Qatar Islamic Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Qatar Islamic Bank Bundle

What is included in the product

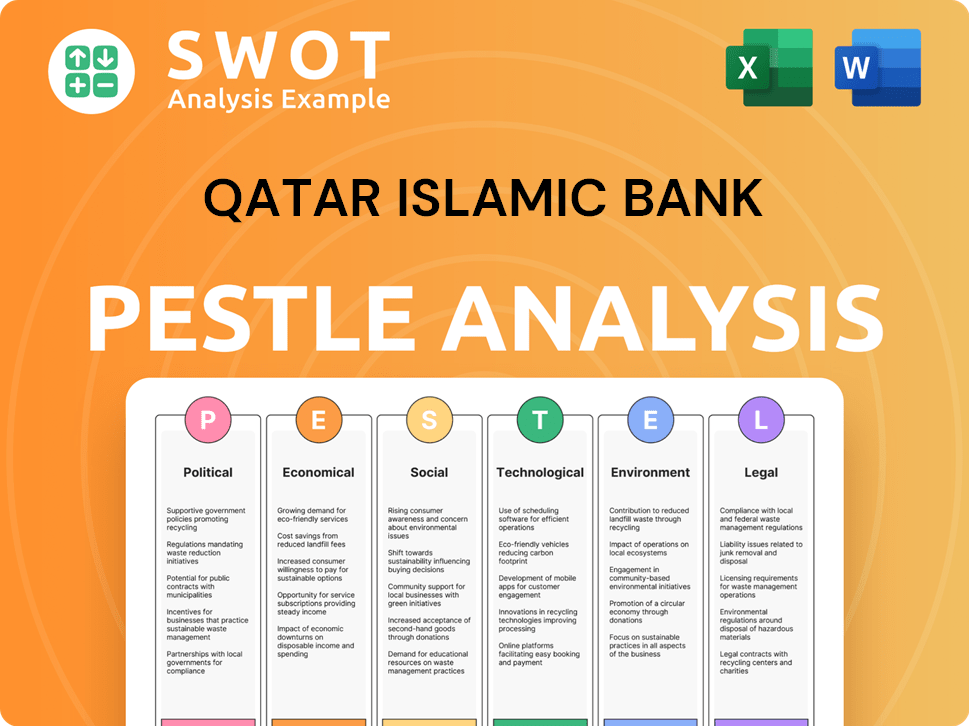

Assesses the macro-environmental forces impacting Qatar Islamic Bank through six key areas: Political, Economic, Social, etc.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Preview the Actual Deliverable

Qatar Islamic Bank PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This PESTLE analysis examines Qatar Islamic Bank through political, economic, social, technological, legal, and environmental lenses. It provides a comprehensive overview ready for your use. Get insights instantly!

PESTLE Analysis Template

Navigate Qatar Islamic Bank's landscape with our PESTLE Analysis. We examine political stability's effect on operations. Economic factors like oil prices and interest rates are also explored. Social and technological advancements are also detailed, showing their influences. Get the full picture of this company's performance. Download now!

Political factors

Qatar's government strongly backs its banking sector, including Islamic finance, aligning with National Vision 2030. This backing fosters a stable environment and boosts industry expansion. In 2024, government initiatives supported financial stability. This approach also reduces risks related to external debt outflows, as seen in recent financial reports.

Qatar's geopolitical landscape, while influenced by regional tensions, supports economic stability. Prudent leadership and strategic diversification bolster resilience. Qatar's GDP grew by an estimated 1.2% in 2024, reflecting stable economic conditions. The government’s focus on non-hydrocarbon sectors further mitigates risks.

The Qatar Central Bank (QCB) oversees the financial sector, ensuring stability and compliance. Recent directives focus on enhancing governance and transparency within banks. These regulations include separating Sharia-compliant and conventional banking operations. This could lead to greater focus for Islamic banks like QIB. In 2024, QCB continued to refine regulations, impacting operational strategies.

International Relations and Global Positioning

Qatar Islamic Bank's (QIB) global positioning is significantly shaped by international relations, especially in Islamic finance. Qatar actively fosters relationships to solidify its role as a key hub for Islamic financial services. This strategic positioning is crucial for attracting international investments and partnerships, thereby boosting QIB's global influence. The nation's involvement in setting global Islamic finance standards further enhances its standing.

- Qatar's financial sector contributed approximately 35% to the country's GDP in 2024.

- QIB's assets grew by 8% in 2024, demonstrating robust international investor confidence.

- Qatar's sovereign wealth fund manages over $500 billion, supporting strategic financial initiatives.

- Islamic finance assets globally are projected to reach $4.9 trillion by the end of 2024.

Policy on Expatriate Workers

Qatar's policies on expatriate workers significantly influence the banking sector's workforce. The government aims to attract skilled workers, but rights and retention remain crucial. Expatriates make up a large part of the population, affecting labor dynamics. In 2024, the Qatari government continued efforts to improve worker conditions.

- Expatriates constitute about 88% of Qatar's total population.

- Qatar's labor law reforms focus on worker protections.

- The banking sector relies heavily on skilled foreign workers.

Qatar's government actively supports its banking sector, fostering stability and expansion aligned with National Vision 2030. Government initiatives aim for financial stability and reduce risks linked to external debt. Strategic diversification mitigates geopolitical risks; Qatar's GDP grew 1.2% in 2024.

| Political Factor | Description | Impact on QIB |

|---|---|---|

| Government Support | Strong backing, strategic financial stability. | Positive: Supports growth, reduces risks. |

| Geopolitical Stability | Prudent leadership and diversification efforts. | Positive: Enhances investment appeal. |

| Regulatory Oversight | QCB ensures stability and compliance. | Neutral: Compliance adds to operational focus. |

Economic factors

Fluctuations in hydrocarbon prices significantly impact Qatar's fiscal and external surpluses, influencing banking sector liquidity. Lower oil and gas prices have previously softened surpluses, but the future looks brighter. Qatar's massive LNG expansion, expected to boost the medium-term outlook, is underway. In 2024, Qatar's GDP growth is projected at 3.3% driven by LNG. The country's LNG production is set to increase by 64% by 2027.

Qatar's economy anticipates modest growth, fueled by public investments and LNG expansion. Non-hydrocarbon sectors are key as Qatar diversifies, aiming for credit growth. In 2024, Qatar's real GDP growth is estimated at 3.6%, driven by these factors.

Anticipated interest rate reductions from the US Federal Reserve are poised to influence Qatar, with the Qatar Central Bank likely to follow suit due to the riyal's peg to the dollar. This alignment is crucial for maintaining currency stability. In 2024, the Federal Reserve is expected to cut rates, potentially impacting Qatari banks. This could lead to a slight decrease in net interest margins for banks.

Real Estate Market Conditions

Qatar's real estate market is a key part of the economy, influencing domestic credit and asset quality. If property prices drop further, it could affect the quality of assets. Government projects and lower interest rates are expected to help prevent big problems. These measures aim to support the market.

- In 2024, real estate transactions in Qatar totaled approximately $10.5 billion.

- The Qatar Central Bank has adjusted interest rates to stabilize the real estate market.

- Public sector spending on infrastructure projects is a key driver for the real estate sector.

Inflation and Cost of Living

Qatar's inflation is projected to moderate, fostering a stable economic climate. This stability is crucial for the financial sector, including Qatar Islamic Bank. The government's measures to control costs are key to maintaining economic health. Managing inflationary pressures is vital for sustainable growth and banking sector support.

- Inflation Rate (2024): Predicted to be around 2.5%.

- Consumer Price Index (CPI) Data: Monitoring CPI is essential for understanding cost of living.

- Government Policies: Focus on price stability through fiscal measures.

- Impact on Banking: Stable inflation supports loan performance and profitability.

Qatar's GDP is projected at 3.3% growth in 2024, supported by LNG. Real estate transactions in Qatar were about $10.5 billion. Inflation is expected around 2.5%, creating a stable environment.

| Factor | Details | Impact |

|---|---|---|

| GDP Growth (2024) | Projected at 3.3% | Supports banking sector liquidity |

| Real Estate (2024) | Transactions: $10.5B | Influences domestic credit |

| Inflation (2024) | Predicted: 2.5% | Supports loan performance. |

Sociological factors

Qatar Islamic Bank (QIB) benefits from the rising demand for Sharia-compliant financial products. The Muslim population's growth fuels this demand, supporting Islamic finance expansion. Globally, Islamic finance assets reached $4.08 trillion in 2023, expected to hit $6.9 trillion by 2028. QIB capitalizes on this trend by offering services aligned with Islamic principles.

Customer education is crucial for Islamic Fintech in Qatar. A lack of awareness about Islamic finance principles and digital solutions hinders growth. QIB needs to invest in educating customers about Sharia-compliant products. This will help increase market penetration. According to recent data, customer understanding significantly impacts adoption rates.

Qatar's young, tech-literate population is driving Islamic fintech's growth. Digital platforms attract this demographic. In 2024, mobile banking users in Qatar grew by 15%. These institutions offer personalized services. The sector's assets are projected to reach $1.5 billion by 2025.

Ethical and Socially Responsible Investing

Ethical and socially responsible investing (ESRI) is gaining traction, aligning with Sharia law principles and broader ESG goals. This trend offers opportunities for Islamic finance to attract diverse investors. In 2024, ESG assets globally reached approximately $40 trillion, showing significant growth. QIB can capitalize on this by promoting its Sharia-compliant, ESG-focused products. This approach appeals to a wider investor base.

- ESG assets globally: $40 trillion (2024)

- Growing investor interest in ethical investments.

- Alignment with Sharia law principles.

- Potential to attract diverse investors.

Cultural Acceptance of Digital Banking

The cultural shift towards digital banking in Qatar is accelerating, driven by convenience and technological advancements. This acceptance is vital for Qatar Islamic Bank's (QIB) digital initiatives. A recent survey showed a 60% increase in mobile banking usage among Qataris in 2024. QIB's ability to adapt to these cultural shifts will influence its market position. This trend presents significant opportunities for QIB to expand its customer base and streamline operations.

Qatar's evolving societal norms, driven by digital advancements, are reshaping banking preferences. The surge in mobile banking, with a 60% increase in 2024, reflects a shift towards convenience. ESG investments, globally valued at $40 trillion in 2024, highlight the importance of ethical alignment for QIB's strategy.

| Factor | Impact | Data |

|---|---|---|

| Digital Banking Adoption | Increased convenience and accessibility | 60% mobile banking increase (2024) |

| Ethical Investing Trends | Growing investor demand for ESG-aligned products | $40T global ESG assets (2024) |

| Customer Awareness | Education key to adoption. | Critical for QIB's market success. |

Technological factors

Qatar Islamic Bank (QIB) is deeply involved in digital transformation. Their goal is to be a digital innovation leader, building a flexible digital ecosystem. This strategy uses new tech to improve customer experiences. In 2024, QIB's digital banking users grew significantly, showing their digital focus is paying off.

Qatar is actively promoting itself as a FinTech center, driven by robust institutional support and a well-defined regulatory framework. The country is seeing increased investment in FinTech, with AI and blockchain playing a crucial role in Islamic finance. For example, Qatar's FinTech market is projected to reach $2 billion by 2025, reflecting strong growth. This growth is fueled by initiatives like the Qatar FinTech Hub.

Mobile banking is central to Qatar Islamic Bank's digital plan, using various apps for different clients. QIB's digital channels offer 24/7 access. In 2024, QIB saw digital transactions rise significantly. The bank's digital services adoption grew by 30% in the first half of 2024, according to recent reports.

Cybersecurity and Data Protection

Qatar Islamic Bank (QIB) faces heightened scrutiny regarding cybersecurity and data protection due to increased digitalization. Regulators are actively focusing on IT risk management within the financial sector. In 2024, global cybersecurity spending reached approximately $214 billion, reflecting the growing need for robust defenses. QIB must invest in advanced security protocols to safeguard customer data and maintain compliance.

- Cybersecurity spending is projected to exceed $270 billion by 2027.

- Data breaches in the financial sector have increased by 15% in the last year.

- QIB's IT risk management budget needs to be aligned with regulatory requirements.

Use of AI and Data Analytics

Artificial Intelligence (AI) and data analytics are reshaping the Islamic Fintech sector. Qatar Islamic Bank (QIB) leverages data analytics for better decision-making, improving customer experiences, and streamlining operations. In 2024, the global AI market in finance was valued at $20.3 billion, expected to reach $47.8 billion by 2029, showing significant growth. QIB uses these technologies to personalize services and detect fraud.

- AI adoption in banking is projected to boost revenue by 20% by 2025.

- The Fintech market in the MENA region is growing, with investments exceeding $2 billion in 2024.

- Data analytics helps QIB reduce operational costs by up to 15%.

Qatar Islamic Bank (QIB) emphasizes digital transformation and mobile banking. QIB saw a 30% rise in digital service adoption in the first half of 2024. Cybersecurity is critical, with global spending reaching $214 billion in 2024.

AI and data analytics are vital. The global AI market in finance was $20.3 billion in 2024. This is expected to reach $47.8 billion by 2029.

| Aspect | Details | Data (2024/2025) |

|---|---|---|

| Digital Banking Growth | Rise in digital transactions | Digital services adoption rose 30% (H1 2024) |

| FinTech Market | Qatar's FinTech growth | Projected to reach $2 billion by 2025 |

| Cybersecurity Spending | Global expenditure | Reached $214 billion in 2024 |

| AI in Finance | Market Valuation | $20.3 billion (2024), $47.8 billion (2029 projection) |

Legal factors

Qatar Islamic Bank (QIB) operates under strict Sharia principles, ensuring all products and services comply with Islamic law. The legal landscape for Sharia-compliant FinTech is evolving, with Qatar actively developing and refining its regulatory frameworks. This includes detailed guidelines for digital banking, which are crucial for QIB's digital transformation. In 2024, Qatar's FinTech market saw a significant increase in investments. The regulatory efforts aim to balance innovation with adherence to Islamic financial principles.

The Qatar Central Bank (QCB) is the primary regulatory body for financial institutions in Qatar, setting the rules that Qatar Islamic Bank (QIB) must adhere to. These regulations include specific financial accounting standards tailored for Islamic banks, ensuring Sharia compliance. QIB's operations are directly shaped by QCB's directives, which influence its financial reporting and operational practices. In 2024, QCB continued to refine its regulatory framework, aiming to strengthen the financial sector's stability and align with global best practices. Compliance with QCB regulations is crucial for QIB to maintain its operational license and financial health.

Qatar Islamic Bank (QIB), like all banks in Qatar, faces rigorous Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) regulations. These regulations, overseen by bodies like the Qatar Central Bank, are crucial for maintaining financial integrity. QIB must constantly update its internal controls to meet evolving compliance demands. In 2024, Qatar's financial sector saw increased scrutiny, with fines and penalties for non-compliance rising. The financial sector's total AML/CFT fines amounted to $5 million in Q4 2024.

Data Privacy and Protection Laws

Qatar Islamic Bank (QIB) must adhere to data privacy laws amid rising digital banking. Ethical data use and strong governance are essential for QIB. Compliance protects customer data and maintains trust. In 2024, data breaches cost companies globally an average of $4.45 million.

- Personal Data Protection Law (PDPL) compliance is vital.

- Cybersecurity measures must be regularly updated.

- Data governance frameworks need to be robust.

- Customer consent and data transparency are paramount.

International Standards and Harmonization

Qatar Islamic Bank (QIB) navigates international standards to ease cross-border transactions. Compliance with global regulations, especially in Islamic finance, is crucial. Adhering to AAOIFI standards is also vital for QIB's operations. This ensures consistency and trust in international markets. The global Islamic finance assets reached $4.08 trillion in 2023.

- AAOIFI sets standards for Islamic financial institutions.

- Cross-border transactions need regulatory clarity.

- Global harmonization boosts QIB's global reach.

Qatar Islamic Bank (QIB) operates under Sharia law, evolving its regulatory environment for FinTech, which saw increased investments in 2024. QCB regulates QIB, with directives influencing financial reporting and operational practices; the financial sector's AML/CFT fines amounted to $5 million in Q4 2024.

Compliance with data privacy laws and ethical data use are crucial, with data breaches costing companies globally an average of $4.45 million in 2024. QIB also navigates international standards to ease cross-border transactions, and global Islamic finance assets reached $4.08 trillion in 2023.

| Aspect | Detail | Impact |

|---|---|---|

| Sharia Compliance | Strict adherence to Islamic law | Guides product and service offerings. |

| QCB Regulations | Qatar Central Bank sets financial standards | Shapes financial reporting and operations. |

| AML/CFT | Regulations against money laundering | Ensures financial integrity, with sector fines. |

Environmental factors

Qatar's arid climate heightens climate change vulnerability, with rising temperatures and water scarcity posing significant challenges. The nation is increasingly focused on sustainability, reflecting global trends. Qatar aims to reduce greenhouse gas emissions by 25% by 2030. In 2024, Qatar launched several green initiatives. The government is investing heavily in renewable energy projects.

Qatar Islamic Bank (QIB) actively supports Qatar's National Climate Change Plan, demonstrating its dedication to environmental responsibility. QIB integrates climate considerations into its financing strategies, reflecting a commitment to sustainable practices. In 2024, QIB's ESG initiatives saw a 15% increase in green financing. This aligns with Qatar's goal of reducing carbon emissions by 25% by 2030.

Qatar is seeing growing interest in sustainable finance. Regulatory support and market transparency are increasing. Qatar Islamic Bank (QIB) is active in ESG-linked transactions. In 2024, sustainable investments in the MENA region reached $134 billion. QIB's focus aligns with the nation's environmental goals.

Energy Efficiency and Renewable Energy

Qatar's commitment to its National Vision 2030 includes boosting renewable energy use and energy efficiency. This focus aligns with the country's climate change strategy, creating chances for financial involvement. The government is backing green initiatives. Qatar aims to generate 20% of its electricity from solar by 2030.

- Qatar is investing heavily in solar power projects.

- Energy efficiency measures are being implemented across various sectors.

- There are increasing opportunities for green financing.

- QNB is also actively involved in sustainable financing.

Environmental Disclosure and Reporting

Environmental factors are increasingly significant for QIB. There's a rising focus on Environmental, Social, and Governance (ESG) disclosure and reporting among companies listed on the Qatar Stock Exchange. QIB is actively preparing its ESG Disclosure report. This reflects a global trend towards greater corporate transparency and sustainability. This is also influenced by Qatar's commitment to the UN Sustainable Development Goals.

- ESG reporting is becoming a standard practice for financial institutions.

- QIB's ESG report will likely cover environmental impact metrics.

- Stakeholders are increasingly considering ESG factors in their investment decisions.

Environmental issues, such as climate change and water scarcity, are vital in Qatar. The nation prioritizes sustainability, aligning with global trends. QIB integrates environmental considerations into its financing, boosting green financing by 15% in 2024, in line with Qatar’s aim to cut carbon emissions by 25% by 2030.

| Environmental Factor | Impact on QIB | Data/Facts |

|---|---|---|

| Climate Change | Risk and Opportunity | Qatar's National Climate Change Plan: Reduce emissions by 25% by 2030. |

| Renewable Energy | Investment & Finance | Qatar aims to generate 20% electricity from solar by 2030, offering green financing opportunities. |

| ESG Reporting | Transparency & Compliance | QIB is preparing ESG Disclosure report, aligning with rising demand for ESG-linked transactions, 2024 sustainable investments in MENA region: $134B. |

PESTLE Analysis Data Sources

The analysis uses data from Qatari government sources, financial institutions' reports, and international databases.