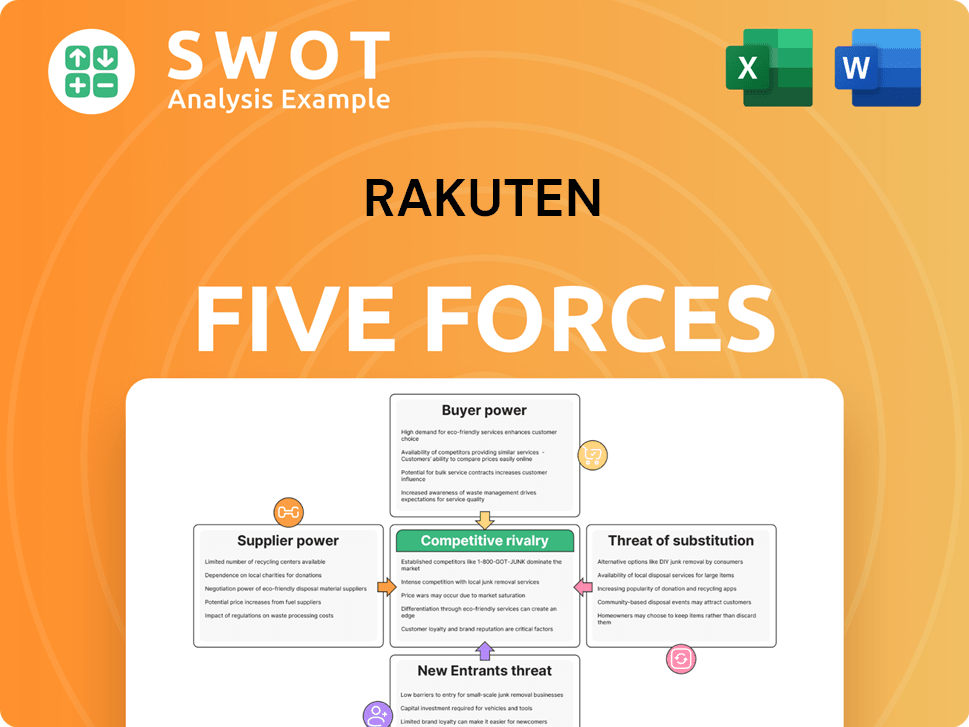

Rakuten Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rakuten Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Easily visualize Rakuten's competitive landscape with a dynamic spider chart.

Same Document Delivered

Rakuten Porter's Five Forces Analysis

The Rakuten Porter's Five Forces analysis you are previewing is the complete document. This detailed analysis provides a comprehensive look at Rakuten's competitive landscape. It covers all five forces influencing the company's industry dynamics. The full analysis, exactly as shown, will be available instantly after your purchase.

Porter's Five Forces Analysis Template

Rakuten operates in a dynamic market, facing diverse competitive pressures. Understanding the intensity of each force is critical for strategic planning. Buyer power, influenced by consumer choice, is a key factor. The threat of new entrants and substitutes also shapes Rakuten's competitive landscape. Analyzing supplier bargaining power reveals cost vulnerabilities. Rivalry intensity within the e-commerce sector is another vital aspect.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Rakuten’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Rakuten's e-commerce operations benefit from low supplier power because of the broad supplier base. This allows Rakuten to negotiate favorable terms. In 2024, the e-commerce market saw over 10 million active sellers globally. Rakuten can easily switch suppliers to manage costs. However, exclusive products might shift the balance.

The logistics landscape features many firms, weakening individual suppliers' influence. Rakuten leverages this to secure better rates, delivery speeds, and service levels. In 2024, the global logistics market was valued at approximately $10.6 trillion. Rakuten's supply chain efficiency is critical in managing supplier relationships.

Suppliers of technology infrastructure, including cloud services and software, exert moderate bargaining power over Rakuten. Rakuten depends on these suppliers for its online platform, yet the availability of various providers offers Rakuten some negotiation power. For instance, the cloud computing market, valued at $670.6 billion in 2024, presents Rakuten with alternatives.

Content Providers

Content providers' bargaining power fluctuates in digital services. Exclusive content boosts their influence, potentially raising Rakuten's expenses or limiting options. Building strong partnerships and creating in-house content can help Rakuten manage these dynamics effectively. For example, Netflix's shift to original content demonstrates this strategy. In 2024, original content spending is projected to reach $25 billion for Netflix.

- Exclusive content increases supplier influence.

- Partnerships impact Rakuten's costs.

- In-house content balances this power.

- Netflix's original content strategy.

Fintech Service Providers

Rakuten's fintech sector depends on suppliers like payment processors and security firms. Their influence hinges on the availability of alternatives and the importance of their services. In 2024, the global fintech market size was estimated at $199.4 billion. This is a significant increase from $112.5 billion in 2021. Diversifying partnerships and developing in-house solutions can lessen supplier power.

- Fintech market growth: The global fintech market was valued at $199.4 billion in 2024, showcasing substantial expansion.

- Supplier Impact: The bargaining power of suppliers affects Rakuten's operational costs and service delivery.

- Mitigation Strategies: Diversifying partnerships and developing proprietary tech are key to reducing supplier influence.

Rakuten's supplier power varies by sector. E-commerce leverages a vast supplier base, lowering costs, with 10M+ sellers in 2024. Tech & content suppliers hold moderate power. Fintech suppliers, like payment processors, impact operational costs.

| Sector | Supplier Power | Mitigation |

|---|---|---|

| E-commerce | Low | Switch suppliers |

| Tech & Content | Moderate | Negotiate/Diversify |

| Fintech | Moderate | Partnerships/In-house |

Customers Bargaining Power

E-commerce customers often hold significant bargaining power, especially when it comes to price. They can effortlessly compare prices across different platforms, making switching easy. Rakuten, like other e-commerce businesses, must provide competitive pricing and demonstrate value. Consider that in 2024, average online shopping cart abandonment rates were around 70%. Loyalty programs and unique offerings are crucial to lessen price sensitivity.

Customers wield substantial power due to the vast choices available in e-commerce. Rakuten faces pressure to offer superior service to compete effectively. In 2024, e-commerce sales reached $1.1 trillion in the U.S., highlighting intense competition. Differentiating through unique offerings is essential for attracting customers.

Customers' bargaining power is amplified by easy access to product reviews and comparison tools. Rakuten needs strong product quality and positive reviews to keep customers. Transparency in pricing and product details is key for trust. In 2024, online reviews significantly impacted 60% of consumer purchasing decisions. Rakuten's success hinges on these factors.

Switching Costs

Switching costs are low in e-commerce, so customers can easily switch to Rakuten's competitors. Rakuten needs to build strong customer loyalty to combat this. Focusing on rewards, personalized services, and a smooth user experience is crucial. Reducing any friction in the buying process is also vital for retaining customers.

- Loyalty programs: In 2024, companies like Amazon and Walmart reported that their loyalty programs significantly boosted customer retention rates.

- Personalized services: Data from 2024 showed that personalized recommendations increased purchase rates by up to 15% for some e-commerce platforms.

- User experience: A 2024 study indicated that a seamless user experience could reduce cart abandonment rates by 20%.

Large Customer Base

While individual customers might wield some power, Rakuten's expansive customer base offers significant advantages. This large scale enables Rakuten to secure better deals from suppliers and collaborators. They use customer data for targeted marketing, boosting retention and value. For example, Rakuten's e-commerce platform boasts over 100 million registered users globally.

- Customer data analytics is crucial for personalized marketing, driving up to 20% higher conversion rates.

- Rakuten's loyalty program significantly enhances customer retention, with repeat purchase rates often 30% higher.

- Negotiating favorable terms with suppliers boosts profit margins by approximately 5-10%.

- Targeted advertising can decrease customer acquisition costs by around 15%.

Customers in e-commerce, like Rakuten's, have considerable bargaining power due to easy price comparisons and switching. Competition is fierce; in 2024, U.S. e-commerce sales hit $1.1T. Loyalty programs and positive reviews help retain customers.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price Comparison | High | 70% cart abandonment |

| Customer Reviews | Significant | 60% purchase impact |

| Loyalty Programs | Positive | Retention boosted |

Rivalry Among Competitors

Rakuten confronts fierce competition within the e-commerce sector, battling giants like Amazon and Alibaba. This intense rivalry directly impacts Rakuten's ability to gain and keep customers. To stand out, Rakuten must offer unique services and leverage its strong loyalty program. Notably, in 2024, Amazon's net sales in North America were $355.9 billion, highlighting the scale of the competition. Focusing on the Japanese market remains a key strategy.

Rakuten dominates Japan's e-commerce scene, yet faces stiff competition. In 2024, its market share in Japan was approximately 27%. Continuous innovation and strategic investments are vital for sustaining this position. Expanding globally and diversifying services, like Rakuten's foray into fintech, boosts competitiveness.

Competitive pricing is crucial in e-commerce, significantly impacting Rakuten's rivalry. Rakuten needs competitive prices to attract customers. Dynamic pricing and promotions are vital for price-conscious customers. In 2024, e-commerce sales were approximately $1.1 trillion in the U.S. alone. Rakuten must navigate this to succeed.

Innovation and Technology

Technological innovation significantly fuels competitive rivalry in e-commerce, and Rakuten must continuously invest in cutting-edge technologies and digital solutions to maintain its market position. AI-driven personalization and mobile optimization are crucial for enhancing customer experience and driving sales. The e-commerce sector's rapid evolution necessitates substantial investments in these areas to stay competitive. In 2024, e-commerce sales are projected to reach $6.3 trillion globally, emphasizing the importance of technological advancements.

- Investment in technologies like AI and machine learning is essential for enhancing customer experience.

- Mobile optimization is crucial as mobile commerce accounts for a significant portion of e-commerce sales.

- In 2024, the e-commerce market is expected to grow by approximately 10% globally.

- Rakuten's ability to leverage data analytics for personalized recommendations will be key.

Customer Loyalty

Customer loyalty is crucial in competitive markets. Rakuten's Super Points program significantly boosts engagement. Customer service and a seamless user experience enhance loyalty. In 2024, customer retention rates are vital for sustained growth.

- Rakuten's Super Points program boasts millions of active users.

- High customer retention rates are a key financial metric.

- Seamless user experience reduces churn and boosts loyalty.

- Customer service investments directly impact retention.

Rakuten's e-commerce battles Amazon, Alibaba. Pricing strategies, tech investments are key. In 2024, global e-commerce sales hit $6.3T. Focus on Japan and loyalty programs.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Market Share (Japan) | Maintains Position | 27% (approx.) |

| Global E-commerce | Drives Strategy | $6.3T sales projected |

| Customer Loyalty | Boosts Engagement | Super Points active users in millions |

SSubstitutes Threaten

Brick-and-mortar stores serve as direct substitutes, particularly for customers preferring in-person shopping experiences. To counteract this, Rakuten needs to strengthen its online offerings to match the appeal of physical retail. Data from 2024 shows that about 70% of retail sales still occur in physical stores, highlighting the ongoing importance of this factor. Integrating online and offline strategies can also help reduce this threat.

Manufacturers selling directly to consumers present a substitution threat to Rakuten Porter. To retain customers, Rakuten must offer unique value and convenience. Building strong merchant relationships and a diverse product assortment are key. In 2024, direct-to-consumer sales grew, impacting e-commerce platforms. Rakuten's 2024 revenue was $14.4 billion.

The threat from other e-commerce platforms is significant for Rakuten, as many competitors offer similar products. To combat this, Rakuten needs to stand out. For example, in 2024, Amazon's net sales increased, showing strong competition. Rakuten should focus on unique features and excellent customer service. Personalized recommendations and a smooth user experience are crucial for keeping customers.

Social Commerce

Social commerce poses a threat to Rakuten as sales shift to social media platforms. To compete, Rakuten must adopt social commerce strategies. Integrating social shopping features and collaborating with influencers is crucial. This approach can enhance Rakuten's competitiveness in 2024.

- Social commerce sales reached $992 billion globally in 2023, a 23.4% increase.

- Influencer marketing spending is expected to hit $21.6 billion in 2024.

- Rakuten's 2023 revenue was $1.9 trillion JPY, affected by e-commerce competition.

Emerging Technologies

Emerging technologies pose a threat to Rakuten. AI-powered shopping assistants are becoming popular alternatives. To counter this, Rakuten needs to adopt new technologies. This includes investing in AI for personalized shopping experiences, a trend that saw a 20% growth in adoption in 2024.

- AI-driven shopping assistants offer alternative shopping experiences.

- Rakuten must integrate new technologies to stay competitive.

- Investing in AI and personalization is key.

- Personalized shopping saw a 20% adoption growth in 2024.

The availability of alternative shopping methods directly challenges Rakuten. Direct-to-consumer sales and social commerce are growing. Rakuten's response involves adapting to these shifting consumer preferences.

| Substitute | Impact | Rakuten's Strategy |

|---|---|---|

| Brick-and-mortar | 70% of retail sales are in-store. | Integrate online & offline strategies. |

| Direct-to-consumer | Growth in DTC sales. | Offer unique value & convenience. |

| Social commerce | $992B globally in 2023. | Adopt social commerce features. |

Entrants Threaten

The e-commerce sector presents moderate barriers to entry, primarily due to the need for tech infrastructure and solid logistics networks. Setting up online stores is easier now, which slightly reduces these barriers. Rakuten faces constant pressure to innovate to stay competitive. In 2024, the global e-commerce market is projected to reach $6.3 trillion, indicating a high level of competition.

Establishing a strong online platform demands considerable investment in tech, logistics, and marketing, which can deter new entrants. Rakuten's existing infrastructure offers a competitive edge. However, well-funded startups still present a challenge. In 2024, Rakuten invested heavily in its e-commerce and fintech sectors, showing its commitment to maintaining its market position. The cost to compete is high.

Rakuten, a major e-commerce player, enjoys significant economies of scale, which gives it a pricing advantage over new entrants. New businesses often struggle to match Rakuten's low prices due to these scale advantages. To compete, new entrants frequently target niche markets. For instance, in 2024, niche e-commerce sales grew by 15%.

Brand Loyalty

Brand loyalty's impact on Rakuten is significant, as online shoppers' fickle nature can open doors for new competitors. Rakuten, therefore, needs to constantly cultivate customer loyalty. This means investing in rewards and personalized experiences. Enhancing customer service and building a positive brand reputation are also key strategies. For instance, in 2024, customer retention rates in e-commerce hovered around 20%, highlighting the need for continuous engagement.

- Focus on enhancing customer service to build trust.

- Implement robust rewards programs to retain customers.

- Personalize shopping experiences to boost loyalty.

- Continuously monitor and improve brand perception.

Regulatory Compliance

Regulatory compliance presents a significant hurdle for new entrants in the market. Rakuten's established presence across diverse markets offers a competitive edge due to their experience in navigating various regulatory landscapes. The company's familiarity with different legal frameworks provides a substantial advantage. However, evolving regulations and data privacy concerns continually challenge all industry participants, including Rakuten.

- Compliance costs can be substantial, potentially deterring smaller firms.

- Rakuten's global operations require adherence to numerous data privacy laws, like GDPR.

- New entrants face challenges in understanding and implementing complex regulations.

- Changes in regulations can force all players to adapt their business models.

The threat of new entrants to Rakuten is moderate due to existing infrastructure demands, but easier online store setups reduce these barriers. High investments are needed for tech, logistics, and marketing, creating a hurdle. However, well-funded startups and niche markets can still pose a threat.

| Factor | Impact on Rakuten | 2024 Data |

|---|---|---|

| Tech & Logistics Investment | High barrier to entry | Global e-commerce market projected at $6.3T |

| Economies of Scale | Pricing advantage | Niche e-commerce sales grew 15% |

| Brand Loyalty | Customer retention crucial | E-commerce retention rates around 20% |

Porter's Five Forces Analysis Data Sources

We use Rakuten's annual reports, competitor analysis, industry databases, and market research to compile data.