Pennon Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pennon Group Bundle

What is included in the product

Analyzes Pennon Group's competitive landscape by assessing five key forces and their impact.

Customize pressure levels based on new data or evolving market trends.

Same Document Delivered

Pennon Group Porter's Five Forces Analysis

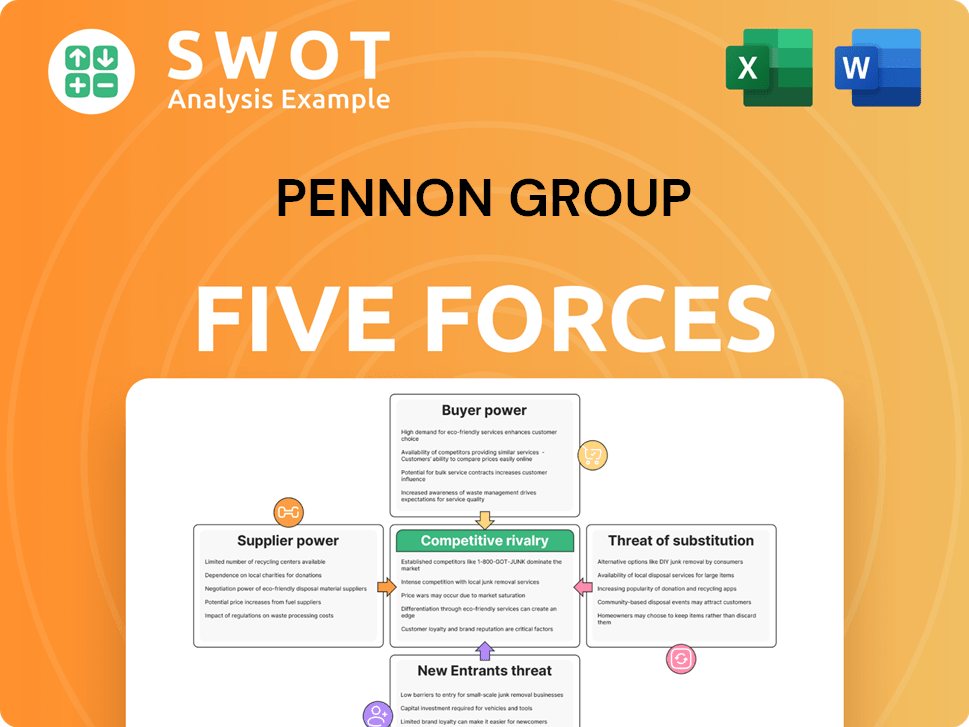

This preview offers Pennon Group's Porter's Five Forces analysis, showcasing competitive rivalry, supplier power, and more.

The document assesses threats of new entrants, bargaining power of buyers, and potential impacts on the business.

See the complete analysis upfront—no hidden details or altered content.

You're viewing the fully formatted, ready-to-use report—downloadable instantly after purchase.

The provided preview is the exact document you'll receive.

Porter's Five Forces Analysis Template

Pennon Group faces moderate rivalry, with competition from other water companies and waste management services. Buyer power is concentrated, mainly from regulated residential and commercial customers, potentially impacting pricing. Supplier power is notable due to infrastructure and specialized service providers. The threat of new entrants is low, given high capital requirements and regulatory hurdles. Substitute products pose a limited threat.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand Pennon Group's real business risks and market opportunities.

Suppliers Bargaining Power

Pennon Group sources chemicals, infrastructure components, and services from diverse suppliers. The availability of alternatives directly affects Pennon's bargaining power. In 2024, the water sector experienced supply chain disruptions, potentially increasing supplier influence. If key supplies are limited, suppliers gain leverage; conversely, numerous options strengthen Pennon's position. Pennon's strategy focuses on diversifying its supplier base to mitigate this risk.

Pennon Group's contractual agreements with suppliers are crucial. Long-term contracts can stabilize costs, though they might restrict responsiveness to market shifts. Terms like pricing and service levels affect the power dynamic. In 2024, Pennon's operational efficiency targets included optimizing supply chain agreements. The company's financial reports detail these contractual impacts.

Switching costs significantly influence Pennon Group's supplier bargaining power. If switching suppliers is expensive due to specialized equipment or unique technologies, Pennon's negotiation power decreases. This is because high costs limit Pennon's ability to seek better deals. In 2024, Pennon's operational expenses were approximately £500 million, highlighting the impact of supplier costs.

Supplier Concentration

Supplier concentration significantly influences Pennon Group's operational costs and supply chain stability. A concentrated supplier base gives suppliers more leverage. This could affect the price of essential resources. For instance, a lack of competition among suppliers may lead to higher input costs.

- In 2024, Pennon Group's cost of sales was £312.5 million, reflecting the impact of supplier pricing.

- A concentrated market might increase the risk of supply disruptions.

- Pennon must diversify its supplier base to mitigate these risks.

Impact of Regulations

Regulatory demands significantly shape supplier power within Pennon Group, especially in water and waste management. Suppliers offering solutions that ensure compliance with environmental standards gain leverage. This is because their products or services are crucial for Pennon's operations. For example, in 2024, environmental fines for non-compliance in the UK water sector reached £20 million.

- Compliance Costs: Suppliers of compliance-related services can command higher prices due to the mandatory nature of their offerings.

- Specialized Expertise: Suppliers with unique expertise in regulatory compliance hold more power.

- Market Dynamics: Stricter regulations can limit the number of qualified suppliers, increasing their bargaining power.

- Essential Services: Suppliers of critical compliance technologies and services are vital.

Pennon Group's supplier power is shaped by alternative availability, with supply chain disruptions increasing supplier influence. Contractual agreements like long-term contracts affect cost stability and market responsiveness. Switching costs and supplier concentration also significantly influence negotiation power. Regulatory demands, particularly in water and waste, also shape supplier power.

| Factor | Impact on Bargaining Power | 2024 Data Insights |

|---|---|---|

| Supplier Concentration | Concentrated bases give suppliers leverage. | Cost of sales was £312.5M; concentrated markets risk supply disruptions. |

| Switching Costs | High costs decrease negotiation power. | Operational expenses approx. £500 million. |

| Regulatory Demands | Compliance suppliers gain leverage. | Environmental fines in UK water sector reached £20M. |

Customers Bargaining Power

Pennon Group's regulated pricing, overseen by Ofwat, constrains its pricing flexibility. Price limits restrict the company's ability to raise prices freely. This diminishes Pennon's bargaining power over customers. The regulatory framework prioritizes customer interests regarding pricing. In 2024, Ofwat continued to enforce these price controls, impacting Pennon's revenue strategies.

Pennon Group's customer bargaining power is low due to the essential nature of water and wastewater services. Customers have limited alternatives, which creates inelastic demand. This allows Pennon to maintain pricing within regulatory frameworks. In 2024, Pennon reported a revenue of £654.2 million for its water business, reflecting the stability of this essential service. The demand for water remains constant, supporting Pennon's strong market position.

Growing customer awareness about environmental issues and service quality strengthens their position. Customers dissatisfied with Pennon Group can use regulatory bodies and media channels to voice concerns. For instance, in 2024, water companies faced increased scrutiny from Ofwat, reflecting customer activism. Public perception significantly impacts the water utility sector, influencing regulatory decisions.

Limited Choice

Pennon Group's customers typically have limited options for water and wastewater services. This lack of choice significantly reduces customer bargaining power. Essentially, customers are locked in, making it difficult to seek alternatives. This is due to the nature of the industry, where monopolies or near-monopolies are common.

- Regulatory oversight ensures service standards.

- Customers' ability to negotiate prices is limited.

- Switching costs are virtually non-existent.

- Customer satisfaction remains a key focus for Pennon.

Affordability Support

Pennon Group's affordability support, vital in 2024, shapes customer relations. It helps vulnerable customers, potentially easing pricing resistance. This support fosters goodwill, softening regulated price hike effects. Pennon's 2025-2026 customer affordability package is about £200 million.

- Customer support affects perceptions of value.

- Mitigates pushback on price changes.

- Builds positive relationships.

- £200M package from 2025-2026.

Pennon's customer bargaining power is generally low due to essential services and limited alternatives. Regulated pricing by Ofwat further constrains price flexibility. The customer's ability to negotiate prices is also limited.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Essential Service | Lowers bargaining power | Water revenue: £654.2M |

| Regulatory Control | Limits price negotiation | Ofwat price controls |

| Customer Alternatives | Few options | Monopoly-like market |

Rivalry Among Competitors

The UK water industry is under intense regulatory scrutiny, especially concerning environmental performance and customer service. This scrutiny directly impacts competitive rivalry. Poor performance results in penalties and reputational damage, intensifying competition among firms. Ofwat actively encourages competition within the sector.

Pennon Group, holding geographic monopolies in water and wastewater, faces limited direct rivalry within its service areas. However, competition exists for investment and regulatory approval, driving efficiency. Companies benchmark each other, fostering innovation. In 2024, Ofwat's performance assessments will influence future investment decisions. Pennon Group's 2024 revenue was about £660 million.

Ofwat's assessments push companies to be more efficient and improve service. This benchmarking sparks competition, with firms aiming to excel. Performance metrics drive competition, leading to sector improvements. In 2024, Pennon Group's water business saw operational efficiency gains, reflecting this rivalry. This continuous improvement is evident in their ongoing investments in infrastructure and customer service enhancements.

Acquisition Strategies

Pennon Group's acquisition of SES Water exemplifies a competitive strategy aimed at market share expansion, significantly influencing competitive rivalry. This approach intensifies the battle for customer base and geographical dominance within the water utility sector. Such acquisitions reshape the industry's competitive landscape, creating both opportunities and challenges for existing players. Pennon's strategic moves directly affect the intensity of rivalry.

- Pennon Group acquired SES Water, which cost £173.6 million.

- This acquisition increased Pennon's customer base.

- Acquisitions are a key strategy for growth in the water sector.

- The water sector is highly regulated.

Investment in Infrastructure

Water companies face intense rivalry centered on infrastructure investment. Pennon Group, like others, must upgrade infrastructure and meet environmental standards. Securing funds and efficient project execution are crucial for competitive advantage. Investment capacity directly influences competitiveness in the water sector.

- In 2024, UK water companies are expected to invest billions in infrastructure.

- Pennon Group's capital expenditure in 2023 was around £200 million.

- Efficient project delivery is key to cost control and regulatory compliance.

- Companies with strong financial backing can undertake larger projects.

Competitive rivalry in the UK water sector is shaped by regulatory pressures, especially Ofwat's assessments. Pennon Group competes through acquisitions, like SES Water, and infrastructure investments, with spending around £200 million in 2023. Performance metrics and operational efficiency are key to staying ahead.

| Aspect | Details | 2024 Data |

|---|---|---|

| Acquisition | SES Water | £173.6 million acquisition cost. |

| Revenue | Pennon Group | About £660 million. |

| Capex | Pennon Group 2023 | Around £200 million. |

SSubstitutes Threaten

The threat of substitutes for Pennon Group includes water efficiency measures. Increased adoption of rainwater harvesting and greywater recycling reduces demand for mains water. Water conservation is a key substitute, gaining popularity due to growing environmental awareness. For example, in 2024, the UK saw a 10% rise in households using water-saving devices.

Bottled water poses a threat as a substitute for tap water, especially if tap water quality is questioned. The UK bottled water market is predicted to rise, hinting at changing consumer choices. This market is forecasted to grow at a CAGR of about 3.6% from 2025 to 2030. This growth indicates a potential shift that could affect Pennon Group. For 2024, the bottled water market in the UK continues to be a significant factor.

The threat of substitutes for Pennon Group, like private water sources, is present. Businesses and households may choose wells or boreholes. This option reduces reliance on the company's public water supply. For example, in 2024, about 15% of UK households consider alternative water sources. Private sources offer independence from the main supply.

Desalination

Desalination presents a long-term threat to Pennon Group, especially in coastal regions. While currently more expensive than traditional water sources, advancements could make it more feasible. The cost of desalination has decreased over time; for example, in 2024, the average cost was around $0.60-$1.00 per cubic meter, a decrease from previous years. This could become a significant substitute.

- Technological improvements drive down desalination costs.

- Desalination is a potential substitute in coastal areas.

- Energy consumption remains a key factor.

- Long-term, desalination could impact Pennon Group.

Alternative Waste Disposal

Alternative waste disposal methods pose a threat to Pennon Group, particularly in wastewater services. On-site treatment systems and decentralized solutions offer substitutes, especially in rural locations. These systems diminish the necessity for centralized wastewater infrastructure. This shift can affect Pennon's market share.

- In 2024, the market for decentralized wastewater treatment systems is projected to reach $15 billion.

- Rural areas are increasingly adopting these systems, with a growth rate of approximately 8% annually.

- Pennon's revenues from wastewater services in 2024 are estimated to be around £600 million.

- The adoption of substitutes could lead to a 5% reduction in Pennon's customer base in certain regions.

Substitute threats for Pennon Group stem from various sources. Water efficiency, like rainwater harvesting, reduces demand for mains water. Bottled water and private sources, such as wells, provide alternatives. Desalination and alternative waste disposal also pose risks.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Water Efficiency | Reduces demand | 10% rise in water-saving devices in UK homes. |

| Bottled Water | Alternative to tap water | UK market continues to grow. |

| Private Water | Independence | 15% of UK households consider alternatives. |

Entrants Threaten

The water and wastewater sector demands massive initial investments, especially in infrastructure. Building and maintaining water treatment plants and extensive distribution networks are incredibly expensive, creating a substantial barrier. For example, in 2024, the average cost to build a new water treatment plant can range from $50 million to over $200 million, depending on its capacity and technology. These high infrastructure costs make it challenging for new entrants to compete.

The water utility sector, including Pennon Group, faces high barriers due to stringent regulations. Environmental and quality standards necessitate costly compliance measures. New entrants must overcome complex, time-consuming regulatory processes and secure necessary permits. This regulatory burden significantly limits the threat of new competitors. For example, in 2024, companies faced increased scrutiny regarding water quality, impacting operational expenses.

Established water companies, such as Pennon Group, benefit from extensive infrastructure, like pipes and treatment plants, and existing customer bases, making it tough for new competitors to enter the market. The cost of replicating this infrastructure is incredibly high. For example, in 2024, Pennon Group invested heavily in its existing infrastructure, demonstrating the substantial upfront investment needed to compete. Incumbents' infrastructure advantage is a significant barrier.

Economies of Scale

The water industry, including Pennon Group, sees a significant barrier to entry due to economies of scale. Established firms like Pennon can leverage their size for cost advantages, making it tough for new competitors. Scale is crucial. The cost of infrastructure and operations is substantial. New entrants face high capital expenditures.

- Pennon Group reported a revenue of £666.9 million for the year ended March 31, 2024.

- Operating profit for Pennon was £193.8 million in 2024.

- The water industry requires massive infrastructure investments.

- Smaller companies often struggle to match the efficiency of larger firms.

Government Concessions

The threat of new entrants to Pennon Group is significantly limited by government concessions. Water and wastewater services, Pennon's primary business, are typically governed by long-term concessions or licenses granted by governmental bodies. These agreements effectively create a barrier, offering incumbents like Pennon a protected market space. In 2024, these contracts continue to restrict new firms from easily entering the market.

- Government concessions provide Pennon with a protected market position.

- New entrants face substantial regulatory hurdles and high initial investment costs.

- The regulatory environment in 2024 remains complex, favoring established operators.

- These contracts typically span decades, solidifying Pennon's market dominance.

High initial costs and regulatory hurdles limit new entrants. Pennon's infrastructure and government concessions create substantial barriers. Pennon Group's revenue was £666.9 million in 2024.

| Factor | Impact on Threat | Example |

|---|---|---|

| High Capital Costs | Significant Barrier | Water treatment plant construction: $50M-$200M+ |

| Regulatory Compliance | Increased Barriers | Stringent water quality standards and permits. |

| Government Concessions | Protected Market | Long-term licenses, limiting new competition. |

Porter's Five Forces Analysis Data Sources

This analysis uses annual reports, market studies, and industry publications. Public financial data and regulatory filings also play a vital role.