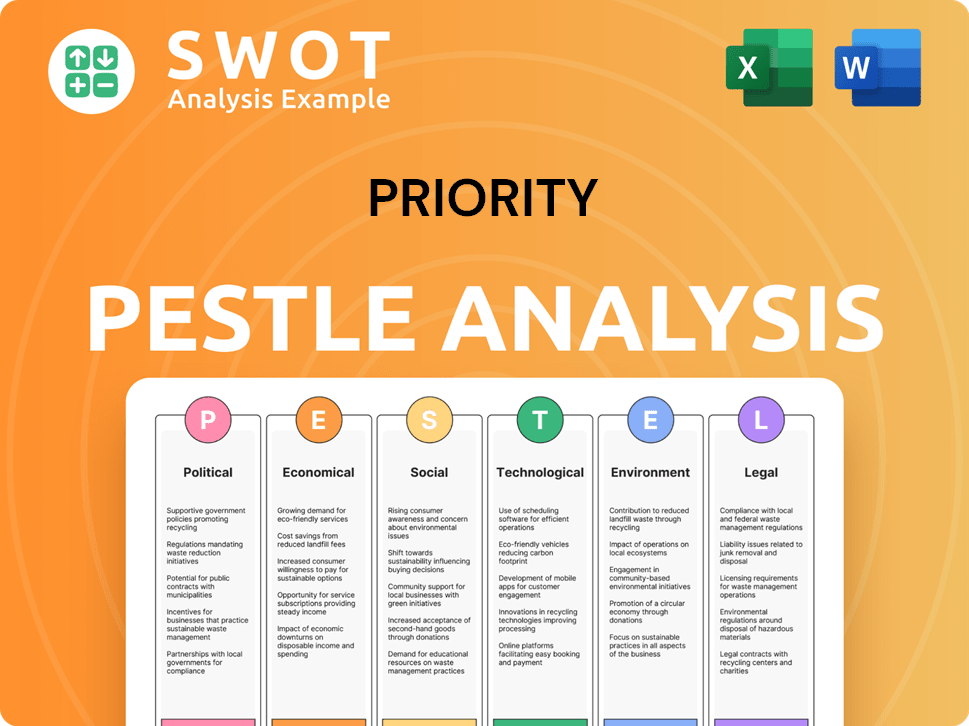

Priority PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Priority Bundle

What is included in the product

Analyzes key external factors impacting a business across Political, Economic, Social, etc.

The concise priority view enables swift strategic decision-making and quick analysis of critical factors.

Preview Before You Purchase

Priority PESTLE Analysis

What you're seeing in the preview is the Priority PESTLE Analysis document. You'll download the exact, fully formatted analysis instantly. The structure, content, and all elements shown are identical. No changes or hidden extras—just what you see here. Your purchase grants immediate access to this document.

PESTLE Analysis Template

Navigate Priority's external environment with clarity using our focused PESTLE Analysis. We explore crucial political, economic, social, technological, legal, and environmental factors. This concise overview helps identify opportunities and potential threats affecting Priority. Equip yourself with this strategic advantage—download the full, in-depth analysis today!

Political factors

Government regulations on financial services and data security are crucial for Priority Technology Holdings. New rules can affect operations and compliance. The company faces a complex legal landscape. Regulations evolve, requiring constant adaptation. For example, in 2024, financial firms faced increased scrutiny over data privacy.

Geopolitical events and political instability significantly impact market conditions. For example, the Russia-Ukraine conflict has caused volatility in global markets. In 2024, political uncertainty could lead to decreased consumer confidence. This could reduce business spending, affecting payment processing demand.

Government spending and initiatives significantly impact Priority Technology Holdings. Support for SMBs, a key customer segment, through programs like the 2024 Small Business Administration loans ($28 billion disbursed) can boost demand. Digital transformation grants, exemplified by the 2024 Digital Equity Act ($2.75 billion allocated), present growth opportunities. Conversely, regulatory changes or budget cuts could pose challenges.

Trade Policies and Agreements

Trade policies significantly affect Priority's operations, especially regarding technology costs and market access. The U.S. market is crucial; thus, changes in U.S. trade agreements are paramount. Recent data shows that U.S. trade deficits, particularly with China, have fluctuated, impacting tech imports. Any tariffs or trade restrictions could increase expenses.

- U.S. trade deficit with China in 2024: approximately $279 billion.

- Impact of tariffs on tech component costs: potential increase of 5-10%.

- U.S.-Mexico-Canada Agreement (USMCA) effects: ongoing, with possible adjustments.

Taxation Policies

Changes to tax policies, such as corporate tax rate adjustments, directly affect Priority Technology Holdings' financial outcomes. For instance, the U.S. corporate tax rate is currently set at 21%, but any shifts could impact the company's bottom line. Tax incentives for R&D, like those in the U.S., also play a crucial role. These incentives help businesses like Priority Tech reduce their tax burden.

- U.S. corporate tax rate: 21%

- Tax incentives for R&D can significantly lower tax liability.

- Tax regulations impact financial planning and profitability.

Political factors strongly affect Priority Technology Holdings. Data security and evolving financial regulations demand continuous adaptation. Political instability and trade policies, like the U.S.-China trade deficit of ~$279B in 2024, influence market dynamics.

Government spending and tax policies are also important. Tax incentives and corporate rates, set at 21% in the U.S., shape financial planning. Digital transformation grants provide growth opportunities.

| Factor | Impact | Data (2024) |

|---|---|---|

| Regulations | Compliance costs & operational changes | Increased scrutiny of data privacy |

| Geopolitics | Market volatility, consumer confidence | Political uncertainty impacting spending |

| Trade | Tech costs & market access | U.S.-China trade deficit ~ $279B |

Economic factors

Priority Technology Holdings' performance is significantly linked to overall economic conditions. GDP growth impacts consumer spending, crucial for payment volume and revenue. For example, U.S. GDP grew by 3.4% in Q4 2023. Inflation rates, like the 3.1% recorded in January 2024, affect purchasing power. Employment rates also influence spending, shaping Priority's financial outcomes.

Consumer spending habits, like payment preferences, are crucial for Priority Technology Holdings. The shift to electronic payments boosts transaction volumes. In 2024, electronic payments grew by 15% globally. This trend continues, with cash usage decreasing. This benefits Priority's business model.

SMBs form a core of Priority's clientele. Their financial well-being directly impacts Priority. In 2024, SMB tech spending saw a 6% rise. This growth signals potential for Priority's expansion, as SMBs invest in tech solutions.

Interest Rates and Access to Capital

Interest rate shifts influence Priority Technology Holdings' and its clients' capital costs. Higher rates can curb borrowing, impacting expansion plans and customer investments. Conversely, lower rates might spur growth by making capital more accessible. Access to capital is essential for Priority's operations, including acquisitions and research and development. The Federal Reserve held its benchmark interest rate steady in early May 2024, remaining in a range of 5.25% to 5.50%.

- Federal Reserve held rates steady in May 2024, at 5.25%-5.50%.

- High rates can slow borrowing and expansion.

- Low rates can foster growth and investment.

Competitive Pricing Pressure

The payment processing sector is very competitive, which can squeeze Priority's profits. Rivals often lower prices to gain market share. This price war might force Priority to reduce its fees, affecting revenue. According to a 2024 report, the average transaction fee for payment processing is between 1.5% and 3.5%.

- Competitive pricing can lower profit margins.

- Price wars can decrease revenue.

- Average fees in 2024 are 1.5% - 3.5%.

Economic factors significantly impact Priority's performance, especially consumer spending and payment trends. U.S. Q4 2023 GDP grew 3.4%, while January 2024 inflation hit 3.1%. The Federal Reserve maintained rates at 5.25%-5.50% in May 2024.

| Factor | Impact | 2024 Data Point |

|---|---|---|

| GDP Growth | Influences consumer spending | Q4 2023: 3.4% |

| Inflation | Affects purchasing power | January: 3.1% |

| Interest Rates | Impacts capital costs | May: 5.25%-5.50% |

Sociological factors

Consumer behavior significantly impacts digital payment adoption. In 2024, mobile payment users in the U.S. reached 125.5 million, a 10% increase from 2023. Contactless payments are also rising, with 60% of consumers preferring them for speed. This shift fuels demand for Priority's secure, user-friendly payment solutions.

The sociological landscape significantly shapes tech adoption by businesses. Small and medium-sized businesses (SMBs) are increasingly embracing new technologies. In 2024, SMB tech spending is projected to reach $700 billion. Integrated payment solutions adoption is also rising, with a 15% annual growth rate. This trend directly influences the market for Priority's services.

Societal shifts significantly affect payment solutions. Remote work and the gig economy's rise demand flexible payment options. In 2024, remote work grew, impacting business payment strategies. The gig economy's expansion necessitates efficient, diverse payment systems. This trend continues into 2025, shaping financial technology requirements.

Data Privacy Concerns and Trust

Data privacy is a significant concern. Public awareness of data breaches is increasing, which impacts trust in payment processors. Companies must adopt strong data protection. The global data privacy market is projected to reach $200 billion by 2026.

- Data breaches cost U.S. businesses $9.44 million on average in 2023.

- 68% of consumers are concerned about how their data is used.

- GDPR fines totaled over €1.6 billion in 2023.

Social Trends in Commerce

Social trends significantly influence Priority's strategies. E-commerce continues its ascent, with global online retail sales projected to reach $6.3 trillion in 2024. Consumers increasingly desire seamless, secure payment options; mobile payments are expected to account for 51.7% of global e-commerce transactions by 2027. These trends necessitate continuous innovation in Priority's service offerings to meet evolving consumer expectations.

- 2024 global e-commerce sales: $6.3T

- Mobile payments share of e-commerce by 2027: 51.7%

Consumer behavior and business tech adoption trends shape Priority's market. Remote work and the gig economy require flexible payment solutions, with a projected rise into 2025. Data privacy is paramount, given the high costs of breaches. E-commerce's growth demands secure payment options.

| Factor | Trend | Impact |

|---|---|---|

| Consumer Behavior | Mobile payment adoption in the U.S. | Drives demand for user-friendly, secure payment solutions. |

| Business Tech | SMB tech spending is rising, integrated payment adoption up | Directly influences demand for Priority's payment services. |

| Social Shifts | Remote work & gig economy | Demand flexible payment options; data privacy is a must. |

Technological factors

Advancements in payment tech are rapidly changing the industry. Integrated and mobile payments are becoming more common. Cybersecurity is crucial, with data breaches costing businesses billions. In 2024, mobile payment transactions reached $1.5 trillion. Priority Technology must adapt to these changes to stay competitive.

Cybersecurity threats and data breaches pose major risks for payment tech companies like Priority. Strong security is vital for safeguarding sensitive data and customer trust. Data breaches cost companies an average of $4.45 million globally in 2023, per IBM. Investing in cybersecurity is essential to mitigate these risks.

Priority's proprietary tech, such as Vortex.Cloud, is key. Investing in it keeps Priority ahead. In 2024, Priority spent $55 million on R&D to boost its tech. This ensures innovative solutions.

Reliance on Third-Party Technologies

Priority's operations depend on third-party technologies, including software and data analytics platforms. Securing and maintaining licenses for these technologies at reasonable costs is essential for continued service delivery. For instance, in 2024, approximately 30% of Priority's operational budget was allocated to third-party technology licenses. Any disruption or increased cost could significantly impact profitability.

- Third-party tech costs make up 30% of operational budget in 2024.

- License renewal terms are critical for financial planning.

- Technological dependency introduces risk.

- Negotiating favorable terms is a priority.

Infrastructure and System Reliability

Priority's technological infrastructure's reliability is paramount for its services. Downtime directly impacts business operations, potentially leading to financial losses. In 2024, the average system uptime for cloud services like those used by Priority was around 99.9%. This ensures minimal disruption. Any service interruptions can cause significant damage.

- 99.9% average uptime for cloud services in 2024.

- Service interruptions can lead to financial losses for businesses.

- The reliability of processing systems is critical.

Priority Technology faces significant tech factors. Data breaches are costly, with the average global cost at $4.45 million in 2023. They spend a lot on third-party tech; about 30% of 2024's operational budget was allocated for these tools. Reliability is critical: Cloud service uptime was around 99.9% in 2024.

| Factor | Details | Impact |

|---|---|---|

| Cybersecurity | Data breaches cost $4.45M on average in 2023 | Protect sensitive data & trust |

| Tech Spending | 30% op budget on 3rd-party tech in 2024 | Control expenses, negotiate terms |

| System Reliability | Cloud uptime at 99.9% in 2024 | Minimize service disruptions |

Legal factors

Priority must adhere to payment network rules (Visa, Mastercard) to process transactions. Non-compliance can lead to fines or operational limitations. For instance, in 2024, Visa imposed over $100 million in fines for various compliance issues. Mastercard also issued significant penalties, impacting businesses directly. Strict adherence to PCI DSS standards is essential to avoid such penalties and maintain operational integrity.

Data protection and privacy regulations are crucial for businesses. Compliance with laws like GDPR and CCPA is a must. These laws govern the handling of sensitive customer and cardholder data. Failing to comply can lead to hefty fines. In 2024, the GDPR saw fines up to €400 million.

Priority, as a fintech, must comply with financial regulations. This includes money transmission and AML rules. In 2024, global AML fines reached $3.5 billion. Compliance is crucial to avoid hefty penalties. Regulations are constantly evolving, demanding constant vigilance. Failure to comply can severely impact operations.

Consumer Protection Laws

Consumer protection laws are crucial for Priority, influencing service offerings and dispute resolution. These regulations, like the Dodd-Frank Act in the U.S., set standards for financial product transparency and consumer rights. In 2024, the Consumer Financial Protection Bureau (CFPB) handled roughly 1.4 million consumer complaints. Compliance with these laws is essential to avoid penalties and maintain customer trust. Non-compliance can lead to substantial fines, as seen with recent cases where financial institutions faced penalties exceeding $100 million.

- Dodd-Frank Act impacts transparency and rights.

- CFPB handled 1.4M complaints in 2024.

- Non-compliance can lead to significant fines.

Litigation and Legal Disputes

Legal disputes and litigation can significantly impact a company. In 2024, legal costs for many tech firms rose by an average of 15%, reflecting increased regulatory scrutiny. Companies must manage risks tied to their operations, including potential lawsuits regarding data privacy or intellectual property. These legal battles can affect a company's financial health and reputation, as seen with recent cases involving data breaches where settlements reached millions of dollars. Analyzing these risks is crucial for strategic planning and investment decisions.

- Increase in legal costs by 15% (2024)

- Data breach settlements reaching millions.

- Impact on financial health and reputation.

- Focus on data privacy and IP.

Legal factors dictate operational and financial compliance, with penalties for non-compliance impacting performance. In 2024, payment network fines and AML penalties were significant. Data privacy and consumer protection regulations, with cases like the Dodd-Frank Act, are crucial, as non-compliance led to fines exceeding $100 million.

| Regulatory Area | 2024 Financial Impact | Compliance Requirement |

|---|---|---|

| Payment Networks | $100M+ in fines | Adherence to Visa/Mastercard rules and PCI DSS |

| Data Privacy (GDPR, CCPA) | Up to €400M fines | Data protection and privacy practices |

| Financial Regulations (AML) | $3.5B in fines | Compliance with money transmission and AML rules |

Environmental factors

Environmental sustainability is increasingly vital. Companies face pressure to adopt green practices. This impacts operations and brand perception. In 2024, ESG-focused investments reached trillions globally. Businesses must adapt to stay competitive. Consider carbon footprint reduction and renewable energy.

Climate change poses a potential, albeit minor, risk to payment processing infrastructure. Extreme weather could disrupt physical operations, but the impact is less severe than for sectors like agriculture. For instance, the 2023 US climate disasters cost over $92.9 billion.

The energy demands of technology infrastructure, particularly data centers, are escalating. In 2024, data centers globally consumed approximately 2% of the world's electricity. Rising energy costs and environmental regulations, like the EU's Green Deal, will likely increase operating expenses. Companies are exploring renewable energy sources and efficiency improvements to mitigate these impacts.

Waste Management from Electronic Equipment

Waste management from electronic equipment, a minor environmental factor, is a growing concern. The disposal of payment processing devices contributes to electronic waste, or e-waste. According to the EPA, in 2024, only about 15% of e-waste was recycled. Proper e-waste disposal is crucial to prevent environmental contamination.

- E-waste volumes are increasing, with an estimated 57.4 million tons generated globally in 2021.

- The Basel Convention regulates the international movement of hazardous wastes, including e-waste.

- Recycling rates for e-waste vary significantly by country, with some nations achieving higher rates than others.

- The cost of e-waste management can be substantial, including collection, transportation, and processing.

Stakeholder Expectations Regarding Environmental Responsibility

Stakeholder expectations regarding environmental responsibility are rising. Investors, customers, and employees now often consider a company's environmental performance in their decisions. For example, in 2024, sustainable funds saw significant inflows, reflecting investor interest in green initiatives. Companies with strong ESG (Environmental, Social, and Governance) ratings often attract more investment and better talent. This shift pressures businesses to adopt eco-friendly practices.

- In 2024, ESG-focused funds grew by 15% globally.

- Consumers are increasingly willing to pay more for sustainable products.

- Employee satisfaction is linked to a company's environmental efforts.

Environmental factors significantly affect businesses. Climate change and resource demands are growing concerns, and in 2024, the data center industry used about 2% of the world's electricity. Proper e-waste management is crucial, especially since global e-waste hit 57.4 million tons in 2021. Stakeholder demand for sustainability is also increasing, reflected in a 15% growth in ESG-focused funds in 2024.

| Aspect | Details | Data (2024/2025) |

|---|---|---|

| Climate Impact | Extreme weather effects on infrastructure | US climate disasters cost over $92.9 billion (2023). |

| Energy Usage | Tech's electricity consumption | Data centers consumed approx. 2% global electricity. |

| Waste | E-waste volumes and recycling | E-waste generated: 57.4M tons (2021), recycle rate ~15%. |

PESTLE Analysis Data Sources

This Priority PESTLE utilizes public data: government reports, market research, and reputable news outlets, to offer data-driven insights.