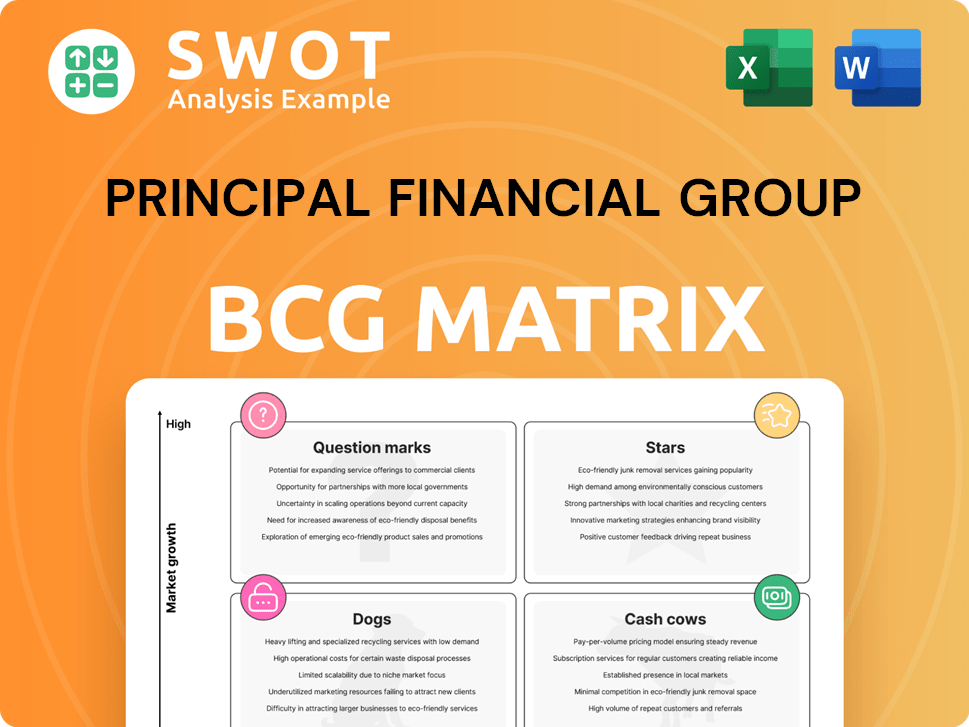

Principal Financial Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Principal Financial Group Bundle

What is included in the product

Tailored analysis for Principal's product portfolio across the BCG Matrix.

Distraction-free view optimized for C-level presentation of the Principal Financial Group BCG Matrix.

Delivered as Shown

Principal Financial Group BCG Matrix

The BCG Matrix preview mirrors the document you'll receive post-purchase. It's the same detailed, professionally crafted report, ready for strategic planning and analysis. No alterations are needed; simply download and utilize the complete, unedited version. Your purchased file is identical to the preview.

BCG Matrix Template

Principal Financial Group's BCG Matrix showcases its diverse portfolio's strategic positioning. Stars likely represent high-growth potential, while Cash Cows provide steady revenue streams. Question Marks hint at uncertain futures, and Dogs may need reevaluation. Understanding these dynamics is crucial for informed investment decisions. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Principal Financial Group's Specialty Benefits segment excels in underwriting, especially in group disability and life insurance. The incurred loss ratio improved, suggesting effective risk management. Pre-tax operating earnings have risen, highlighting profitability. In 2024, this segment contributed significantly to the company's overall financial health.

Principal Financial Group's Retirement and Income Solutions (RIS) is a "Star" in its BCG Matrix. This segment shows strong growth in recurring deposits due to high demand for retirement products. RIS benefits from a solid pipeline for future fee-based income, boosted by increasing Private Retirement Trust (PRT) sales. In 2024, pre-tax operating earnings improved, driven by business growth and favorable markets.

Principal Asset Management's non-affiliated private real estate arm is currently experiencing positive net cash flow. These strategies are demonstrating robust performance, reflecting strong investor confidence and market demand. This positive trajectory significantly boosts the overall assets under management (AUM) and revenue growth for Principal Financial Group. In 2024, Principal Financial reported $668.9 billion in AUM.

Life Insurance (New Business Sales)

Principal Financial Group's Life Insurance segment, a rising star, showcases robust expansion in new business sales, driving up market premiums and fees. This growth compensates for declines in older products, signaling a successful shift to meet evolving market trends and consumer needs. Pre-tax earnings have improved, supported by regulatory changes and strategic investments in high-growth areas. In 2024, new sales surged, reflecting strong performance.

- New business sales are a key driver of the segment's growth.

- Adaptation to changing consumer preferences is evident.

- Regulatory adjustments have positively impacted earnings.

- Strategic focus on growth areas is paying off.

Digital Transformation Initiatives

Principal Financial Group's digital transformation, including cloud migration and AI integration, is yielding positive outcomes. These initiatives boost customer experience, optimize operations, and elevate employee productivity. The company's focus on technology and innovation solidifies its leadership in financial services. In 2024, Principal allocated a significant portion of its budget to digital initiatives, with a 20% increase in tech spending.

- 20% increase in tech spending in 2024

- Focus on cloud migration and AI integration

- Enhanced customer experience

- Improved operational efficiency

Principal Financial Group's "Stars" are segments with high growth and market share. The Retirement and Income Solutions (RIS) segment is a strong performer, boosted by increased PRT sales. Life Insurance also shines with expanding new business sales in 2024. These segments drive overall company success.

| Segment | Key Metric (2024) | Result |

|---|---|---|

| RIS | Pre-tax operating earnings | Improved |

| Life Insurance | New sales growth | Surged |

| Digital Transformation | Tech spending increase | 20% |

Cash Cows

Principal Financial Group's retirement solutions, especially those with a solid client base, are cash cows. These plans ensure steady cash flow through consistent deposits and a stable asset base. In 2024, Principal saw strong retention rates, with over 90% in key segments. Optimizing efficiency is crucial to boost cash flow from these established products.

Principal's annuities are cash cows, generating consistent cash flow. They offer reliable income, appealing in low-rate environments. Product innovation and pricing are key to maintaining demand. In 2024, Principal's annuity sales reflect this strength, with substantial revenue. This market position is crucial for sustained financial health.

Group dental and vision insurance from Principal Financial Group is a cash cow. These services offer stable revenue, vital for employee benefits, ensuring consistent demand. Competitive pricing and great service are key. In 2024, Principal's group benefits saw steady growth, with dental and vision plans contributing significantly to overall earnings, demonstrating a reliable revenue stream.

Asset Management (Established Funds)

Principal Financial Group's established funds are cash cows. They generate consistent management fees from a loyal investor base. Solid performance and effective client communication sustain assets under management (AUM). This ensures a strong cash flow for the company.

- Principal had $529.1 billion in AUM as of December 31, 2023.

- The asset management segment contributed significantly to the company's overall revenue.

- Focus on investment performance is crucial to maintain AUM.

- Client communication is vital for investor retention.

International Pension (Select Markets)

Principal Financial Group's international pension business, particularly in select markets, acts as a cash cow, providing consistent revenue. These markets profit from favorable demographics and a growing need for retirement solutions. Success hinges on tailoring products to local needs and maintaining strong distribution partnerships. In 2024, Principal's international business saw a 10% increase in assets under management.

- Focus on markets with aging populations and pension reforms.

- Adapt product offerings to local regulatory environments.

- Cultivate strong relationships with local financial advisors.

- Prioritize efficient operational models to maintain profitability.

Principal Financial Group's cash cows, including retirement solutions and annuities, consistently generate strong cash flow. Group benefits, like dental and vision, also provide stable revenue. Established funds and international pension businesses further boost financial stability. These segments ensure consistent revenue streams.

| Cash Cow Segment | Key Feature | 2024 Performance Highlight |

|---|---|---|

| Retirement Solutions | High client retention | Retention rate over 90% |

| Annuities | Consistent income | Substantial revenue |

| Group Benefits (Dental/Vision) | Stable demand | Steady growth in earnings |

Dogs

Principal's legacy life insurance products, some dating back to the early 2000s, face headwinds. These policies, impacted by lower interest rates and increased mortality, may strain capital. In 2024, Principal may consider restructuring or selling these to free up capital. This is due to their limited growth potential compared to newer offerings.

International pension markets can be tricky due to currency fluctuations, regulatory issues, and economic instability. These markets might demand considerable investment with potentially low returns, making them less appealing for sustained growth. In 2024, some emerging markets saw pension fund returns struggle, with certain regions experiencing negative growth. Consider evaluating the strategic alignment of these markets and potentially restructuring to focus on more profitable areas.

Low-margin products face tough competition, impacting profitability. High marketing and distribution costs further strain finances. These products often see limited revenue growth potential. In 2024, the average profit margin for commoditized goods was around 5%. Focus on higher-margin options for better returns.

Underperforming Investment Funds

Underperforming investment funds within Principal Financial Group's portfolio can lead to significant outflows and reduced revenue through lower management fees. These funds, consistently failing to meet benchmarks, can severely damage the company's reputation and erode investor trust, potentially triggering further redemptions. To mitigate these issues, Principal must take decisive action.

- In 2024, the average expense ratio for actively managed funds was 0.74%, while passive funds averaged 0.15%.

- Funds underperforming for three years saw average outflows of 5-10% of their assets.

- Merging underperforming funds can help stabilize assets and potentially improve performance.

- Revamping investment strategies might include hiring new portfolio managers.

Non-Strategic Business Units

In Principal Financial Group's BCG Matrix, 'dogs' represent business units that don't fit their main goals or growth plans. These units may need lots of resources but offer little synergy or competitive edge. The aim is to assess how well these units fit and think about selling or changing them to focus on what Principal does best. This strategic move helps the company concentrate on its key strengths for better performance. In 2024, Principal Financial Group's strategic moves focused on core business areas.

- Principal aims to streamline operations and improve efficiency.

- They are evaluating their business units to ensure alignment with their strategic direction.

- Divestitures are a key part of their strategy to optimize their portfolio.

- The focus is on enhancing shareholder value.

Principal Financial Group's "dogs" include underperforming or misaligned business units, draining resources with low growth. These units may face restructuring or divestiture. In 2024, strategic reviews and asset reallocation were key. The goal is to enhance shareholder value by optimizing the portfolio.

| Area | Focus | Action |

|---|---|---|

| Strategic Fit | Business unit alignment | Evaluate for divestiture |

| Financials | Resource allocation | Reduce underperforming investments |

| Shareholder Value | Performance Metrics | Improve focus and efficiency |

Question Marks

Principal Financial Group's Workplace Personal Investing Program, aimed at emerging and mass affluent savers, is a recent venture. Its success hinges on effectively connecting with and involving the target demographic, showcasing the benefits of financial advice. Achieving profitability and scaling this program could necessitate substantial investments in marketing and advisor training. In 2024, Principal's assets under management reached $668.2 billion.

Principal's move into passive target-date funds (TDFs) faces established rivals. Success hinges on competitive fees and solid investment returns. They must invest in product development and marketing to gain ground. In 2024, passive TDFs saw significant inflows, but margins are tight. Principal's AUM in TDFs was about $100 billion as of late 2024.

Principal's investment in AI, like 'Paige,' is a question mark. Success hinges on boosting productivity, customer experience, and revenue. The company's tech and talent investments are key. In 2024, AI spending by financial services firms is projected to reach $20.4 billion, indicating significant industry focus.

Emerging Market Expansion

Expanding into new emerging markets presents both opportunities and challenges for Principal Financial Group. Success hinges on understanding local market conditions and adapting products and services. Significant investment in market research and infrastructure is needed to establish a presence. Profitability is achievable through strategic planning and execution.

- Principal Financial Group's revenue in 2023 was $14.8 billion.

- Emerging markets offer high growth potential but also higher risks.

- Adaptation is key, as local needs vary greatly.

- Building strong partnerships is crucial for distribution.

New Insurance Products

New insurance products, like those with in-plan annuity options, are a potential growth area for Principal Financial Group. Success hinges on effective marketing, demonstrating value, and managing risks. This requires significant investment in development, marketing, and risk management. However, the potential for increased revenue and market share makes it a worthwhile venture.

- Principal Financial's 2024 financial reports will provide specific figures on investments in new product development and marketing.

- The market for retirement income products is projected to grow, offering opportunities for Principal.

- Risk management strategies are crucial to mitigate potential losses.

- Customer education is key to the adoption of new insurance products.

Principal's AI investment, like Paige, is a question mark in the BCG matrix, with its success depending on boosting productivity and revenue. The company's tech and talent investments are pivotal. The financial services industry's AI spending is significant, projected to reach $20.4 billion in 2024.

| BCG Matrix Element | Principal's AI Initiative | Key Considerations |

|---|---|---|

| Market Growth | High (potential) | Rapid growth in AI adoption across financial services. |

| Market Share | Low (currently) | Principal's current market position in AI-driven solutions. |

| Investment | Significant | Investment in technology, talent, and infrastructure. |

| Risk | High | Implementation challenges, ROI uncertainty, and competition. |

| Strategic Focus | Focus on innovation, customer experience, and revenue generation. | Achieving profitability, enhancing productivity, and scaling AI initiatives. |

BCG Matrix Data Sources

Principal Financial's BCG Matrix leverages financial statements, market share data, and industry reports for strategic alignment. We incorporate competitor analysis and expert insights as well.