Progressive Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Progressive Bundle

What is included in the product

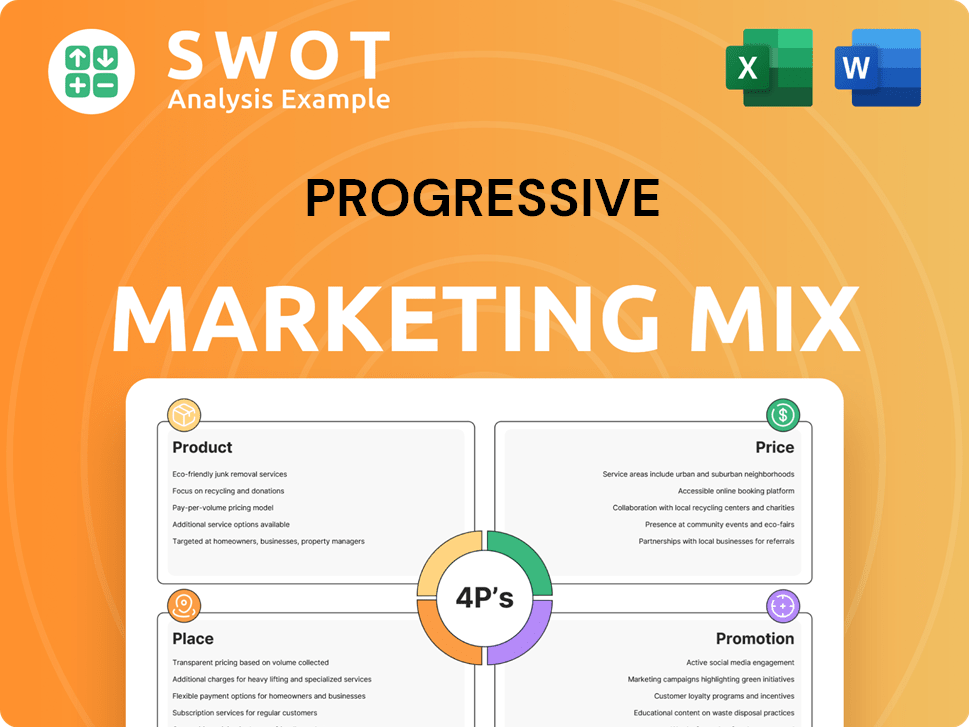

Examines Progressive's Product, Price, Place, & Promotion.

Quickly and clearly visualizes complex marketing data for efficient decision-making.

Full Version Awaits

Progressive 4P's Marketing Mix Analysis

You're examining the complete Progressive 4Ps Marketing Mix Analysis. This comprehensive document outlines the strategies for Product, Price, Place, and Promotion. Every detail within the preview is what you'll get. No revisions, no alterations; it's immediately ready.

4P's Marketing Mix Analysis Template

Discover how Progressive crafts its successful marketing campaigns. Explore their product line and how they’re positioned. Analyze their competitive pricing strategies. Uncover the channels Progressive uses to reach customers. Examine their promotional techniques in detail.

Want to dive deeper? Get our in-depth 4P's Marketing Mix Analysis, packed with actionable insights, ready for your business needs.

Product

Progressive, a leading US insurer, offers personal and commercial auto insurance. They cover cars, trucks, motorcycles, and more. In 2024, Progressive's net premiums written for auto insurance exceeded $50 billion. This makes them a significant player in the market.

Progressive extends beyond auto insurance, offering specialty property-casualty products. These cater to diverse risks, going beyond standard policies. In 2024, Progressive's commercial lines premiums grew, indicating expansion. They provide coverage for unique needs, solidifying their market position. This diversification helps manage risk exposure and attract varied customers.

Progressive extends its insurance offerings to include personal residential property insurance, catering to homeowners. This coverage protects homes against various perils, offering financial security. Bundling home and auto insurance with Progressive can lead to potential cost savings for customers. In 2024, the average homeowners insurance premium was around $1,700 annually, indicating the market's scale. Progressive's strategy aims to capture a portion of this market, enhancing its customer base.

Business Insurance

Progressive's product strategy includes business insurance, targeting small businesses. Their offerings feature general liability and commercial property coverage. In 2024, the commercial lines segment generated approximately $19.8 billion in net premiums written. This reflects a significant portion of Progressive's overall revenue.

- Commercial lines contributed significantly to Progressive's revenue.

- Offers general liability and commercial property insurance.

- Progressive focuses on small business insurance needs.

- 2024 net premiums written were around $19.8 billion.

Workers' Compensation Insurance

Progressive's focus on workers' compensation insurance, primarily for the transportation industry, is a key product offering. This insurance covers medical costs and lost wages for employees injured at work. In 2024, the workers' compensation insurance market in the U.S. saw premiums of approximately $70 billion. Progressive's market share in this segment is growing, reflecting its strategic focus.

- Offers coverage for medical expenses.

- Provides lost wages for employees.

- Targets the transportation industry.

- Aims to increase market share.

Progressive provides diverse insurance products, including auto, property, and commercial lines. These offerings cater to personal and business needs, driving substantial revenue. The company’s product strategy extends to workers' compensation, focusing on the transportation sector.

| Product | Description | 2024 Data |

|---|---|---|

| Auto Insurance | Covers cars, trucks, and motorcycles | $50B+ net premiums written |

| Commercial Lines | General liability and commercial property | ~$19.8B in net premiums |

| Workers Comp | Transportation industry focus | Growing market share |

Place

Progressive leverages a vast network of over 40,000 independent insurance agencies for distribution. This extensive reach allows for localized customer service. In 2024, independent agents accounted for a significant portion of Progressive's new business, with the company aiming to increase this channel's contribution further in 2025. This strategy supports personalized customer interactions.

Progressive's direct-to-consumer online channel allows customers to buy and manage policies easily. This strategy caters to those who favor digital interactions, enhancing customer convenience. In 2024, Progressive reported that over 70% of new policies were initiated online. This approach streamlines service, contributing to operational efficiency.

Progressive allows direct insurance purchases via phone, catering to customers preferring human interaction. This complements its online and agent channels, increasing accessibility. In 2024, direct-to-consumer sales via phone continue to be a significant revenue stream. Phone sales represent a notable portion of Progressive's overall sales, contributing to its diverse distribution strategy.

Progressive Mobile App

Progressive's mobile app allows personal auto insurance customers to manage their policies digitally, enhancing customer interaction. This digital platform is crucial, especially as mobile usage continues to rise. Data from 2024 shows that over 70% of Progressive customers actively use the mobile app for policy management and claims. It streamlines policy access and claim filing, offering convenience.

- Mobile app usage increased by 15% in 2024.

- Over 2 million claims filed via the app annually.

- App store ratings consistently above 4.5 stars.

Underwritten by Progressive Companies and Other Carriers

Progressive's personal property insurance strategy involves underwriting through its own entities and partnerships. This allows Progressive to broaden its market reach and tailor coverage options. Partnering with other carriers can also help manage risk and adapt to regional market dynamics. In 2024, Progressive reported a net premium written of over $57 billion, reflecting the scale of its insurance operations. This blended approach helps them offer more diverse and competitive products.

- Partnerships expand Progressive's market presence.

- Risk management is enhanced through diversification.

- 2024 net premium written was over $57 billion.

- Coverage options are more flexible.

Progressive uses diverse channels to distribute insurance, including a network of independent agents. Direct online and phone sales further broaden Progressive's market reach, enhancing customer accessibility. The mobile app, with over 70% usage in 2024, simplifies policy management.

| Channel | 2024 Contribution | Strategy Focus |

|---|---|---|

| Independent Agents | Significant New Business | Personalized Service |

| Online | 70%+ New Policies | Digital Convenience |

| Phone | Significant Revenue Stream | Human Interaction |

| Mobile App | 70%+ Active Users | Policy Management |

Promotion

Progressive ramped up media spending in 2024. They invested heavily in advertising. This boosted growth and expanded their reach. In 2024, Progressive's advertising expenses were approximately $2.4 billion, a rise from $2.1 billion in 2023, indicating a strategic focus on market visibility.

Progressive's marketing strategy heavily relies on advertising campaigns, particularly on television, to engage its target demographic. These ads frequently employ humor, aiming to boost brand recognition and highlight their services. In 2024, Progressive spent approximately $2.1 billion on advertising, a significant investment. This spending underscores their dedication to maintaining a robust market presence.

Progressive's brand purpose, "We exist to help people move forward and live fully," is central to its promotion. This new approach goes beyond insurance, focusing on customer well-being. In 2024, Progressive's advertising spend reached $2.5 billion, reflecting this broader message. This shift aims to enhance brand loyalty and attract a wider audience. The strategy aligns with the growing consumer demand for socially conscious brands.

Leveraging Technology in Marketing

Progressive leverages technology, especially AI, to refine its marketing. This tech-focused strategy boosts campaign efficiency and audience targeting. By analyzing data, Progressive personalizes its marketing efforts for better results. This data-driven method helps pinpoint and engage the right customers effectively. In 2024, Progressive's marketing spend was approximately $2.5 billion, reflecting its strong tech integration.

- AI-driven personalization improves customer engagement.

- Data analytics optimize campaign performance.

- Technology enhances audience targeting precision.

- Marketing spend reflects investment in tech.

Collaboration with Organizations

Progressive's commitment to its purpose is evident in its collaborations with external entities. These partnerships span both public and private sectors. The goal is to co-create solutions that promote equity and progress. Progressive invested $1.2 million in community initiatives in 2024.

- Community investments reached $1.2M in 2024.

- Partnerships are across public and private sectors.

- Focus is on solutions for equity and progress.

Progressive uses diverse promotional strategies to boost brand presence. Advertising remains key, with about $2.5 billion spent in 2024. This includes TV ads leveraging humor. Their tech-focused methods also refine customer targeting and campaign efficiency.

| Promotion Aspect | Description | 2024 Data |

|---|---|---|

| Advertising Spend | Investment in market visibility through ads. | $2.5 billion |

| Technological Integration | AI-driven marketing for better results. | Increased spending on tech-related promotion |

| Community Investments | Partnerships to promote equity and progress | $1.2 million |

Price

Progressive's pricing strategy hinges on assessing individual risk and market dynamics. They leverage data analytics to customize premiums, considering factors like driving history. In 2024, Progressive's combined ratio was around 96%, showing effective risk management. This approach helps them stay competitive and profitable.

Progressive focuses on offering competitive insurance rates. In 2024, they aimed for rate adjustments to align with risk profiles. This pricing strategy helps them gain market share. It's crucial for their continued growth and customer retention, as seen in their Q1 2024 earnings.

Progressive's pricing strategy includes discounts to attract customers. They provide savings like multi-car and good student discounts. Snapshot® also helps lower premiums based on driving habits. In 2024, Progressive's combined ratio was around 96%, showing effective pricing and cost management. These discounts are crucial for competitiveness.

Consideration of External Factors

Progressive's pricing strategy is dynamic, carefully considering external economic factors. Inflation and any new tariffs are closely monitored for their potential impact on costs. The company's data-driven approach allows for agile rate adjustments. This helps maintain competitiveness while managing profitability. In 2024, the U.S. inflation rate was around 3.1%, influencing insurance pricing.

- Inflation: The 2024 inflation rate in the US was approximately 3.1%.

- Tariffs: Progressive monitors tariff changes that could affect vehicle parts costs.

- Rate Adjustments: Progressive regularly adjusts rates based on economic conditions.

Personalized Rates through Snapshot®

Progressive's Snapshot program personalizes rates by monitoring driving habits via telematics. This approach allows for rate adjustments based on individual driving behavior, potentially offering lower premiums for safe drivers. As of 2024, usage-based insurance (UBI) like Snapshot is gaining popularity. Progressive's UBI programs have shown to reduce accident frequency among participants. Data from 2024 indicates that drivers using UBI can save an average of 10-15% on their insurance costs.

- Snapshot uses telematics to personalize rates.

- Rates are based on actual driving behavior.

- UBI programs are becoming increasingly popular.

- Drivers could save 10-15% on average.

Progressive tailors prices with data-driven risk assessments and dynamic adjustments. They provide discounts to attract customers and remain competitive. In 2024, Snapshot helped save drivers 10-15%.

| Metric | Details |

|---|---|

| 2024 Combined Ratio | Approximately 96% |

| Snapshot Savings | 10-15% average |

| 2024 Inflation Rate (U.S.) | Around 3.1% |

4P's Marketing Mix Analysis Data Sources

We source data from Progressive's filings, ads, web pages, and industry reports for its 4P's analysis.