Pennon Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pennon Group Bundle

What is included in the product

Tailored analysis for the featured company's product portfolio

Export-ready design for quick drag-and-drop into PowerPoint, saving valuable time.

Delivered as Shown

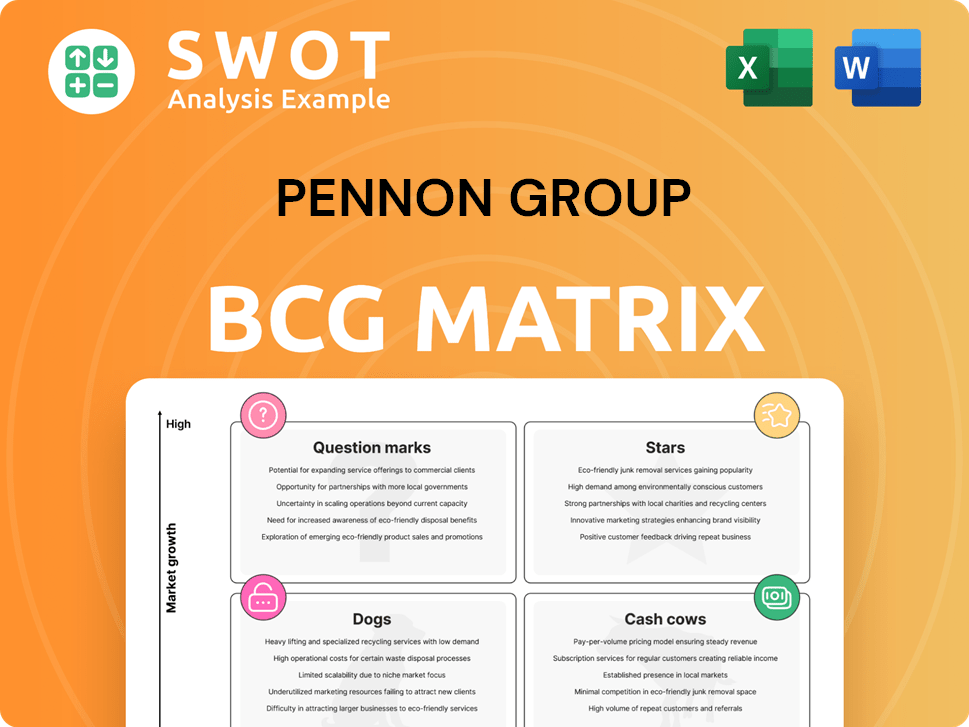

Pennon Group BCG Matrix

The BCG Matrix preview showcases the complete document you'll receive upon purchase. This is the final, professionally designed report with no hidden content—ready for immediate application. The full, editable version awaits, complete with Pennon Group's strategic insights. Download, analyze, and leverage this proven tool.

BCG Matrix Template

The Pennon Group's BCG Matrix reveals its product portfolio's market position. This analysis categorizes products as Stars, Cash Cows, Dogs, or Question Marks. Understanding these classifications is crucial for strategic decisions. This preview offers a glimpse into the company's landscape. Want to know which products drive growth and which need re-evaluation?

Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

South West Water (SWW) is a Star within the Pennon Group's BCG Matrix, showcasing its strong market position. In 2024, SWW's financial resilience was again top-rated by Ofwat. Its business plan received an 'outstanding' rating from Ofwat, particularly for Bournemouth, Bristol, Cornwall, Devon, and the Isles of Scilly. This indicates significant growth potential for SWW.

Pennon Group's strategic investments in K8, totaling £3.2 billion from 2025-2030, are a key focus. These investments aim to enhance water quality and address storm overflows. Such initiatives are designed to foster significant improvements in the company's performance.

Pennon Power is actively expanding its renewable energy portfolio. Approximately 45% of its planned capacity is currently being built across two sites, with the initial power generation anticipated by the end of 2024/25. These projects are projected to deliver attractive annualized returns, ranging from 11% to 15%.

Acquisition Synergies

Pennon Group is focused on integrating acquired businesses to unlock synergies. This includes integrating Bristol Water and SES Water into its operations. These integrations are expected to generate substantial cost savings and improve profitability.

- Pennon anticipates annual savings of around £20 million from Bristol Water.

- SES Water integration is projected to yield approximately £11 million in yearly savings.

- These synergies are key to enhancing overall operational efficiency.

Water Resources and Quality

Pennon Group, within the Stars quadrant, actively focuses on enhancing water resources and quality. This commitment involves significant efforts to reduce phosphorus in post-treatment water, aiming for an 80% reduction across 37 sites. They've also improved the percentage of River Nutrient Assessment Groups (RNAGs) over K7, decreasing from 19% to 12%. These initiatives highlight Pennon's dedication to environmental stewardship and operational excellence.

- Reducing post-treatment phosphorus by ~80% at 37 sites.

- Improved RNAGs over K7 from 19% to 12%.

Stars within Pennon Group, like South West Water, demonstrate strong market positions and significant growth potential, as seen in their top ratings by Ofwat in 2024. Pennon's strategic investments, notably £3.2 billion in K8 from 2025-2030, further strengthen this status, focusing on water quality improvements. These efforts, alongside Pennon Power's renewable energy expansion with projected returns of 11%-15%, cement the Stars' position for continued success.

| Metric | Details | Value |

|---|---|---|

| K8 Investment (2025-2030) | Strategic investment to enhance water quality and address storm overflows | £3.2 billion |

| Pennon Power Projected Returns | Annualized returns from renewable energy projects | 11%-15% |

| Bristol Water Savings | Annual savings from Bristol Water integration | £20 million |

Cash Cows

Pennon Group's regulated water and wastewater services in the South West are a solid Cash Cow. This segment consistently generates revenue, thanks to essential services and regulated pricing. In 2024, this sector likely contributed significantly to Pennon's stable financial performance. The stability is evident in its consistent revenue stream, making it a reliable cash generator. For example, in 2023, the water business generated £580.7 million in revenue.

Pennon Group prioritizes operational efficiencies. In H1 2024/25, £55 million in annual efficiencies were achieved. The target is £86 million for K8. These savings boost profits and cash flow. This strategic focus strengthens Pennon's financial position.

Pennon Group's WaterShare+ scheme, launched in 2020, is innovative. It provides customers with a stake and a voice in the business. Customers have also benefited financially. In 2024, the scheme's impact continues to be felt. The total number of shareholders is 20,000.

Customer Affordability Support

Pennon Group excels in customer affordability support, unlocking over £110 million in financial aid. This commitment ensures 100% affordability for South West and Bristol customers, surpassing industry standards. Such actions boost customer loyalty while mitigating bad debt risks, a strategic win. This approach is crucial in today's economic landscape.

- £110 million in financial support unlocked.

- 100% affordability achieved in South West and Bristol.

- Proactive measures enhance customer loyalty.

- Reduces bad debt risks effectively.

Non-Household Retail Businesses

Pennon Group's non-household retail businesses are a cash cow, holding approximately 15% market share. These ventures are experiencing growth alongside profitability, a positive sign for investors. Impressively, customer service shines, with Pennon Water Services (PWS) and Water2Business (W2B) boasting high Trustpilot scores, 4.8 and 5.0 respectively. Moreover, business retail PBT doubled from H1 2022/23.

- Market share approximately 15%.

- PWS Trustpilot score: 4.8.

- W2B Trustpilot score: 5.0.

- Business retail PBT doubled from H1 2022/23.

Pennon Group's Cash Cows include regulated water services and non-household retail. These segments generate consistent revenue. Non-household retail holds about 15% market share. Strong customer service boosts profitability.

| Segment | Market Share/Score | Key Financial Data |

|---|---|---|

| Regulated Water | N/A | 2023 Revenue: £580.7M |

| Non-Household Retail | ~15% | PBT doubled from H1 2022/23 |

| Customer Service | PWS: 4.8, W2B: 5.0 (Trustpilot) | Financial support unlocked: £110M |

Dogs

Viridor, once a part of Pennon Group, operated in the waste management sector, which can be a capital-intensive business. Before its divestiture in 2020, it could be categorized as a 'Dog' within the BCG matrix. Waste management profitability fluctuates with market conditions and regulatory pressures. In 2019, Viridor's revenue was £1.3 billion.

Dogs in Pennon Group's BCG matrix might include small, non-core business units. These units have low growth and market share. They may need significant management attention. For example, Pennon's 2024 annual report shows a focus on core water services.

Underperforming contracts in Pennon Group's portfolio, like projects, consistently underperform. These projects may face delays, cost overruns, or regulatory issues. In 2024, Pennon's operational performance was impacted by these factors. For example, specific projects may have faced challenges.

Legacy Assets Requiring High Maintenance

Legacy assets, like aging water infrastructure, fall into the "Dogs" category. These assets demand substantial maintenance, yet generate limited returns. For example, in 2024, Pennon Group allocated a significant portion of its capital expenditure to maintain its older assets. This focus on upkeep often overshadows opportunities for growth and innovation. These assets are nearing the end of their lifecycle.

- High Maintenance Costs: Older infrastructure requires constant upkeep.

- Diminishing Returns: Limited contribution to overall profitability.

- Lifecycle Stage: Assets are nearing the end of their useful life.

- Capital Allocation: Significant resources are dedicated to maintenance.

Operations Facing Stricter Environmental Regulations

Operations within Pennon Group that grapple with stringent environmental regulations, necessitating substantial investment for compliance without revenue growth, are categorized as Dogs. These may become financially unsustainable. For instance, in 2024, water companies faced increased scrutiny. This resulted in higher operational costs.

- Environmental compliance costs rose by an average of 7% across the sector in 2024.

- Investments in infrastructure to meet new standards increased by 10% in 2024.

- The regulatory landscape became stricter, with potential fines for non-compliance.

Dogs in Pennon Group represent business units with low market share and growth. They often require significant maintenance, such as legacy assets or underperforming contracts. These units may generate limited returns, particularly those facing strict environmental regulations. Pennon Group's 2024 annual report showed a prioritization of core water services.

| Category | Example | 2024 Impact |

|---|---|---|

| Low Growth, Low Share | Small business units | Limited revenue contribution |

| High Maintenance | Legacy assets | High upkeep costs, reduced returns |

| Regulatory Burden | Environmental compliance | Increased costs by 7% |

Question Marks

Pennon Power's renewable energy ventures position it in a high-growth, but uncertain, market. Investments are recent and market share is not yet established. Projected returns look good, but need time to validate performance. In 2024, the renewable energy sector saw significant investment, but profitability varied.

The SES Water acquisition places Pennon Group in the 'Question Mark' quadrant. This is due to integration hurdles and the need to boost SES Water's business plan rating. Pennon Group's revenue in 2024 was £672.9 million. Achieving planned synergies is crucial for SES Water's future. The group's strategic focus is on enhancing operational efficiency.

Pennon Group's investment in innovative water tech, like advanced treatment methods and leak detection systems, positions it in the "Question Marks" quadrant of the BCG matrix. These technologies aim to boost efficiency and cut expenses. However, their impact hinges on successful rollout and consumer acceptance. In 2024, Pennon Group allocated significant capital to these areas, aiming for long-term gains. Specifically, the company invested £30 million in smart metering.

New Water Resource Projects

New water resource projects, like reservoirs or desalination plants, are considered "Question Marks" in Pennon Group's BCG matrix. These projects require substantial initial investment and face regulatory hurdles. Their success hinges on variables like weather, population trends, and policy shifts. For example, the UK water sector has seen rising capital expenditure, with £1.1 billion spent in 2023.

- High Investment Costs: Requires significant upfront capital.

- Regulatory Risk: Subject to stringent environmental and planning approvals.

- Market Uncertainty: Dependent on unpredictable factors like rainfall.

- Growth Potential: Opportunity for expansion based on population needs.

Expansion of Retail Services

Expansion of retail services within Pennon Group's portfolio, particularly in competitive markets, is categorized as a Question Mark in the BCG Matrix. This positioning reflects the inherent uncertainty associated with these ventures. Their success hinges on effectively managing customer acquisition costs, ensuring high service quality, and implementing competitive pricing strategies to attract and retain customers. These factors directly impact profitability and market share, determining whether the expansion will transition into a Star or decline. A strategic approach is crucial for these investments to flourish.

- Retail expansion faces uncertainty.

- Success depends on acquisition costs.

- Service quality and pricing matter.

- Strategic approach is crucial.

Question Marks in Pennon Group's portfolio represent ventures requiring strategic evaluation. High initial investments and uncertain returns characterize these projects. Successfully navigating market dynamics is crucial for these investments to succeed and provide long-term returns. Pennon Group's operating profit in 2024 reached £189.9 million.

| Aspect | Description | Data |

|---|---|---|

| Investments | Significant upfront capital needed | £30M smart metering |

| Market Dynamics | Success tied to market conditions | UK water sector £1.1B capex (2023) |

| Strategic Goal | Maximize returns & build value | 2024 operating profit £189.9M |

BCG Matrix Data Sources

Our BCG Matrix utilizes official financial reports, market research, industry analyses, and competitor benchmarks, all carefully assessed for insightful and strategic business recommendations.