Rathbone Brothers Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rathbone Brothers Bundle

What is included in the product

Clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs

A clean, distraction-free view optimized for C-level presentation, highlighting key strategies.

Full Transparency, Always

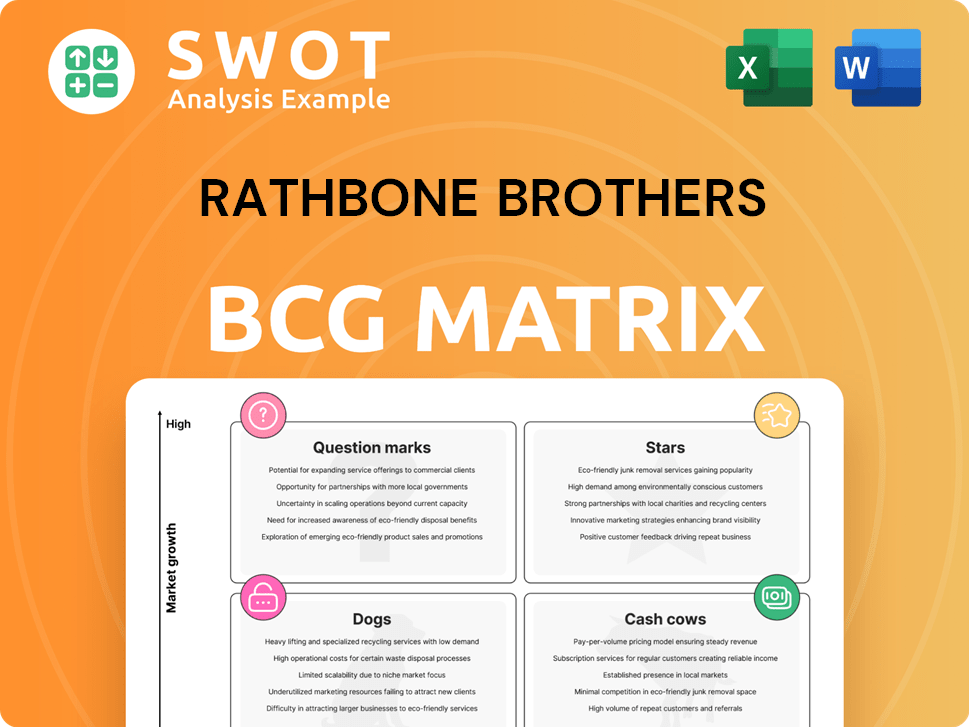

Rathbone Brothers BCG Matrix

The BCG Matrix preview displays the exact file you'll download after purchase. This ready-to-use report is fully formatted, offering strategic insights without any hidden elements.

BCG Matrix Template

Rathbone Brothers' BCG Matrix helps clarify their product portfolio's health. It categorizes offerings into Stars, Cash Cows, Dogs, and Question Marks, showing their market position. This overview provides a glimpse of their strategic priorities and potential challenges. Analyzing these quadrants reveals resource allocation decisions and growth opportunities. The full BCG Matrix offers a comprehensive breakdown, giving you actionable strategic insights to drive your investment decisions.

Stars

The integration of Investec Wealth & Investment (IW&I) has been a game-changer for Rathbones. This strategic move significantly increased Funds Under Management and Administration (FUMA). By the close of 2024, FUMA hit £109.2 billion. This integration sets the stage for growth and innovation.

In 2024, Rathbones experienced record gross inflows, a direct result of its expanded platform following the IW&I merger. This strategic move significantly boosted its capacity to attract new clients and manage more capital. The inflows, coupled with positive investment performance, led to a 5.2% increase in funds under management (FUM) to £60.9 billion by the end of 2024. This shows their strong market position.

Rathbone Brothers, under the "Stars" quadrant of the BCG Matrix, impressively surpassed its synergy goals in 2024. The firm achieved this through its IW&I combination, showcasing effective integration strategies. By the end of 2024, Rathbones had already realized £30.1 million in run-rate synergies, demonstrating efficiency.

Underlying Operating Margin Growth

Rathbones has demonstrated a strong ability to expand its underlying operating margin. In 2024, this margin reached 25.4%, reflecting effective cost management and revenue generation strategies. The company's strategic goal is to boost this to 30% by September 2026, indicating ambitious growth plans. This focus on margin expansion highlights its commitment to improving profitability and efficiency.

- 2024 Underlying Operating Margin: 25.4%

- Target Underlying Operating Margin (September 2026): 30%

Strong Financial Performance

Rathbone Brothers, categorized as a "Star" in the BCG Matrix, demonstrated robust financial health in 2024. The company's underlying profit before tax surged impressively, reaching £227.6 million, a remarkable 79.1% increase. This significant growth underscores the successful integration of IW&I and the effective realization of synergies. This performance solidifies Rathbone's position as a strong performer.

- 79.1% increase in underlying profit before tax.

- Profit reached £227.6 million in 2024.

- Successful IW&I combination.

- Effective synergy delivery.

Rathbones, as a "Star," showed strong 2024 performance.

Funds under management and administration (FUMA) reached £109.2 billion, driven by the IW&I merger.

Underlying profit before tax surged to £227.6 million. This increase of 79.1% shows strong synergy.

| Metric | 2024 Value | % Change |

|---|---|---|

| FUMA | £109.2B | N/A |

| Underlying Profit Before Tax | £227.6M | +79.1% |

| Underlying Operating Margin | 25.4% | N/A |

Cash Cows

Rathbones' discretionary investment management is a cash cow. It holds a solid market share and provides steady revenue. Client retention is high due to its reputation and personalized service. In 2024, Rathbones managed £63.7 billion in funds.

Rathbone Brothers' wealth management arm is a cash cow, offering consistent revenue via its loyal client base and fee arrangements. In 2024, this segment saw a substantial boost, with underlying profit before tax soaring by 91.8%. This indicates strong profitability and efficiency within the wealth management division.

Rathbones' financial planning services, boosted by Saunderson House, provide consistent revenue. In 2024, they aimed to expand advice revenues, focusing on advisor capacity. The company highlighted a 12.7% increase in funds under management in their Q1 trading update. This growth is driven by meeting client needs effectively.

Trust and Company Management

Trust and company management at Rathbones are cash cows, offering a consistent revenue stream. These services thrive on the firm's established reputation and wealth management expertise, providing a dependable income source. In 2023, Rathbones' total discretionary and managed funds increased to £63.7 billion. The stable nature of these services supports Rathbones' financial health.

- Provides steady income due to long-standing reputation.

- Services benefit from expertise in wealth management.

- Represents a reliable revenue source for Rathbones.

- Managed funds grew to £63.7B in 2023.

Unit Trust Business

Rathbones' unit trust business acts like a cash cow, offering a stable income stream. It serves as a key platform for their asset management services. Despite the tough market for active managers, it still brings in reliable revenue. In 2024, the unit trust sector saw about £1.3 trillion in assets.

- Steady Income: Generates consistent revenue.

- Asset Management Platform: Supports broader service offerings.

- Market Challenges: Faces headwinds in active management.

- Revenue Contribution: Remains a key revenue source.

Rathbones' cash cows generate reliable revenue, like discretionary investment management, wealth management, financial planning, and trust services.

These services benefit from high client retention and strong market positions.

In 2024, these segments contributed significantly to the firm's financial health.

| Service Area | Key Feature | 2024 Data Point |

|---|---|---|

| Wealth Management | Underlying Profit | Up 91.8% |

| Funds Managed (total) | Discretionary/Managed Funds | £63.7 billion |

| Financial Planning | Focus | Expand advice revenue |

Dogs

Execution-only services faced net outflows, partly from closing a major, low-margin account. This segment's profitability needs assessment to boost returns. In 2024, similar services saw a 5% drop in assets.

Legacy IT systems at Rathbone Brothers can slow efficiency and innovation, impacting competitiveness. Modernization is key for better operational performance. In 2024, many financial firms are investing heavily in IT upgrades, with spending expected to reach billions globally. This is due to the need to stay competitive in the financial sector.

Single strategy funds have struggled, experiencing net outflows as investors shift focus. These funds might require a re-evaluation to regain investor confidence. For example, in 2024, some single-strategy funds saw outflows of up to 10%. Restructuring could involve diversifying strategies or lowering fees.

Underperforming Acquisitions

Underperforming acquisitions at Rathbone Brothers could be a concern if they haven't met expected financial targets or are poorly integrated. These units may drag down overall performance, requiring immediate action. In 2023, similar issues led to write-downs in the financial sector, as reported by the Financial Times. Restructuring or selling off underperforming assets might be necessary to improve profitability.

- Financial performance of the acquired entity is below projections.

- Integration challenges lead to operational inefficiencies.

- The acquisition fails to achieve the expected synergies.

- Market conditions shift, making the acquisition less viable.

High Compliance Costs

High compliance costs can severely impact a business's profitability. Increased regulatory scrutiny, particularly in 2024, has led to escalating expenses. These costs can be especially damaging if they outpace revenue growth. Effective management and optimization of compliance processes are essential for survival.

- Compliance costs can represent a significant portion of operational expenses, potentially up to 15-20% for heavily regulated industries.

- Failure to comply can result in substantial fines and legal fees, which can be in the millions of dollars.

- Investing in technology and automation can streamline compliance, reducing costs by up to 30%.

- Businesses in the financial sector face the most rigorous compliance requirements, with costs often higher.

Dogs represent businesses with low market share in slow-growing markets, often generating low or negative returns. Rathbone Brothers may have Dogs, such as underperforming acquisitions. These require careful evaluation, possibly divestiture, to prevent them from draining resources.

| Category | Description | Financial Impact |

|---|---|---|

| Characteristics | Low market share, slow-growth market. | May generate low/negative returns, drains resources. |

| Examples | Underperforming acquisitions, legacy services. | Requires strategic review. |

| Actions | Divestiture, restructuring. | Aim to free up capital and resources. |

Question Marks

Rathbone Brothers' digital transformation, highlighted by the InvestCloud CLM system, fits the question mark quadrant. These initiatives promise high growth but demand substantial capital. Successful tech adoption is vital, with digital transformation spending in the financial sector estimated at $18.8 billion in 2024. The financial sector's digital transformation is growing by 12% annually.

Rathbones can capitalize on the growing interest in sustainable investing. Expanding its offerings in this area could draw in new clients. In 2024, ESG assets reached approximately $40 trillion globally. This strategy aligns with market trends and client preferences. This could improve Rathbones' market position.

Expanding into international markets presents significant growth for Rathbone Brothers. This move requires careful planning and investment to be successful. Targeting high-net-worth individuals in emerging economies could be strategic. In 2024, the wealth management sector saw increased global demand. For example, assets under management (AUM) in Asia grew by 10% year-over-year.

Strategic Alliances and Acquisitions

Rathbones could boost its offerings by forming strategic alliances and acquiring specialized investment firms. This would broaden their service range and potentially attract new clients. These moves demand careful assessment and smooth integration to succeed. In 2024, the financial services sector saw a rise in such activities, with mergers and acquisitions reaching a certain value.

- 2024 saw a rise in financial services M&A.

- Due diligence is crucial for successful integration.

- Strategic alliances can expand service portfolios.

- Acquisitions can bring in niche investment strategies.

AI and Technology Integration

Embracing AI and technology is crucial for Rathbone Brothers, positioning it as a Question Mark in the BCG Matrix. This involves significant investment in research and development, aiming to enhance investment processes and client services. Talent acquisition becomes vital to successfully integrate these advanced technologies. The focus is on gaining a competitive edge through innovation.

- Investment in AI in the financial sector is projected to reach $20 billion by the end of 2024.

- Companies that effectively use AI see a 15% increase in operational efficiency.

- The demand for AI specialists in finance has grown by 25% in the last year.

- Rathbone Brothers' ability to capitalize on these trends will determine its future market position.

Rathbone Brothers' ventures in AI and technology place them in the Question Mark category. These initiatives demand high investment but offer potential high growth, like the projected $20 billion investment in AI for 2024. Success hinges on effective talent and integration to stay competitive. These investments could redefine their market position.

| Aspect | Details | 2024 Data |

|---|---|---|

| AI Investment | Financial Sector | $20 Billion Projected |

| Efficiency Gain | AI Adoption | 15% Increase |

| Talent Demand | AI Specialists | 25% Growth |

BCG Matrix Data Sources

The BCG Matrix relies on financial statements, market analysis, and competitor benchmarks. Our findings come from trusted data and industry insights.