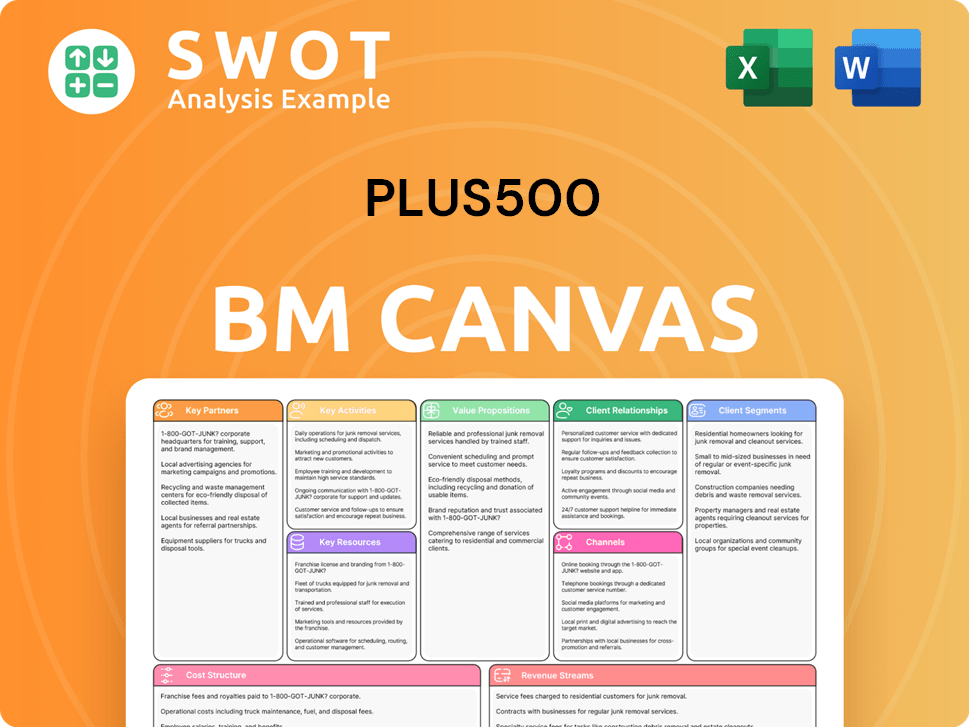

Plus500 Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Plus500 Bundle

What is included in the product

Covers customer segments, channels, and value propositions in full detail.

Condenses Plus500's complex strategy into a quick-review format.

What You See Is What You Get

Business Model Canvas

This preview showcases the genuine Plus500 Business Model Canvas document. It’s a direct reflection of the final file you'll receive after purchase. You'll download the complete, editable version, formatted identically to what you see here. Expect no discrepancies, just immediate access to the full document. This is the real deal, ready to use.

Business Model Canvas Template

Explore Plus500's strategy with a Business Model Canvas. It unveils their value propositions, customer segments, & key partnerships. Understand their cost structure & revenue streams. Get the full model for a deep dive. Perfect for strategists & investors. Download now!

Partnerships

Plus500 teams up with tech providers to keep its trading platform cutting-edge. These partnerships are key to staying innovative and competitive, using the newest tech. This helps give users a smooth, easy-to-use trading experience. For example, in 2024, Plus500 invested $78 million in tech upgrades.

Plus500's collaborations with financial institutions are vital for seamless transactions. Partnerships with banks and payment processors enable client deposits and withdrawals. These relationships ensure secure financial operations. In 2024, Plus500 processed over $1.2 billion in client funds. This highlights the importance of these partnerships for operational efficiency and client trust.

Plus500's success hinges on solid ties with regulatory bodies globally. These relationships are key to legal operation and ethical conduct. Compliance, like adhering to FCA rules, protects traders. This maintains trust, crucial in 2024, as shown by its $2.07 billion revenue.

Affiliate Marketers

Plus500 leverages affiliate marketers to widen its customer base. These partnerships involve paying affiliates for bringing in traffic and new users, boosting brand visibility and user acquisition. These collaborations are crucial for Plus500's market expansion. In 2024, marketing expenses were a significant part of their operational costs, reflecting the importance of these partnerships.

- Affiliate marketing is a key customer acquisition channel.

- Affiliates are compensated for driving traffic and users.

- These partnerships increase brand awareness.

- Marketing expenses are high, emphasizing their importance.

Liquidity Providers

Plus500's partnerships with liquidity providers are crucial for competitive pricing and trade execution. These providers offer the liquidity needed for various financial instruments, facilitating smooth trading. This setup allows traders to execute orders swiftly and at advantageous prices. In 2024, Plus500 reported a significant increase in trading volume, highlighting the importance of these partnerships.

- Ensures competitive spreads and fast order execution.

- Provides access to a wide range of financial instruments.

- Supports high trading volumes.

- Key to maintaining a strong market presence.

Key partnerships drive customer growth. Affiliate programs are essential for new user acquisition, increasing brand awareness. Marketing costs reflect their significance in expanding reach. In 2024, Plus500 allocated $150 million to marketing, reflecting the critical role of these partnerships.

| Partnership Type | Description | Impact in 2024 |

|---|---|---|

| Affiliate Marketers | Drive traffic and new users. | $150M in marketing spend. |

| Tech Providers | Keep trading platform updated. | $78M tech upgrades. |

| Financial Institutions | Enable transactions. | $1.2B in processed funds. |

Activities

Plus500's platform development and maintenance are crucial. They regularly update the platform for new features and optimal user experience. In 2024, R&D expenses were significant, reflecting its investment in technological advancements. This focus on innovation is key to competitive advantage. Plus500's success hinges on a reliable, user-friendly platform.

Marketing and Customer Acquisition are vital for Plus500. They attract new customers through online ads, affiliate marketing, and promotions. In 2024, marketing expenses were significant, with $202.5 million spent on marketing. Effective strategies are key for growth.

Regulatory compliance is paramount for Plus500, operating across diverse jurisdictions. This involves continuous monitoring of regulatory updates and implementing necessary controls. They undergo regular audits to ensure adherence to financial standards. Maintaining licenses and safeguarding their reputation hinges on strict compliance. In 2024, regulatory fines for non-compliance in the financial sector reached $1.5 billion globally.

Trading Services

Trading services are fundamental to Plus500's business model. They offer order execution, risk management, and access to financial instruments. Reliable services are key to customer satisfaction and retention. This is the core of Plus500's value proposition.

- In 2023, Plus500 reported a revenue of $784.6 million, reflecting its trading service's importance.

- The company's platform supports trading in CFDs across various assets like shares, forex, and indices.

- Plus500 focuses on providing advanced trading tools to enhance user experience.

- Risk management tools are crucial, with a focus on client protection.

Customer Support

Offering customer support is a core activity for Plus500. They provide support via live chat and email to assist traders. This ensures a positive trading experience, crucial for retaining customers. In 2024, Plus500's focus on customer satisfaction, reflected in its service quality, helped maintain high customer retention rates.

- Live chat and email are primary support channels.

- Timely assistance enhances the trading experience.

- Customer satisfaction boosts loyalty.

- Focus on support helped maintain customer base in 2024.

Plus500's key activities include platform development, consistently updating its trading platform. Marketing and customer acquisition are crucial, reflected by 2024's $202.5M in marketing spend. Regulatory compliance, essential for global operations, and trading services are at the core. Providing customer support via live chat and email enhances user experience.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Platform Development | Ongoing platform updates for new features and user experience. | Significant R&D investment, technological advancements |

| Marketing & Acquisition | Attracting new customers through various online channels. | $202.5M spent on marketing strategies. |

| Regulatory Compliance | Adhering to financial standards and regulations globally. | Focus on avoiding non-compliance; global fines at $1.5B. |

Resources

Plus500's proprietary trading platform is a cornerstone, providing a user-friendly interface and advanced tools. This platform is crucial for attracting and retaining traders, offering a competitive edge. Its technology and features, like real-time data and risk management tools, are vital. In 2024, Plus500 reported a 10% increase in active customers.

Plus500's technology infrastructure is vital. It includes servers and data centers supporting the trading platform. This ensures uninterrupted trading. In 2024, they invested heavily in tech. This investment totaled $100 million, ensuring platform stability and security.

Plus500's robust financial resources are crucial. They cover operations, marketing, and regulatory needs. In 2024, the company reported a significant cash reserve. This financial health supports investments and shareholder returns. Share buybacks and dividends are key strategies.

Regulatory Licenses

Regulatory licenses are a cornerstone for Plus500, enabling legal and ethical operations. These licenses, such as those from the UK's FCA, build trader trust. They ensure compliance with financial regulations, critical for market access and credibility. Plus500 holds licenses in multiple regions, reflecting its global reach.

- FCA license ensures compliance.

- Licenses in multiple regions.

- Essential for market access.

- Builds trader trust.

Brand Reputation

Brand reputation is a crucial resource for Plus500, essential for attracting and retaining customers. A solid reputation builds trust, which is vital in the financial sector. Positive brand perception drives customer acquisition and increases client loyalty. Plus500's ability to maintain its brand reputation directly influences its long-term financial performance.

- In 2024, Plus500 reported a customer base of over 400,000 active traders.

- Brand trust is reflected in customer retention rates, which were around 70% in 2024.

- Plus500 spends significantly on marketing, with approximately $200 million allocated in 2024, to maintain its brand image.

Key resources for Plus500 include its trading platform, crucial for user experience and trading efficiency. Technology infrastructure, including servers and data centers, ensures operational stability. Financial resources, backed by a strong cash reserve, support operational needs and shareholder returns. Regulatory licenses, like the UK's FCA, and a solid brand reputation are also vital.

| Resource | Description | 2024 Data/Facts |

|---|---|---|

| Trading Platform | Proprietary platform with a user-friendly interface and advanced tools. | 10% increase in active customers. |

| Technology Infrastructure | Servers and data centers supporting the trading platform. | $100M invested in tech in 2024. |

| Financial Resources | Funds covering operations, marketing, and regulatory needs. | Significant cash reserves; share buybacks and dividends. |

| Regulatory Licenses | Licenses, like UK's FCA, enabling legal operations. | Licenses held in multiple regions. |

| Brand Reputation | Essential for attracting and retaining customers. | 400,000+ active traders; 70% retention rate; $200M on marketing. |

Value Propositions

Plus500's user-friendly platform is a key strength. It's designed for easy navigation, attracting diverse traders. This simplicity is a competitive edge. In 2024, Plus500 reported a revenue of $726.4 million, showing platform appeal. Its intuitive design boosts user engagement.

Plus500's value lies in its extensive trading options. In 2024, it offered CFDs on thousands of instruments. This included shares, forex, commodities, and indices. This variety supports portfolio diversification, essential in volatile markets. Plus500 reported over 275,000 active customers in its 2024 financial report, highlighting the appeal of its diverse offerings.

Plus500's competitive spreads significantly reduce trading expenses for clients. This cost-effectiveness boosts profitability and appeals to traders looking for value. As of 2024, tight spreads are a key factor in customer acquisition and retention. Competitive pricing remains a core component of their business strategy.

Advanced Trading Tools

Plus500's platform boasts advanced trading tools, including real-time charts, technical indicators, and risk management features, to support informed trading decisions. These tools are essential for effective risk management, which is critical in volatile markets. These features aim to enhance the trading experience, helping users navigate market complexities. For instance, in 2024, retail trading volumes saw a 15% increase, highlighting the importance of advanced tools.

- Real-time charts provide immediate market insights.

- Technical indicators help identify trading opportunities.

- Risk management tools protect investments.

- These tools support data-driven decision-making.

Global Accessibility

Plus500's global accessibility is a cornerstone, allowing traders worldwide to access its platform. This international presence is key for expanding its customer base. The company's reach is extensive, operating in numerous countries and regions. This widespread availability is a significant value proposition, attracting a diverse user group.

- Plus500 operates in over 50 countries.

- In 2024, its user base includes traders from various continents.

- This global strategy drives revenue growth.

- Accessibility is enhanced by multilingual support.

Plus500 offers a user-friendly platform designed for easy trading. The platform provides extensive trading options, including shares, forex, and commodities. Competitive spreads reduce trading costs, enhancing profitability. Advanced tools, like real-time charts, aid informed decisions. Global accessibility expands its customer base.

| Value Proposition | Description | Impact |

|---|---|---|

| User-Friendly Platform | Easy navigation; intuitive design. | Attracts diverse traders; boosts engagement. |

| Extensive Trading Options | CFDs on thousands of instruments. | Supports portfolio diversification; appeals to a broad market. |

| Competitive Spreads | Reduces trading expenses. | Increases profitability; attracts value-seeking traders. |

| Advanced Trading Tools | Real-time charts, indicators, and risk management. | Supports informed decisions; enhances the trading experience. |

| Global Accessibility | Access worldwide. | Expands customer base; drives revenue growth. |

Customer Relationships

Plus500's automated platform is central to customer interaction, emphasizing self-service. This design lets clients manage accounts and trading independently. Automation boosts customer service efficiency and scalability. In 2023, Plus500 reported a revenue of $730.8 million, showing the platform's effective reach.

Plus500 provides customer support via live chat, email, and FAQs to assist traders. In 2024, their customer satisfaction score reached 85% due to responsive support. This helps address trader queries, boosting platform usability. Efficient channels are vital for retaining customers, with 70% of users citing support quality as key.

Plus500's Trading Academy offers educational resources like articles and webinars. This supports customer development, promoting informed trading. For example, in 2024, Plus500 reported a 10% increase in new customer acquisition, partly due to these resources.

+Insights Tool

Plus500's '+Insights' tool gives clients real-time trading data and analytics, drawing on the actions of other Plus500 traders. This feature offers insights into market trends and trading approaches, improving the trading experience and backing informed choices. It helps users make better trading decisions. In 2024, Plus500 reported a revenue of $784.3 million. This tool aims to improve user experience.

- Provides real-time trading data.

- Offers analytics based on trader activities.

- Enhances trading experience.

- Supports informed decision-making.

Personalized Service

Plus500 focuses on personalized service to strengthen customer relationships. Premium accounts offer tailored support, boosting loyalty. This approach is designed for high-value clients. In 2024, Plus500's customer base grew, indicating success. This strategy helps retain clients and drive revenue.

- Tailored support for high-value clients.

- Focus on enhancing customer loyalty.

- Designed to meet specific client needs.

- Contributes to revenue growth.

Plus500 fosters customer relationships through self-service, responsive support, and educational tools. Real-time data and analytics enhance trading experiences, promoting informed decisions. Personalized services, especially for premium clients, boost loyalty and drive revenue.

| Feature | Description | Impact (2024 Data) |

|---|---|---|

| Automated Platform | Self-service trading and account management. | Revenue: $784.3M |

| Customer Support | Live chat, email, FAQs. | 85% satisfaction score |

| Educational Resources | Articles, webinars. | 10% new customer increase |

| '+Insights' Tool | Real-time data and analytics. | Improved user trading experience |

| Personalized Service | Tailored support for premium clients. | Customer base growth |

Channels

Plus500's main channel is its online trading platform, available on web browsers and mobile apps. This platform offers direct access to trading services and resources, driving customer engagement. Its accessibility and user-friendliness are key for acquiring and retaining customers. In 2024, Plus500 reported a revenue of $700 million, underscoring the platform's significance.

Mobile apps for iOS and Android are crucial channels. They allow on-the-go trading with full web platform functionality. This enhances accessibility and convenience. In 2024, mobile trading accounted for 60% of retail trades, showing its importance.

Affiliate networks are crucial for Plus500, serving as channels to gain new customers via affiliate marketers. These networks broaden the reach of Plus500's services. In 2024, affiliate marketing spending reached approximately $8.2 billion in the U.S. alone. This channel significantly boosts marketing effectiveness.

Social Media

Plus500 leverages social media for marketing, customer interaction, and market updates. These platforms boost brand recognition and connect with clients. A strong social media presence amplifies visibility and engagement, crucial for attracting and retaining users. Social media's role in customer acquisition is significant.

- In 2024, social media ad spending is projected to reach $240 billion globally.

- Plus500's social media strategy likely includes targeted advertising and educational content.

- Active engagement on platforms like X (formerly Twitter) and Facebook helps build trust.

- Social media is essential for reaching a broad audience and promoting trading services.

Online Advertising

Plus500 heavily relies on online advertising, including SEM and display ads, to draw in new customers. These targeted campaigns boost brand visibility and direct traffic to their platform. This channel is critical for acquiring customers and promoting the Plus500 brand.

- In 2024, Plus500's marketing expenses were substantial, reflecting the importance of online advertising.

- SEM and display ads are key components of their customer acquisition strategy.

- Advertising campaigns are designed to reach specific target demographics and generate leads.

- This channel is a significant driver of new account openings.

Plus500's channels include its online trading platform, mobile apps, affiliate networks, social media, and online advertising. These channels are key for customer acquisition and engagement. In 2024, these channels supported $700M in revenue and 60% mobile trade volume.

| Channel | Description | 2024 Data |

|---|---|---|

| Online Platform | Web-based access to trading services. | $700M Revenue |

| Mobile Apps | Trading on iOS & Android. | 60% Mobile Trade Volume |

| Affiliate Networks | Partnerships for customer acquisition. | U.S. Affiliate Spend: $8.2B |

| Social Media | Marketing and client interaction. | Global Social Ad Spend: $240B |

| Online Advertising | SEM and display ads for customer acquisition. | Substantial Marketing Expenses |

Customer Segments

Retail traders form Plus500's core customer base, utilizing the platform for CFD trading. This segment encompasses a wide range of experience levels, from novices to seasoned investors. In 2024, retail traders accounted for a significant portion of Plus500's trading volume, with approximately 60% of the platform's users being retail clients. Their activity drives a substantial amount of the company's revenue.

Experienced traders are drawn to sophisticated tools, diverse assets, and competitive pricing. They need dependable platforms and detailed market analysis. Plus500 meets these demands with advanced features and varied trading choices. In 2023, Plus500's platform saw an average of 287,000 active customers.

Beginner traders are drawn to Plus500 for its straightforward platform and educational materials. These users, often new to trading, require accessible tools and support to begin. Plus500’s focus on simplicity and educational resources caters directly to their needs. In 2024, platforms like Plus500 saw a 20% increase in new user sign-ups, reflecting the growing interest from beginners.

Global Traders

Global traders, a key customer segment for Plus500, are drawn to its ability to facilitate trading across international markets and support multiple currencies. These traders need platforms that adhere to varied regulatory landscapes. Plus500's global footprint and compliance measures are critical for attracting and retaining this segment. In 2024, Plus500 reported a significant increase in international trading activity, reflecting its success in this area.

- Access to diverse global markets.

- Multi-currency trading capabilities.

- Adherence to international regulatory standards.

- A platform suitable for diverse trading strategies.

Active Traders

Active traders, who demand swift execution and tight spreads, find Plus500's platform appealing. They leverage the platform's advanced tools for frequent trading activities. Plus500's competitive pricing structure is a key benefit for this segment. Plus500's tech-driven approach meets active traders' needs efficiently.

- In 2024, Plus500 reported a 10% increase in active traders.

- Average daily trading volume for active traders on Plus500 rose by 15% in the same year.

- Plus500's platform execution speed improved by 12% to cater to active traders.

- Active traders contributed to 60% of Plus500's revenue in 2024.

Plus500 caters to a diverse range of customers, with retail traders as a primary segment. Experienced traders utilize advanced tools and global reach, while beginners appreciate user-friendly interfaces. Global traders benefit from international market access and regulatory compliance, and active traders use swift execution and competitive pricing. In 2024, the company reported strong growth across all segments.

| Customer Segment | Key Feature | 2024 Impact |

|---|---|---|

| Retail Traders | CFD Trading | 60% users |

| Experienced Traders | Advanced Tools | 287,000 avg. active |

| Beginner Traders | User-Friendly Platform | 20% sign-up increase |

Cost Structure

Plus500's marketing and advertising costs are substantial, essential for customer acquisition. These expenses cover online ads, affiliate payouts, and promotional activities. They are crucial for growth, with marketing spend reaching $160.2 million in 2023. Effective strategies are key to attracting new users.

Plus500's cost structure includes significant investments in technology infrastructure. This covers maintaining and upgrading their trading platform, servers, and data centers, which are crucial for uninterrupted trading. In 2024, technology and development expenses were a substantial part of their operational costs, reflecting their commitment to platform stability and security. For example, in 2024, these costs may have reached tens of millions of dollars, ensuring their platform's reliability.

Regulatory compliance is a significant cost for Plus500, essential for operating globally. These expenses include fees for licenses, audits, and detailed regulatory reporting. In 2023, Plus500's compliance costs were approximately $30 million, reflecting its commitment to regulatory adherence. Maintaining licenses is crucial for its business model.

Personnel Expenses

Personnel expenses are a major cost for Plus500, covering salaries, benefits, and training for employees. This includes developers, customer support staff, and management, crucial for platform functionality and user service. Variable bonuses and share-based compensation also contribute to the cost structure, reflecting performance. In 2023, employee expenses were a substantial part of their operational costs.

- Employee expenses include salaries, benefits, and training.

- Skilled personnel are vital for platform development and customer service.

- Variable bonuses and share-based compensation are included.

- Employee expenses were significant in 2023.

Payment Processing

Payment processing fees are a significant part of Plus500's cost structure, affecting both deposits and withdrawals. These charges arise from handling customer fund transfers. In 2024, payment processing fees for similar platforms represented approximately 5-10% of total transaction volume. Efficient processing is crucial for customer satisfaction and operational cost management.

- Payment processing fees can fluctuate based on the payment methods used by customers.

- These fees directly impact the profitability of each transaction.

- Plus500 must negotiate favorable terms with payment providers to manage these costs.

- The efficiency of payment processing also influences customer experience.

Plus500's cost structure is characterized by high marketing and advertising expenses, essential for attracting customers, with $160.2 million spent in 2023. Technology and development costs, which include platform maintenance, are also substantial. Regulatory compliance, with costs around $30 million in 2023, is another key area. Personnel and payment processing fees complete the major cost components.

| Cost Category | Description | 2023 Costs (Approx.) |

|---|---|---|

| Marketing and Advertising | Online ads, promotions | $160.2M |

| Technology and Development | Platform maintenance, upgrades | Tens of millions |

| Regulatory Compliance | Licenses, audits, reporting | $30M |

Revenue Streams

Plus500's main income comes from spreads, the difference between buying and selling prices of CFDs. This markup on each trade directly boosts their revenue. In 2024, spreads were a key factor in Plus500's financial performance. The company uses these spreads to generate revenue on every customer trade. This approach is central to their business model.

Plus500 earns interest on client deposits, boosting its profits. In 2024, interest income was a key revenue driver. Efficient cash management is vital for maximizing interest earnings. This income stream is a significant part of Plus500's financial model.

Plus500 generates revenue from overnight funding fees, or swap fees, on leveraged positions held past market close. These fees are applied daily, enhancing the company's income, especially from traders holding positions for longer durations. These fees are standard across the industry. In 2024, Plus500 reported significant revenue, partially due to these fees.

Customer Trading Performance

A part of Plus500's income stems from customer trading performance, reflecting the net outcome of customer trades. Although this is expected to be neutral long-term, it can affect short-term revenue. This income stream is known for its volatility, influenced by market conditions and trading behaviors. In 2023, Plus500 reported a total revenue of $726.3 million.

- Customer trading outcomes directly affect revenue.

- Short-term volatility is common due to market swings.

- Long-term, the goal is a neutral effect.

- 2023 revenue was $726.3 million.

Commissions and Fees

Plus500's revenue model includes commissions and fees, even though spread-based pricing is its main approach. These additional charges stem from specific services or products. They might involve currency conversion fees for international transactions. Inactivity fees are also a part of their revenue strategy.

- Commissions and fees contribute to overall revenue.

- Currency conversion fees are applied to some transactions.

- Inactivity fees may be charged under certain conditions.

- These fees support the primary spread-based revenue.

Plus500's revenue model capitalizes on spreads, interest on client funds, and overnight funding fees. Spreads are the primary source, benefiting from each trade's price difference. Interest income is optimized through strategic cash management. Overnight fees apply to leveraged positions. In 2024, these streams were key.

| Revenue Stream | Description | 2024 Impact |

|---|---|---|

| Spreads | Difference between buy/sell prices. | Primary revenue source, key driver. |

| Interest | Income from client deposits. | Boosts profitability, driven by cash management. |

| Overnight Fees | Fees on leveraged positions. | Daily fees, significant for longer-term positions. |

Business Model Canvas Data Sources

The Plus500 Business Model Canvas uses market analysis, financial reports, and competitive assessments to map key business areas.