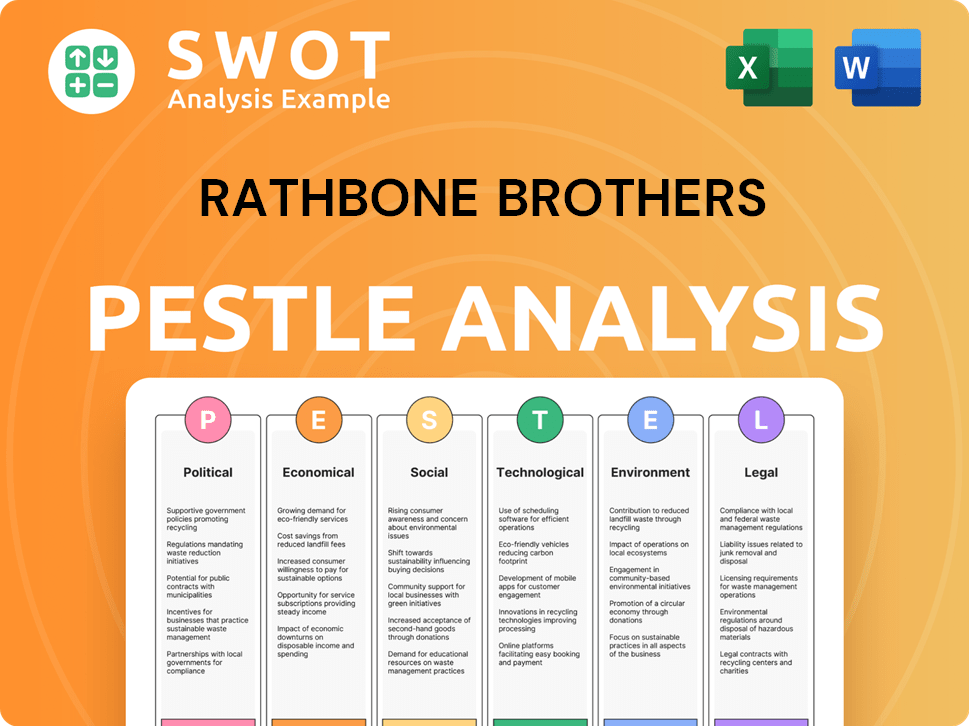

Rathbone Brothers PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rathbone Brothers Bundle

What is included in the product

It helps identify threats/opportunities via Political, Economic, Social, Technological, Environmental, and Legal factors.

Helps support discussions on external risk during planning sessions.

Full Version Awaits

Rathbone Brothers PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This comprehensive Rathbone Brothers PESTLE Analysis details key factors impacting the business. Explore political, economic, social, technological, legal, and environmental aspects. Understand the current state of the firm. Ready for immediate download!

PESTLE Analysis Template

Explore the forces shaping Rathbone Brothers' future with our PESTLE analysis. We dissect political, economic, social, technological, legal, and environmental factors. This analysis offers a clear snapshot of the external landscape. Understand key trends and how they impact the firm’s performance. Get actionable insights. Download the full version to enhance your strategy.

Political factors

Government policies significantly shape Rathbones' landscape. Regulatory shifts in financial services, investment, and wealth management directly affect operations and compliance. For instance, the Financial Conduct Authority (FCA) regularly updates rules. In 2024, the FCA increased scrutiny on investment firms' capital adequacy. This impacts how Rathbones manages capital.

Political stability significantly impacts Rathbones. The UK's stable political climate supports its financial services. Brexit and global events introduce uncertainty; however, the UK's GDP grew by 0.1% in Q1 2024, showing resilience. This stability is key for investor confidence and business continuity.

Changes in tax laws significantly impact investment strategies and client needs. For instance, the UK's capital gains tax rate is currently up to 28% for residential property. Recent adjustments in income tax brackets also affect disposable income, influencing investment decisions. In 2024/2025, wealth managers must stay informed on these shifts to advise clients effectively.

International Relations and Trade Agreements

Geopolitical events and revisions to international trade agreements significantly influence cross-border investments and capital flows, directly impacting Rathbones' international operations and its diverse client base. The UK's exit from the European Union, for example, has prompted adjustments in financial regulations affecting cross-border transactions. The World Bank reported that in 2024, global trade growth slowed to 2.6%, a decrease from the 3.1% in 2023, showing vulnerabilities.

- Brexit-related adjustments to financial regulations.

- Slowing global trade growth.

- Changes in tariffs and trade barriers.

- Geopolitical tensions impacting investment decisions.

Government Spending and Fiscal Policy

Government spending and fiscal policies significantly affect economic growth, inflation, and interest rates, impacting financial markets and Rathbones' operational environment. For instance, in 2024, the UK government's budget deficit is projected around £120 billion. Changes in corporation tax, such as the increase to 25% in the UK, directly affect corporate profitability and investment decisions. These factors shape the investment landscape and influence Rathbones' strategic planning.

- UK's budget deficit projected at £120 billion in 2024.

- Corporation tax in the UK increased to 25%.

Political factors critically impact Rathbones, influencing regulatory compliance and operational strategies. Government policies, such as financial service regulations, and tax laws like capital gains tax, require continuous adaptation. Political stability, while generally supportive, faces uncertainties from global events, influencing investor confidence.

| Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Regulatory Changes | Compliance costs, operational adjustments | FCA scrutiny on capital adequacy continues |

| Taxation | Investment strategy shifts | UK capital gains tax up to 28% |

| Political Stability | Investor confidence, business continuity | UK GDP grew 0.1% in Q1 2024 |

Economic factors

Economic growth directly influences investor behavior and the demand for financial services. Robust economic conditions often boost investment, as seen in the U.S., with GDP growth of 3.3% in Q4 2023. Conversely, a recession can curb investment, potentially decreasing assets under management. For example, a 1% drop in GDP might correlate with a 0.5% decrease in investment activity.

Interest rate fluctuations, dictated by central banks, impact borrowing costs and investment returns. This directly influences the appeal of various asset classes, affecting Rathbones' financial service offerings. For instance, the Bank of England held the base rate at 5.25% in May 2024, influencing mortgage rates and investment decisions. Changes in rates affect the investment strategies Rathbones recommends to clients. The current economic climate necessitates careful consideration of interest rate sensitivities in portfolio construction.

Inflation diminishes the value of money and investments. In the UK, the Consumer Prices Index (CPI) rose by 3.2% in March 2024, a slight decrease from 3.4% in February. High inflation prompts clients to adjust investment strategies to preserve capital, potentially affecting Rathbone's asset allocation. Rising costs, influenced by inflation, can also increase Rathbone's operational expenses.

Market Volatility

Market volatility poses a significant risk for Rathbone Brothers. Fluctuations in financial markets, encompassing stocks, bonds, and currencies, directly influence the value of managed assets and investment portfolio performance. High volatility can lead to unpredictable returns, impacting client confidence and potentially causing shifts in investment strategies. For instance, the VIX index, a measure of market volatility, saw notable spikes in 2024, reflecting increased uncertainty. This volatility necessitates careful risk management by Rathbones.

- VIX index reached 20-30 range in Q1 2024.

- Bond market volatility impacted by interest rate changes.

- Currency fluctuations affect international asset values.

- Rathbones' AUM influenced by market performance.

Disposable Income and Wealth Distribution

The amount of disposable income and how wealth is spread out significantly impact Rathbones' client potential. A rise in the affluent population often boosts the need for wealth management. Recent data shows that the top 1% in the UK holds over 25% of the total wealth. This concentration underscores the market opportunity.

- UK household disposable income grew by 1.3% in Q4 2023.

- The wealth gap continues to widen, with the richest getting richer.

- Demand for wealth management services is expected to increase.

Economic conditions critically affect Rathbones. GDP growth influences investor behavior and financial service demand; the U.S. saw 3.3% growth in Q4 2023.

Interest rates are a key factor; the Bank of England's rate at 5.25% affects investment choices and Rathbones' strategies, with rates set to influence mortgage rates and investment decisions.

Inflation and market volatility create significant risks, impacting asset values and operational costs; UK CPI was at 3.2% in March 2024, and the VIX index reflected market uncertainty.

Disposable income distribution influences client potential; the UK's top 1% holds over 25% of wealth, affecting the need for wealth management services and creating strategic market opportunities.

| Factor | Impact | Recent Data |

|---|---|---|

| GDP Growth | Affects investment | US Q4 2023: 3.3% |

| Interest Rates | Influence investments | BoE base rate: 5.25% (May 2024) |

| Inflation | Diminishes value | UK CPI (Mar 2024): 3.2% |

Sociological factors

Rathbones faces demographic shifts. An aging population boosts demand for retirement and estate planning services. Wealth distribution changes, like Gen X and Millennials gaining wealth, alter service needs. In the UK, over-65s make up 19% of the population in 2024, increasing demand. These trends affect Rathbones' strategy.

Societal views on wealth, saving, and investing are changing. There's rising interest in ethical and responsible investing. In 2024, ESG assets hit $30 trillion globally, with 60% of investors considering ESG factors. This shift impacts client choices and investment product demand.

Education and financial literacy significantly shape the demand for wealth management services. A financially literate populace better understands investment products, increasing the likelihood of seeking expert advice. Recent studies show that only about 34% of U.S. adults are considered financially literate as of early 2024. This impacts the adoption of services like those offered by Rathbone Brothers.

Cultural Values and Trust

Cultural values and trust significantly influence client relationships and firm reputation for companies like Rathbones. High trust levels in financial institutions are crucial for attracting and keeping clients. Trust impacts investment decisions and the willingness to seek financial advice. In 2024, global trust in financial services remained a key concern, with only 53% of consumers fully trusting their financial advisors, according to a recent survey by Edelman.

- Edelman's 2024 Trust Barometer indicated that trust in financial services globally is moderate, but varies significantly by region.

- Client retention rates often correlate with the level of trust, with higher trust leading to increased loyalty.

- Cultural differences affect how trust is built and maintained, requiring firms to tailor their approaches.

Social Responsibility and Ethical Considerations

Societal expectations for corporate social responsibility (CSR) and ethical conduct significantly shape perceptions of Rathbones. The firm's commitment to responsible investment, including environmental, social, and governance (ESG) factors, is increasingly crucial. In 2024, ESG-focused assets under management (AUM) are projected to reach \$50 trillion globally. Community engagement initiatives also play a vital role.

- 2024: ESG assets projected to reach \$50T globally.

- Rathbones' focus on ethical investment practices.

- Importance of community engagement for reputation.

Sociological factors significantly influence Rathbones' operations. Changing societal views boost ethical investment demand. ESG assets are predicted to hit \$50T globally in 2024. Trust, particularly crucial, directly affects client retention rates.

| Factor | Impact | 2024 Data |

|---|---|---|

| ESG Assets | Client Demand | Projected \$50T Globally |

| Financial Literacy | Service Uptake | 34% Financially Literate in U.S. |

| Trust in Advisors | Client Retention | 53% Fully Trust Financial Advisors |

Technological factors

Digitalization is key for Rathbones. In 2024, 75% of wealth management clients used digital platforms. Offering user-friendly and secure online services is crucial. This includes mobile apps and online portals. Digital adoption boosts client engagement and operational efficiency. Cyber security spending is up 15% in 2024.

Rathbones, like all financial institutions, confronts escalating cybersecurity threats. In 2024, the financial sector saw a 28% rise in cyberattacks. Strong cybersecurity is vital for retaining client trust and adhering to data protection laws like GDPR. Recent data indicates cybercrime costs the global financial industry billions annually; in 2024, it reached $3.4 billion.

Rathbone Brothers faces technological shifts. Automation and AI are transforming portfolio management, client service, and back-office functions. These technologies boost efficiency and lower costs. However, they also necessitate investments in new tech and may affect staffing levels. In 2024, the financial services sector saw a 15% increase in AI adoption, according to a recent industry report.

Data Analytics and Big Data

Rathbones can leverage data analytics to understand clients better and spot market opportunities. This involves collecting and analyzing vast datasets to personalize services and improve investment strategies. For example, the global big data analytics market is projected to reach $684.12 billion by 2025. This growth shows the increasing importance of data-driven decision-making in finance.

- Personalized services: Tailoring financial advice to individual client needs.

- Market trend identification: Using data to predict and capitalize on emerging trends.

- Risk management: Employing analytics to assess and mitigate financial risks.

- Operational efficiency: Optimizing internal processes through data insights.

Fintech Innovation

Fintech innovation significantly impacts Rathbones. The rise of digital payments and robo-advisors challenges traditional wealth management. In 2024, global fintech investments reached $146.8 billion. Rathbones could partner with fintechs to enhance services or face competitive threats. Adapting to these technological advancements is crucial for staying relevant.

- Fintech investments in 2024: $146.8B

- Robo-advisors manage billions globally

- Digital payments are rapidly growing

- Partnerships offer growth opportunities

Rathbones navigates tech shifts like automation and AI to transform portfolio management and reduce costs. Cybersecurity remains crucial, as financial sector cyberattacks rose by 28% in 2024, costing the industry billions. Data analytics helps personalize services, with the global market projected to reach $684.12 billion by 2025.

| Technology Aspect | Impact on Rathbones | Data/Stats (2024) |

|---|---|---|

| Digitalization | Enhanced client engagement, operational efficiency. | 75% clients use digital platforms; cybersecurity spending +15% |

| Cybersecurity | Vital for trust and GDPR compliance. | Financial sector cyberattacks +28%; global cost $3.4B |

| AI & Automation | Efficiency gains, cost reduction. | Financial sector AI adoption +15% |

| Data Analytics | Personalized services, market opportunity spotting. | Big data market proj. $684.12B by 2025 |

| Fintech | Competition, need for partnerships. | Fintech investments $146.8B |

Legal factors

Rathbones must comply with UK's FCA and PRA regulations. These rules govern financial conduct and stability. In 2024, regulatory compliance costs for financial firms rose by approximately 7%. Changes may necessitate operational adjustments. Failure to comply can lead to penalties.

Client protection laws are crucial for Rathbone Brothers. These laws, focused on transparency and advice suitability, shape client interactions. For instance, the Financial Conduct Authority (FCA) in the UK enforces strict standards. In 2024, the FCA handled over 400,000 complaints. Compliance with these regulations is essential for maintaining trust and avoiding penalties.

The UK and EU's GDPR significantly impacts Rathbones. These regulations mandate strict data handling, requiring strong security protocols. In 2024, data breaches cost companies an average of $4.45 million globally. Compliance is crucial to avoid hefty fines, potentially up to 4% of annual global turnover. Rathbones must invest heavily in data protection.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Regulations

Rathbones faces strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. These rules are crucial to stop its services from being used for illegal activities. This includes thorough client checks and detailed reporting. In 2024, the Financial Conduct Authority (FCA) fined firms over £100 million for AML failings. Compliance is costly, but essential for maintaining trust and avoiding penalties.

- Client due diligence processes are vital.

- Reporting suspicious activities is a must.

- Ongoing monitoring is necessary.

- Failure leads to hefty fines.

Contract Law and Litigation

Rathbones, like any financial firm, operates under contract law, governing agreements with clients and suppliers. Litigation risk, though, is a constant concern. Legal disputes can arise from various issues, impacting financial performance and reputation. Managing these legal factors is crucial for stability and investor confidence.

- In 2024, the financial services industry saw a 15% increase in litigation costs.

- Rathbones' legal expenses were approximately £12 million in the last fiscal year.

- Effective risk management can reduce litigation by up to 20%.

- Compliance failures led to $500 million in fines for similar firms.

Rathbone Brothers operates under rigorous UK and EU legal frameworks like the FCA, GDPR, and AML/CTF regulations. These rules necessitate compliance with detailed operational procedures and reporting mandates. In 2024, firms faced increased compliance costs; for example, the financial services sector saw a 15% rise in litigation expenses.

The firm's contracts and client interactions are subject to contract and client protection laws. The Financial Conduct Authority handled over 400,000 complaints. In the past fiscal year, Rathbone's legal expenses were around £12 million. Data breaches cost about $4.45 million globally in 2024.

Failure to adhere to legal standards leads to serious penalties, like fines. For example, the FCA levied over £100 million in fines for AML failings. Data protection failures can incur penalties of up to 4% of a company's annual global turnover.

| Regulatory Area | Compliance Challenge | Impact in 2024/2025 |

|---|---|---|

| Financial Conduct (FCA/PRA) | Operational adjustments | Compliance costs rose by approximately 7%. |

| Data Protection (GDPR) | Data security | Average data breach cost: $4.45M. |

| Anti-Money Laundering (AML) | Client due diligence | FCA fines > £100M for AML failures. |

Environmental factors

Climate change and environmental concerns fuel ESG investing's growth. Rathbones meets this demand with sustainable investment options. In 2024, ESG assets hit $40 trillion globally. Rathbones' focus on ESG aligns with client values and market trends. This is expected to grow by 15% by the end of 2025.

Rathbones, like all firms, must adhere to environmental regulations. These cover office buildings, energy use, and waste. Compliance costs can impact profitability. The UK's focus on sustainability is increasing such demands. Recent data shows rising energy prices, potentially increasing operational expenses.

Rathbones faces rising energy costs, impacting operational expenses, especially for office spaces and data centers. Energy prices in the UK increased by 6.5% in 2024, affecting business profitability. Resource scarcity concerns, like water, may also raise operational costs. These factors necessitate sustainable practices to mitigate financial impacts.

Supply Chain Environmental Impact

Rathbones, though service-oriented, faces indirect environmental risks through its supply chain. Supplier environmental practices increasingly influence a company's reputation. In 2024, 68% of consumers considered a company's environmental impact when making purchasing decisions. Proactive engagement with suppliers is crucial for mitigating risks.

- Supply chain emissions account for up to 80% of a company's total carbon footprint.

- Companies with strong ESG (Environmental, Social, and Governance) ratings often experience higher valuations.

- Regulatory pressures, like the EU's Corporate Sustainability Reporting Directive (CSRD), demand greater supply chain transparency.

Physical Risks from Climate Change

Physical risks from climate change pose a significant threat to Rathbone Brothers. Extreme weather events, such as floods and storms, could disrupt their business operations. These events can also affect the value of investments in client portfolios, impacting returns. The Bank of England's 2024 Climate Biennial Exploratory Scenario highlighted potential financial instability due to climate risks. These factors necessitate careful consideration in investment strategies.

- Disruptions from extreme weather could lead to financial losses.

- Investment values may fluctuate due to climate-related events.

- Regulatory bodies are increasingly scrutinizing climate risk exposure.

Rathbones faces environmental risks from climate change, energy costs, and supply chain factors. Extreme weather events pose physical risks, potentially disrupting operations and investment values. In 2024, the UK saw energy prices rise by 6.5%, and ESG assets reached $40 trillion.

| Environmental Factor | Impact on Rathbones | Recent Data (2024-2025) |

|---|---|---|

| Climate Change | Physical disruption to operations & investments | Bank of England highlighted financial instability risk; extreme weather events on the rise |

| Energy Costs | Increased operational expenses, especially for offices | UK energy price increase by 6.5% (2024); impacting profitability |

| Supply Chain | Indirect risks to reputation & regulatory compliance | 68% consumers consider environmental impact; supply chain emissions account for 80% carbon footprint |

PESTLE Analysis Data Sources

Rathbone Brothers' PESTLE analyzes data from governmental, financial institutions & industry reports.