Pharmaron Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pharmaron Bundle

What is included in the product

Strategic overview of Pharmaron's business units, assigning each to BCG Matrix quadrants.

Printable summary optimized for A4 and mobile PDFs, providing accessible insights wherever needed.

What You’re Viewing Is Included

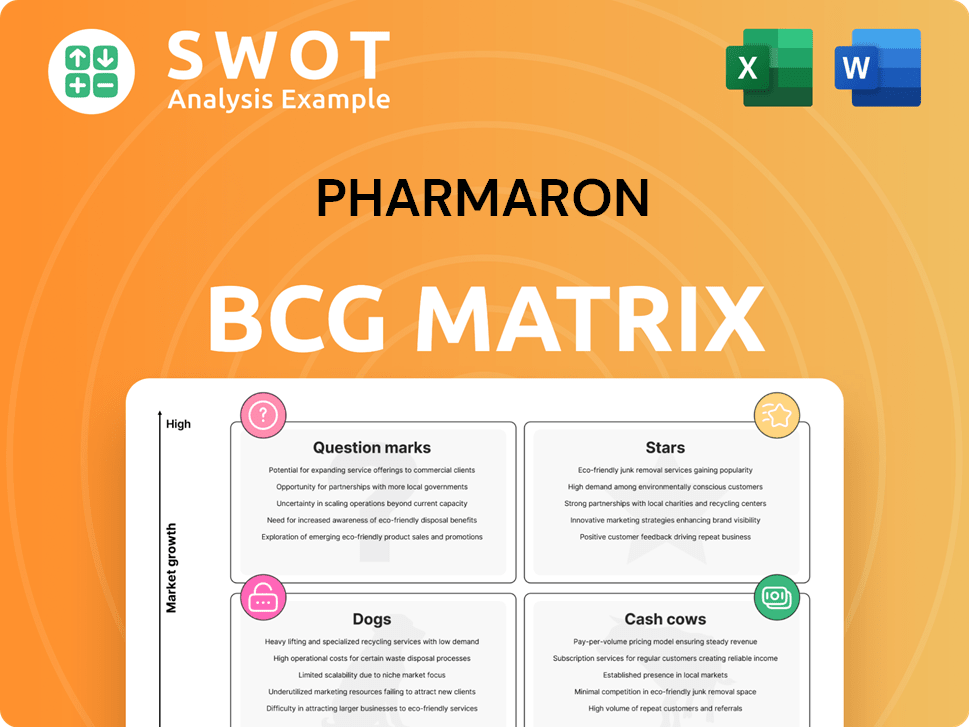

Pharmaron BCG Matrix

The BCG Matrix preview showcases the complete document you'll receive instantly upon purchase. It’s a fully functional, ready-to-implement report for strategic analysis, without any alterations.

BCG Matrix Template

Pharmaron's BCG Matrix offers a snapshot of its diverse portfolio, categorizing products as Stars, Cash Cows, Dogs, or Question Marks. This initial glimpse reveals key insights into market share and growth potential. Understanding these dynamics is crucial for strategic planning. The matrix highlights where resources should be allocated for maximum impact. But this is just a taste. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Pharmaron's integrated R&D and manufacturing platform offers end-to-end services from drug discovery to manufacturing. This comprehensive approach supports clients throughout the drug development lifecycle, enhancing efficiency. In 2024, Pharmaron's revenue grew, reflecting its strong market position and customer focus. The company's commitment to innovation and quality drives its success.

Pharmaron's strategic focus includes significant investments in biologics and cell & gene therapy (CGT). This expansion involves facility upgrades and strategic alliances, responding to rising demand. Notably, the Liverpool facility expansion supports gene therapy development. In 2024, the CGT market is projected to reach $13.5 billion, a significant growth driver.

Pharmaron shines as a "Star" due to its robust financial performance. The company's 2024 revenue hit CN¥12.3 billion, a 6.4% rise from 2023, reflecting its market strength. This growth highlights Pharmaron's effective strategies in capturing market share. Consistent profitability, alongside revenue increases, solidifies its strong position.

Global Footprint and Customer Base

Pharmaron's extensive presence across China, the U.S., and the U.K. boosts its competitive edge. Serving clients in North America, Europe, Japan, and China highlights its global scope and regulatory acumen. In 2024, Pharmaron aimed to increase both domestic and international market shares. This strategy is supported by its diverse, loyal customer base, crucial for sustained growth.

- Global operations in key markets.

- Diverse customer base across regions.

- Focus on market share expansion.

- Expertise in different regulations.

Strategic Partnerships and Collaborations

Pharmaron strategically partners with industry leaders, boosting its service offerings. Collaborations with AstraZeneca and CN Bio drive innovation and expand capabilities. These partnerships tap into external expertise, enhancing client service. Pharmaron and CN Bio work together on Organ-on-a-Chip drug discovery. In 2024, Pharmaron's revenue grew, reflecting the value of these alliances.

- Partnerships with AstraZeneca and CN Bio.

- Collaboration for Organ-on-a-Chip drug discovery.

- Enhances service offerings and innovation.

- Pharmaron's revenue growth in 2024.

Pharmaron is a "Star" in the BCG Matrix due to strong financial results. Its 2024 revenue of CN¥12.3 billion, a 6.4% increase, confirms its market strength. The company's focus on expanding market share, supported by global operations and a diverse customer base, drives this performance. Strategic partnerships also boost innovation and service offerings.

| Metric | 2023 | 2024 |

|---|---|---|

| Revenue (CN¥ billions) | 11.56 | 12.3 |

| Revenue Growth | - | 6.4% |

| CGT Market (USD billions, projected) | 12.5 | 13.5 |

Cash Cows

Pharmaron's laboratory services, encompassing chemistry, biology, and DMPK, are a key Cash Cow. This segment provides a stable cash flow thanks to the rising demand for drug discovery services. In 2024, Laboratory Services brought in CN¥7.05 billion. This represented 57% of Pharmaron's overall revenue.

Pharmaron's small molecule CDMO services, focusing on chemistry, manufacturing, and controls (CMC), are a cash cow due to consistent demand. Their expertise in process development and manufacturing ensures steady revenue streams. The global pharmaceutical CDMO market is projected to reach US$86.2 billion in 2024, according to Sullivan's forecast. This highlights the significant market opportunity Pharmaron capitalizes on.

Pharmaron's clinical development services are a key "Cash Cow" in its BCG matrix, fueled by the rising complexity and costs of clinical trials. The company's expertise in managing trials across various regions and therapeutic areas gives it a strong edge. Pharmaron currently manages 1,062 clinical CRO projects, including 94 Phase III trials. This robust portfolio demonstrates its capability and market position.

Established Regulatory Track Record

Pharmaron's solid regulatory record, with facilities okayed by bodies like the FDA and EMA, supports dependable revenue from regulated services. This commitment to quality builds its reputation, drawing clients looking for dependable CDMO partners. The Coventry Site showcases a history of cGMP API manufacturing.

- FDA inspections for drug facilities rose in 2023, indicating the importance of regulatory compliance.

- The EMA's focus on GMP compliance remains strong, ensuring manufacturing standards.

- Pharmaron's consistent compliance supports steady client contracts and revenue streams.

Strong Reputation and Brand Influence

Pharmaron's strong reputation and brand influence are key assets, helping to secure clients and foster loyalty. Its dedication to scientific rigor and customer support boosts its image, backing its sustained expansion. Pharmaron is a top, reliable service provider in the life sciences sector globally. This reputation is reflected in its financial performance.

- Pharmaron's revenue in 2023 was approximately RMB 10.8 billion.

- The company's customer retention rate is over 90%.

- Pharmaron's brand is associated with innovation.

Pharmaron's cash cows include laboratory and small molecule CDMO services, and clinical development services, generating stable revenue. Laboratory Services accounted for CN¥7.05 billion in revenue in 2024. The pharmaceutical CDMO market is forecast to reach US$86.2 billion in 2024. These services benefit from consistent demand.

| Service | 2024 Revenue (CN¥ Billions) | Market Forecast (USD Billions) |

|---|---|---|

| Laboratory Services | 7.05 | N/A |

| Small Molecule CDMO | N/A | 86.2 (2024) |

| Clinical Development | N/A | N/A |

Dogs

Some of Pharmaron's standalone services, facing stiff competition and lower profit margins, could be "dogs" in its BCG Matrix. These services might need substantial investment to keep their market share, yet show limited growth potential. Identifying these services is crucial for strategic decisions. In 2024, Pharmaron's revenue was approximately $1.2 billion, so a small portion of this could be from these underperforming services.

Services facing pricing pressure, classified as dogs in Pharmaron's BCG matrix, struggle with profitability due to competition. These services, sensitive to commoditization, require competitive pricing. Pharmaron advances quality management, refining quality control protocols. In 2024, the CRO market saw increased price competition, impacting margins.

Underperforming acquisitions are like "dogs" in Pharmaron's portfolio. These acquisitions, which haven't met performance goals, can be a drag on resources. Pharmaron has made 6 acquisitions, averaging $128M each, and some may fall into this category, impacting overall profitability in 2024.

Niche Services with Limited Scalability

Niche services with limited scalability can be considered dogs in Pharmaron's BCG Matrix. These services, targeting small segments, might not bring in enough revenue to warrant continued investment. Pharmaron's focus remains on innovation to improve service quality and speed up drug discovery. For 2024, the company's R&D spending is projected to be around $500 million. This strategic shift aims to optimize resource allocation and boost overall profitability.

- Limited market reach impacts revenue generation.

- Innovation is key for service quality and speed.

- Strategic resource allocation aims for profitability.

- R&D investment is a key focus in 2024.

Services with Declining Demand

Pharmaron's "Dogs" category includes services facing declining demand, potentially due to shifts in technology or market dynamics. These areas might need heavy investment with uncertain long-term growth. The company actively reshapes business segments to capitalize on future opportunities. For instance, certain legacy analytical services could be considered dogs.

- Declining revenue in specific analytical services, potentially down 5% in 2024.

- Investment in these services may yield less than a 10% ROI.

- Restructuring efforts aim to reallocate resources to faster-growing areas.

- Focus on innovative technologies to replace underperforming services.

Pharmaron's "Dogs" are services struggling in competitive markets or facing declining demand, pulling down profitability. These include underperforming acquisitions and niche services. In 2024, services facing pricing pressure, like certain CRO offerings, experienced reduced margins. Legacy analytical services, potentially seeing a 5% revenue decline, also fall into this category.

| Category | Characteristics | Impact in 2024 |

|---|---|---|

| Underperforming Acquisitions | Failed to meet performance targets, draining resources. | Impact on profitability. |

| Niche Services | Limited scalability, small market reach. | May not justify further investment. |

| Services under Price Pressure | Stiff competition, commoditization risks. | Reduced margins. |

| Declining Services | Facing reduced demand, due to technology changes. | Possible revenue decline of about 5%. |

Question Marks

Pharmaron's AI-driven drug discovery services are positioned as a "question mark" within its BCG matrix due to high growth potential paired with an uncertain market share. The company is investing in AI, aiming for breakthroughs. For example, the global AI in drug discovery market was valued at USD 1.3 billion in 2023 and is projected to reach USD 6.9 billion by 2030. Pharmaron is actively exploring AI applications in R&D.

Pharmaron's collaboration with CN Bio to integrate Organ-on-a-Chip (OOC) technologies into its R&D represents a high-growth, unproven market segment. OOC tech has the potential to revolutionize drug development, potentially cutting costs and time. However, market acceptance and commercial success remain uncertain. In 2024, the global OOC market was valued at approximately $200 million, with significant growth expected.

Pharmaron's push into emerging markets, especially China, is a key part of its growth strategy. China's drug discovery R&D market reached RMB19.5 billion in 2024. This expansion faces regulatory hurdles and competition. Success hinges on Pharmaron's ability to adapt and thrive in these environments.

New Therapeutic Modalities

Pharmaron's foray into novel therapeutic modalities, like cell and gene therapies, is a strategic move. These areas promise high growth, although they need substantial investment. Pharmaron plans to use its existing advantages to attract more clients and improve its operational effectiveness. The company's revenue in 2024 reached $1.1 billion, showing strong growth.

- High-growth potential in cell and gene therapies.

- Significant investment needed for specialized infrastructure.

- Focus on leveraging existing strengths for expansion.

- 2024 revenue: approximately $1.1 billion.

Digital Transformation of Clinical Development

Pharmaron's acquisition of Aistarfish represents a "Question Mark" in its BCG matrix. This move aims to boost digital and AI capabilities in clinical development. The integration of AI in clinical trials is still evolving, and its long-term impact is uncertain. The success hinges on effective integration and demonstrable improvements in trial efficiency and outcomes. In 2024, the global clinical trial software market was valued at approximately $2.5 billion, with projections for significant growth.

- Acquisition of Aistarfish aims to enhance digital and AI in clinical development.

- The impact of AI in clinical trials is uncertain at this stage.

- Success depends on seamless integration and improved outcomes.

- In 2024, the clinical trial software market was valued at around $2.5 billion.

Pharmaron's "Question Marks" represent high-growth ventures with uncertain market positions. This category includes AI drug discovery, with the global market valued at $1.3B in 2023. The company's expansions, like into novel therapies and through acquisitions such as Aistarfish, have the potential for significant returns.

| Area | Status | Market Value (2024) |

|---|---|---|

| AI in Drug Discovery | High Growth, Uncertain Share | Projected $2.0B |

| Cell & Gene Therapies | High Growth, Strategic Focus | Growing, Revenue: $1.1B (Pharmaron) |

| Clinical Trial Software | High Growth, Integration Needed | Approximately $2.5B |

BCG Matrix Data Sources

The Pharmaron BCG Matrix relies on market analyses, financial reports, and sales data combined with expert forecasts for each quadrant.