Plus500 PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Plus500 Bundle

What is included in the product

Assesses how Political, Economic, etc., factors affect Plus500. Offers forward-looking insights for strategy.

A valuable asset for business consultants creating custom reports for clients.

Preview Before You Purchase

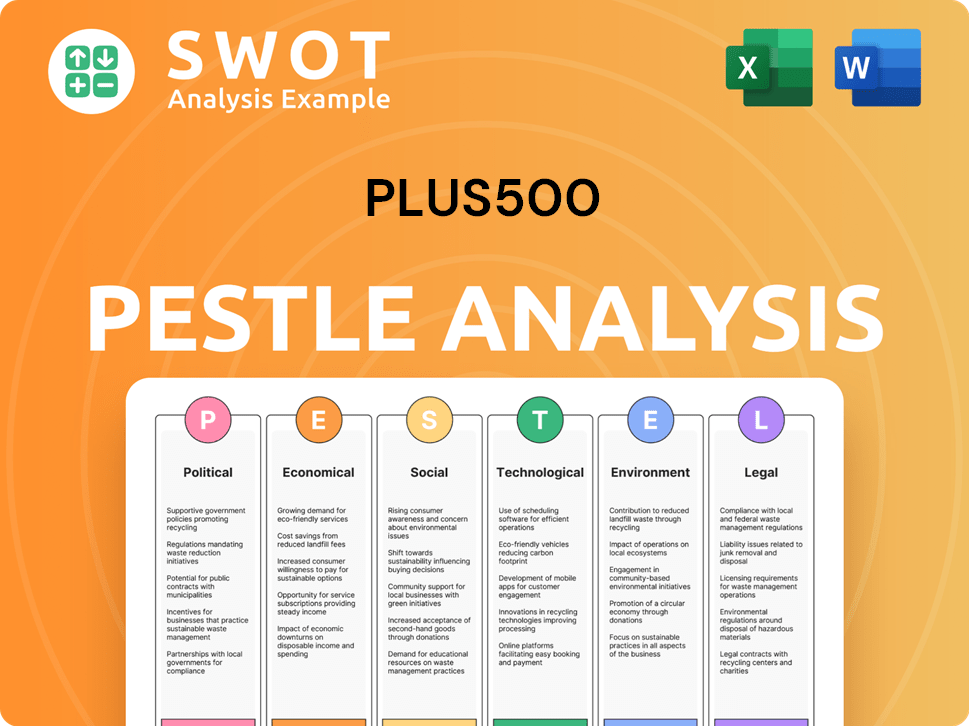

Plus500 PESTLE Analysis

What you see is what you'll get! This preview showcases the comprehensive Plus500 PESTLE Analysis.

The document's format and content are identical to the one you receive.

Upon purchase, you’ll download this analysis without alteration.

Enjoy a detailed look at Plus500's PESTLE factors right now.

Get ready to utilize this expertly crafted document.

PESTLE Analysis Template

Navigate Plus500's market landscape with our expert PESTLE analysis. Uncover critical political, economic, social, technological, legal, and environmental factors influencing the company. Identify potential risks and opportunities for enhanced strategic planning. Leverage actionable insights to optimize investment decisions. Buy the full version for in-depth analysis and strategic advantages.

Political factors

Plus500 faces strict regulations in financial services. The FCA in the UK and ASIC in Australia oversee its operations. These bodies set rules impacting product offerings. In 2024, regulatory fines for non-compliance in the sector reached $500 million.

Government policies on trading, especially for CFDs, are vital for Plus500. Regulations to protect retail investors can affect marketing and growth. For instance, the FCA in the UK has specific rules. In 2024, Plus500's revenue reached approximately $772.2 million, influenced by these policies. These policies shape how Plus500 operates across different markets.

Political stability significantly impacts Plus500's operations. Stable environments foster investor confidence and market activity. Countries with consistent policies and governance are preferred. Reduced political risk minimizes operational disruptions. Plus500's 2024 reports highlight this, showing enhanced performance in stable regions.

International Relations

International relations and trade agreements significantly shape Plus500's global reach. These factors influence the company's capacity to operate across different countries and its ease of market expansion. For instance, Brexit caused fluctuations; as of early 2024, Plus500 has adapted, maintaining services in the UK. Geopolitical tensions and trade wars can disrupt operations and profitability.

- Brexit impact: Plus500 adapted to maintain services in the UK post-Brexit.

- Geopolitical risk: Tensions can disrupt operations and profitability.

Tax Regulations

Tax regulations are a critical political factor for Plus500, affecting its financial performance across various markets. Changes in tax policies in jurisdictions where Plus500 operates can significantly impact its profitability and the tax burden on its clients. These shifts can influence trading volumes and investor sentiment. For example, in 2024, changes in capital gains tax in key markets could alter trading behavior.

- Tax rates on financial transactions vary significantly by country, potentially affecting Plus500's bottom line.

- Tax incentives or disincentives can drive or deter trading activity.

- Regulatory changes, such as those impacting how profits are taxed, impact the company's financial strategy.

- Plus500 must continuously monitor tax law changes globally to remain compliant and competitive.

Plus500 navigates strict financial regulations and government policies. These factors influence product offerings and market entry, affecting revenue streams. Political stability and international relations shape the company's operational environment, influencing expansion strategies and investor confidence.

| Aspect | Details | Impact |

|---|---|---|

| Regulatory Oversight | FCA (UK), ASIC (Australia) | Controls product offerings and compliance, $500M fines in 2024 |

| Government Policies | CFD regulations | Affect marketing and retail investor protection |

| Political Stability | Stable regions | Boosts investor confidence; Plus500's performance enhances |

Economic factors

Economic cycles, spanning growth and recession phases, significantly shape aggregate demand and investment across an economy. This dynamic directly impacts trading volumes and profitability for Plus500. For instance, in 2024, the global GDP growth is projected at approximately 3.2%. This affects the company.

Foreign exchange rate fluctuations are critical for Plus500. Changes affect the Forex instruments it offers, impacting trading and revenue. For instance, the GBP/USD rate saw volatility in early 2024, influencing trading volumes. In Q1 2024, Plus500's revenue was $205.1 million, partly due to FX market activity.

Inflation and interest rates are vital economic factors influencing Plus500. High inflation can erode consumer purchasing power and impact trading volumes. In 2024, the U.S. inflation rate was around 3.5%, impacting market dynamics. Interest rate hikes by central banks, like the Federal Reserve, can increase borrowing costs. These rates affect Plus500's operational costs and customer trading behavior.

Market Volatility

Market volatility, a key economic factor, significantly impacts Plus500. Driven by economic news and events, volatility creates trading opportunities. Plus500's revenue is directly influenced by these market fluctuations, as seen in recent financial reports. Increased volatility can lead to higher trading volumes and potential gains, but also increases risk.

- Plus500 reported a 2024 revenue of $641.1 million, reflecting market activity.

- Volatility can lead to a higher frequency of trades.

- Risk management is crucial during volatile periods.

Customer Deposit Trends

Customer deposit trends are vital for Plus500, reflecting customer confidence and trading activity. In 2024, customer deposits reached record levels, indicating strong market participation. This growth is fueled by economic stability and positive market sentiment. These deposits provide the capital necessary for trading and reflect the overall health of the financial markets.

- Customer deposits are key for Plus500's operational capabilities.

- Economic stability boosts customer confidence.

- Positive market sentiment drives deposit growth.

- Deposits provide capital for trading activities.

Economic factors like growth, inflation, and interest rates strongly influence Plus500's performance, affecting trading volumes and costs. Foreign exchange rates also impact the company through its forex trading instruments.

Market volatility provides opportunities, yet it can also increase risks, influencing trading activity and profitability. For example, Plus500's revenue was significantly tied to market fluctuations, reaching $641.1 million in 2024.

Customer deposit trends, vital for assessing customer confidence and operational capital, reached record highs in 2024. The strength of financial markets thus impacts trading volume.

| Economic Factor | Impact on Plus500 | 2024 Data Point |

|---|---|---|

| GDP Growth | Influences trading volumes | Global GDP ~3.2% |

| FX Rates | Impacts Forex instruments | GBP/USD Volatility |

| Inflation | Affects consumer spending | US Inflation ~3.5% |

Sociological factors

Plus500 must understand its users, spanning from novices to experts, to refine its platform. In 2024, retail trading surged, with demographics shifting towards younger investors. Data from 2024 shows a 20% increase in mobile trading, reflecting changing user habits. This data helps Plus500 adapt its services.

Financial literacy significantly shapes Plus500's customer base. Educational resources are vital for attracting and retaining clients. In 2024, only about 40% of adults globally demonstrated basic financial literacy. Offering educational tools can help bridge this gap. Companies like Plus500 can benefit by supporting client understanding.

Societal views on financial risk shape CFD trading behavior. Plus500 offers risk tools, yet 77% of retail investor accounts lose money. This highlights the impact of risk perception. In 2024, risk-averse attitudes might curb trading volume. Conversely, a higher risk appetite could boost Plus500's user base.

Brand Reputation and Trust

Plus500's brand reputation significantly impacts its ability to attract and retain customers. Transparency in fees and trading practices is vital for building trust. Customer service quality directly affects customer satisfaction and loyalty, influencing how the brand is perceived. A strong reputation can lead to increased market share and investor confidence. In 2024, Plus500 reported a customer base of over 340,000 active users.

- Customer trust is essential for sustained growth.

- Transparency and customer service are key factors.

- A positive reputation boosts customer acquisition.

- Reputation impacts investor confidence and market share.

Corporate Social Responsibility

Plus500's commitment to corporate social responsibility (CSR) is crucial for its brand perception. Initiatives in local communities and employee welfare, including diversity and inclusion programs, enhance its public image. These efforts attract customers and employees who prioritize ethical business practices. In 2024, companies with strong CSR saw up to a 20% increase in customer loyalty, according to a study by the Reputation Institute.

- Employee satisfaction rates at companies with robust CSR programs are 15% higher.

- Plus500's CSR investments could boost its ESG ratings, influencing investor decisions.

- Socially responsible investments (SRI) accounted for over $40 trillion globally in 2024.

Societal attitudes greatly affect CFD trading. In 2024, risk perception saw potential impacts on trading. Plus500 must focus on brand trust via clear practices.

| Factor | Impact | Data (2024) |

|---|---|---|

| Risk Appetite | Influences Trading Volume | 77% retail investor losses reported |

| Brand Reputation | Affects Customer Trust | Customer base of over 340,000 |

| CSR | Enhances Brand Perception | Up to 20% customer loyalty increase |

Technological factors

Plus500's proprietary trading platform is a key technological asset, offering competitive advantages. This platform allows for swift adaptation to market shifts and quick integration of user feedback. The platform's agility supports the rapid launch of new products and features. In 2024, Plus500 invested significantly in its technology, allocating $78.2 million to enhance its platform's capabilities.

Plus500 heavily invests in tech, crucial for attracting and keeping customers. This includes marketing tech and infrastructure. In 2024, they spent $100M+ on tech. This fuels new product launches and market expansion.

Data security and privacy are crucial for Plus500. They must protect sensitive financial and personal data. In 2024, cybersecurity incidents cost businesses globally an average of $4.45 million. Plus500 invests heavily in robust security measures to safeguard client information and maintain trust.

Mobile Trading Technology

Plus500's mobile trading app is crucial for attracting and retaining clients who favor mobile trading. In 2024, mobile trading accounted for over 60% of retail trading activity globally, highlighting its significance. A user-friendly and feature-rich app enhances the trading experience and customer satisfaction. The app's performance and reliability directly impact customer retention rates and trading volumes.

- Mobile trading adoption is growing with over 70% of retail traders using mobile platforms in 2025.

- Plus500's mobile app saw a 15% increase in active users in Q1 2024.

- Customer satisfaction scores for mobile apps are directly correlated with trading volume.

Integration of AI and Analytics

Plus500 can use AI and analytics to boost marketing, target customers better, and improve trading experiences. Integrating these technologies can lead to more efficient operations and better user engagement. By analyzing vast datasets, Plus500 could offer personalized trading insights. This could increase customer satisfaction and retention rates.

- AI-driven customer support could cut response times by 30%.

- Personalized trading tools might boost user engagement by 20%.

- Targeted marketing campaigns could lower customer acquisition costs by 15%.

Plus500 leverages its tech, including its trading platform, for competitive advantages. The company invests significantly in technology, with expenditures exceeding $100M+ in 2024, for enhanced platform capabilities and product launches. Data security remains crucial, necessitating substantial investment to protect user data. Mobile trading apps and AI integration offer opportunities for enhanced user experiences and efficient operations.

| Aspect | Details | Impact |

|---|---|---|

| Tech Investment (2024) | $100M+ | Supports product development, global expansion |

| Mobile Trading (2025 est.) | 70%+ retail traders using mobile platforms | Increases user base, trading volumes |

| AI in Customer Support | Reduce response times by 30% | Improve customer satisfaction |

Legal factors

Plus500 faces stringent regulatory compliance across its global operations. It must secure and maintain licenses in various jurisdictions, adhering to diverse financial regulations. For instance, in 2024, Plus500 faced scrutiny from regulators regarding its KYC/AML procedures. The company continues to invest heavily in compliance, with expenditures reaching $35 million in 2024, reflecting the importance of legal adherence. This ensures its operational legitimacy and mitigates legal risks.

Consumer protection laws are crucial for Plus500, affecting how it markets services. These laws mandate clear risk disclosures for CFD trading. In 2024, regulatory fines for non-compliance reached $5 million. Plus500 must adhere to stringent rules to protect its clients.

Data protection, like GDPR, is key. Plus500 must protect customer data to build trust. In 2024, GDPR fines hit €1.5 billion across the EU. Breaches can severely damage a firm's reputation and finances. Companies must invest in robust data security.

Employment Law

Employment laws are crucial for Plus500, impacting how it manages its global workforce. These laws vary significantly by country, influencing hiring, contract terms, and employee working conditions. Compliance is vital to avoid legal issues and maintain a positive work environment. Failure to comply could lead to penalties and damage the company's reputation.

- 2024: Plus500 employs staff in several regions, with specific employment regulations in each.

- 2023: Compliance costs related to employment law were a notable part of operational expenses.

Intellectual Property Rights

Intellectual property rights are crucial for Plus500's legal standing. Protecting proprietary technology and trading algorithms is essential to maintain its competitive advantage in the financial markets. This includes securing patents, trademarks, and copyrights to prevent unauthorized use or replication of its innovative features. Plus500's legal team actively monitors and enforces these rights. Breaches can lead to significant legal battles, impacting its market position.

- In 2024, Plus500's R&D expenditure was approximately $60 million, indicating a strong focus on innovation, which necessitates robust IP protection.

- The company holds multiple patents related to its trading platform, reflecting its investment in proprietary technology.

- Legal costs related to IP protection and enforcement can be substantial, potentially affecting profitability.

Legal factors are critical for Plus500. They must adhere to financial regulations and consumer protection laws globally. Data and IP protection are key for operational integrity and competitive advantage. Strict compliance necessitates substantial investments to avoid penalties and reputational harm.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Regulatory Compliance | Licensing and operational legitimacy | Compliance costs $35M in 2024. |

| Consumer Protection | Clear risk disclosure for CFD trading | Regulatory fines of $5M. |

| Data Protection | Protecting customer data, building trust | GDPR fines of €1.5B across EU |

Environmental factors

Plus500's ESG performance is under scrutiny, especially regarding governance and social factors. In 2024, ESG-focused funds saw inflows, highlighting investor interest. The company's governance practices and social impact are increasingly important to stakeholders. Plus500's commitment to ESG could affect its valuation and access to capital. This is a growing trend in the financial sector.

Plus500, like all businesses, must adhere to environmental regulations. While not as heavily affected as manufacturing, they must manage office operations. For example, they need to consider energy consumption and waste management. In 2024, the global market for environmental compliance software was valued at $1.5 billion. This is expected to grow, influencing operational costs.

Plus500's reputation is increasingly tied to environmental responsibility. Investors are now heavily scrutinizing companies' environmental impact. Stakeholder expectations, including clients and partners, are evolving. For example, in 2024, ESG-focused funds saw record inflows, highlighting the financial impact of environmental perception.

Impact of Climate Change on Markets

Climate change poses indirect risks to Plus500's trading environment. Extreme weather events and shifts in climate patterns can disrupt supply chains, impacting commodity prices. These fluctuations can lead to increased volatility in assets like agricultural products and energy, which are traded on the platform. For example, in 2024, the agricultural sector faced significant price swings due to droughts and floods.

- Commodities volatility increased by 15% in 2024 due to climate-related events.

- Plus500 offers trading on numerous commodities.

- Climate change impacts can create both risks and opportunities.

Sustainability in Business Practices

Plus500 can enhance its image by adopting sustainable practices. This includes waste management and energy efficiency in its offices, aligning with corporate social responsibility. Investors increasingly favor companies with strong environmental records. For example, in 2024, sustainable investments reached over $40 trillion globally. This shows the growing importance of environmental considerations for financial success.

Plus500 faces environmental scrutiny regarding operational sustainability and climate impact on trading markets.

They must manage office practices like energy consumption, in line with growing environmental regulations.

Climate change indirectly affects the firm, with extreme weather influencing commodity price volatility.

| Factor | Impact | 2024 Data |

|---|---|---|

| Regulations | Compliance costs | Environmental compliance software market: $1.5B |

| Climate Change | Commodity Volatility | Volatility up 15% (climate-related events) |

| Sustainable Investment | Reputation/Investment | Sustainable investments reached $40T |

PESTLE Analysis Data Sources

Plus500's PESTLE leverages governmental, financial, and industry data for credible, up-to-date macro-environmental insights.