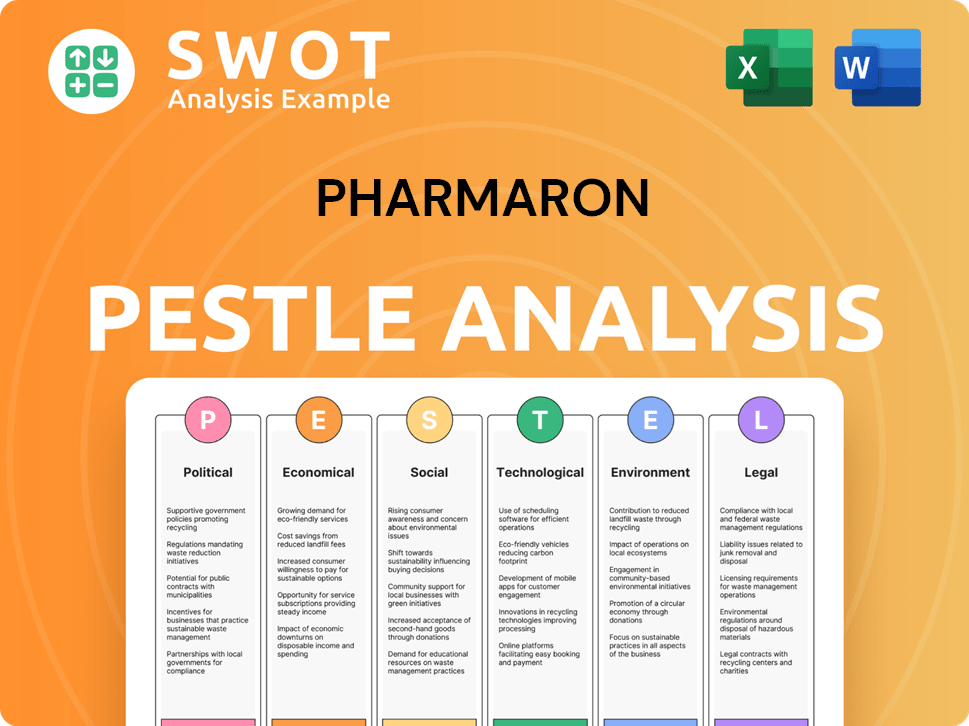

Pharmaron PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pharmaron Bundle

What is included in the product

Offers a deep-dive analysis of external factors impacting Pharmaron, spanning political, economic, social, and more.

Quickly identifies opportunities and threats, improving strategic planning and informed decision-making.

Preview Before You Purchase

Pharmaron PESTLE Analysis

The layout you see is the final product you'll get after purchase. This Pharmaron PESTLE Analysis is professionally structured and ready to use.

PESTLE Analysis Template

Our concise PESTLE analysis of Pharmaron reveals critical external factors impacting its operations.

We examine the political landscape, regulatory environment, and economic forces shaping the company's strategy.

Discover social trends, technological advancements, and legal frameworks influencing Pharmaron’s growth potential.

This analysis offers a snapshot, highlighting key areas for strategic decision-making.

For a comprehensive view and actionable insights, unlock the full PESTLE analysis.

Enhance your understanding and make informed decisions with our complete report—available now.

Download now for an in-depth strategic advantage!

Political factors

Geopolitical tensions, especially U.S.-China trade, pose risks. Pharmaron's services may face dampened demand. Supply chains could disrupt, raising expenses. For example, in 2024, trade disputes increased logistics costs.

Government healthcare policies significantly impact Pharmaron. Policies on spending, drug pricing, and R&D incentives directly affect demand. For example, the Inflation Reduction Act of 2022 in the US, allowing Medicare to negotiate drug prices, could reshape R&D investment. China's policies also play a crucial role, as the country is a major market for Pharmaron. The global pharmaceutical R&D market is projected to reach $270 billion by 2025.

Pharmaron faces evolving regulatory landscapes globally. Changes in drug development and manufacturing rules impact its services. For instance, the FDA updates, like those in 2024-2025, influence client needs. These changes affect operational costs and project timelines, requiring adaptability.

Trade Regulations and Sanctions

Pharmaron's global operations expose it to diverse trade regulations and sanctions. These regulations, encompassing import/export controls and economic sanctions, vary significantly across countries. Compliance is crucial, as violations can lead to hefty penalties and operational disruptions. For example, in 2024, the US imposed sanctions on entities linked to pharmaceutical activities in certain regions.

- Compliance failures can result in fines exceeding millions of dollars.

- Sanctions can block access to critical markets, impacting revenue.

- Changes in regulations necessitate continuous monitoring.

- Geopolitical events can swiftly alter trade dynamics.

Government Support for R&D

Government backing for R&D is crucial. Funding for biomedical research and tax credits stimulate drug development, benefiting CRO and CDMO services like those offered by Pharmaron. In 2024, the U.S. government allocated over $47 billion to the National Institutes of Health (NIH) for biomedical research. This directly fuels demand for services. These incentives encourage innovation.

- NIH funding in 2024: Over $47 billion.

- Tax credits: Enhance R&D investments.

- Impact: Increased demand for CRO/CDMO.

Political factors deeply influence Pharmaron's business environment. Government healthcare policies and R&D funding greatly affect its services and profitability. Trade regulations and sanctions introduce risks.

The Inflation Reduction Act impacts R&D; the pharmaceutical R&D market is projected to $270 billion by 2025.

| Political Aspect | Impact on Pharmaron | 2024/2025 Data |

|---|---|---|

| Government Policies | Influences drug pricing & R&D incentives. | U.S. NIH funding: $47B+, R&D Market: $270B (proj. 2025) |

| Trade Regulations | Affects supply chains & operational costs. | Compliance failures can lead to $millions in fines. |

| Geopolitical Tension | Impacts global demand and operational costs | Trade disputes increased logistics costs |

Economic factors

Global economic conditions significantly impact the pharmaceutical industry's investment capabilities. In 2024, global healthcare spending reached $10.9 trillion, projected to hit $12.8 trillion by 2027. This spending influences R&D budgets and the demand for services. Economic downturns can lead to budget cuts.

Fluctuations in inflation and exchange rates, especially between the RMB and USD, affect Pharmaron's finances. In 2024, the RMB saw moderate volatility against the USD. A 1% change in the RMB/USD rate can shift costs significantly. Inflation in China, at 3% in late 2024, also plays a role.

Pharmaceutical R&D spending significantly impacts the CRO and CDMO market. In 2024, global pharmaceutical R&D expenditure reached approximately $250 billion. This spending is influenced by potential drug revenues and escalating development costs. Anticipated revenue growth in the oncology sector and technological advancements drive R&D investments. These factors shape Pharmaron's strategic outlook.

Cost of Drug Development

The cost of drug development remains a significant economic factor. Bringing a new drug to market can cost over $1 billion. This high cost drives pharmaceutical companies like Pharmaron to outsource R&D and manufacturing. Outsourcing helps to manage expenses and improve efficiency.

- The average cost to develop and launch a new drug is approximately $2.6 billion, as of 2024.

- Clinical trial expenses can account for 60-70% of the total R&D costs.

- Outsourcing can reduce these costs by 20-30%.

Market Growth in the Pharmaceutical Industry

The global pharmaceutical market is experiencing substantial growth. This expansion is fueled by an aging global population and rising healthcare expenditures. These trends directly impact the demand for services offered by companies like Pharmaron. Market analysts project continued growth in the pharmaceutical sector through 2024 and into 2025. This offers opportunities for companies providing vital services.

- Global pharmaceutical market size in 2023: approximately $1.5 trillion.

- Projected market size by 2025: around $1.7 trillion.

- Aging population: a key driver of increased drug demand.

Economic factors greatly affect Pharmaron's performance. Global healthcare spending, projected at $12.8T by 2027, impacts R&D budgets. Fluctuations in currency rates and inflation, like China's 3% in late 2024, are crucial.

| Factor | Details | Impact |

|---|---|---|

| R&D Spending | $250B in 2024. | Drives CRO/CDMO demand. |

| Drug Cost | $2.6B average cost. | Drives outsourcing. |

| Market Growth | $1.5T in 2023; $1.7T by 2025 | Increases demand. |

Sociological factors

The global aging population is surging, intensifying the need for healthcare and pharmaceuticals. In 2024, the 65+ population reached 790 million, a 3% increase. This demographic shift fuels demand for new drugs and healthcare services. Consequently, it boosts R&D in the pharmaceutical sector and the CRO and CDMO services that support it.

Increased healthcare spending, fueled by higher disposable incomes, is a key sociological driver. The global pharmaceutical market is projected to reach $1.97 trillion by 2025. This growth directly boosts demand for drug development services, like those offered by Pharmaron. Specifically, the Asia-Pacific region shows substantial growth in healthcare spending.

The CRO/CDMO sector thrives on talent. Pharmaron needs bioprocess engineers, data scientists, and regulatory experts. Investing in employee development is key. In 2024, the global CRO market was valued at $77.7 billion, showcasing the demand for skilled professionals. A strong talent pool supports growth and innovation.

Focus on Patient Outcomes

The healthcare sector’s increasing focus on patient outcomes directly impacts Pharmaron. This trend fuels demand for R&D services, as companies seek therapies that demonstrably improve patient health. In 2024, the global focus on patient-centric care saw a 15% rise in clinical trial investments. Pharmaron's ability to deliver therapies that enhance patient outcomes is crucial. This drives the need for innovation and effective treatments.

- Increased demand for R&D services.

- Focus on innovative therapies.

- Emphasis on effective treatments.

- Investment in clinical trials.

Public Perception and Trust

Public perception of the pharmaceutical industry and trust in new drugs are critical elements. Negative perceptions can lead to decreased demand and increased regulatory scrutiny, indirectly affecting companies like Pharmaron. Recent surveys show a mixed view: 44% of Americans trust pharmaceutical companies, while 29% distrust them. This trust level is vital for market success.

- Trust in pharma companies is at 44% in 2024, according to recent polls.

- Regulatory scrutiny can increase costs by up to 20% for drug development.

- Public perception impacts market demand, potentially affecting sales by 15-25%.

An aging global population continues to increase the demand for healthcare, projected to cost $21.8 trillion worldwide in 2025. Higher disposable incomes and increased healthcare spending are significant drivers, with the Asia-Pacific region demonstrating substantial growth. Public trust is critical, as fluctuations impact market demand.

| Factor | Impact | Data |

|---|---|---|

| Aging Population | Increased demand for healthcare | 65+ population reached 790M in 2024 |

| Healthcare Spending | Growth in R&D, CDMO | Global mkt $1.97T by 2025 |

| Public Perception | Impact on market success | 44% trust pharma companies |

Technological factors

Technological advancements are reshaping drug discovery. Genomics, proteomics, and bioinformatics are accelerating the process. High-throughput screening enables rapid testing of compounds. Pharmaron, with its advanced capabilities, is well-positioned to capitalize on these trends. The global drug discovery market is projected to reach $80.8 billion by 2025.

Pharmaron's adoption of automation and digital transformation is key. Digital twins and real-time analytics boost efficiency across manufacturing and R&D. In 2024, the global pharmaceutical automation market was valued at $2.6 billion, expected to reach $4.5 billion by 2029. This shows a strong growth trend.

The emergence of advanced drug modalities, such as cell and gene therapies, is reshaping the pharmaceutical landscape, demanding unique expertise and manufacturing capabilities. This shift is opening up new avenues for contract development and manufacturing organizations (CDMOs) like Pharmaron. The cell and gene therapy market is projected to reach $10.8 billion by 2025, growing at a CAGR of 28% from 2019. Pharmaron is investing in these areas.

Data Analytics and AI

Pharmaron can leverage data analytics and AI to optimize drug development. This includes predicting clinical trial outcomes and improving manufacturing processes. The global AI in drug discovery market is projected to reach $4.2 billion by 2025. This can lead to significant cost savings and faster time-to-market for new drugs.

- $4.2 billion market by 2025

- Faster time-to-market

- Improved manufacturing

- Predictive analytics

Continuous Manufacturing

Technological advancements in continuous manufacturing are revolutionizing drug production. This shift towards faster, more cost-effective, and environmentally friendly methods is significantly influencing contract development and manufacturing organizations (CDMOs) like Pharmaron. Continuous manufacturing enables increased production volumes and reduced waste, enhancing operational efficiencies. For example, the global continuous manufacturing market is projected to reach $10.8 billion by 2029, growing at a CAGR of 12.3% from 2022.

- Faster production times compared to traditional batch processes.

- Reduced manufacturing costs due to lower waste and higher efficiency.

- Improved product quality and consistency.

- Enhanced sustainability through reduced solvent use and energy consumption.

Technological factors significantly shape Pharmaron's growth, with digital tools and AI optimizing drug development and manufacturing, improving time-to-market, and predictive analytics driving efficiency. Advanced modalities and continuous manufacturing also play a critical role.

| Technology Area | Impact on Pharmaron | 2025 Market Projection |

|---|---|---|

| AI in Drug Discovery | Predicts outcomes, improves manufacturing | $4.2 billion |

| Cell & Gene Therapy | Opens new CDMO avenues | $10.8 billion |

| Continuous Manufacturing | Boosts efficiency, reduces costs | $10.8 billion by 2029 |

Legal factors

Drug development is heavily regulated by bodies like the FDA and EMA, impacting CROs and CDMOs. These regulations demand strict quality control and adherence throughout the process. For instance, in 2024, the FDA approved 55 novel drugs, showing the stringent requirements. Pharmaron, like other companies, must navigate these evolving legal landscapes to ensure compliance. This compliance directly affects project timelines and costs, influencing investment decisions.

Intellectual property (IP) protection is paramount for Pharmaron. Patents and data exclusivity laws heavily influence the company's R&D investments. In 2024, global pharmaceutical R&D spending reached approximately $250 billion, underscoring the importance of IP. Strong IP safeguards Pharmaron's innovations, ensuring competitive advantage. This protection allows for market exclusivity and return on investment.

Pharmaron faces intricate trade compliance and sanctions regulations globally. These laws, including import/export controls, differ greatly across nations, impacting operations. For example, the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC) enforces sanctions that could affect Pharmaron's international transactions. In 2024, violations of these regulations resulted in significant penalties for several multinational companies, highlighting the importance of strict adherence.

Labor Laws and Employment Regulations

Pharmaron must navigate diverse labor laws globally, impacting operational costs and employee relations. Compliance includes adhering to minimum wage standards, working hours, and providing employee benefits. Non-compliance can lead to significant fines and reputational damage. For instance, in 2024, China's labor disputes saw a 10% increase.

- China's 2024 labor dispute increase: 10%.

- Compliance impacts operational costs and employee relations.

- Non-compliance leads to fines and reputational damage.

Environmental Regulations

Pharmaron faces legal hurdles due to environmental regulations. It must adhere to environmental laws concerning waste management, emissions, and energy use. Non-compliance can lead to hefty fines or operational restrictions. The company needs to invest in sustainable practices. This includes waste reduction, cleaner energy adoption, and emission controls.

- In 2024, the global environmental compliance market was valued at $16.8 billion.

- Companies failing to meet environmental standards can face penalties up to $1 million.

- Pharmaron's sustainability report for 2024 shows a 15% increase in renewable energy use.

- China's environmental regulations are becoming stricter, increasing compliance demands.

Pharmaron operates in a highly regulated landscape, needing to meet various legal standards like FDA and EMA rules. This impacts project timelines and costs, potentially affecting investment. Intellectual property rights, especially patents, are crucial for safeguarding innovation and market exclusivity. Pharmaron also navigates trade compliance and labor laws globally, influencing operational costs. Moreover, environmental regulations significantly affect the company's operations.

| Legal Factor | Impact on Pharmaron | 2024/2025 Data |

|---|---|---|

| Regulations | Compliance affecting costs & timelines | FDA approved 55 novel drugs in 2024. |

| IP Protection | Safeguards innovation, ROI | 2024 pharma R&D spending ~$250B globally. |

| Trade & Labor Laws | Operational costs, employee relations | China labor disputes increased 10% in 2024. |

| Environmental Rules | Waste, emissions compliance | Global compliance market valued at $16.8B in 2024. |

Environmental factors

Pharmaron prioritizes environmental management. They manage wastewater, air emissions, and solid waste to comply with regulations. This minimizes environmental impact across their operations. In 2024, environmental compliance costs were approximately $5 million. Pharmaron aims for continuous improvement in environmental performance.

Pharmaron actively pursues sustainability. The company has waste reduction initiatives. They also focus on lowering its carbon footprint. This includes energy-efficient operations. In 2024, Pharmaron increased renewable energy use by 15%.

Pharmaron acknowledges the impact of climate change. They are working on reducing emissions, which is vital. In 2024, the pharmaceutical industry faced increased scrutiny regarding its environmental footprint. Companies are under pressure to adopt sustainable practices. For example, the industry's carbon emissions were a significant concern in the past year.

Resource Usage and Energy Consumption

Resource usage and energy consumption are critical for Pharmaron. Efficient material and resource management, alongside energy use, significantly impacts environmental sustainability. For example, in 2024, the pharmaceutical industry's energy consumption was approximately 2% of total industrial energy use. Pharmaron's focus on reducing waste and optimizing energy efficiency aligns with industry trends and regulatory pressures. This also leads to cost savings and improved operational efficiency.

- Energy use accounted for 2% of industrial energy use in 2024.

- Focus on waste reduction and energy efficiency.

- Aims to cut costs and boost efficiency.

Stakeholder Expectations for ESG Performance

Stakeholders, like investors and the public, are increasingly demanding strong environmental, social, and governance (ESG) performance from companies. This pressure is growing, as evidenced by the rise in ESG-focused investment funds. For instance, in 2024, ESG assets under management hit approximately $40 trillion globally. Companies like Pharmaron face scrutiny to align with ESG standards. Failure to meet these expectations can lead to reputational damage and financial repercussions.

- ESG assets under management reached ~$40T globally in 2024.

- Public and investors increasingly prioritize ESG factors.

- Non-compliance can result in financial and reputational risks.

Pharmaron focuses on environmental sustainability through waste reduction and energy efficiency. In 2024, environmental compliance cost ~$5M. The pharmaceutical industry faced increased ESG scrutiny. Rising stakeholder pressure drives ESG alignment for companies like Pharmaron.

| Aspect | Details | 2024 Data |

|---|---|---|

| Compliance Cost | Environmental regulations adherence | ~$5 million |

| Renewable Energy Increase | Growth in green energy usage | 15% |

| ESG Assets | Global ESG assets under management | ~$40 trillion |

PESTLE Analysis Data Sources

Pharmaron's PESTLE analysis incorporates data from regulatory bodies, financial institutions, and market intelligence reports for comprehensive insights.