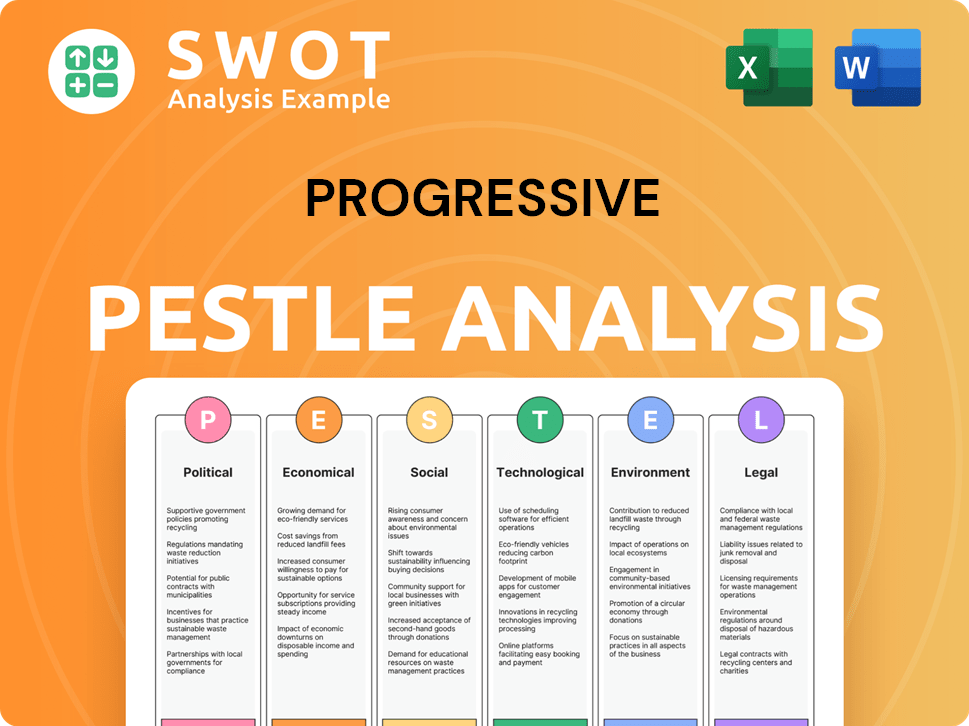

Progressive PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Progressive Bundle

What is included in the product

Analyzes how external factors influence Progressive, offering insights into its operational environment.

Provides actionable insights by identifying relevant external factors shaping strategic decisions.

Same Document Delivered

Progressive PESTLE Analysis

This is a complete Progressive PESTLE Analysis preview. Explore it thoroughly, as its the real thing.

The layout and content are exactly as you will receive after purchase. Ready to implement strategies.

This analysis considers Political, Economic, Social, Technological, Legal, and Environmental factors.

No placeholders, no editing needed; what you see is what you download! You can analyze any situation now.

PESTLE Analysis Template

Navigate Progressive's landscape with our insightful PESTLE Analysis. Uncover how external factors affect their strategy & operations. Analyze political, economic, social & more! Discover growth areas & potential risks for informed decisions. Ready for research, planning, or pitches? Get the full PESTLE breakdown now for strategic clarity.

Political factors

The insurance sector, including Progressive, faces stringent state-level regulations in the U.S. These rules govern pricing, policy details, and market behavior. In 2024, state regulators focused on auto insurance rate approvals. Progressive's profitability can shift due to regulatory changes. For example, in 2024, California's regulations impacted insurance pricing.

Federal policies significantly impact Progressive's auto insurance business. Transportation policies, infrastructure spending, and regulations for autonomous vehicles are key. Infrastructure spending, like the $1.2 trillion Bipartisan Infrastructure Law, affects accident rates. Changes in these areas influence repair costs and coverage needs. For example, in 2024, the National Highway Traffic Safety Administration (NHTSA) reported 42,795 traffic fatalities.

Political decisions significantly affect U.S. healthcare costs, directly influencing auto insurance. Rising healthcare expenses drive up personal injury claim costs for insurers. For example, in 2024, healthcare spending in the U.S. reached approximately $4.8 trillion. This increase impacts auto insurance premiums.

Legislative Changes on Distracted Driving

Legislative changes regarding distracted driving directly impact Progressive's operations. Stricter laws and increased enforcement can lead to fewer accidents. Progressive must adapt its risk assessment models and pricing strategies to reflect these legal shifts. These changes influence claims frequency and severity, crucial for profitability.

- 2024: 48 states have laws prohibiting texting while driving.

- 2024: Traffic fatalities increased by 12% due to distracted driving.

- 2024: Progressive spent $2.5 billion on claims related to distracted driving.

Government's Role in Climate Risk and Resilience

Government policies heavily influence climate risk and resilience, significantly affecting the insurance sector. Initiatives like the Inflation Reduction Act in the U.S. allocate substantial funds towards climate resilience, impacting insurance strategies. Collaboration between insurers and government entities is vital for managing escalating climate risks. For example, in 2024, the U.S. government invested over $20 billion in climate resilience projects.

- Government funding for climate resilience projects reached $20.7 billion in 2024.

- The Inflation Reduction Act includes provisions directly impacting insurance market dynamics.

- Insurers are increasingly partnering with government agencies to assess and mitigate climate risks.

- Policy changes can mandate or incentivize specific climate risk management practices within the industry.

Progressive's auto insurance faces state regulations impacting pricing and profitability. Federal policies like transportation spending and autonomous vehicle rules affect claims. Healthcare costs, influenced by U.S. political decisions, drive up claim expenses. Legislative changes on distracted driving and climate policies affect risk models.

| Political Factor | Impact on Progressive | 2024 Data |

|---|---|---|

| State Regulations | Pricing, policy details, market behavior | California regulations impacted pricing. |

| Federal Policies | Infrastructure spending and autonomous vehicles. | NHTSA reported 42,795 traffic fatalities in 2024. |

| Healthcare Costs | Influence personal injury claim costs. | U.S. healthcare spending ≈ $4.8T. |

| Distracted Driving Laws | Risk assessment models, pricing. | Progressive spent $2.5B on related claims in 2024. |

| Climate Policies | Insurance strategies. | Government invested $20.7B in resilience in 2024. |

Economic factors

Inflation significantly affects Progressive's claims costs. Increased prices for auto parts and medical services directly raise expenses. In Q1 2024, overall inflation was around 3.5%, potentially increasing repair costs. This impacts Progressive's profitability and pricing strategies.

Interest rates significantly influence insurance companies' investment income. Higher rates boost returns on investments, enhancing profitability. Conversely, a low-rate environment can squeeze margins, especially for products like annuities. For example, in early 2024, the Federal Reserve held rates steady, impacting insurers' investment strategies. As of May 2024, the 10-year Treasury yield hovered around 4.5%, influencing insurance product pricing.

Economic growth and employment significantly impact insurance demand. A robust economy with job growth and increased consumer spending typically boosts insurance sales. Conversely, economic downturns can slow the insurance sector's growth, as seen during the 2020 recession. For 2024, U.S. GDP growth is projected around 2.1%, influencing insurance product uptake.

Supply Chain Disruptions

Supply chain disruptions continue to affect the automotive industry. These disruptions result in increased costs for parts, which in turn drive up repair expenses and influence auto insurance claims. The semiconductor shortage in 2021-2022 significantly impacted car production, leading to higher prices for both new and used vehicles. This situation has eased somewhat, but vulnerabilities remain. For example, the average cost of a car repair increased by 10% in 2023 due to part shortages.

- Increase in repair costs.

- Impact on auto insurance claims.

- Shortages in vehicle parts.

- Semiconductor shortage.

Social Inflation and Nuclear Verdicts

Social inflation, fueled by litigation and "nuclear verdicts," is a key economic factor. This trend, especially evident in commercial auto insurance, drives up claims costs. Insurers respond by raising premiums and adjusting risk appetites. For example, in 2024, the average nuclear verdict exceeded $20 million, a significant increase from prior years. This can lead to higher premiums and affect insurers' risk tolerance.

- Nuclear verdicts are becoming more frequent and larger.

- Commercial auto insurance is particularly affected.

- Insurers adjust by increasing premiums and changing risk profiles.

- The trend increases the cost of doing business.

Economic factors, such as inflation, directly impact Progressive's costs, particularly repair expenses and claims. High-interest rates affect investment returns, while a strong economy typically boosts insurance sales. Supply chain disruptions also play a significant role, as do social inflation trends in litigation.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Inflation | Increased repair costs & claims | Q1 2024 Inflation: ~3.5%; Repair Cost Increase (2023): 10% |

| Interest Rates | Affect investment income | 10-year Treasury Yield (May 2024): ~4.5% |

| Economic Growth | Influences insurance demand | 2024 GDP growth: ~2.1% (projected) |

Sociological factors

Societal shifts significantly affect driving behaviors, impacting auto insurance risk. Distracted driving, a major concern, contributes to numerous accidents. New mobility models, such as ride-sharing, also change how people use vehicles. Data from 2024 shows distracted driving caused over 3,300 fatalities. These trends directly influence accident frequency and severity.

Demographic shifts significantly shape insurance. An aging population drives demand for health and retirement products. Migration patterns alter regional risk profiles. The U.S. population aged 65+ is projected to reach 83.7 million by 2050. Changing demographics influence product innovation and market strategies.

Consumer expectations are rapidly evolving, particularly in digital services. Customers now demand personalized insurance offerings and seamless experiences. A 2024 study showed 70% of consumers prefer digital interactions. Insurers must adapt to these preferences to stay competitive, or risk losing customers.

Social Attitudes Towards Risk and Insurance

Social attitudes significantly shape insurance demand. Public perception of risk, whether optimistic or pessimistic, impacts willingness to buy coverage. For instance, a 2024 study showed that 68% of U.S. adults believe insurance is essential. Cultural values and trust in financial institutions also play a role. These factors influence market penetration rates and product preferences.

- 68% of U.S. adults view insurance as essential (2024).

- Risk perception varies by demographic and geographic location.

- Trust in insurers affects policy uptake.

- Cultural norms influence insurance product preferences.

Workforce Diversity and Inclusion

Societal emphasis on diversity, equity, and inclusion (DEI) is significantly shaping hiring practices and company culture in the insurance sector. Progressive, along with its competitors, is actively working to enhance DEI within its workforce. This involves implementing strategies to attract, retain, and promote diverse talent. The goal is to foster a more inclusive environment.

- Progressive's 2023 Corporate Social Responsibility report highlights its DEI efforts, including employee resource groups and diversity training programs.

- In 2024, the insurance industry saw a 15% increase in DEI-related initiatives.

Social trends deeply influence insurance demand and operations. Public trust, cultural norms, and views on risk are pivotal.

In 2024, 68% of U.S. adults viewed insurance as essential. DEI initiatives in 2024 increased by 15% across the industry, affecting company culture.

| Factor | Impact | Data (2024) |

|---|---|---|

| Trust in Insurers | Affects policy uptake | 68% view insurance as essential |

| Cultural Norms | Influences product prefs | 15% rise in DEI initiatives |

| Risk Perception | Varies regionally | DEI focus in workforce |

Technological factors

Technological leaps in data analytics and AI are revolutionizing insurance. By 2024, AI-driven tools were streamlining claims by up to 40% for some insurers. Machine learning now predicts fraud with over 90% accuracy. These advancements lead to more precise risk assessments and personalized premiums, enhancing operational efficiency.

Telematics, including GPS and onboard diagnostics, is transforming auto insurance. Usage-based insurance (UBI) is growing, with 30% of new policies in 2024 using it. Progressive's Snapshot program exemplifies this, offering personalized rates. Real-time data analysis enables insurers to adjust premiums based on driving habits. This tech promotes safer driving, potentially lowering accident frequency and severity.

Digitalization continues to reshape insurance. Mobile apps and online platforms are pivotal, with 60% of consumers preferring digital interactions in 2024. This shift boosts efficiency, with digital claims processing reducing costs by up to 30%. Online sales are rising, projected to comprise 25% of new policies by 2025, impacting traditional distribution channels.

Cybersecurity Risks

Increased reliance on technology introduces significant cybersecurity risks for insurers. Protecting customer data and maintaining operational integrity requires substantial investment in robust cybersecurity measures. The insurance industry faces increasing cyber threats, with attacks becoming more frequent and sophisticated. Cybersecurity spending in the insurance sector is projected to reach $12.5 billion by 2025, reflecting the growing importance of digital security. These efforts are crucial for maintaining trust and ensuring business continuity.

- Cybersecurity spending in the insurance sector is forecast to hit $12.5 billion by 2025.

- Data breaches cost the insurance industry an average of $4.8 million per incident in 2024.

- Phishing attacks account for 30% of all cyberattacks targeting insurers.

Emerging Vehicle Technology

The automotive industry is rapidly evolving, with electric vehicles (EVs) and autonomous vehicles leading the charge. This shift demands that insurers reassess risk models and develop new products. The rise of EVs is significant: in Q1 2024, EVs accounted for 7.2% of all new car registrations in the US, a 1.5% increase year-over-year. Autonomous vehicles introduce complex liability issues, requiring innovative insurance solutions.

- EV market share in the US is projected to reach 15% by the end of 2024.

- The global autonomous vehicle market is expected to reach $65 billion by 2025.

- Insurers are investing heavily in telematics to better assess risks associated with new vehicle technologies.

AI and data analytics are boosting efficiency; cybersecurity spending is forecast to hit $12.5 billion by 2025. Telematics transforms auto insurance with usage-based models, and digital platforms are now preferred by consumers. Rapid tech evolution also heightens cybersecurity threats and reshapes vehicle risk assessments.

| Technology Area | Impact | 2024/2025 Data |

|---|---|---|

| AI & Data Analytics | Streamlined claims, fraud detection, personalized premiums. | AI streamlining claims by 40%; 90% accurate fraud detection. |

| Telematics | Usage-based insurance (UBI), real-time premium adjustments. | 30% of new policies use UBI; UBI promotes safer driving. |

| Digitalization | Mobile apps, online platforms, cost reduction. | 60% prefer digital; online sales forecast at 25% by 2025. |

| Cybersecurity | Protecting data, maintaining operations. | Spending $12.5B by 2025; data breaches average $4.8M each. |

| EV & Autonomous Vehicles | Risk model and insurance solutions development. | EV market share: 7.2% in Q1 2024; AV market $65B by 2025. |

Legal factors

Progressive faces intricate state insurance regulations, impacting operations nationwide. These laws dictate policy terms, pricing, and claims procedures, varying significantly by state. For example, in 2024, state regulators scrutinized auto insurance rates, leading to adjustments. Progressive must adapt to these diverse legal landscapes, ensuring compliance across all states to avoid penalties and maintain its operational licenses. Understanding these nuances is crucial for strategic planning and risk management.

Legal restrictions heavily influence insurance operations. These regulations dictate how insurers can cancel policies, renew coverage, or exit markets. For instance, in 2024, several states tightened regulations, impacting insurers' risk management. A study showed that compliance costs rose by 15% due to these legal changes. This impacts insurers' flexibility in managing risk and profitability.

Progressive faces legal risks, primarily from litigation. This includes lawsuits about claims and underwriting. In 2024, the insurance industry saw a 7% increase in litigation cases. Progressive allocated $350 million in Q1 2025 for potential legal settlements. These challenges can impact profits and operations.

Data Privacy Regulations

Data privacy regulations are becoming more rigorous, compelling insurers to safeguard customer data and adhere to privacy standards. The rise of laws like GDPR and CCPA means significant investment in data security and compliance. Non-compliance can result in hefty fines; for example, GDPR fines can reach up to 4% of global annual turnover. Insurers are also facing increased consumer scrutiny regarding data usage, with a recent survey showing that 70% of consumers are concerned about how their data is handled.

- GDPR fines can reach up to 4% of global annual turnover.

- 70% of consumers are concerned about data handling.

Regulatory Scrutiny of AI and Technology Usage

Regulatory bodies are intensifying their scrutiny of AI and technology in insurance. This includes a focus on algorithmic bias and data privacy. These concerns could lead to new compliance requirements. The global AI in insurance market is projected to reach $20.9 billion by 2025.

- Data privacy regulations like GDPR and CCPA are already impacting the insurance sector.

- The EU AI Act, if adopted, will set strict rules on AI usage.

- In 2024, the US saw increased enforcement of data protection laws.

Progressive navigates complex state-specific insurance regulations impacting operations and pricing. They face risks from litigation, including claims and underwriting disputes, with a notable 7% increase in cases during 2024. Data privacy regulations, such as GDPR, require major investment in data security; GDPR fines may reach up to 4% of global turnover.

| Legal Factor | Impact | Data Point (2024/2025) |

|---|---|---|

| State Regulations | Operational constraints | Auto insurance rate adjustments in multiple states |

| Litigation | Financial Risk | $350 million allocated for Q1 2025 settlements |

| Data Privacy | Compliance Costs | 70% consumer concern, potential GDPR fines (up to 4%) |

Environmental factors

Climate change intensifies extreme weather, increasing disaster frequency and severity. Property and casualty insurers face rising claims. Swiss Re estimates climate change could cost the global economy $23.7 trillion annually by 2030. Insurers must adapt to these financial impacts.

Environmental regulations, like those on pollution and hazardous substances (e.g., PFAS), significantly affect businesses. These regulations can lead to new risks and liabilities, notably impacting the demand for environmental liability insurance. The global environmental liability insurance market was valued at $13.8 billion in 2024. This is projected to reach $20.5 billion by 2030.

ESG factors are reshaping the insurance landscape, influencing how businesses operate and how investments are made. The industry faces rising pressure to manage environmental risks and showcase sustainability efforts. Data from 2024 shows a 20% increase in insurers integrating ESG criteria into their underwriting processes. Regulatory bodies are also increasingly scrutinizing ESG practices.

Company Environmental Initiatives

Progressive's environmental efforts, including reducing carbon emissions and investing in renewable energy, are key to its sustainability strategy. These initiatives affect its reputation and operational expenses. For instance, in 2024, the company may report on its progress towards using more sustainable resources. Such actions can boost its brand image among environmentally conscious consumers and investors.

- Progressive has invested in eco-friendly practices.

- They aim to lower their carbon footprint.

- Progressive focuses on renewable energy sources.

- These efforts improve their public image.

Development of Green Insurance Products

The rising demand for environmental sustainability is influencing the insurance sector. This is leading to the creation of 'green' insurance products. These products often reward eco-friendly actions, such as owning electric vehicles. For example, in 2024, the global green insurance market was valued at approximately $35 billion. Projections estimate it could reach $60 billion by 2025, reflecting its growing importance.

- The green insurance market was valued at $35 billion in 2024.

- The market is projected to reach $60 billion by 2025.

- These products incentivize environmentally friendly behaviors.

- Consumers and society increasingly focus on environmental sustainability.

Environmental factors heavily influence the insurance industry. Climate change and extreme weather drive up disaster-related costs; Swiss Re projects $23.7T in global annual economic costs by 2030. Regulations around pollution, and ESG integration, also shape operational strategies, with environmental liability insurance hitting $13.8B in 2024, estimated to reach $20.5B by 2030.

| Environmental Factor | Impact | Data |

|---|---|---|

| Climate Change | Increased claims, risk | $23.7T annual global cost (by 2030, Swiss Re) |

| Environmental Regs | New risks & liabilities | Environmental Liability Ins. Market: $13.8B (2024), $20.5B (2030) |

| ESG Factors | Shape operations & investments | 20% increase in insurers integrating ESG (2024) |

PESTLE Analysis Data Sources

Our PESTLE utilizes official reports from government agencies and reputable international institutions, alongside industry publications.