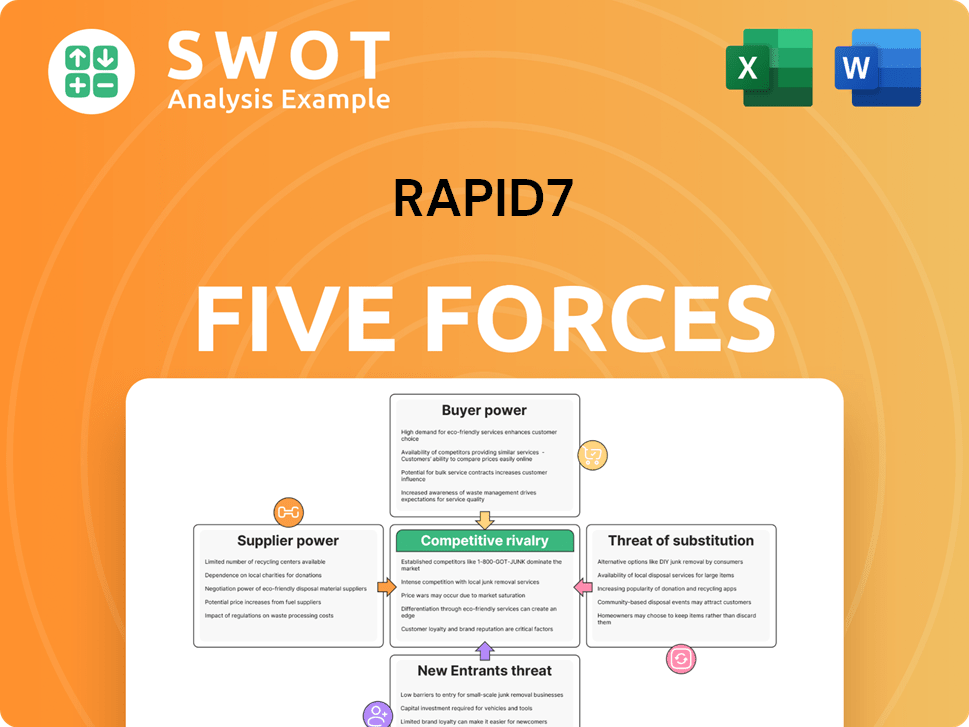

Rapid7 Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rapid7 Bundle

What is included in the product

Analyzes Rapid7's competitive position, covering rivals, buyers, suppliers, and potential new entrants.

Quickly visualize your market's dynamics with a concise, shareable spider chart.

What You See Is What You Get

Rapid7 Porter's Five Forces Analysis

This preview offers the complete Rapid7 Porter's Five Forces analysis. What you see now is the identical document you'll download and use instantly after your purchase.

Porter's Five Forces Analysis Template

Rapid7 faces moderate rivalry in the cybersecurity market, pressured by strong competition. Buyer power is somewhat low, given enterprise dependence on their solutions. Supplier power is moderate, with diverse tech providers. The threat of new entrants is moderate, due to high barriers. The threat of substitutes is also moderate, amid evolving security needs.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Rapid7’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Rapid7's reliance on specialized tech and intelligence suppliers grants these vendors some power. This dependence could lead to increased costs or supply disruptions. Diversifying supplier relationships is crucial to mitigate this risk. In 2024, Rapid7's cost of revenue was $250 million, highlighting the impact of supplier costs.

The cybersecurity talent pool significantly affects supplier power. A scarcity of skilled professionals boosts their bargaining power, making it harder to negotiate favorable terms. In 2024, the global cybersecurity workforce gap was estimated at 3.4 million. Rapid7, like other companies, can lessen supplier power by investing in internal training. This strategy reduces reliance on external talent.

Rapid7 relies on external data feeds for threat intelligence and vulnerability information. The uniqueness and accuracy of these feeds directly impact supplier power. For example, in 2024, the cybersecurity market saw a 12% rise in demand for specialized threat data. Diversifying data sources can reduce dependency on any single provider. This strategic move helps maintain control over costs and data quality.

Cloud service dependencies

Rapid7's reliance on cloud providers such as AWS and Azure introduces supplier power. These providers control critical infrastructure for hosting and services. This dependency can impact pricing and service terms for Rapid7. In 2024, the cloud infrastructure market reached $270 billion, demonstrating its significant influence.

- Cloud spending is projected to keep growing, with a 20% increase expected in 2024.

- Multi-cloud strategies can reduce vendor lock-in.

- Negotiating favorable terms is crucial.

- Optimizing cloud usage minimizes costs.

Proprietary technology reliance

If Rapid7 relies heavily on suppliers with exclusive, patented technologies, the suppliers' bargaining power increases. This situation can impact Rapid7's cost structure and operational flexibility. To mitigate this, Rapid7 could invest in its own R&D, aiming to develop proprietary solutions.

This approach not only lessens dependence on external suppliers but also fosters innovation within Rapid7, giving it a competitive edge. For instance, in 2024, Rapid7 allocated a significant portion of its budget, approximately 20%, to research and development to enhance its proprietary technologies.

- Supplier Concentration: A few dominant suppliers control essential technologies.

- Switching Costs: High costs or complexities involved in changing suppliers.

- Impact on Quality: Supplier's ability to impact the quality of Rapid7's products.

- R&D Investment: Rapid7's investment in creating its own solutions.

Rapid7 faces supplier bargaining power due to specialized tech needs and talent scarcity.

Reliance on external data and cloud providers further influences this dynamic.

In 2024, cost of revenue was $250M, and cloud market reached $270B, highlighting supplier impact.

| Factor | Impact | Mitigation |

|---|---|---|

| Specialized Tech | Increased Costs | Diversify Suppliers |

| Talent Scarcity | Unfavorable Terms | Internal Training |

| Data Feeds | Dependency | Diversify Sources |

Customers Bargaining Power

Large enterprise clients, managing substantial security budgets, wield significant bargaining power, enabling them to negotiate advantageous pricing and service conditions. Rapid7's ability to demonstrate clear ROI and deliver exceptional value is crucial. In 2024, the cybersecurity market is projected to reach $267.1 billion, emphasizing the financial stakes.

Switching costs for cybersecurity solutions like Rapid7's are moderately high due to complex migrations. This provides some customer lock-in. Competitors are actively reducing these costs with better migration tools. In 2024, companies spent an average of $2.7 million to recover from cyberattacks, incentivizing them to seek solutions with easier transitions.

Customers are now more price-sensitive because of the growing number of cybersecurity options. Showing the clear value and return on investment (ROI) is crucial. Flexible pricing and tiered services help address various customer needs. For example, a 2024 study shows a 15% rise in price-focused purchasing in the cybersecurity market. This shift impacts vendor strategies.

Demand for customized solutions

Some Rapid7 clients demand customized solutions, increasing their dependency on the company. Developing modular, adaptable solutions is crucial for efficiently meeting these diverse needs. This approach can balance customer power by providing flexibility. In 2024, the cybersecurity market saw a 12% rise in demand for tailored services. This trend emphasizes the importance of adaptable offerings.

- Customization increases customer dependency on Rapid7.

- Modular solutions efficiently address diverse client needs.

- Demand for tailored cybersecurity services rose 12% in 2024.

- Adaptability is key to balancing customer power.

Regulatory compliance needs

Customers in highly regulated sectors like finance and healthcare heavily depend on cybersecurity for compliance. Rapid7's proficiency in this area is a key factor in client retention. Offering solutions that meet evolving regulatory standards is crucial. Staying current with the latest cybersecurity mandates and providing compliance support is essential for Rapid7's success.

- In 2024, the global cybersecurity market is estimated at $200 billion.

- The healthcare sector is expected to spend $15 billion on cybersecurity by the end of 2024.

- Financial services firms face an average of 200 cyberattacks per month.

- Rapid7's revenue in 2023 was approximately $750 million.

Customer bargaining power varies based on client size and industry regulations. Large enterprises can negotiate favorable terms, impacting pricing. Customization needs can increase dependence on Rapid7.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Pricing Pressure | Large clients drive price negotiations. | Cybersecurity market reached $267.1B. |

| Customization | Increases customer dependence. | 12% rise in demand for tailored services. |

| Compliance | Key for retention in regulated sectors. | Healthcare sector to spend $15B. |

Rivalry Among Competitors

The cybersecurity market is fiercely competitive, with many firms providing similar solutions. This rivalry drives down prices and pushes companies to innovate rapidly. For example, in 2024, the cybersecurity market saw over 3,000 vendors vying for market share. Differentiating through specialized services and unique tech is crucial for survival.

Rapid7 faces intense competition, with rivals using aggressive marketing to capture market share. To compete, Rapid7 must invest in impactful marketing and brand development. A robust brand reputation and a clear value proposition are crucial for attracting and retaining customers. In 2024, cybersecurity spending is projected to reach $215 billion globally, highlighting the stakes.

Differentiating cybersecurity products is tough, often sparking price wars. Specializing, such as in vulnerability management, can help. Continuous innovation and unique features are essential for staying ahead. In 2024, the cybersecurity market is projected to reach $220 billion, intensifying competition.

Mergers and acquisitions

The cybersecurity industry is marked by frequent mergers and acquisitions, significantly influencing competitive dynamics. Companies must remain agile and responsive to market shifts to stay competitive. Keeping a close eye on competitor activities and strategic partnerships is crucial for success. In 2024, the cybersecurity M&A market saw a 15% increase in deal volume compared to the previous year, with valuations reaching record highs. This environment demands strategic foresight and adaptability.

- M&A volume increased by 15% in 2024.

- Valuations in the cybersecurity sector reached record highs.

- Strategic partnerships are essential for market positioning.

- Agility and adaptability are key to survival.

Global competition

Rapid7 contends with global cybersecurity companies, each offering varied products. Entering new markets geographically spreads risk. In 2024, the cybersecurity market is valued at over $200 billion. Adapting solutions to regional needs is vital. This includes adherence to local data privacy laws.

- Market size: The global cybersecurity market was estimated at $217.9 billion in 2024.

- Geographic expansion: Rapid7 has a presence in North America, Europe, Asia-Pacific, and Latin America.

- Key competitors: Includes companies like CrowdStrike, Palo Alto Networks, and Microsoft.

- Regulatory landscape: GDPR in Europe, CCPA in California, and other regional laws impact product development.

Competitive rivalry in the cybersecurity sector is intense, fueled by numerous vendors and aggressive market tactics. Rapid7 faces this directly, needing strong marketing and distinct solutions. The market's rapid growth and frequent M&A activity, exemplified by a 15% rise in M&A in 2024, amplify competitive pressures, demanding adaptability and strategic agility.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Size | Global Cybersecurity Market | $217.9 billion |

| M&A Activity | Increase in Deal Volume | 15% increase |

| Key Competitors | Major Players | CrowdStrike, Palo Alto Networks, Microsoft |

SSubstitutes Threaten

Open-source security tools pose a threat as substitutes, especially given their free or low-cost nature. Rapid7 must highlight its superior features, support, and seamless integration capabilities. For example, 2024 saw a rise in open-source SIEM adoption. Showing the total cost of ownership advantages is vital to compete.

Organizations might opt for DIY security, building solutions internally. This path is complex, demanding specialized expertise to be effective. Rapid7's managed services offer a simpler, supported alternative. In 2024, 35% of companies cited a lack of skilled staff as a top cybersecurity challenge, highlighting the appeal of external support.

Operating systems and software are integrating basic security features, which act as substitutes. Rapid7 must highlight its advanced, specialized solutions. In 2024, the global cybersecurity market was valued at $223.8 billion, showing the need for comprehensive protection. Demonstrating added value justifies the investment.

Consulting services

Cybersecurity consulting firms present a threat by offering advisory services as an alternative to Rapid7's technology. Consulting firms can provide tailored solutions, potentially reducing the need for Rapid7's specific products. Integrating consulting services with Rapid7's offerings, however, could create a more holistic solution, enhancing value. Building strong partnerships with consulting partners could expand Rapid7's market reach.

- The global cybersecurity consulting market was valued at $77.5 billion in 2023.

- Market is projected to reach $131.3 billion by 2028.

- North America held the largest share of the cybersecurity consulting market in 2023.

- The Asia-Pacific region is expected to grow at the highest CAGR during the forecast period.

Insurance policies

Cyber insurance policies pose a threat to Rapid7 as they cover breach costs, potentially decreasing the urgency for security investments. Rapid7 should showcase how its solutions lower risks, leading to reduced insurance premiums for clients. This strategy makes Rapid7 more attractive. Partnerships with insurance providers could create bundled offerings, providing comprehensive security and coverage. For example, in 2024, the cyber insurance market was valued at approximately $7.2 billion.

- Cyber insurance can offset the need for advanced security measures.

- Highlighting the risk-reducing benefits of Rapid7's solutions to lower premiums is essential.

- Bundling services with insurance providers creates attractive combined offerings.

- The cyber insurance market's substantial value underscores the importance of this threat.

Substitutes like open-source tools and DIY security solutions present challenges. Cybersecurity consulting firms offer advisory services, and cyber insurance can reduce the urgency for security investments. Rapid7 must emphasize its value and integrated solutions.

| Substitute | Threat | Rapid7 Strategy |

|---|---|---|

| Open-source tools | Free/low-cost alternatives. | Highlight superior features, support, and integration. |

| DIY security | Internal solutions with specialized expertise. | Offer managed services as a simpler alternative. |

| Cybersecurity consulting | Tailored advisory services. | Integrate consulting services and build partnerships. |

Entrants Threaten

Developing a cybersecurity platform like Rapid7's requires substantial upfront investment. This includes technology, infrastructure, and skilled personnel, creating a high barrier. The need for significant capital deters many potential new entrants in the market. Rapid7's strong financial position, with $724.5 million in revenue in 2023, allows for continuous innovation.

Brand reputation significantly impacts the threat of new entrants. Building a solid reputation in cybersecurity requires considerable time and resources. Existing brand recognition provides a competitive edge, fostering trust among clients. Marketing and public relations are vital for enhancing brand awareness; for instance, in 2024, cybersecurity firms allocated, on average, 12% of their budget to these areas to boost their brand's image.

New entrants face regulatory hurdles, requiring expertise in compliance. Tailoring solutions to specific regulations is key. Staying updated on evolving regulations is crucial for success. In 2024, the cybersecurity industry saw increased regulatory scrutiny, with companies needing to comply with standards like GDPR and CCPA. Penalties for non-compliance reached billions of dollars.

Technological expertise

The cybersecurity landscape demands deep technological expertise; new entrants must possess this to compete. Ongoing investment in research and development is vital for staying ahead of evolving threats. Attracting and retaining top cybersecurity talent offers a significant competitive advantage, as skills are paramount. The global cybersecurity market is projected to reach $345.4 billion in 2024, highlighting the high stakes.

- Market Growth: The global cybersecurity market is expected to reach $345.4 billion in 2024.

- R&D Spending: Companies must allocate significant resources to R&D.

- Talent Acquisition: Cybersecurity firms compete fiercely for skilled professionals.

- Competitive Advantage: Top talent and R&D provide a crucial edge.

Customer relationships

Customer relationships are critical for Rapid7. Building strong trust is essential in cybersecurity. Excellent customer service and support are key to retaining clients. Leveraging existing relationships for referrals boosts growth.

- Rapid7 was named a Leader in the 2024 Gartner Magic Quadrant for Vulnerability Assessment.

- Rapid7 provides solutions for threat detection and response.

- Rapid7's partners help expand its reach.

- Rapid7's total revenue was $280.8 million for the three months ended December 31, 2023.

The threat of new entrants to the cybersecurity market is moderate. High initial costs and brand recognition create barriers for new companies. Regulatory compliance and the need for technological expertise add to these challenges. The global cybersecurity market's value reached $345.4 billion in 2024, intensifying competition.

| Factor | Impact | Details (2024) |

|---|---|---|

| Capital Needs | High | R&D investments essential for new tech, high costs. |

| Brand Recognition | Significant | Established brands gain client trust easily, market share. |

| Regulatory Hurdles | Complex | GDPR, CCPA compliance is costly; billions in penalties. |

Porter's Five Forces Analysis Data Sources

Our Porter's analysis draws data from SEC filings, financial statements, market share data, and industry research reports. We leverage reliable data sources to assess industry forces.