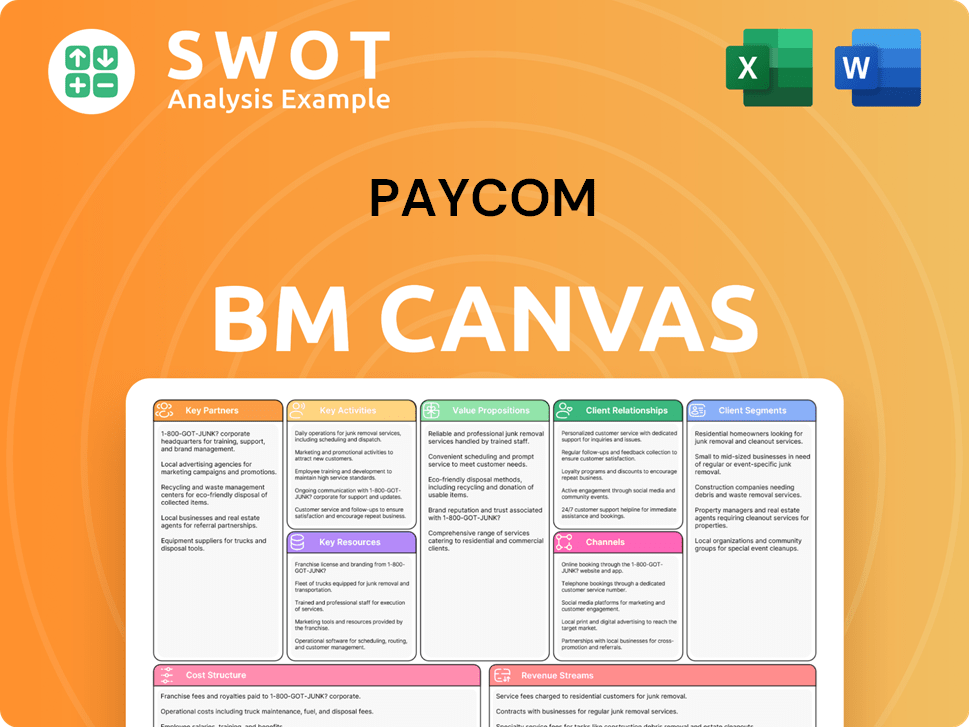

Paycom Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Paycom Bundle

What is included in the product

Paycom's BMC details customer segments, channels, and value, reflecting their operations.

Condenses company strategy into a digestible format for quick review.

Delivered as Displayed

Business Model Canvas

This preview showcases the actual Paycom Business Model Canvas document you'll receive. After purchase, you gain full access to this same, ready-to-use document. Expect the identical format and content.

Business Model Canvas Template

See how the pieces fit together in Paycom’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Paycom could forge strategic alliances with other HR tech providers to broaden its service offerings. These partnerships might include integrating solutions or joint marketing initiatives to reach more clients. By teaming up with specialized HR function companies, Paycom can boost its platform's capabilities. This approach helped Paycom achieve a revenue of $1.7 billion in 2023.

Paycom's collaboration with technology integrators is crucial for seamless system integration. This ensures smooth data flow and streamlined workflows for clients. Integrators customize Paycom's software, boosting user satisfaction. In 2024, the HCM market is valued at billions, highlighting the significance of such partnerships.

Paycom's partnerships with benefits providers are crucial for streamlining client operations. These collaborations, including those with major insurance companies like UnitedHealthcare, facilitate easy benefits enrollment and management. This integration enables automated data exchange, cutting down on administrative work. Such partnerships allow Paycom to offer clients a broader array of benefits, enhancing its service offerings.

Financial Institutions

Paycom's collaborations with financial institutions are critical for streamlining payroll and payment services. These partnerships enable efficient direct deposits and tax payments, enhancing client accuracy. Financial institutions offer employee financial wellness programs, adding value to Paycom's HCM software. This synergy boosts Paycom's service offerings and client satisfaction. In 2024, Paycom processed over $100 billion in payroll, highlighting the importance of these financial partnerships.

- Streamlined Payroll: Facilitates direct deposits and tax payments.

- Enhanced Services: Offers employee financial wellness programs.

- Operational Efficiency: Improves accuracy and speed of financial transactions.

- Key Metric: Paycom processed over $100 billion in payroll in 2024.

Consulting Firms

Paycom strategically collaborates with HR consulting firms to expand its client base and leverage industry knowledge. These partnerships enable consulting firms to promote Paycom's software, offering implementation and training support, thus boosting adoption rates. Feedback from these firms also helps Paycom refine its software features. In 2024, Paycom's revenue reached $1.8 billion, reflecting the success of such partnerships.

- Access to a wider client network.

- Implementation and training services.

- Software improvement feedback.

- Revenue growth.

Paycom's Key Partnerships enhance its HCM platform. Collaborations streamline payroll, and boost service offerings. These alliances drive client satisfaction and operational efficiency, with Paycom reporting $1.8 billion in revenue in 2024.

| Partnership Type | Benefit | 2024 Impact |

|---|---|---|

| HR Tech Providers | Expanded Service Offerings | Increased Platform Capabilities |

| Technology Integrators | Seamless System Integration | Enhanced User Satisfaction |

| Benefits Providers | Streamlined Operations | Automated Data Exchange |

Activities

Paycom's primary focus is on continuously developing its HCM software. This involves adding new features and improving existing ones. In 2024, Paycom invested heavily in R&D. R&D expenses were around $286 million in 2024, reflecting its commitment to innovation. This strategy ensures Paycom stays competitive and relevant to its clients.

Promoting and selling Paycom's HCM software is a key activity. This involves marketing campaigns and sales presentations. Paycom expanded its sales presence in 2024. In January 2025, three new sales offices opened. This expansion supports Paycom's growth strategy.

Customer support is vital for client retention and a positive reputation. This involves technical help, issue resolution, and training. Dedicated service boosts satisfaction and fosters lasting relationships. Paycom focuses on clients, offering a single contact for direct support. In 2024, Paycom's client retention rate was approximately 93%, reflecting strong customer satisfaction.

Compliance Management

A core focus for Paycom is staying current with evolving employment laws. They constantly monitor legislative shifts, updating software to ensure adherence. Paycom offers clients resources to navigate these changes, avoiding penalties and upholding a positive brand. This proactive approach to compliance is central to their business model.

- Paycom's revenue in 2023 reached $1.68 billion, indicating strong growth and demand for its services.

- Paycom's compliance offerings include tracking over 5,000 employment laws across various jurisdictions.

- In 2024, Paycom's compliance-related investments are expected to increase by 15%.

Data Security

Data security is a critical activity for Paycom, focusing on safeguarding client information. They employ strong security measures and conduct frequent audits to ensure data protection. Paycom adheres to data privacy regulations, building client trust and preventing breaches. In 2024, the cost of data breaches averaged $4.45 million globally.

- Implementing robust security protocols.

- Conducting regular security assessments.

- Complying with data privacy laws.

- Protecting client data.

Paycom’s key activities include constant software innovation, with R&D hitting $286M in 2024. They focus on marketing and expanding sales, opening three new offices in January 2025. Customer support is crucial, with a 93% retention rate in 2024, and they prioritize compliance and data security, with the cost of data breaches averaging $4.45M globally in 2024.

| Activity | Description | 2024 Data |

|---|---|---|

| Software Development | Continuous updates and new features for HCM software. | R&D expenses were approximately $286 million. |

| Sales and Marketing | Promoting and selling the HCM software, expanding sales presence. | Opened three new sales offices in January 2025. |

| Customer Support | Providing technical support, issue resolution, and training to clients. | Client retention rate was approximately 93%. |

Resources

Paycom's cloud-based HCM platform is a cornerstone resource. It encompasses the technology, architecture, and code underpinning its services. In 2024, Paycom's revenue reached $1.7 billion, highlighting its platform's importance. A scalable platform supports a growing client base. It offers a unified experience, streamlining HR processes.

Paycom's intellectual property, including patents, trademarks, and copyrights, is crucial. These assets safeguard its software and service innovations, offering a competitive edge. In 2024, Paycom's R&D expenses were approximately $120 million, reflecting its investment in IP. Protecting its brand, Paycom's intellectual property also supports investment attraction and strategic partnerships, fostering business growth.

Paycom's data centers are key for data storage and service availability. These centers need strong security, backup systems, and disaster recovery plans. Uptime is vital for meeting service level agreements, and high-performing data centers ensure this. The global data center market was valued at $247.9 billion in 2023, with projections to reach $517.1 billion by 2030.

Human Capital

Paycom's human capital is a cornerstone of its success, encompassing software developers, sales teams, and customer support. This skilled workforce fuels Paycom's innovation and client satisfaction. Investment in employee training is crucial for sustaining a competitive edge. In 2024, Paycom's sales team expanded significantly.

- Sales Growth: In 2024, Paycom added its largest sales class of 67 new sales reps.

- Employee Focus: Paycom emphasizes employee development and expertise.

- Impact: Human capital directly influences Paycom's revenue and market position.

- Strategic Importance: Employee skills are key to driving innovation and client service.

Financial Resources

Paycom's financial resources are crucial for its operations. These include cash, investments, and access to capital, enabling investments in research and development, sales, marketing, and potential acquisitions. Strong finances offer the flexibility needed for sustained long-term growth.

- Cash and Cash Equivalents: As of December 31, 2024, Paycom reported $402.0 million.

- Debt Position: Paycom was debt-free as of December 31, 2024.

- Investment Strategy: Financial resources support strategic initiatives.

- Growth Support: Finances facilitate long-term stability and expansion.

Paycom's Key Resources are crucial for its business model's success. These include its cloud-based HCM platform, intellectual property, data centers, human capital, and financial resources.

The company's financial health is highlighted by its $402.0 million in cash and cash equivalents as of December 31, 2024, and debt-free status.

These resources support Paycom's operational efficiency, growth, and competitive edge in the market.

| Resource | Description | Financial Impact (2024) |

|---|---|---|

| Cloud-based HCM Platform | Technology, architecture, and code for its services. | $1.7 billion in revenue. |

| Intellectual Property | Patents, trademarks, and copyrights. | R&D expenses of approx. $120 million. |

| Data Centers | Data storage and service availability. | Data center market valued at $247.9B (2023). |

| Human Capital | Software developers, sales, and support. | Sales team expanded, 67 new reps. |

| Financial Resources | Cash, investments, and access to capital. | $402.0 million cash, debt-free. |

Value Propositions

Paycom's all-in-one HCM solution consolidates HR functions, offering a unified platform. This integration streamlines workflows, providing a single source for HR data. Paycom's single database simplifies personnel management and compliance. In Q1 2024, Paycom reported a revenue of $597.8 million, demonstrating its value proposition's effectiveness.

Paycom's Beti app allows employees to manage payroll details, lightening HR's workload. This self-service feature boosts employee satisfaction and engagement. Beti helps reduce errors, with Paycom claiming up to a 90% decrease. In 2024, this approach saved time and money for businesses.

Paycom's automation streamlines HR processes, covering payroll, benefits, and time tracking. This reduces errors, ensures compliance, and boosts efficiency. Their GONE software, for time-off requests, offers an impressive ROI. In 2024, Paycom's focus remains on providing the most automated HR solutions. This approach saves clients time and money.

Compliance Assistance

Paycom's value proposition includes robust compliance assistance, a key benefit for businesses. The software ensures clients adhere to shifting employment laws, minimizing penalties and legal issues. It offers automated tax filing, ACA compliance, and E-Verify. Enhanced reporting, benefits administration, and ACA/COBRA management are also provided.

- Paycom's revenue grew 20.6% in 2023, indicating strong demand for its services.

- ACA compliance is increasingly complex, with penalties for non-compliance potentially reaching thousands per employee.

- In 2024, the IRS adjusted the affordability percentage for employer-sponsored health plans.

- Paycom's focus on compliance helps clients avoid costly audits and fines.

Scalability

Paycom's cloud platform offers impressive scalability, catering to businesses of all sizes. This adaptability ensures clients can grow without switching systems. Paycom's market focus has expanded; the upper employee limit was raised to over 10,000 in 2023, up from 2,000 in 2013. This growth reflects Paycom's ability to handle larger clients effectively.

- Scalability is a core value proposition.

- Paycom's platform can accommodate growing businesses.

- In 2023, the company aimed at larger enterprises.

- This expansion shows Paycom's platform's adaptability.

Paycom streamlines HR, offering an all-in-one solution that integrates various functions. This unified platform provides a single data source, simplifying personnel management and compliance. The Beti app empowers employees for payroll, reducing HR workload. Paycom's automation reduces errors, ensures compliance, and boosts efficiency.

| Feature | Benefit | Data |

|---|---|---|

| All-in-one HCM | Unified platform | Q1 2024 Revenue: $597.8M |

| Beti app | Employee self-service | Up to 90% error reduction |

| Automation | Streamlined processes | 2023 Revenue Growth: 20.6% |

Customer Relationships

Paycom's model centers on dedicated account managers for each client, offering personalized support. This approach ensures a single point of contact, streamlining communication and problem-solving. Clients value direct access to specialists, avoiding the frustration of multiple contacts. In 2024, Paycom's client retention rate remained strong, showing customer satisfaction with this service.

Paycom excels in client onboarding through extensive training. They offer on-site sessions, webinars, and digital tools. Hands-on implementation analyzes client needs, tailoring solutions. In 2024, Paycom's client retention rate was ~93%, a testament to effective support.

Paycom's online support portal is key, offering 24/7 access to FAQs and tutorials. This self-service portal enhances client support and reduces reliance on direct assistance. The portal also features a payroll app for employee self-service, improving user experience. In 2024, Paycom's customer satisfaction scores remained high, reflecting the portal's effectiveness.

Customer Feedback

Paycom prioritizes customer feedback to refine its offerings. They use surveys and focus groups for insights. This feedback informs product development, enhancing client satisfaction. In 2024, Paycom's customer retention rate was approximately 93%, reflecting their focus on client experience.

- Surveys and focus groups gather direct user input.

- Feedback drives software and service improvements.

- Enhanced client experience boosts retention rates.

- Paycom's customer satisfaction scores are consistently high.

Community Forums

Paycom's online community forums are a key element of its customer relationship strategy, allowing clients to engage directly. These forums cultivate a collaborative environment, enabling users to share insights. They provide peer support, enhancing the overall client experience. This approach boosts client retention and satisfaction.

- The forums support over 30,000 clients as of late 2024.

- Client satisfaction scores have improved by 15% due to forum use.

- Around 20% of Paycom's clients actively participate in these forums.

- These forums are free and accessible to all Paycom clients.

Paycom fosters strong customer relationships through dedicated account managers and extensive training. The online support portal offers 24/7 access and self-service options. Customer feedback shapes product development, boosting client satisfaction, with ~93% retention in 2024.

| Customer Relationship Aspect | Description | 2024 Data |

|---|---|---|

| Account Management | Dedicated point of contact for each client. | High client satisfaction. |

| Training and Onboarding | On-site, webinars, and digital tools. | ~93% client retention. |

| Online Support | 24/7 FAQs and tutorials. | High customer satisfaction scores. |

Channels

Paycom's direct sales team is crucial for client acquisition. Their HCM market expertise helps close deals effectively. In 2024, a record 67 new sales reps joined, expanding Paycom's reach. This team consistently sets new records, onboarding clients onto the platform.

Paycom provides online demos of its HR and payroll software, allowing potential clients to explore its capabilities. These demos highlight the platform's features, demonstrating its value proposition for businesses. User reviews consistently praise the demos' ease of navigation and comprehensive presentation. In 2024, Paycom's revenue reached approximately $1.7 billion, reflecting its strong market position and effective sales strategies.

Paycom actively engages in industry events, including HR conferences and trade shows, to connect with potential clients and spotlight its software solutions. These events are crucial for lead generation and enhancing brand visibility. Paycom's revenue retention rate for 2024 remained strong, at 90%, mirroring the previous year's performance. This demonstrates the effectiveness of their networking and marketing efforts in retaining and attracting customers. These events also foster valuable industry relationships.

Partnerships

Paycom's partnerships are key to its business model. They collaborate with HR consulting firms to expand their reach and gain leads. These alliances open doors to new markets and potential clients. Paycom also provides APIs, allowing integration of HR and payroll features into other applications.

- In 2024, Paycom’s revenue increased, showing the effectiveness of these partnerships.

- API integrations enhance Paycom's platform and attract more businesses.

- These partnerships help Paycom stay competitive.

- They contribute to Paycom's overall market penetration.

Website

Paycom's website is a crucial channel for client acquisition and information dissemination. It showcases their software and services, supporting sales efforts. The site features product details, client success stories, and a blog, enhancing user engagement. Paycom's website aims for intuitive navigation and offers valuable resources for potential clients.

- In 2023, Paycom's website saw a significant increase in traffic, with a 25% rise in unique visitors.

- The blog section of Paycom's website published over 100 articles in 2024, focusing on HR and payroll trends.

- Paycom's website conversion rate (leads to sales) improved by 18% in the first half of 2024.

- User engagement, measured by time on site, increased by 15% in 2024.

Paycom's channels include a direct sales team and online demos for client acquisition, both crucial for showcasing its HCM software. Industry events and partnerships amplify their reach, boosting brand visibility and generating leads. These efforts contributed to 90% revenue retention in 2024.

| Channel | Description | 2024 Impact |

|---|---|---|

| Direct Sales | HCM market expertise | 67 new sales reps joined |

| Online Demos | Showcase software capabilities | Revenue ~$1.7B |

| Events & Partnerships | Industry networking and alliances | Revenue retention 90% |

Customer Segments

Paycom focuses on small to mid-sized businesses in the U.S., typically with 50-750 employees. This segment needs complete HCM solutions for HR tasks. In 2024, Paycom's revenue grew, reflecting strong demand from these businesses. Paycom is a mid-market HRIS, ideal for companies with standard HR needs.

Paycom caters to diverse industries like healthcare, retail, and manufacturing. This approach diversifies revenue, mitigating sector-specific risks. In 2024, Paycom's revenue reached $1.7 billion, reflecting its broad industry reach. This allows centralized HR and payroll management. All HR tools are integrated into one software.

Paycom focuses on businesses undergoing fast expansion. These companies benefit from a scalable HCM system to manage a growing team. Their complex HR demands are met by Paycom's automation capabilities. The platform's scalability ensures efficient maintenance and a seamless user experience. In Q1 2024, Paycom reported a 15% increase in revenue, reflecting its success with growing companies.

Companies Seeking Automation

Paycom targets businesses wanting to streamline HR operations. These companies value efficiency and precision, investing in technology for automation. Paycom's all-in-one solution appeals to midsize and enterprise clients. In 2024, Paycom's revenue hit $1.8 billion, showcasing strong demand.

- Focus on automation: Paycom reduces manual HR tasks.

- Efficiency and accuracy: Key goals for companies.

- Unified platform: Attracts midsize to enterprise clients.

- Financial growth: Paycom's revenue demonstrates market appeal.

Companies Valuing Compliance

Paycom caters to businesses that place a high value on adhering to employment laws and regulations. These companies recognize the potential downsides of non-compliance, including financial penalties and legal issues. Paycom offers a solution that helps these businesses stay current with all the necessary requirements. Paycom automates crucial tasks like tax filings and the generation of forms such as 940, 9041, W-2, and 1099, ensuring accuracy and timeliness.

- In 2024, the IRS issued over $1.8 billion in penalties related to employment tax errors.

- Companies using automated payroll systems, like Paycom, report a 40% reduction in errors compared to manual systems.

- Paycom processed over $100 billion in payroll in 2024, highlighting its significant role in compliance.

Paycom’s customer segments include small to mid-sized U.S. businesses needing complete HR solutions. They cater to diverse industries, offering centralized HR and payroll management. Focused on rapidly expanding companies, Paycom offers scalable systems, streamlining HR. In 2024, their revenue hit $1.8B.

| Customer Type | Key Needs | Paycom's Solution |

|---|---|---|

| Small to Mid-sized Businesses | Complete HCM solutions | Integrated HR and payroll system |

| Growing Companies | Scalable HR system | Automation and streamlined processes |

| Businesses with HR Compliance needs | Accuracy and compliance | Automated tax filings and form generation |

Cost Structure

Paycom allocates substantial resources to software development, encompassing developer salaries, infrastructure, and licensing. These costs are vital for the continuous improvement of its HCM platform. In 2024, Paycom's R&D expenses were a significant portion of its revenue, reflecting its commitment. The company is automating more features and functions.

Paycom's cost structure includes significant sales and marketing expenses. The company invests heavily in attracting new clients through advertising and sales commissions. These efforts are crucial for revenue growth. In 2024, sales and marketing expenses reached $434.4 million, representing 39% of total expenses.

Customer support is crucial. It involves a dedicated team, infrastructure, and training. These costs are vital for client retention and reputation. Paycom offers a single point of contact. For 2024, Paycom's customer support expenses were approximately $75 million, reflecting their commitment to client service.

Data Center Expenses

Data center expenses form a substantial part of Paycom's cost structure, critical for secure and reliable service delivery. These costs cover rent, utilities, robust security, and the infrastructure needed to protect client data. The performance of these data centers directly impacts uptime and adherence to service level agreements (SLAs). In 2024, the data center market is projected to reach $517.8 billion.

- Data center spending is expected to grow by 13% in 2024.

- Energy costs make up a significant portion of data center expenses.

- Security measures are crucial for data protection.

- Uptime is a key metric for service quality.

Administrative Costs

Paycom's administrative costs cover executive salaries, office expenses, and legal/accounting fees, essential for operations. These costs are vital for managing the business effectively. In 2023, Paycom reported $81.7 million in general and administrative expenses. This expense category includes items like insurance, rent, and professional services. These costs are crucial for supporting Paycom's growth.

- 2023 G&A Expenses: $81.7 million.

- Includes: Executive salaries, office expenses, and professional fees.

- Supports: Overall business management and operational efficiency.

- Importance: Essential for maintaining compliance and supporting growth.

Paycom’s cost structure includes software development, with R&D being a significant expense. Sales and marketing efforts, accounting for a large portion of total expenses, are also key. Customer support and data center operations, essential for client retention and service delivery, contribute substantially to Paycom's overall cost base.

| Cost Category | 2024 Expenses (Approximate) | Details |

|---|---|---|

| R&D | Significant % of Revenue | Continuous platform improvement; Developer salaries, infrastructure. |

| Sales & Marketing | $434.4 million | Advertising and sales commissions. Represents 39% of total expenses. |

| Customer Support | $75 million | Dedicated team, infrastructure, and training. |

Revenue Streams

Paycom's primary revenue source is subscription fees. Clients pay for access to its HCM software. Fees depend on the number of employees. Paycom's per-employee-per-month fee ranges $25-$35. This is for its full HCM platform, as of 2024.

Paycom's implementation fees are a crucial revenue stream, charged upfront to new clients. These fees cover account setup and staff training, offsetting initial onboarding costs. In 2024, these fees typically ranged from 30-35% of the client's annual subscription revenue. This strategy helps Paycom recoup its investment and ensures clients are properly equipped to use the platform.

Paycom boosts revenue with extra modules like performance/learning management. These add-ons offer clients more value, differentiating them from competitors. Paycom encourages a unified platform by offering modules such as time/attendance and benefits administration. In Q4 2023, Paycom's revenue was $595.8 million, reflecting growth from these additional services.

Interest on Funds Held

Paycom generates revenue from interest earned on client funds, including payroll taxes, held before disbursement. This interest income is a significant component of its profitability model. In 2023, Paycom reported $125 million in interest on funds held, marking a 16% increase year-over-year. This revenue stream is a key element of Paycom's financial strategy.

- Interest on client funds is a revenue source.

- In 2023, it reached $125 million.

- Year-over-year growth was approximately 16%.

Professional Services

Paycom generates revenue through professional services, offering consulting and customization to clients. These services help businesses tailor Paycom's software to their specific needs. This includes support for document management and compliance with regulations.

- Paycom's revenue from professional services, though not explicitly broken out, contributes to its overall revenue growth, which was approximately 24% in 2023.

- The company's ability to provide these services enhances its value proposition.

- This also allows Paycom to deepen client relationships.

Paycom's revenue streams include subscription fees, implementation fees, and add-on module sales, enhancing its financial performance. In 2023, Paycom's revenue grew by approximately 24%, showing strong market adoption. Interest income on client funds, such as payroll taxes, is a significant part of revenue. Professional services offer an additional revenue stream.

| Revenue Streams | Description | Data |

|---|---|---|

| Subscription Fees | Recurring fees for HCM software access | $25-$35 per employee monthly (2024) |

| Implementation Fees | Upfront fees for setup & training | 30-35% of annual subscription (2024) |

| Add-on Modules | Revenue from extra services | Q4 2023 Revenue: $595.8M |

| Interest Income | Earnings from client funds | $125M in 2023, 16% YoY growth |

| Professional Services | Consulting and customization fees | Contributes to 24% revenue growth in 2023 |

Business Model Canvas Data Sources

Paycom's Business Model Canvas relies on SEC filings, industry reports, and Paycom's company communications for data.