding marketing and sales investments. In Q1 2024, Paycom's revenue reached $540.5 million, a 12.8% increase year-over-year, reflecting ongoing product development efforts. These investments are crucial.

Paycom's AI initiatives, like its client support AI, are a growth opportunity. These innovations could boost client satisfaction and efficiency, attracting new clients. However, their success needs to be proven, requiring investment and improvement. In Q3 2024, Paycom's revenue grew by 18.3% YoY, indicating strong potential.

Strategic Acquisitions

Paycom might use strategic acquisitions to broaden its services and customer base. Buying related companies could speed up growth and strengthen its market standing. However, such moves involve risks and considerable financial input. In 2024, Paycom's revenue was approximately $1.7 billion, indicating financial capacity for strategic acquisitions.

- Expansion: Acquisitions can help Paycom enter new markets.

- Product Enhancement: They can add new features to Paycom's offerings.

- Financial Impact: Acquisitions require significant capital investment.

- Market Position: Strategic acquisitions can improve Paycom's competitive edge.

Upselling and Cross-selling Opportunities

Paycom can boost revenue by upselling and cross-selling its services to existing clients. This strategy helps retain clients and increases the revenue generated from each client. To succeed, Paycom must understand client needs and offer suitable solutions. In 2024, Paycom's focus is on expanding its services to increase its market share and client satisfaction.

- Upselling involves offering premium features.

- Cross-selling includes adding new HR modules.

- Client retention is key to long-term growth.

- Paycom's goal is to enhance client relationships.

New products and AI initiatives are question marks for Paycom. These require significant investments with uncertain outcomes, impacting Paycom’s BCG matrix. The company's moves into AI client support and new features have the potential to boost revenue but carry risks. Paycom’s growth, shown by its Q3 2024 revenue of $456.3 million, reflects these efforts.

| Aspect | Details | Impact |

|---|---|---|

| New Products | Feature launches for HCM platform | Drive revenue, but with execution risks. |

| AI Initiatives | Client support AI | Enhance client satisfaction. |

| Strategic Acquisitions | Expansion into new markets and services | Bolster market standing. |

BCG Matrix Data Sources

The Paycom BCG Matrix uses public financial reports, industry market analyses, and competitor data. It's also supported by growth rate predictions and company performance.