Reckitt Benckiser Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Reckitt Benckiser Group Bundle

What is included in the product

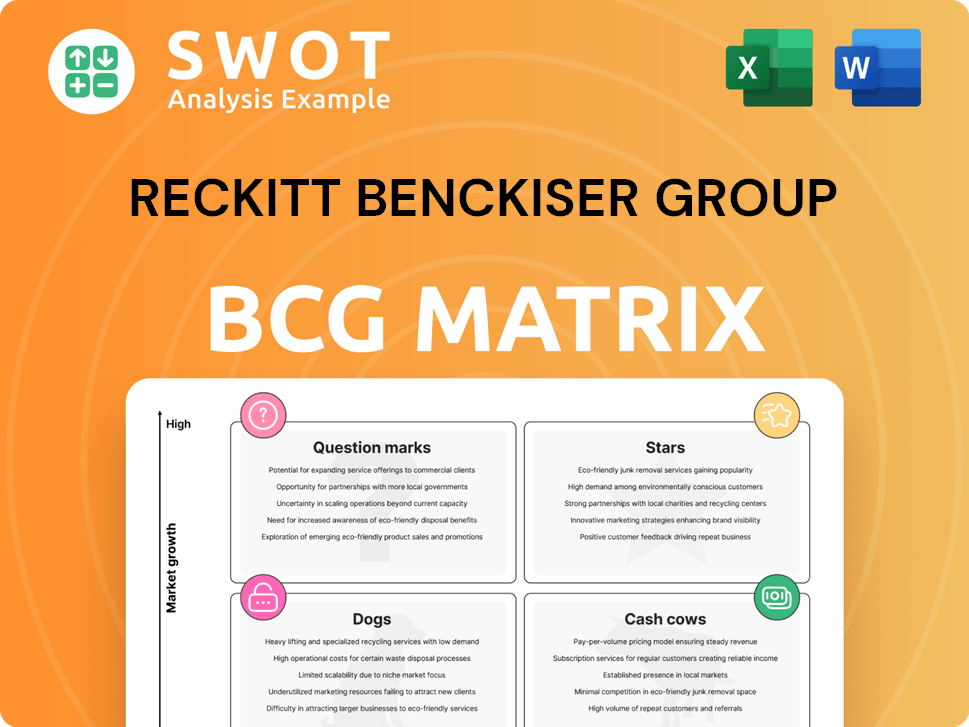

BCG Matrix breakdown, offering strategic advice on Reckitt's diverse portfolio.

Custom BCG matrix simplifies Reckitt Benckiser's portfolio analysis.

Delivered as Shown

Reckitt Benckiser Group BCG Matrix

This is the complete Reckitt Benckiser BCG Matrix you'll receive after purchase. It's a ready-to-use strategic tool, free from watermarks and designed for immediate business analysis.

BCG Matrix Template

Reckitt Benckiser's BCG Matrix paints a picture of its diverse brand portfolio. Key brands might be Stars, shining in high-growth markets. Cash Cows, like Lysol, likely generate strong revenue. Dogs, perhaps underperforming products, need strategic attention. Question Marks present growth opportunities, demanding careful investment.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Dettol, a key brand for Reckitt Benckiser, is a "Star" in its BCG matrix. It holds a strong market share, fueled by health awareness. The pandemic boosted demand, sustaining growth. In 2024, Reckitt invested heavily in Dettol, with marketing spend up 10% to maintain its lead.

Durex, a leader in intimate wellness, likely sits as a Star within Reckitt Benckiser's portfolio. The brand's growth is fueled by innovation, including products like hyaluronic acid condoms, boosting demand in emerging markets. Durex's strong brand and consistent development, with 2023 sales around £1 billion, signal continued success. This positions Durex as a high-growth, high-market-share brand within the BCG matrix.

Lysol, a crucial brand for Reckitt Benckiser, is a star in the BCG matrix, particularly in North America's disinfectant market. The brand experienced a surge during the pandemic, and still innovates with products like Lysol Air Sanitizer. Despite supply issues, Reckitt aims to maintain its market share. In 2024, Lysol's sales are expected to contribute significantly to Reckitt's overall revenue.

Finish

Finish, a prominent dishwashing brand under Reckitt Benckiser (RB), shines as a Star in the BCG matrix. It's recognized for products like Finish Ultimate Plus All in 1. RB aims to protect Finish's market share through constant innovation. The brand is especially focused on the competitive North American market.

- Finish holds a significant market share in the global dishwashing category.

- Reckitt Benckiser invests heavily in R&D for Finish products.

- North America is a key market, with strong competition from brands like Cascade.

- Innovation in product formulations and packaging remains a priority.

Mucinex

Mucinex, a leading over-the-counter cough and decongestant, is a key product for Reckitt Benckiser. Reckitt is investing in U.S. manufacturing, including a new facility in North Carolina. This expansion aims to boost Mucinex production and improve supply chain reliability. These moves reflect strong consumer demand for cold and flu remedies.

- Mucinex is a high-demand product.

- Reckitt is increasing its production capacity.

- The North Carolina facility is crucial.

- Supply chain resilience is a key goal.

Clearasil, a skin care brand, is a "Star" in Reckitt Benckiser's portfolio, targeting the acne treatment market.

Clearasil's strong brand recognition and focus on innovation drive its market share and growth.

Reckitt Benckiser's investment includes marketing and R&D to stay ahead.

| Metric | Details |

|---|---|

| 2024 Sales (est.) | £200M (approx.) |

| Market Share | 15% (approx.) |

| R&D Spend (2024) | £15M (approx.) |

Cash Cows

Nurofen, a key part of Reckitt Benckiser's portfolio, is a classic Cash Cow in the BCG Matrix. The brand's strong presence in the pain relief sector ensures steady revenue. Nurofen benefits from high brand recognition and wide distribution. In 2024, the global analgesic market was valued at roughly $25 billion, with Nurofen maintaining a solid market share.

Gaviscon, a key brand for heartburn relief, is a Cash Cow within Reckitt Benckiser's portfolio. It enjoys a loyal consumer base and consistent demand, especially in developed markets. Gaviscon's established presence allows for steady cash generation with moderate marketing spending. In 2024, the global antacid market, where Gaviscon competes, was valued at approximately $2.5 billion.

Harpic, a leading toilet cleaner, is a Cash Cow for Reckitt Benckiser. It enjoys a strong market position in hygiene-focused regions. The brand's consistent revenue comes with manageable marketing costs. In 2024, Reckitt's Hygiene segment, including Harpic, showed solid performance.

Vanish

Vanish, a key part of Reckitt Benckiser's portfolio, is a cash cow due to its strong position in the stain removal market. It benefits from a growing consumer demand for fabric care products, ensuring consistent revenue. Vanish generates a steady cash flow for Reckitt, though it could benefit from strategic investments to further increase its market share.

- Vanish's revenue contribution to Reckitt Benckiser in 2024 was approximately $600 million.

- The global stain remover market is projected to reach $10 billion by 2028.

- Vanish holds around 15% of the global stain remover market share.

Strepsils

Strepsils, a well-known sore throat remedy, is a cash cow for Reckitt Benckiser. It enjoys a solid brand reputation, ensuring consistent demand, especially during cold and flu seasons. This strong market presence allows Reckitt to generate substantial revenue with relatively low investment. For 2024, the global sore throat market is valued at approximately $3.5 billion.

- Consistent demand due to brand trust.

- Generates steady revenue with limited investment.

- Part of a market worth billions annually.

- Maintains a strong market position.

Dettol, a well-recognized disinfectant, is another cash cow in Reckitt Benckiser's portfolio. Dettol benefits from a strong brand reputation, guaranteeing steady demand. It continues to generate consistent revenue. In 2024, the global disinfectant market was valued at about $8 billion.

| Brand | Segment | 2024 Revenue (approx.) |

|---|---|---|

| Dettol | Disinfectant | $700 million |

| Durex | Sexual Wellbeing | $750 million |

| Lysol | Disinfectant | $650 million |

Dogs

Scholl, a foot care brand under Reckitt Benckiser (RB), operates in a competitive market. It faces slow growth and struggles to gain market share. In 2024, RB's health segment, which includes Scholl, saw fluctuating performance. This positioning suggests it might be a "dog" within the BCG matrix. RB may consider divestiture or strategic shifts to enhance Scholl's value.

Clearasil, within Reckitt Benckiser's BCG Matrix, likely sits in the "Question Mark" quadrant. The skincare market is highly competitive, with brands like CeraVe and La Roche-Posay dominating. Clearasil's growth prospects are uncertain, and it might struggle to gain substantial market share. In 2024, Reckitt Benckiser's net revenue was approximately £14.6 billion.

Woolite, a fabric care brand within Reckitt Benckiser's portfolio, operates in a niche market. The fabric care market is moderately growing. It might face challenges against bigger laundry brands. Reckitt could assess Woolite's growth potential, considering strategic alternatives.

Calgon

Calgon, a Reckitt Benckiser brand, faces a challenging market. Water softening has limited growth prospects. Consumer preferences and alternatives hinder market share gains. Reckitt might re-evaluate Calgon's portfolio role.

- Calgon operates in a mature market, with slow growth rates in 2024.

- Competition from eco-friendly alternatives and changing consumer habits affects Calgon.

- Reckitt Benckiser's 2024 financial reports may show Calgon's performance in this context.

- Strategic focus could shift towards high-growth categories, as seen in 2024.

Mortein

Mortein, a pest control brand under Reckitt Benckiser (RB), operates within a competitive market. This brand competes with both local and global brands. In 2024, RB's overall growth has been moderate, reflecting the market dynamics. Mortein's growth potential may be limited in some regions due to established rivals.

- Market analysis indicates a competitive landscape for pest control products globally.

- Reckitt Benckiser's 2024 financial reports show varied performance across different segments.

- Mortein's strategic positioning is crucial for maintaining or improving its market share.

- Evaluating Mortein's profitability and market share is vital for RB's portfolio management.

Within Reckitt Benckiser's portfolio, specific brands likely fit the "Dogs" category. These brands operate in slow-growth markets with low market share. Financial data from 2024 will reveal their performance.

| Brand Example | Market Growth | Market Share |

|---|---|---|

| Calgon | Slow | Low |

| Scholl | Slow | Low |

| Woolite | Moderate | Moderate |

Question Marks

Veet, under Reckitt Benckiser, operates in the competitive hair removal market. The brand competes with established players, indicating a need for strategic investment. To gain market share, Veet requires substantial financial backing, as Reckitt's 2024 financial reports might show. Reckitt Benckiser must evaluate whether to invest more or consider divestiture, depending on Veet's growth prospects.

Air Wick, a home fragrance brand under Reckitt Benckiser (RB), likely falls into the Question Mark quadrant of the BCG matrix. The home fragrance market is highly competitive, requiring significant investment. RB must evaluate Air Wick's potential for growth and profitability. In 2024, RB's Home & Hygiene segment, which includes Air Wick, saw fluctuations in sales.

Enfamil, within Reckitt Benckiser's portfolio, likely sits in the "Question Mark" quadrant of the BCG matrix. The infant formula market, where Enfamil competes, shows growth potential, but faces intense competition. In 2024, the global baby food market was valued at approximately $70 billion. Enfamil requires considerable investment in marketing and R&D to gain market share.

Nutramigen

Nutramigen, a specialized infant formula for allergy sufferers, fits into Reckitt Benckiser's BCG matrix with unique considerations. This product serves a niche market with growth opportunities, driven by rising allergy rates. Its success depends on efficient marketing and distribution, targeting sensitive consumers. Reckitt must evaluate Nutramigen's ability to gain market share and warrant further investment.

- Market size for infant formula is approximately $60 billion globally, with a steady growth rate of around 3-5% annually.

- Nutramigen's segment, hypoallergenic formulas, represents a smaller, but growing portion of this market.

- Reckitt's overall revenue in 2023 was approximately £14.5 billion.

- Marketing spend for specialized products like Nutramigen is crucial.

Cillit Bang

Cillit Bang, a cleaning product under Reckitt Benckiser (RB), often fits the "Question Mark" category in the BCG matrix. This indicates that Cillit Bang has potential but faces challenges. These challenges include the need for strategic marketing to increase brand awareness and market share. The company needs to invest significantly to grow Cillit Bang.

- Market potential exists but needs strategic investment.

- Reckitt Benckiser needs to allocate resources.

- Requires effective marketing strategies.

- The product's future depends on successful growth initiatives.

Cillit Bang's position as a "Question Mark" means it needs significant investment to grow. In 2024, the cleaning products market was worth roughly $60 billion globally. Reckitt Benckiser must determine if Cillit Bang's growth justifies more spending.

| Aspect | Details | Implication |

|---|---|---|

| Market Status | Growing, competitive | Requires strategic focus |

| Investment Needs | High for growth | Decision critical |

| Reckitt's Strategy | Allocation of resources | Future depends on it |

BCG Matrix Data Sources

This Reckitt Benckiser BCG Matrix uses company reports, market analysis, and financial filings for accuracy.