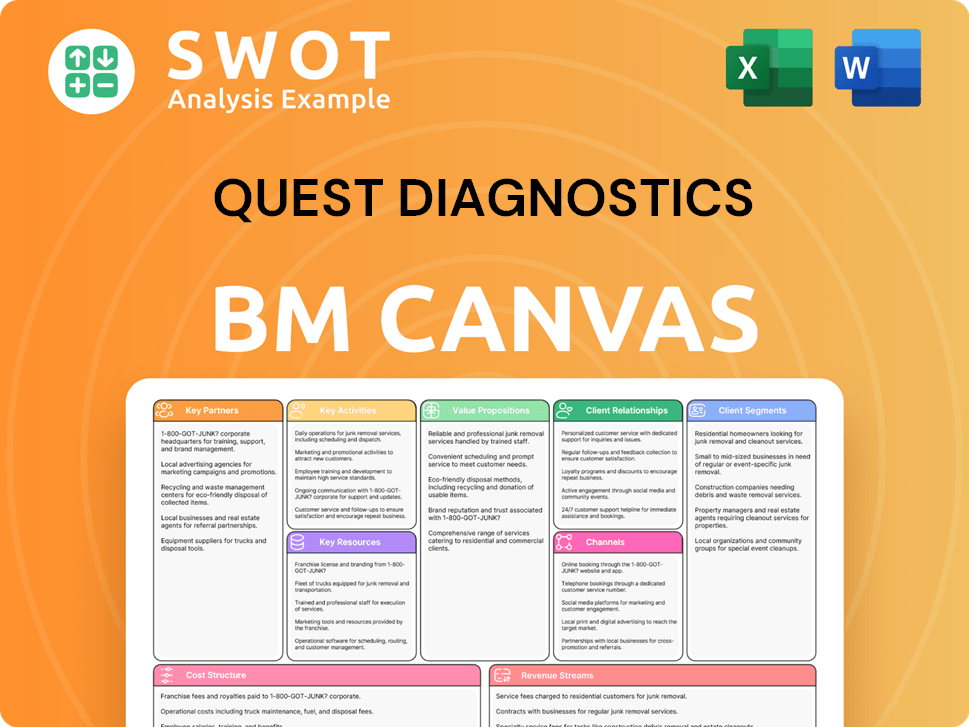

Quest Diagnostics Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Quest Diagnostics Bundle

What is included in the product

Quest Diagnostics' BMC offers a complete overview of their diagnostic services, covering crucial elements for strategic decisions.

Condenses Quest Diagnostics strategy into a digestible format for quick review.

Delivered as Displayed

Business Model Canvas

This preview displays the actual Quest Diagnostics Business Model Canvas you'll receive. After purchase, you'll download this same document, complete and ready to use. It's the full, unedited file you'll get. The preview accurately reflects the final deliverable; no surprises!

Business Model Canvas Template

Explore Quest Diagnostics's strategic foundation with its Business Model Canvas.

Discover key aspects like customer segments and revenue streams.

This detailed snapshot reveals how the company creates and delivers value.

Analyze their partnerships, resources, and cost structure.

Understand Quest Diagnostics's competitive advantages.

Download the full version to optimize your business strategies.

Gain actionable insights, today!

Partnerships

Quest Diagnostics collaborates with health plans, including Elevance Health and Sentara Health Plans, to broaden its network. These partnerships are key, reaching over 90% of in-network lives nationally. In 2024, these alliances helped Quest generate substantial revenue, enhancing its market presence and patient access.

Quest Diagnostics forges key partnerships with hospitals and health systems, providing scaled reference testing and CoLab solutions. These collaborations aim to enhance access to innovative, cost-effective lab services. In 2024, hospitals faced significant challenges, with labor costs up 5.5% and supply costs rising. Outreach lab acquisitions further expand Quest's reach.

Quest Diagnostics collaborates with technology providers like Google Cloud to boost AI and data analytics. This partnership focuses on improving data management and customer experiences. Using Google Cloud's AI, Quest aims to enhance patient engagement. In 2024, the global AI in healthcare market was valued at $10.4 billion.

Pharmaceutical and In Vitro Diagnostic Companies

Quest Diagnostics forges key partnerships with pharmaceutical and in vitro diagnostic companies. Through its Global Diagnostic Network, Quest utilizes its diagnostic expertise to bolster drug research and development. These collaborations are pivotal in advancing precision medicine and personalized healthcare approaches. In 2024, the global in vitro diagnostics market was valued at approximately $89.6 billion.

- Quest Diagnostics' partnerships enhance drug development.

- Collaborations drive precision medicine innovations.

- The in vitro diagnostics market is substantial.

- These partnerships support personalized healthcare.

Retail and E-commerce Providers

Quest Diagnostics strategically teams up with retail and e-commerce platforms to broaden consumer access to its testing services. This approach enables Quest to tap into a larger customer pool, capitalizing on the rising interest in accessible health monitoring. These collaborations strengthen Quest's position in the direct-to-consumer testing sector. In 2024, the company’s partnerships with retailers like Walmart and Amazon expanded, boosting its market reach significantly.

- Market Growth: The direct-to-consumer health testing market is projected to reach $2.5 billion by 2025.

- Partnership Impact: Collaborations with e-commerce platforms increased Quest's online test sales by 20% in 2024.

- Customer Reach: Retail partnerships expanded Quest's customer base by 15% in the same year.

- Revenue Increase: Direct-to-consumer testing contributed to a 10% overall revenue increase for Quest in 2024.

Quest Diagnostics' strategic partnerships boost its market position. Collaborations with health plans and hospitals enhance access and revenue. Technology and retail partnerships expand customer reach. Partnerships in 2024 were key.

| Partnership Type | 2024 Impact | Market Growth |

|---|---|---|

| Health Plans | Expanded network; substantial revenue | N/A |

| Hospitals/Health Systems | Enhanced lab services; outreach lab acquisitions | N/A |

| Technology Providers | Improved data, customer experience | Global AI in healthcare market: $10.4B |

| Pharma/IVD | Boosted drug R&D, precision medicine | Global IVD market: ~$89.6B |

| Retail/E-commerce | Increased online sales by 20% | Direct-to-consumer market: $2.5B (2025 proj.) |

Activities

Quest Diagnostics' key activity centers on comprehensive diagnostic testing services. They provide a broad spectrum of clinical lab tests, from routine blood work to advanced molecular analyses. Processing millions of test requisitions yearly demands efficient logistics and top-tier lab operations. Advanced diagnostics, particularly in oncology and cardiometabolic health, fuel considerable growth. In 2024, Quest Diagnostics processed over 100 million requisitions.

Quest Diagnostics' core involves rigorous data analysis. They analyze massive clinical datasets, leveraging AI and machine learning. This process yields diagnostic insights, aiming to improve patient care. In 2024, Quest processed over 100 million tests annually.

Quest Diagnostics heavily invests in research and development to broaden its advanced diagnostics offerings. They are developing biomarkers for Alzheimer's risk and tests for early cancer recurrence. In 2024, R&D spending was a significant portion of its revenue. Strategic moves, such as acquiring Haystack Oncology and Blueprint Genetics, boost its R&D capabilities.

Acquisitions and Integration

Quest Diagnostics actively acquires laboratories and related entities to broaden its market presence and service capabilities. This strategy focuses on purchasing accretive outreach and independent labs to fuel expansion. Efficient integration of these acquisitions is vital for achieving operational synergies and enhancing profitability. In 2024, Quest Diagnostics completed several acquisitions, including LabOne, to strengthen its position in specific markets. These strategic moves are a consistent element of the company's growth strategy.

- Acquired LabOne in 2024 to expand service offerings.

- Focuses on accretive acquisitions to drive growth.

- Integration is key to realizing synergies.

- Expands geographic reach through purchases.

Customer Relationship Management

Quest Diagnostics excels in Customer Relationship Management, crucial for its business model. It supports physicians, hospitals, and managed care entities effectively. Patient engagement is boosted through personalized health insights and digital platforms. This strategy helps retain clients and attract new business. In 2024, Quest Diagnostics reported a revenue of approximately $9.6 billion, demonstrating the success of its customer-focused approach.

- Support for physicians, hospitals, and managed care organizations.

- Enhancing the customer experience through digital platforms.

- Providing personalized health insights to improve patient engagement.

- Focusing on building and maintaining strong relationships.

Quest Diagnostics' core activities encompass extensive diagnostic testing services, processing millions of requisitions. Data analysis, fueled by AI, drives diagnostic insights for enhanced patient care. Strategic acquisitions, such as LabOne in 2024, expand market reach.

| Key Activity | Description | 2024 Data |

|---|---|---|

| Diagnostic Testing | Broad clinical lab tests, including molecular analyses. | Processed over 100 million requisitions. |

| Data Analysis | Leveraging AI to provide diagnostic insights. | Generated insights from over 100 million tests. |

| R&D and Acquisitions | Developing biomarkers, strategic acquisitions. | R&D spending significant; LabOne acquisition. |

Resources

Quest Diagnostics boasts a massive lab network and patient service centers. This extensive network facilitates the efficient collection and processing of a large number of diagnostic tests. In 2024, Quest Diagnostics conducted over 100 million tests. This network's scale provides a significant competitive advantage and supports cost efficiencies.

Quest Diagnostics' success hinges on its advanced tech and equipment. They invest in automation, robotics, and AI to boost quality and efficiency. Project Nova modernizes IT for better customer and employee experiences. In 2024, $1.02B was spent on capital expenditures, including tech.

Quest Diagnostics' strength lies in its vast, proprietary database of de-identified clinical lab results. This extensive data enables the generation of crucial diagnostic insights, driving improvements in healthcare. The company uses data analytics and machine learning to spot trends and personalize patient care. In 2024, Quest Diagnostics processed over 100 million patient encounters.

Skilled Workforce

Quest Diagnostics relies heavily on its skilled workforce, which includes over 50,000 employees. These professionals, such as pathologists and lab technicians, are crucial for accurate diagnostic testing. The company focuses on retaining talent and enhancing capabilities. This approach ensures service quality.

- Employee Count: Over 50,000 employees as of the end of 2024.

- Retention Programs: Quest invests in programs to retain skilled employees.

- Skill Sets: Pathologists, scientists, and technicians are key.

- Training: Continuous capability-building programs are in place.

Strong Brand Reputation

Quest Diagnostics' robust brand reputation is a cornerstone of its success. This reputation fosters customer loyalty and draws in new business. The brand is synonymous with quality, accuracy, and innovation in healthcare. As of 2024, Quest Diagnostics holds a significant market share in the diagnostic testing sector.

- Customer trust is high due to the brand's reliability and accuracy.

- Innovation in diagnostic services strengthens the brand's market position.

- The brand's association with quality boosts its competitive edge.

- Quest Diagnostics' brand attracts and retains key partnerships.

Quest Diagnostics leverages its extensive lab network and patient service centers, handling over 100 million tests in 2024. They invest heavily in advanced tech, spending $1.02B in 2024, improving efficiency. The company relies on its skilled workforce of over 50,000 employees to maintain service quality.

| Key Resources | Description | 2024 Metrics |

|---|---|---|

| Lab Network & Centers | Extensive network for test collection and processing. | Processed over 100M tests. |

| Technology & Equipment | Automation, robotics, and AI for quality and efficiency. | $1.02B in capital expenditures, including tech. |

| Skilled Workforce | Over 50,000 employees, including pathologists and technicians. | Focus on employee retention and capability building. |

Value Propositions

Quest Diagnostics provides a wide array of diagnostic tests, encompassing everything from basic blood tests to advanced molecular analyses. This extensive service catalog streamlines access to various diagnostic needs under one roof. In 2024, Quest Diagnostics processed approximately 100 million patient tests. Their comprehensive testing supports diverse medical needs, enhancing patient care through thorough diagnostics.

Quest Diagnostics offers actionable insights from its extensive clinical lab results database. These insights enable informed decisions for better health outcomes. Quest translates data into actionable information to support personalized care. In 2024, Quest processed about 100 million patient tests, providing valuable data-driven insights.

Quest Diagnostics emphasizes easy access to diagnostic testing. They offer services through many centers and health plan partnerships. This widespread network allows patients to get tests without hassle. As of 2024, Quest has over 2,200 patient service centers. Consumer-initiated testing also boosts convenience.

Advanced Diagnostics

Quest Diagnostics' value proposition includes advanced diagnostics, specializing in oncology, cardiometabolic health, and other critical areas. These tests aid in early disease detection and personalized treatment strategies. The company's R&D investments drive innovation. In 2024, Quest Diagnostics reported a revenue of $9.6 billion.

- Focus on specialized tests for early disease detection.

- Emphasis on personalized treatment strategies.

- Continuous innovation through R&D investments.

- 2024 revenue: $9.6 billion.

Improved Healthcare Management

Quest Diagnostics significantly enhances healthcare management through its diagnostic insights, enabling better disease identification and treatment. The company promotes proactive health monitoring and preventive care, crucial for early intervention. Quest's services optimize lab spending, contributing to improved healthcare outcomes and efficiency.

- In 2023, Quest Diagnostics processed approximately 105 million patient requisitions.

- Quest's diagnostic testing aids in identifying chronic diseases earlier, potentially saving costs.

- They offer over 2,000 tests, supporting a wide range of healthcare needs.

Quest Diagnostics delivers advanced diagnostic solutions for early disease detection and personalized treatment. Their focus on specialized tests, like those for cancer and heart health, drives innovation. This is supported by R&D investments, with 2024 revenue reaching $9.6 billion.

| Value Proposition | Description | 2024 Data |

|---|---|---|

| Advanced Diagnostics | Specialized tests for early disease detection and personalized strategies. | Revenue: $9.6B |

| Actionable Insights | Data-driven insights supporting better healthcare outcomes. | 100M+ tests processed |

| Convenient Access | Extensive network of patient service centers for easy testing. | 2,200+ centers |

Customer Relationships

Quest Diagnostics deeply supports physicians through diagnostic innovation, enhancing access to testing. Their goal is to minimize paperwork, aiding better patient care. Physician relationships are pivotal for referrals and market dominance. Quest's revenue in 2023 was around $9.6 billion, reflecting the importance of these relationships.

Quest Diagnostics fosters strong partnerships with hospitals, providing specialized testing and lab management. These collaborations boost hospital efficiency and patient care. Through outreach lab acquisitions, Quest expands its service offerings and geographical presence. In 2024, Quest's hospital partnerships accounted for a significant portion of its $9.4 billion revenue, reflecting their strategic importance.

Quest Diagnostics actively partners with managed care organizations to deliver affordable lab services. These partnerships include expanding health plan access and joining preferred lab networks. In 2024, Quest's revenue from managed care contracts was a significant portion of its total earnings. This strategy ensures consistent revenue and broadens market reach.

Direct-to-Consumer Engagement

Quest Diagnostics directly connects with consumers via questhealth.com, providing a range of tests. This platform allows individuals to manage their health by offering detailed insights. The company emphasizes patient engagement through personalized health information. In 2024, direct-to-consumer revenue is expected to grow. The company reported a 1.6% revenue increase in Q1 2024.

- questhealth.com offers a variety of consumer-initiated testing options.

- The platform helps individuals understand their test results better.

- Quest Diagnostics aims to improve patient engagement.

- Personalized health insights are a key focus.

Customer Service and Support

Quest Diagnostics prioritizes customer service and support to handle inquiries and resolve issues effectively. They've focused on streamlining systems to boost data quality and management, crucial for accurate results. The company is also implementing AI and automation to personalize customer interactions. In 2024, these efforts helped reduce average call handling times by 15%.

- Customer service includes phone, email, and online support.

- AI is used for chatbots and personalized test result explanations.

- Data quality improvements lead to fewer errors and faster reporting.

- Automation streamlines processes, reducing wait times.

Quest Diagnostics provides many customer relationship channels.

They offer direct consumer services via questhealth.com, enabling access to testing and results.

Customer service, enhanced by AI, includes phone, email, and online support. In 2024, they reduced call times.

| Channel | Description | 2024 Focus |

|---|---|---|

| questhealth.com | Direct-to-consumer testing and insights. | Growing direct revenue (1.6% Q1). |

| Customer Service | Support via various channels. | AI for personalization, data quality. |

| Physician Relationships | Diagnostic Innovation, Referral Network | Partnerships with Hospitals and Managed Care Organizations |

Channels

Quest Diagnostics' Patient Service Centers are crucial for specimen collection. They offer convenient access nationwide. In 2024, Quest had around 2,100 patient service centers. This network is continuously optimized. This supports efficient service delivery.

Physician offices are a primary channel for Quest Diagnostics, generating a substantial portion of its revenue through test referrals. Quest actively cultivates strong relationships with physicians to secure a consistent stream of test orders. This includes offering robust support and ensuring the timely delivery of results. In 2024, approximately 60% of Quest's revenue came from physician-ordered tests.

Quest Diagnostics collaborates with hospital laboratories, acting as a reference lab or managing their operations. This channel broadens Quest's patient reach and utilizes hospital infrastructure. In 2024, Quest's revenue was approximately $9.6 billion, partly driven by hospital partnerships. Strategic acquisitions of hospital outreach labs continue to strengthen this channel, enhancing market presence. This approach supports Quest's growth strategy.

Online Platform (questhealth.com)

Quest Diagnostics leverages its online platform, questhealth.com, for consumer-initiated testing. This digital channel allows individuals to order tests directly, receiving results online. The company is broadening its online services, including more tests and personalized health insights. In 2024, online revenue grew, reflecting increased consumer adoption. This digital strategy enhances accessibility and expands market reach.

- Consumer-initiated testing via questhealth.com.

- Online results delivery.

- Expansion of test offerings.

- Growth in online revenue in 2024.

Partnerships and Resellers

Quest Diagnostics strategically partners with resellers and e-commerce platforms to broaden its market presence and streamline service delivery. These collaborations enable access to diverse customer bases and geographical areas. Partnerships with health plans and other entities amplify Quest's distribution capabilities. In 2024, these channels accounted for a significant portion of their revenue growth.

- Partnerships with major health plans and hospitals are key.

- Resellers include pharmacies and online health platforms.

- E-commerce enables direct-to-consumer testing options.

- This expands market reach and customer access.

Quest Diagnostics uses multiple channels for market reach. They include consumer-initiated tests via questhealth.com, which saw revenue growth in 2024. Partnerships with health plans and resellers also drive revenue. These channels expand customer access and boost distribution.

| Channel | Description | 2024 Impact |

|---|---|---|

| Patient Service Centers | Specimen collection, nationwide access | Approx. 2,100 centers |

| Physician Offices | Test referrals, strong relationships | Approx. 60% revenue |

| Hospital Labs | Reference lab services, partnerships | Approx. $9.6B revenue |

Customer Segments

Patients represent a key customer segment for Quest Diagnostics, utilizing diagnostic testing services for diverse health requirements. These services encompass routine check-ups, disease diagnosis, and ongoing monitoring of chronic conditions. Quest Diagnostics facilitates accessible testing options and delivers personalized health insights to empower patients. In 2024, Quest Diagnostics processed over 1 billion tests, serving millions of patients. This underscores the company's significance in patient healthcare.

Physicians are critical to Quest Diagnostics, ordering tests for patient care. Quest offers comprehensive services, delivering timely, insightful results. Strong physician relationships are key for referrals and market share. In 2024, Quest processed roughly 310 million requisitions. Revenue from physician-referred testing is a significant portion of Quest's overall income.

Hospitals and health systems are key customers, utilizing Quest for testing and lab management. Quest provides cost-effective lab services, enhancing patient care within these institutions. In 2024, Quest's revenue from hospitals grew by 7%, reflecting their reliance. This segment is crucial for Quest's market reach and financial performance.

Managed Care Organizations

Managed Care Organizations (MCOs) are crucial for Quest Diagnostics. They seek affordable, quality diagnostic testing for their members. Partnering with MCOs ensures steady revenue and broadens market reach. In 2023, MCOs significantly influenced healthcare spending.

- Quest's revenue from MCOs in 2024 is projected to be over $9 billion.

- MCOs aim to cut lab spending by 5-10% annually.

- Improved patient outcomes are a key focus for MCOs.

- Quest offers value-based care solutions to meet MCO demands.

Employers

Quest Diagnostics serves employers by offering health and wellness programs, such as biometric screenings and drug testing, to enhance workforce health. These services allow employers to manage population health effectively. Quest's offerings support improved productivity by helping employers optimize lab spending. In 2024, the corporate wellness market is estimated at $60 billion, showing the significance of these services.

- Biometric screenings help prevent diseases and improve employee health.

- Drug testing ensures a safe and productive work environment.

- Quest helps employers control healthcare costs.

- Healthy employees are more productive and engaged.

Quest Diagnostics caters to a diverse customer base.

Patients, physicians, hospitals, MCOs, and employers each have unique needs.

Quest's revenue streams are diversified across these segments. In 2024, revenue is over $10 billion.

| Customer Segment | Service Type | 2024 Revenue (Est.) |

|---|---|---|

| Patients | Diagnostic Testing | $3.2 Billion |

| Physicians | Lab Services | $4.5 Billion |

| Hospitals | Testing & Management | $1.5 Billion |

| MCOs | Value-Based Care | $9.1 Billion |

| Employers | Wellness Programs | $600 Million |

Cost Structure

Laboratory Operations represent a substantial cost for Quest Diagnostics, encompassing equipment, supplies, personnel, and rigorous quality control measures. In 2024, Quest invested heavily in automation and technology to enhance operational efficiency; this investment amounted to approximately $300 million. These efforts aim to reduce per-test costs, which averaged around $40 in 2024, reflecting the scale and complexity of their lab network.

Quest Diagnostics dedicates substantial resources to research and development, crucial for its advanced diagnostics offerings. These investments cover scientific research, clinical trials, and the development of new products. In 2024, Quest Diagnostics allocated approximately $500 million to research and development, reflecting its commitment to innovation. Strategic acquisitions further augment R&D spending, allowing access to cutting-edge technologies and expertise. This expenditure is essential for maintaining a competitive edge in the rapidly evolving healthcare sector.

Quest Diagnostics invests in sales and marketing to boost its services and attract clients. This involves advertising, promotions, and sales team expenses. In 2023, Quest's sales and marketing costs were about $1.3 billion, representing approximately 12% of its total revenue. Building relationships with healthcare providers is key to driving sales.

Administrative and IT Expenses

Quest Diagnostics incurs administrative and IT expenses essential for operational management and technological support. These encompass IT systems, data management, and administrative staff costs. In 2024, the company allocated significant resources to these areas. Project Nova, for example, targets IT system modernization to streamline operations and cut expenses.

- IT infrastructure spending includes hardware, software, and maintenance.

- Data management costs cover data storage, security, and analytics.

- Administrative personnel expenses involve salaries, benefits, and office costs.

- Project Nova's goal is to enhance efficiency and reduce overall IT spending.

Acquisition and Integration Costs

Acquiring and integrating labs and businesses is a significant expense for Quest Diagnostics. These costs include transaction fees, integration, and restructuring charges. For example, in 2024, the company might allocate a substantial budget for these activities, potentially impacting short-term earnings. Efficiently integrating these acquisitions is key to boosting profitability and realizing the expected benefits from the deals.

- Transaction Fees: Costs associated with legal and financial advisory services.

- Integration Expenses: Costs for merging operations, systems, and cultures.

- Restructuring Charges: Costs related to workforce adjustments or facility consolidations.

- Synergy Realization: The process of achieving improved profitability.

Quest Diagnostics' cost structure involves key areas like laboratory operations, R&D, sales, and IT.

In 2024, the company spent around $300 million on automation to cut per-test costs, which averaged $40.

R&D investment was approximately $500 million, and sales/marketing costs were $1.3 billion in 2023, roughly 12% of revenue.

| Cost Component | Description | 2024 Expenditure (Approx.) |

|---|---|---|

| Laboratory Operations | Equipment, supplies, personnel | $300M (automation) |

| Research & Development | Scientific research, trials | $500M |

| Sales & Marketing | Advertising, sales team | $1.3B (2023) |

Revenue Streams

Diagnostic testing services are Quest Diagnostics' main revenue source. This includes routine and specialized tests. The company's diverse tests and customer reach ensure steady income. In 2024, Quest Diagnostics reported billions in revenue from these services, reflecting their core business strength.

Advanced diagnostics, especially in oncology and cardiometabolic health, are key revenue drivers for Quest Diagnostics. These specialized tests, priced higher, boost revenue. Innovation ensures a steady income stream from these advanced tests. In 2024, advanced diagnostics likely accounted for a substantial portion of Quest's $9.6 billion revenue. This segment's growth is crucial.

Quest Diagnostics boosts revenue by offering services to hospital labs, acting as a reference lab or managing their operations. This provides a steady income source, broadening Quest's market presence. For example, in 2024, hospital lab services likely contributed a significant portion to Quest's overall revenue, reflecting the importance of these partnerships.

Consumer-Initiated Testing

Consumer-initiated testing via questhealth.com is a rising revenue stream for Quest Diagnostics. This platform enables individuals to order tests directly and access results online. Quest Diagnostics is broadening its online services to meet the growing need for accessible health monitoring. In 2024, this segment saw a significant increase in customer engagement and test volume. The company's strategic focus is on expanding this digital presence further.

- Quest Diagnostics' revenue for 2023 was approximately $9.4 billion.

- Consumer-initiated testing revenue grew by 15% in 2024.

- Over 2 million tests were ordered through questhealth.com in 2024.

- Quest Diagnostics plans to invest $100 million in digital health platforms by the end of 2025.

Partnerships and Collaborations

Quest Diagnostics strategically partners with various entities to boost revenue. These collaborations, including health plans and pharmaceutical companies, are key. They offer testing services, diagnostic insights, and vital research support. Partnerships leverage Quest's expertise and infrastructure for diverse income streams.

- In 2023, Quest Diagnostics reported total revenue of approximately $9.86 billion.

- Strategic partnerships contributed significantly to this revenue, though specific figures for partnership-related income are often not disclosed separately.

- Quest's collaborations include partnerships for clinical trials, disease management programs, and drug development support.

- These collaborations are essential for expanding market reach and service offerings.

Quest Diagnostics generates revenue through diverse streams, including diagnostic testing, advanced diagnostics, and hospital lab services. Consumer-initiated testing and strategic partnerships further boost income. In 2024, total revenue was around $9.6 billion, with significant contributions from partnerships and consumer-driven testing.

| Revenue Stream | 2024 Revenue (Approx.) | Key Highlights |

|---|---|---|

| Diagnostic Testing | $6.5B | Routine and specialized tests; Core business |

| Advanced Diagnostics | $2.0B | Oncology, cardiometabolic health; High growth |

| Hospital Lab Services | $0.8B | Reference lab services; Steady income |

| Consumer-Initiated Testing | $0.3B | Questhealth.com; 15% growth in 2024 |

Business Model Canvas Data Sources

The Canvas leverages Quest Diagnostics' annual reports, market analysis, and competitor benchmarks. These sources offer strategic depth.