Quest Diagnostics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Quest Diagnostics Bundle

What is included in the product

Uncovers how Political, Economic, etc., elements impact Quest Diagnostics, offering strategic insights.

Provides a concise version to enhance focus during team sessions or high-level presentations.

Preview Before You Purchase

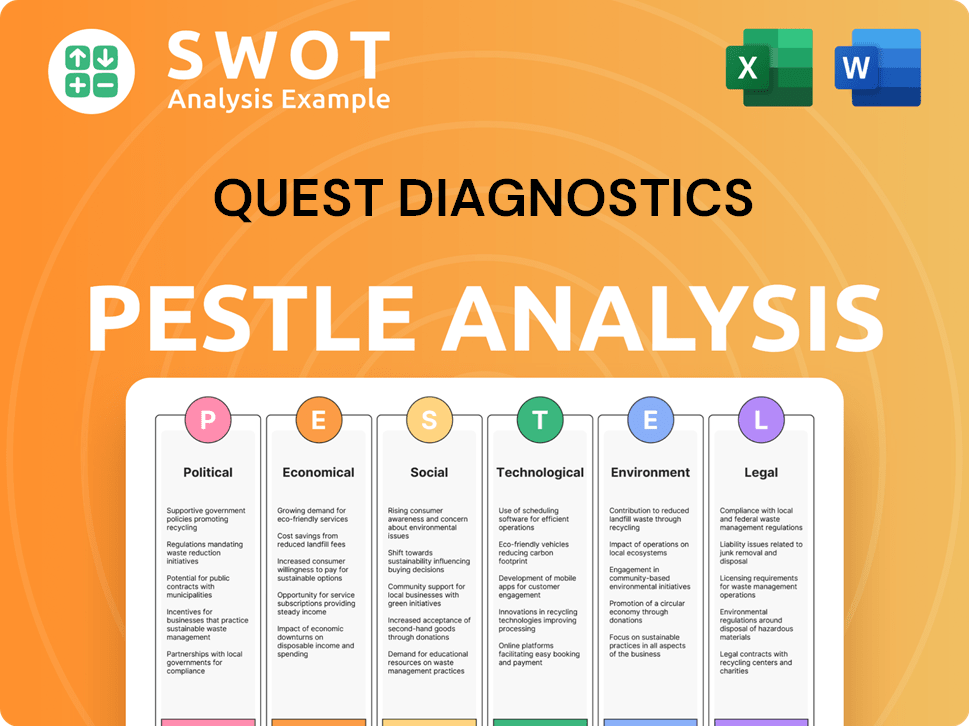

Quest Diagnostics PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured for the Quest Diagnostics PESTLE Analysis. Examine the document closely to see the comprehensive analysis of Political, Economic, Social, Technological, Legal, and Environmental factors. This detailed overview provides valuable insights and strategic direction. Rest assured, the final product mirrors the preview perfectly, available for immediate download post-purchase.

PESTLE Analysis Template

Uncover Quest Diagnostics' external landscape with our PESTLE Analysis. We explore how political factors like healthcare regulations impact operations.

We analyze the economic shifts and the impact of technological advancements. Our study delves into social trends, environmental considerations, and legal frameworks affecting the company's trajectory. Stay informed, gain a competitive edge, and be ahead of your peers.

Download the full PESTLE Analysis now for comprehensive insights.

Political factors

Quest Diagnostics faces stringent government regulations, including CLIA 88, impacting its operations. Compliance necessitates substantial annual spending, a critical financial consideration. Regulatory shifts, such as FDA updates on diagnostics, directly affect Quest's strategies. In 2024, the company spent approximately $1.2 billion on regulatory compliance and legal matters.

Changes in healthcare policies, especially regarding Medicare and Medicaid, directly impact Quest Diagnostics. The Affordable Care Act (ACA) affected reimbursement rates, influencing revenue. In 2024, policy shifts continue to reshape the landscape. For instance, updates to the Protecting Access to Medicare Act (PAMA) can affect the reimbursement for lab tests. These regulatory adjustments are critical for Quest's financial planning.

Government funding significantly impacts Quest Diagnostics. Funding for healthcare initiatives, including responses to health crises, boosts demand for diagnostic testing. For instance, the U.S. government allocated billions for COVID-19 testing, benefiting companies like Quest. In 2024, federal funding for public health initiatives continues.

Government Investigations and Legal Actions

Quest Diagnostics faces political risks tied to government probes and legal battles, which can result in hefty fines and operational adjustments. Recent legal settlements, like the $1.1 million agreement in 2024 for hazardous waste disposal violations, stress the need for strict compliance. Patient data protection is crucial; breaches can trigger severe penalties. These issues affect investor confidence and operational costs.

- 2024: Quest Diagnostics reached a $1.1 million settlement over hazardous waste disposal.

- Legal and ethical standards are paramount to avoid fines and operational changes.

International Operations and Political Stability

Quest Diagnostics, though mainly U.S.-based, faces political risks with its international ventures. Changes in foreign economic policies and political instability can impact its operations. For instance, currency fluctuations in international markets can affect revenue translation. The company's global expansion strategy must consider these factors to mitigate risks. In 2024, international revenue accounted for approximately 5% of total revenue, highlighting the importance of managing these risks.

- Currency fluctuations: 2024 impact on revenue.

- Political instability: assessment of market entries.

- International revenue: ~5% of total in 2024.

- Global expansion: risk mitigation strategies.

Political factors significantly impact Quest Diagnostics, particularly through stringent healthcare regulations that demand substantial compliance spending. Healthcare policy changes, such as modifications to Medicare and Medicaid, directly affect reimbursement rates and revenue. Government probes and legal battles present significant risks, potentially leading to large fines and operational adjustments.

| Political Factor | Impact | 2024 Data |

|---|---|---|

| Regulations & Compliance | High costs, operational changes | $1.2B spent on compliance, $1.1M fine in settlement. |

| Healthcare Policy | Revenue and reimbursement | Impact of ACA, PAMA updates affect revenue. |

| Government Funding | Demand for diagnostic testing | COVID-19 testing benefits, federal health initiatives. |

| International Ventures | Currency risks & instability | ~5% international revenue, mitigation strategies. |

Economic factors

Healthcare spending is a significant economic factor, with projections showing continued growth. The Centers for Medicare & Medicaid Services (CMS) estimates national health spending reached $4.8 trillion in 2023, and is projected to reach nearly $7.7 trillion by 2032. Reimbursement rates, especially from government programs, are crucial for Quest's earnings. These rates are subject to change, impacting the company's financial performance. For example, Medicare payment cuts or changes in coverage for specific tests directly affect revenue.

Economic conditions significantly influence Quest Diagnostics' business. The U.S. economy's health directly impacts clinical testing orders. During economic downturns, demand for elective tests may decrease. In 2024, the U.S. GDP growth is projected around 2.1%, impacting healthcare spending.

Quest Diagnostics battles rivals in the lab testing market, affecting pricing and market share dynamics. The firm's pricing strategy includes list prices, contracted rates, and negotiated deals, vital for financial health. In 2024, the diagnostic testing market was valued at $78.4 billion, highlighting the competitive landscape. Quest's ability to adapt pricing is key to maintaining its position.

Acquisitions and Market Expansion

Quest Diagnostics leverages strategic acquisitions and partnerships to fuel economic growth by broadening its market presence, enhancing testing services, and expanding its customer network. The company's financial performance is directly impacted by its rate of acquisitions and the effectiveness of their integration. In 2024, Quest Diagnostics completed several acquisitions, including a diagnostic laboratory in the Northeast, to strengthen its regional footprint. These acquisitions are essential for revenue growth and market share expansion.

- Acquisition of diagnostic laboratory in the Northeast: strengthens regional presence.

- Partnerships with healthcare providers: expands service offerings and customer reach.

- Focus on integrating acquired entities: impacts financial performance.

- Revenue growth through market share expansion: driven by strategic moves.

Operational Costs and Efficiency

Managing operational costs is crucial for Quest Diagnostics, encompassing fixed expenses like equipment and facilities, and variable costs such as reagents and supplies. Operational excellence initiatives, automation, and cost-saving programs directly influence the company's efficiency and profitability. Quest Diagnostics aims to improve operational efficiency. In 2024, Quest Diagnostics reported a gross margin of 38.1%.

- Gross Margin: 38.1% (2024)

- Cost of Revenues: Increased by 0.8% (Q1 2024)

- Operating Expenses: Increased by 2.6% (Q1 2024)

- Automation Initiatives: Ongoing investments.

Quest Diagnostics is heavily influenced by economic conditions. Healthcare spending is expected to grow, with projections reaching $7.7 trillion by 2032. The U.S. GDP, projected around 2.1% in 2024, affects demand for clinical tests and company's revenue. Competition and pricing strategies are vital, with the diagnostic testing market valued at $78.4 billion in 2024.

| Factor | Impact | 2024 Data |

|---|---|---|

| Healthcare Spending | Drives Revenue | $4.8T (2023), $7.7T (2032) |

| U.S. GDP Growth | Affects Demand | Projected 2.1% |

| Market Competition | Influences Pricing | $78.4B (Diagnostic Market) |

Sociological factors

An aging global population and the rise in chronic diseases like diabetes and heart disease are key drivers for diagnostic testing. In 2024, the World Health Organization (WHO) reported that chronic diseases account for 74% of all deaths worldwide. This demographic shift boosts demand for Quest Diagnostics' services. The medical diagnostics market is projected to reach $132.9 billion by 2025, reflecting this trend.

Quest Diagnostics benefits from heightened health awareness. Consumers increasingly seek health testing and personalized data. This trend boosts demand for their services. In 2024, the global health and wellness market reached $7 trillion, reflecting this growth. Consumer-initiated testing is a key driver.

Social determinants of health significantly affect healthcare access and outcomes, influencing demand for diagnostic services. Factors like economic stability and access to healthcare play crucial roles. Approximately 133 million Americans live in areas with healthcare shortages. Quest Diagnostics engages in initiatives to address these determinants.

Workplace Wellness and Employee Health

The increasing emphasis on workplace wellness significantly shapes employer-sponsored health programs, directly affecting the demand for diagnostic testing. Companies are now prioritizing employee well-being, encompassing physical, mental, and social health. This shift drives the adoption of wellness initiatives that often include regular health screenings and diagnostic services. The global corporate wellness market is projected to reach $81.7 billion by 2027, highlighting the growing investment in employee health.

- 2024: Approximately 70% of U.S. employers offer wellness programs.

- 2025: Expected increase in mental health support within wellness programs.

- Growing demand for preventive health services.

Accessibility and Inclusivity

Quest Diagnostics must ensure its services are accessible to everyone, including those with disabilities. This is not just a matter of ethical practice, but also a legal requirement. For example, in 2024, several lawsuits were filed against healthcare providers regarding the accessibility of digital kiosks. These lawsuits highlight the necessity of inclusive design in all patient-facing technologies and services.

- ADA compliance is crucial for avoiding legal issues and maintaining a positive public image.

- Investment in accessible technology and infrastructure is essential.

- Training staff on inclusivity and disability awareness is beneficial.

- Regular audits to assess and improve accessibility are recommended.

Sociological factors such as demographic shifts and lifestyle changes significantly influence Quest Diagnostics. The aging global population and rising chronic diseases increase demand. Workplace wellness programs and health awareness further boost the market. Accessibility to diagnostic services is crucial for all individuals.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Aging Population | Increased demand | Chronic diseases cause 74% of deaths worldwide (WHO, 2024) |

| Health Awareness | Demand for testing | Global health and wellness market: $7T (2024) |

| Workplace Wellness | Focus on screening | Corporate wellness market projected: $81.7B (2027) |

Technological factors

Technological advancements in laboratory automation are critical for boosting efficiency, reducing turnaround times, and improving diagnostic testing accuracy. Quest Diagnostics leverages automation to streamline operations and enhance the employee work environment. In 2024, Quest's capital expenditures reached approximately $700 million, with a significant portion allocated to technological upgrades. This investment supports advanced robotics and automated systems, increasing testing capacity.

Digital pathology and AI are revolutionizing diagnostics, enhancing accuracy and efficiency. Quest Diagnostics integrates AI across its labs. This technology could boost precision and speed up diagnoses. As of 2024, the global AI in healthcare market is projected to reach $67.9 billion.

Technological advancements are crucial for Quest Diagnostics. Innovation leads to new diagnostic tests, including molecular and gene-based tests. This expands the company's services and market reach. Quest Diagnostics invested $1.2 billion in R&D in 2024, focusing on these advanced technologies. This investment aims to improve accuracy and expand test offerings, such as Alzheimer's and HPV tests.

Data Management and IT Infrastructure

Quest Diagnostics heavily relies on advanced data management and robust IT infrastructure. This is crucial for managing the vast amounts of patient information they handle daily. Partnerships, such as the one with Google Cloud, are key to improving data flow and customer experiences. In 2024, Quest Diagnostics invested $400 million in IT infrastructure.

- Data security and privacy are paramount, with ongoing investments in cybersecurity.

- Cloud computing enhances scalability and data accessibility.

- Advanced analytics improve diagnostic accuracy.

- Digital platforms are used to improve patient engagement.

Telemedicine and Digital Health Integration

The rise of telemedicine and digital health is significantly influencing Quest Diagnostics. This growth amplifies the need for advanced diagnostic testing that seamlessly integrates with remote healthcare. The global digital health market is projected to reach $660 billion by 2025. This trend requires Quest Diagnostics to develop solutions compatible with telehealth platforms to ensure efficient patient care.

- Telemedicine adoption has surged, with a 38x increase in telehealth visits in 2020.

- The digital diagnostics market is expanding, with a projected value of $13.5 billion by 2028.

- Quest Diagnostics' revenue in 2023 was approximately $9.96 billion.

Technological factors drive efficiency and innovation at Quest Diagnostics, with substantial investments in automation and AI. The company's 2024 capital expenditures of around $700 million demonstrate this focus. Digital health, boosted by telemedicine, pushes for advanced diagnostics, which the global digital health market predicts to reach $660 billion by 2025. Quest Diagnostics uses these innovations to improve patient care and data security.

| Technology Area | Investment/Focus | Impact/Benefit |

|---|---|---|

| Laboratory Automation | $700M+ in CAPEX (2024) | Increased efficiency, reduced turnaround times, and improved employee work environment |

| AI and Digital Pathology | Integration across labs | Enhanced diagnostic accuracy and efficiency |

| R&D (New Tests) | $1.2B in 2024, focuses on molecular & gene-based tests | Expanded services and market reach, improving test accuracy |

| IT Infrastructure | $400M (2024) | Improved data management, patient information handling, and customer experience |

Legal factors

Quest Diagnostics operates under stringent regulatory oversight, including the FDA and CLIA. These regulations ensure quality and accuracy in lab testing. Failure to comply can lead to substantial financial penalties. In 2023, the FDA issued over 100 warning letters for various violations.

Quest Diagnostics must adhere to HIPAA to protect patient data. This includes safeguarding health information and ensuring secure reporting of results. In 2024, HIPAA violations led to significant penalties, highlighting the importance of compliance. Quest Diagnostics invests heavily in data security to meet these legal obligations. The healthcare sector faces increasing scrutiny on data privacy, making compliance critical.

Quest Diagnostics navigates complex billing and reimbursement for lab tests, a key legal factor. They must comply with regulations to avoid investigations and penalties related to fraud. In 2024, the healthcare sector saw over $5 billion in False Claims Act settlements. Quest Diagnostics faces ongoing scrutiny regarding billing practices.

Labor Laws and Employee Relations

Quest Diagnostics must adhere to labor laws, ensuring employee rights like collective bargaining. Effective employee relations are vital for smooth operations. Compliance is crucial to avoid legal issues and maintain a positive work environment. In 2024, labor costs represented a significant portion of operating expenses. This impacts profitability.

- Labor costs significantly impact operating expenses.

- Compliance with labor laws is essential.

- Employee relations affect operational efficiency.

Litigation and Legal Actions

Quest Diagnostics confronts legal risks from environmental practices and service accessibility. These issues could lead to lawsuits, potentially increasing costs. In 2024, legal expenses were a notable part of operational expenditures. The resolution of these issues can affect both finances and reputation.

- Environmental compliance and related litigation.

- Accessibility lawsuits impacting service delivery.

- Financial impact of legal settlements and defense.

- Reputational damage from unfavorable legal outcomes.

Quest Diagnostics faces extensive legal demands across multiple fronts. Healthcare data protection, particularly under HIPAA, is paramount, with significant financial penalties for violations. Billing practices and labor laws are other critical areas impacting operational efficiency and finances.

| Legal Area | Compliance Focus | 2024/2025 Implications |

|---|---|---|

| Data Privacy | HIPAA regulations | Increased scrutiny & penalties. |

| Billing & Reimbursement | Fraud prevention | >$5B in False Claims Act Settlements. |

| Labor Laws | Employee Rights | Affects operational costs. |

Environmental factors

Quest Diagnostics must properly manage hazardous and medical waste from its labs, a key environmental duty. Non-compliance with waste disposal rules can result in fines and environmental harm. In 2024, the EPA reported over $200 million in penalties for improper waste handling. Quest's waste management costs in 2024 were roughly $15 million.

Quest Diagnostics focuses on reducing energy consumption and shifting to renewables. In 2024, they aimed to cut emissions by 50% from 2019 levels. They invested over $10 million in energy efficiency projects. Their renewable energy use increased by 15% in 2024, showing progress.

Quest Diagnostics is actively working to decrease its carbon footprint. Optimizing courier routes and switching to alternative fuel vehicles are key strategies. In 2024, the company invested heavily in electric vehicle (EV) fleets. This move aims to reduce emissions from their transportation and logistics.

Water Stewardship

Quest Diagnostics integrates water stewardship into its environmental initiatives, focusing on water conservation and responsible usage within its laboratory operations. This is essential, given the significant water footprint of healthcare facilities. According to recent data, the healthcare sector consumes a substantial amount of water annually. Quest Diagnostics aims to minimize its environmental impact.

- Water conservation is a key focus.

- Responsible water usage in labs is prioritized.

- Healthcare sector's water footprint is significant.

- Quest Diagnostics strives for minimal environmental impact.

Environmental Management Systems and Certifications

Quest Diagnostics' environmental strategies include implementing environmental management systems, like ISO 14001, showcasing dedication to environmental standards and regulatory adherence. These systems help monitor and improve environmental performance. For instance, in 2024, the healthcare sector saw a 15% rise in companies adopting such certifications. Quest Diagnostics likely faces increased pressure to reduce its carbon footprint.

Quest Diagnostics tackles environmental responsibilities like hazardous waste management to avoid penalties, with the EPA issuing over $200 million in related fines in 2024. They are also actively curbing emissions by switching to renewable energy and investing in energy-efficient projects. Investments in electric vehicles highlight efforts to cut the carbon footprint from their operations.

| Aspect | Details | 2024 Data |

|---|---|---|

| Waste Management | Focus on proper disposal of medical and hazardous waste. | $15M spent; EPA penalties exceeded $200M |

| Energy & Emissions | Reduce energy use, shift to renewables. | 50% emissions cut target; 15% renewable use rise |

| Carbon Footprint | Optimized routes; use of alternative fuels. | Increased EV investments in fleet |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws on reliable financial reports, healthcare industry data, and regulatory updates. Each factor is supported by credible sources.