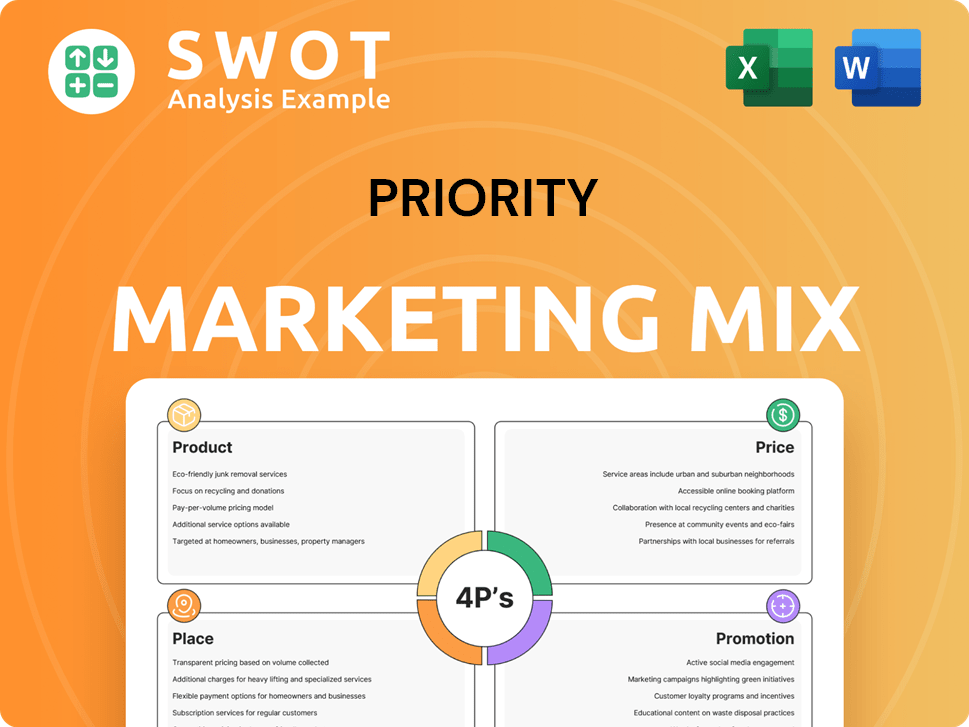

Priority Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Priority Bundle

What is included in the product

A complete marketing mix analysis of Priority's 4Ps (Product, Price, Place, Promotion).

Prioritizes the 4Ps to clarify your marketing strategy, ensuring quick understanding & action.

Preview the Actual Deliverable

Priority 4P's Marketing Mix Analysis

The analysis previewed here is exactly what you'll download—no changes, no surprises.

4P's Marketing Mix Analysis Template

Discover the powerful strategies behind Priority's marketing success. Uncover their product development, pricing, distribution, and promotional approaches.

This condensed analysis reveals core tactics but only offers a glimpse.

The complete Marketing Mix report dives deeper, giving you all the details.

You'll get actionable insights, ready-to-use formatting, and strategic recommendations.

Enhance your understanding and make informed decisions—purchase the full report today!

Product

Priority Technology Holdings' unified commerce engine is a key component of its marketing strategy, designed to simplify financial processes. This engine integrates payment processing and banking services, offering a centralized solution. By using this platform, businesses can aim to speed up cash flow and cut expenses. In Q1 2024, Priority processed $15.3 billion in payments, showing strong market adoption.

Integrated payment processing is central to Priority's marketing mix. It facilitates efficient payment acceptance and management for businesses. Priority's proprietary software platform supports these solutions. In 2024, the global payment processing market was valued at $87.8 billion. Analysts project it to reach $135.4 billion by 2029, growing at a CAGR of 9.1%.

Priority offers commercial payment systems, including accounts payable automation. These systems serve corporations, software partners, and financial institutions. The 2023 acquisition of Plastiq strengthened Priority's B2B payables. In Q1 2024, Priority's payment volume was $2.3 billion.

Banking and Treasury Solutions

Banking and treasury solutions are a cornerstone of the company's platform, facilitating the management of funds. These services encompass collection, storage, lending, and sending of money for businesses. Customers benefit from financial tools designed to enhance cash flow and working capital efficiency. In 2024, the global treasury management systems market was valued at $1.8 billion, projected to reach $2.6 billion by 2029.

- Streamlined fund management.

- Tools for cash flow optimization.

- Working capital maximization.

Payroll and Benefits Solutions

Priority's acquisition of Rollfi in January 2025 expanded its service offerings to include payroll and benefits solutions. This strategic move allows banks, accountants, and software providers to seamlessly integrate these services for their clients. The payroll and benefits market is substantial, with an estimated value of $25 billion in 2024, projected to reach $30 billion by 2026. This integration streamlines financial processes, enhancing efficiency and client satisfaction.

- Market size: $25B in 2024.

- Projected growth: $30B by 2026.

- Acquisition: Rollfi, January 2025.

Priority's unified commerce engine and integrated payment solutions streamline financial processes for businesses. Commercial payment systems, including AP automation, serve corporations and financial institutions, supporting robust transaction volumes. The acquisition of Rollfi in January 2025 expands service offerings to include payroll and benefits solutions, catering to the $25 billion market.

| Feature | Details | Data |

|---|---|---|

| Payment Processing | Unified platform for businesses. | Processed $15.3B in Q1 2024. |

| Market Growth | Global market. | $87.8B (2024) to $135.4B (2029). |

| Payroll and Benefits | Acquired Rollfi. | $25B market value in 2024. |

Place

Priority uses a direct sales approach to reach clients. This method enables direct interaction with businesses. It helps understand their payment and banking needs. Tailored solutions are then offered. This direct sales strategy is effective, as evidenced by Priority's revenue, which reached $630 million in 2024.

The company leverages Independent Sales Organizations (ISOs) and agents to expand its market presence. This strategy enables them to reach a wider array of small and medium-sized businesses (SMBs). Data from 2024 showed a 15% increase in SMB acquisition through this channel. ISOs and agents are crucial for localized market penetration and customer acquisition.

Priority collaborates with financial institutions, utilizing their established networks for distribution. This partnership strategy expands Priority's reach, tapping into the customer bases of banks. For example, in 2024, partnerships contributed to a 15% increase in transaction volume. These alliances are crucial for Priority's growth.

Independent Software Vendors (ISVs) and Value-Added Resellers (VARs)

Priority leverages Independent Software Vendors (ISVs) and Value-Added Resellers (VARs) to expand its market reach. This approach integrates their payment solutions into existing software platforms, streamlining the payment process for businesses. By partnering with ISVs and VARs, Priority can access a wider customer base through software applications. This strategy is essential for market penetration and revenue growth, particularly in the evolving fintech landscape.

- In 2024, the global fintech market was valued at $111.24 billion.

- The ISV market is projected to reach $136.3 billion by 2025.

- VARs contribute significantly to software distribution and support.

Online Platforms

Online platforms are crucial for tech companies, providing service delivery and customer access. In 2024, digital ad spending reached $225 billion in the US, highlighting the importance of online presence. The global e-commerce market is projected to hit $8.1 trillion by 2026, showing the growth potential. Effective platforms enhance customer engagement and streamline operations.

- Digital ad spending in the US hit $225 billion in 2024.

- Global e-commerce market is projected to hit $8.1 trillion by 2026.

Priority's market presence uses a multifaceted 'Place' strategy.

It focuses on direct sales and partnerships, expanding through ISOs, agents, and financial institutions to widen its reach.

Leveraging ISVs and online platforms are crucial for adapting to digital trends; the U.S. digital ad spend in 2024 was $225B.

| Channel | Description | Impact |

|---|---|---|

| Direct Sales | Direct client interactions. | $630M revenue in 2024. |

| ISOs & Agents | Expanded market via local teams. | 15% SMB acquisition increase. |

| Financial Partnerships | Utilizing bank networks. | 15% transaction volume gain. |

| ISVs & VARs | Software platform integration. | Enhance reach in fintech market. |

| Online Platforms | Digital advertising and e-commerce | Digital ad spend hit $225B. |

Promotion

Priority uses financial results announcements and conference calls. These are key for investor communication and transparency. For example, in Q4 2024, Priority's revenue increased by 12%, as reported. These calls also highlight growth strategies. They are crucial for market understanding.

Companies use news releases for major announcements like acquisitions or product launches, reaching stakeholders through business wire services and their websites. For instance, in 2024, over 100,000 press releases were distributed daily globally. This communication strategy aims to keep the market informed and shape public perception. The costs for these services can range from $500 to $5,000 per release, depending on distribution.

Priority's investor relations (IR) focuses on communication with investors. The company's website offers financial filings, presentations, and contact details. For 2024, IR spending averaged 0.8% of revenue. Effective IR can boost stock valuation. Data from Q1 2025 suggests a 10% increase in investor engagement.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions are key promotional tools. Announcements of partnerships like with Ideon for ICHRA administration boost visibility. These moves highlight growth and expanded capabilities. Recent data shows a 15% increase in market share following acquisitions. This enhances market positioning and investor confidence.

- Partnerships increase visibility.

- Acquisitions signal growth.

- Market share can increase after acquisitions.

Industry Events and Webcasts

Priority leverages industry events and webcasts as a key promotion strategy within its marketing mix. These channels enable direct engagement with potential customers and partners. By participating in events and hosting webcasts, Priority showcases its solutions and expertise. This approach aligns with the growing trend of digital marketing, which saw a 15% increase in adoption by B2B companies in 2024.

- Reach: Webcasts can reach thousands, with an average attendance of 200-500 viewers.

- Engagement: Events allow for face-to-face interaction and immediate feedback.

- Cost-effectiveness: Webcasts are a cost-effective way to build brand awareness.

- Lead Generation: Events and webcasts are effective tools for lead generation.

Promotion in Priority's marketing mix uses financial results and news releases. Investor relations boost stock value and strategic partnerships enhance visibility and growth. Industry events and webcasts enable direct customer engagement. Digital marketing adoption grew by 15% in B2B companies in 2024.

| Promotion Channel | Activity | Impact |

|---|---|---|

| Financial Results | Q4 2024 Revenue Report | 12% Revenue increase. |

| News Releases | Daily Press Releases Globally | Over 100,000 distributed, costs: $500-$5,000 per release |

| Investor Relations | IR spending | Averaged 0.8% of revenue (2024), 10% investor engagement increase (Q1 2025). |

| Partnerships/Acquisitions | Ideon ICHRA | 15% Market share increase post-acquisition |

| Industry Events/Webcasts | Reach | Webcasts average 200-500 viewers. |

Price

Priority's flexible financial toolset allows for tailored pricing, catering to varied business needs. This adaptability is crucial, especially with the evolving economic landscape. For instance, in 2024, SaaS companies saw a 15% increase in demand for customizable pricing plans. This approach aligns with the trend of businesses seeking cost-effective solutions. The flexibility in pricing models and terms is expected to become even more important in 2025.

Priority's pricing strategy likely centers around value-based pricing, reflecting the substantial benefits their solutions offer. They focus on demonstrating ROI through revenue opportunities, cash flow optimization, and cost reduction. This approach aims to justify the cost by highlighting the financial gains clients can achieve. In 2024, businesses using value-based pricing saw a 15% increase in profitability.

Priority's pricing strategy is crucial in the competitive payments market. They assess competitor pricing and market demand to determine their rates. In 2024, the BaaS market hit $3.3 billion, indicating strong demand. Competitive pricing helps Priority attract and retain clients in this growing sector.

Pricing Policies and Terms

Pricing policies are crucial, outlining transaction fees, service charges, and contract terms. These vary based on the product, service, and customer segment. For example, in 2024, subscription-based software saw average monthly prices ranging from $9.99 to $99.99, depending on features. Understanding these policies helps in financial planning and comparison.

- Transaction fees can significantly impact profitability, with credit card fees often ranging from 1.5% to 3.5% per transaction in 2024.

- Service charges may include setup fees, support fees, or maintenance fees, which varied widely in 2024, from $0 to several hundred dollars depending on the service.

- Contract terms define the duration and conditions of the service agreement, with many SaaS contracts in 2024 offering annual discounts of up to 20%.

Potential for Discounts and Incentives

Priority can use discounts and incentives to draw in and keep customers. They might offer special deals or tailored pricing, especially for big clients or through their partners. According to a 2024 study, companies using dynamic pricing saw a 15% increase in customer engagement. This approach can boost sales and build customer loyalty.

- Volume discounts for bulk purchases.

- Early bird offers or seasonal promotions.

- Loyalty programs to reward repeat customers.

- Partnership discounts through channel partners.

Priority's flexible pricing is key in adapting to varied business needs, especially considering the evolving financial environment. Value-based pricing highlights the benefits, like ROI and cost savings. Competitively priced, with transaction fees affecting profitability, plus service charges and contract terms.

| Pricing Aspect | Description | 2024 Data | 2025 Forecast |

|---|---|---|---|

| Pricing Models | Types offered | Customizable, subscription, usage-based | More dynamic options |

| Transaction Fees | Impact on profitability | Credit card fees: 1.5%-3.5% | Potentially increased due to economic shifts |

| Contract Terms | Service agreements | Annual discounts up to 20% | More flexible, with focus on shorter terms |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis leverages public company info like investor docs & website data. This, plus market research and campaign examples, provides a thorough mix analysis.