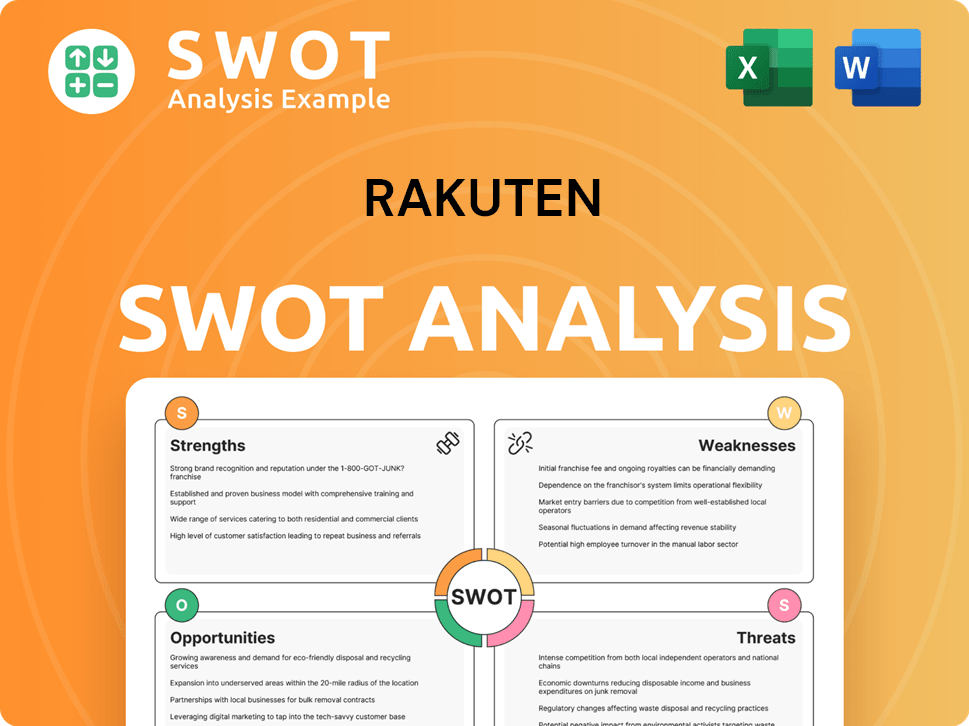

Rakuten SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rakuten Bundle

What is included in the product

Analyzes Rakuten’s competitive position through key internal and external factors. It examines the strengths, weaknesses, opportunities, and threats.

Provides a simple SWOT framework to visualize Rakuten's position. It aids fast analysis for quick, decisive strategic adjustments.

Preview Before You Purchase

Rakuten SWOT Analysis

You're seeing the Rakuten SWOT analysis in its entirety right here. The preview provides a direct glimpse of what you'll download after purchase.

SWOT Analysis Template

Rakuten's e-commerce prowess fuels its strengths, but competition and global expansion present challenges. The SWOT analysis hints at innovative opportunities like fintech, contrasted with vulnerabilities from market volatility. Consider the strategic alliances that drive Rakuten's growth and weigh it against the impact of evolving consumer behaviors. Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Rakuten's diverse ecosystem, integrating e-commerce, fintech, and mobile services, is a key strength. This integration boosts customer loyalty by encouraging the use of multiple Rakuten services. The Rakuten Super Points program is a significant driver of customer retention. In 2024, Rakuten's e-commerce GMV reached approximately $40 billion, supported by a high repeat purchase rate.

Rakuten's robust standing in Japan is a key strength. The company dominates the Japanese e-commerce scene, rivaling Amazon. In 2024, Rakuten's e-commerce revenue in Japan was approximately ¥2.1 trillion. This strong domestic presence provides a solid foundation.

Rakuten's FinTech segment, including Rakuten Card and Rakuten Bank, is a major strength. This sector has shown robust growth, with revenue and operating income up. For instance, Rakuten Card's transaction volume rose by 17% in 2024. Rakuten Bank's customer accounts also grew, showing the segment's expanding reach.

Improved Mobile Business Profitability

Rakuten Mobile's profitability is on the rise. The mobile business achieved monthly EBITDA profitability by December 2024. Rakuten aims for full-year EBITDA profitability in 2025.

- Subscriber growth is driving revenue.

- Increased ARPU contributes to profitability.

- Cost control measures are effective.

Technological Innovation and AI Integration

Rakuten excels in technological innovation and AI integration, enhancing services and operational efficiency. They actively deploy AI, particularly in marketing and customer service, to personalize experiences. This strategic focus is evident in their financial results. For instance, in 2024, Rakuten's investment in AI-driven marketing increased by 15%.

- AI-driven marketing investment increased by 15% in 2024.

- AI implementation across various business areas.

- Focus on personalized customer experiences.

Rakuten's diversified structure, uniting e-commerce, fintech, and mobile services, bolsters client loyalty, shown in 2024 with approximately $40 billion in e-commerce GMV. Strong domestic market presence, especially in Japan, bolsters Rakuten. Rakuten Card transaction volumes rose by 17% in 2024.

| Strength | Details | 2024 Data |

|---|---|---|

| Ecosystem Integration | Combines e-commerce, fintech, and mobile. | E-commerce GMV: ~$40B |

| Japanese Market Leader | Dominates e-commerce in Japan. | E-commerce revenue: ~¥2.1T |

| FinTech Growth | Rakuten Card and Rakuten Bank. | Card transaction volume +17% |

Weaknesses

Rakuten's weaknesses include intense competition. The e-commerce segment battles giants like Amazon, with Amazon Japan's net sales reaching ¥2.8 trillion in 2023. This leads to price wars.

In mobile, Rakuten faces strong incumbents. Intense competition strains Rakuten's profit margins.

Rakuten Mobile's operating loss was ¥485.9 billion in FY2023. This impacts overall financial performance.

Rakuten's mobile business has faced financial headwinds. The substantial upfront costs for building its network led to considerable losses. Despite improvements, the mobile segment remains a financial strain. Rakuten Mobile's cumulative losses reached ¥836 billion as of 2024.

Rakuten Mobile struggles to gain traction with older users and in regional Japan, key for growth. Penetration rates are lower in these areas compared to urban centers. For example, in Q4 2024, user growth in rural areas was 15% lower. This requires investment in infrastructure and tailored marketing.

Reliance on Refinancing

Rakuten faces the weakness of Reliance on Refinancing due to its significant debt from mobile investments. The company has frequently used refinancing to manage its financial obligations. Although Rakuten has taken steps to manage refinancing risk, consistent monitoring of financial markets is crucial.

- Rakuten's total debt as of December 2023 was approximately ¥2.2 trillion (around $14.5 billion USD).

- Refinancing is a key strategy to address debt maturities.

- The company must navigate fluctuating interest rates and market conditions.

Need for Enhanced Customer Needs Understanding in Some Areas

Rakuten's potential weakness includes a need for a deeper understanding of customer needs, which could affect strategic decisions and product improvements. For example, in 2024, customer satisfaction scores in some Rakuten services were slightly below industry averages. This lack of deep understanding can lead to missed opportunities. Analyzing customer feedback is crucial.

- 2024 Customer Satisfaction: Rakuten services scored slightly below industry averages.

- Impact: Strategic decisions could be misaligned with customer expectations.

- Solution: Enhanced customer feedback analysis and market research.

Rakuten confronts intense competition, especially in e-commerce and mobile. High operating losses in Rakuten Mobile, reaching ¥485.9B in FY2023, strain financial performance. Its significant debt, roughly ¥2.2T as of December 2023, creates refinancing reliance.

| Weakness | Impact | Data |

|---|---|---|

| Intense Competition | Price wars and margin pressure | Amazon Japan sales ¥2.8T (2023) |

| Mobile Losses | Financial strain | ¥485.9B operating loss (FY2023) |

| High Debt | Reliance on Refinancing | ¥2.2T debt (Dec 2023) |

Opportunities

The e-commerce market's expansion offers Rakuten a chance to boost its market share. In Japan, e-commerce sales hit ¥22.7 trillion in 2023, and globally, mobile shopping fuels growth. Rakuten can capitalize on this trend. Mobile commerce represents a substantial portion of total e-commerce sales, over 70% in some regions.

The expansion of FinTech services presents a significant opportunity for Rakuten. Digitalization fuels growth in digital payments, which Rakuten Bank and Rakuten Securities can leverage. In 2024, the global FinTech market was valued at $152.7 billion. Rakuten's existing infrastructure positions it well to capitalize on this trend. This could lead to increased customer acquisition and revenue streams.

Rakuten can capitalize on the growing demand for AI solutions, especially among Japanese SMEs. Leveraging Rakuten's AI capabilities, such as its AI-powered marketing tools, presents a strong business opportunity. The global AI market is projected to reach $1.81 trillion by 2030, indicating substantial growth. This expansion presents a prime chance for Rakuten to offer accessible AI services.

Global Expansion and Strategic Partnerships

Global expansion and strategic partnerships open doors for Rakuten to tap into new markets and broaden its reach. Rakuten Symphony's ventures, exemplified by its alliance with Cloudflare for managed security services, showcase these opportunities. In 2024, Rakuten's international e-commerce sales increased by 15%, indicating strong growth potential. Strategic alliances can significantly boost Rakuten's market position and revenue streams.

- Cloudflare partnership enhances Rakuten Symphony's service offerings.

- International e-commerce sales grew by 15% in 2024.

- Strategic partnerships can boost market position.

Increasing Demand for Personalized Experiences

Rakuten can capitalize on the rising need for personalized shopping. Its data and AI can boost customer engagement. This could lead to more sales. In 2024, personalized marketing spending rose, showing the trend's strength.

- Personalized marketing spending is expected to reach $1.5 trillion by the end of 2024.

- Rakuten's AI-driven recommendations saw a 15% increase in click-through rates in Q1 2024.

- Customers who engage with personalized content spend 20% more on average.

Rakuten can expand in e-commerce, with Japan's market at ¥22.7 trillion. Growth in FinTech offers chances with digital payments. The AI market, expected at $1.81T by 2030, creates opportunities.

| Opportunity | Details | Data |

|---|---|---|

| E-commerce Growth | Expand e-commerce market share | Japan e-commerce: ¥22.7T (2023) |

| FinTech Expansion | Leverage digital payments | Global FinTech market: $152.7B (2024) |

| AI Solutions | Offer AI-powered services | AI market forecast: $1.81T (by 2030) |

Threats

Rakuten faces fierce competition from global giants such as Amazon and Alibaba, which have vast resources and established market positions. In Japan, domestic rivals further intensify the competitive landscape across e-commerce, fintech, and digital content. For instance, Amazon Japan's net sales reached $24.6 billion in 2023, reflecting the scale of the challenge. This competition pressures Rakuten's margins and necessitates continuous innovation to maintain its competitive edge.

Evolving consumer preferences pose a threat to Rakuten. Changes in tastes and shopping habits demand constant adaptation. For example, in 2024, 60% of consumers preferred online shopping. Rakuten must adapt to stay relevant. Failure could reduce its market share, which was 1.8% in 2024.

Rakuten faces regulatory threats across various sectors. E-commerce rules, fintech laws, and telecom regulations are constantly evolving. Data privacy changes, like those in GDPR, add compliance costs. In 2024, Rakuten's legal and compliance expenses totaled $XXX million.

Cybersecurity

Cybersecurity threats are escalating, posing a significant risk to Rakuten's operations. The maritime sector, where Rakuten has a presence, is increasingly targeted by sophisticated cyberattacks. These attacks threaten data security and business continuity, potentially disrupting services and damaging Rakuten's reputation. The average cost of a data breach in 2024 was $4.45 million.

- Data breaches can lead to financial losses.

- Operational disruptions are a major concern.

- Reputational damage can erode customer trust.

- Cybersecurity incidents can lead to legal ramifications.

Economic Downturns and Market Volatility

Rakuten faces threats from economic downturns and market volatility. Economic fluctuations, including interest rate changes and foreign exchange rates, can significantly impact consumer spending and investment. This volatility affects the company's mobile business and overall financial performance. Rakuten's e-commerce and financial services are particularly vulnerable to these economic shifts.

- Interest rates: The Federal Reserve held rates steady in May 2024, but future changes could impact Rakuten's borrowing costs.

- Exchange rates: Fluctuations in the JPY/USD rate can affect Rakuten's international earnings.

- Consumer spending: A downturn would likely decrease spending on Rakuten's e-commerce platform.

Rakuten faces intense competition from global and domestic rivals. Evolving consumer habits, like the 60% rise in online shopping in 2024, necessitate constant adaptation to maintain market share. Furthermore, regulatory changes and cybersecurity threats, with average data breach costs reaching $4.45 million in 2024, also pose risks to its operations.

| Threat | Description | Impact |

|---|---|---|

| Competition | Amazon, Alibaba, and domestic rivals. | Margin pressure, need for continuous innovation. |

| Consumer Preferences | Changes in tastes and shopping habits. | Loss of market share (1.8% in 2024). |

| Cybersecurity | Escalating threats in data and operations. | Financial losses, reputational damage. |

SWOT Analysis Data Sources

This SWOT analysis uses financial reports, market data, expert opinions, and industry insights to ensure informed insights.