Rapid7 Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rapid7 Bundle

What is included in the product

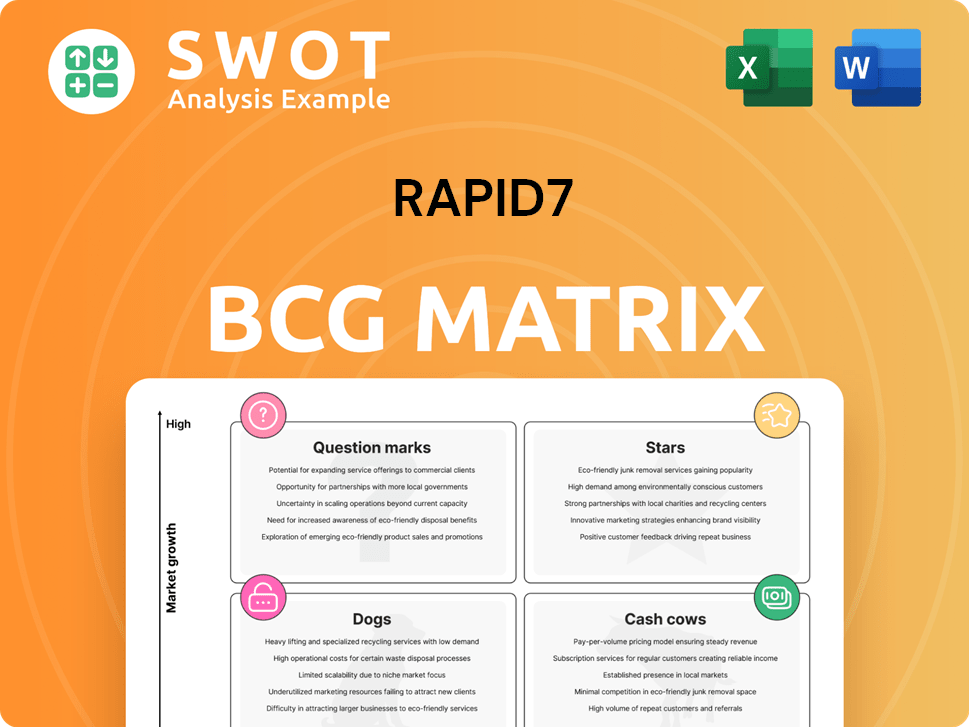

Rapid7's BCG Matrix analysis evaluates its product portfolio's growth and market share.

Clean, distraction-free view optimized for C-level presentation, making it easy to communicate strategic insights.

What You See Is What You Get

Rapid7 BCG Matrix

The BCG Matrix preview showcases the exact document you'll receive after purchase. Get instant access to a fully realized, ready-to-implement strategy tool, designed for immediate analysis and presentation.

BCG Matrix Template

Rapid7’s BCG Matrix helps analyze their product portfolio. We offer a glimpse into their Stars, Cash Cows, Dogs, and Question Marks. See which products are thriving and which need rethinking. Understand Rapid7's market position and investment priorities. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Rapid7's MDR services are gaining traction, enhancing customer value. The MDR market is booming, crucial for Rapid7's growth. Focusing on MDR provides comprehensive security. Rapid7's 2024 revenue reached $791.8 million, with MDR a key driver.

Rapid7's Exposure Command Platform launch significantly boosted its customer value. The platform gives a complete view of the attack surface. Security teams can prioritize exposures efficiently. This proactive approach helps organizations manage their attack surface effectively. In Q3 2024, Rapid7 reported a 13% increase in revenue, showing the positive impact of such platforms.

Rapid7's cloud security solutions are poised to benefit from the expanding cloud security market. This market is projected to hit USD 121.04 billion by 2034, growing at a CAGR of 12.87% from 2025 to 2034. Rapid7's comprehensive solutions help customers manage cloud risk and detect threats effectively. In 2024, the company's revenue was approximately $800 million.

Threat Intelligence

Rapid7's Threat Intelligence, a "Stars" component, leverages its Intelligence Hub within the Command Platform for rapid threat detection and response. Rapid7 Labs enriches this with data from honeypots and proprietary research, offering industry-specific insights. This integrated approach strengthens threat intelligence capabilities. In 2024, Rapid7 reported a 17% increase in threat intelligence subscriptions.

- Actionable insights for security teams.

- Data from honeypots and proprietary research.

- Industry-specific contextualization.

- 17% increase in threat intelligence subscriptions in 2024.

Vulnerability Management Solutions

Rapid7's vulnerability management solutions are classified as "Stars" within the BCG Matrix, reflecting their strong market position and high growth potential. The vulnerability management market is experiencing robust expansion, with a projected compound annual growth rate (CAGR) of around 8% from 2025 to 2030. Rapid7's solutions are essential for organizations to proactively manage their cybersecurity risks. Their tools help in identifying, prioritizing, and fixing vulnerabilities efficiently.

- Market Growth: The global vulnerability management market was valued at USD 7.8 billion in 2023.

- Rapid7 Revenue: Rapid7's revenue in 2023 was $759 million.

- Key Feature: Rapid7's InsightVM offers real-time vulnerability assessments.

- Competitive Edge: They focus on automation and integration.

Rapid7's threat intelligence, a "Stars" component, is a key driver of growth, especially within the Command Platform. It leverages Rapid7 Labs for data, including honeypots, enhancing threat detection. Threat intelligence subscriptions saw a 17% rise in 2024.

| Key Metric | Value | Year |

|---|---|---|

| Threat Intelligence Subscription Growth | 17% | 2024 |

| Revenue | ~$800M | 2024 |

| Vulnerability Management Market Value (2023) | $7.8B | 2023 |

Cash Cows

InsightVM, Rapid7's leading vulnerability management solution, is a flagship product. It offers key insights into vulnerability and risk management. In 2024, Rapid7's revenue was approximately $800 million, demonstrating consistent financial performance. InsightVM likely contributes significantly to this revenue, acting as a cash cow.

Metasploit, Rapid7's penetration testing software, is a cash cow. It simulates attacks to train security teams. The software is a well-established tool, generating stable revenue. In 2024, the cybersecurity market is projected to reach $217.9 billion. Metasploit helps organizations proactively strengthen their defenses.

Product subscriptions are a major revenue source for Rapid7. These include cloud-based subscriptions, managed services, and software licenses. This recurring revenue stream is crucial. In 2023, subscription revenue hit $728.6 million, up from $605.3 million in 2022, showing strong growth.

North American Market Share

North America leads in the vulnerability management market, making it a key area for Rapid7. Rapid7's substantial revenue comes from its robust presence in North America. The United States holds a significant market share within the region. This dominance positions Rapid7 as a cash cow.

- North America has the largest market share.

- Rapid7's revenue is significantly from North America.

- The US is a major contributor to the North American share.

- This market position makes Rapid7 a "Cash Cow".

Large Enterprise Customers

Large enterprise customers are a crucial segment for Rapid7, demanding robust security solutions. These clients typically seek extensive, multi-layered security approaches to protect their assets. A substantial part of Rapid7's income originates from these large enterprise contracts. In 2024, Rapid7's revenue from enterprise clients accounted for over 70% of its total revenue, demonstrating their significance.

- Enterprise clients drive over 70% of Rapid7's revenue.

- These clients prioritize comprehensive security strategies.

- High-security infrastructure is key for large enterprises.

Cash Cows are profitable, well-established products. They generate consistent revenue with minimal investment. Rapid7's subscription model and enterprise client base solidify its cash cow status. In 2024, Rapid7's revenue was around $800 million.

| Cash Cows | Description | Financial Impact (2024) |

|---|---|---|

| InsightVM | Leading vulnerability management solution | Significant revenue contributor |

| Metasploit | Penetration testing software | Generates stable revenue |

| Product Subscriptions | Recurring revenue from various subscriptions | Subscription revenue was $728.6 million in 2023 |

Dogs

Rapid7's legacy on-premise products face challenges amid the cloud shift, potentially becoming "dogs" in the BCG matrix. They might exhibit low growth and market share, with 2024 data reflecting slower adoption. Divestiture could be considered, aligning with strategic shifts. Rapid7's 2023 revenue was $756.2 million.

Rapid7 excludes InsightOps and Logentries contracts valued under $2,400 annually from its customer count. These low-value contracts, potentially indicating low growth and profitability, don't significantly impact Rapid7's ARR. In 2023, Rapid7's total revenue was around $745 million, highlighting the impact of higher-value contracts.

Rapid7's vulnerability management (VM) faces stiff competition, impacting market share. Its products might be classified as "dogs" where rivals dominate. The company struggles to shift VM clients to its integrated risk solutions. In 2024, Rapid7's revenue grew, yet competition in VM persisted. This VM struggle hinders overall growth.

Services with Declining Demand

If some of Rapid7's services face decreasing demand, possibly because of tech changes or shifting customer needs, they'd be categorized as dogs. Revamping these services often proves costly and may not boost performance. For instance, legacy security offerings might fall into this category. In 2024, Rapid7's revenue was $816 million.

- Declining demand can stem from new cybersecurity solutions.

- Turnaround plans are often ineffective for dogs.

- Rapid7's growth rate in 2024 was approximately 15%.

- Shifting customer preferences are another factor.

Products Lacking Innovation

Products lagging in innovation and failing to adapt to current cybersecurity trends can be classified as dogs within Rapid7's portfolio. These offerings may struggle to gain market share and profitability. Rapid7's Q3 2024 earnings reported a 15% increase in revenue, emphasizing the need to continuously innovate. Failure to evolve could lead to these products becoming obsolete. Rapid7 must prioritize updating these products to maintain its competitive edge.

- Stagnant products struggle in a competitive market.

- Innovation is key to staying ahead of threats.

- Rapid7's financial results highlight the importance of evolving.

- Obsolete products can negatively impact revenue.

Rapid7's "dogs" face challenges from on-premise shifts and market competition, reflected in potential low growth and market share. Vulnerability management struggles and lagging innovation contribute to their status. These products may see divestiture or require costly overhauls. In 2024, Rapid7's revenue was $816 million, with a 15% growth rate.

| Aspect | Impact | Data Point |

|---|---|---|

| On-Premise Products | Low growth, potential divestiture | 2024 revenue: $816M |

| Vulnerability Management | Stiff competition, struggles | 2024 Growth: 15% |

| Lagging Innovation | Obsolete potential | Q3 2024 Revenue Up 15% |

Question Marks

Rapid7 is positioning itself in the managed security operations (MSO) sector, a high-growth segment. As a relatively new venture for Rapid7, it is currently classified as a question mark within its BCG matrix. MSO contributes a significant portion, about one-third, of Rapid7's approximately $840 million annual recurring revenue. This investment reflects Rapid7's strategic focus on expanding its security offerings.

Rapid7 is expanding its Exposure Command, aiming for revenue growth. This service rethinks vulnerability management. While promising, its market share is currently modest. In 2024, Rapid7's revenue reached $813.7 million, a 14% increase year-over-year, indicating growth potential for Exposure Command.

As Rapid7 introduces new cloud security solutions, these offerings likely fall into the "Question Marks" quadrant of a BCG Matrix. They represent high-growth potential within the cloud security market, yet currently hold a smaller market share. Rapid7 should strategically invest in these products if they demonstrate strong growth potential, or consider divesting if market adoption lags. In 2024, the cloud security market is projected to reach $77.5 billion, growing significantly from $62.9 billion in 2023, indicating substantial opportunity.

AI-Driven Security Solutions

Rapid7 is utilizing generative AI in product development, aiming to boost its security solutions. AI-driven security has high growth potential, though its market share is currently limited. The integration of AI and Gen AI is changing the market, boosting threat detection. Rapid7's focus on AI aligns with the growing cybersecurity needs.

- Market growth is projected, with AI in cybersecurity reaching billions by 2024.

- Rapid7's revenue in 2023 was approximately $768 million.

- The cybersecurity market is experiencing rapid expansion.

International Expansion (GCC/India)

Rapid7 is strategically expanding into high-growth regions, including the Gulf Cooperation Council (GCC) and India. These markets present significant opportunities for growth due to increasing cybersecurity demands. While the market share is still developing, Rapid7 is actively building its presence. As part of this expansion, Rapid7 will host three Security Day events in May 2025 across Mumbai, Delhi, and Bangalore.

- GCC and India offer high growth potential for cybersecurity solutions.

- Rapid7 is working to increase its market share in these regions.

- Security Day events in India are planned for May 2025.

- These events will take place in Mumbai, Delhi, and Bangalore.

Rapid7's offerings, like MSO and cloud security solutions, are in the "Question Mark" category. They operate in high-growth areas, but their market share is currently small. Strategic investment is crucial to capitalize on growth opportunities, as demonstrated by the increasing cybersecurity market, which reached $77.5 billion in 2024.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue | Rapid7's total revenue | $813.7 million |

| Market Growth (Cloud Security) | Projected Market Size | $77.5 billion |

| Year-over-year growth | Rapid7's growth rate | 14% |

BCG Matrix Data Sources

Rapid7's BCG Matrix is shaped by credible sources like threat intel, industry reports, & sales figures, offering reliable market assessments.