Reckitt Benckiser Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Reckitt Benckiser Group Bundle

What is included in the product

Analyzes competitive forces impacting Reckitt Benckiser, evaluating suppliers, buyers, and new market risks.

Customize force pressures for tailored strategic planning and competitive advantage.

What You See Is What You Get

Reckitt Benckiser Group Porter's Five Forces Analysis

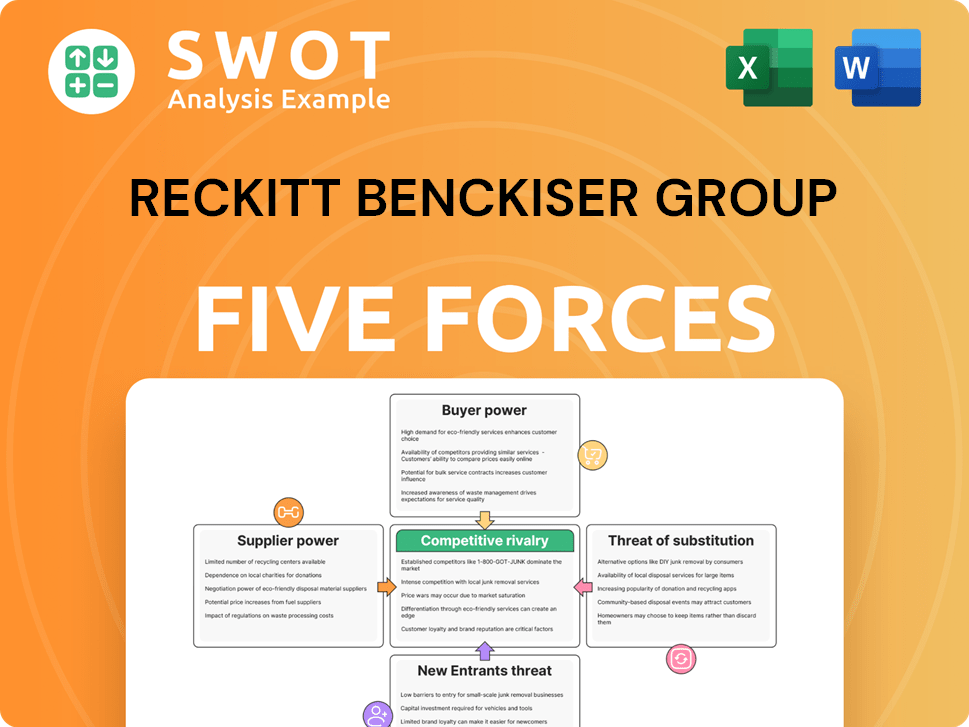

This preview presents the full Reckitt Benckiser Group Porter's Five Forces Analysis. The document comprehensively assesses industry dynamics, including competitive rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants. You’re previewing the final version—precisely the same document that will be available to you instantly after buying.

Porter's Five Forces Analysis Template

Reckitt Benckiser Group (RKT) faces a complex competitive landscape. Bargaining power of suppliers is moderate, influenced by supply chain dynamics. Buyer power is strong due to product availability and consumer choice. The threat of new entrants is moderate, impacted by brand strength and regulatory hurdles. Substitute products pose a significant threat, with diverse consumer preferences. Rivalry among existing competitors is high, demanding continuous innovation. Ready to move beyond the basics? Get a full strategic breakdown of Reckitt Benckiser Group’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Reckitt Benckiser (RB) sources from key suppliers for raw materials and packaging, increasing supplier power. Limited suppliers for critical inputs give them leverage in price and terms negotiations. Switching suppliers is often difficult due to quality or specialized needs. In 2023, RB's cost of sales was £7.7 billion, highlighting the impact of supplier costs.

Reckitt Benckiser sources many commodity inputs, like raw materials, which typically limits supplier power. These are easily sourced, giving the company leverage. For example, in 2024, the company's cost of goods sold was approximately £7.7 billion, reflecting its reliance on various suppliers. However, specialized ingredients could still pose a supplier power risk.

Reckitt Benckiser's (RB) sustainability drive significantly shapes supplier dynamics. Striving for sustainable sourcing, like using eco-friendly packaging, narrows down supplier choices. This shift might empower suppliers compliant with RB's environmental and social standards. For instance, in 2024, RB's focus on sustainable palm oil impacted its supplier relationships, affecting costs and availability.

Global supply chain complexities

Global supply chain disruptions, like those seen recently, can boost supplier power temporarily. Suppliers gain leverage when materials are scarce, as highlighted by the 2021-2022 supply chain bottlenecks. Reckitt Benckiser, in its 2024 reports, acknowledges these challenges, emphasizing the need for resilient supply chains. This is crucial for maintaining production and controlling costs in a volatile market.

- 2024: Supply chain disruptions continue to impact various sectors.

- 2024: Reckitt Benckiser focuses on supply chain diversification.

- 2024: Strong supplier relationships are prioritized.

- 2024: The goal is to mitigate risks from supplier power.

Regulation on raw materials

Regulations significantly shape supplier dynamics, especially concerning raw materials. Compliance with new sourcing or processing rules can inflate costs and reduce supplier options, strengthening their position. For instance, the EU's REACH regulation impacts chemical suppliers. In 2024, Reckitt Benckiser navigated these regulations to secure its supply chains. Proactive adaptation to regulatory shifts is vital to maintain control over supplier relationships.

- REACH compliance costs for chemical suppliers can range from 1% to 10% of revenue.

- In 2024, the global market for sustainable raw materials grew by 7%.

- Reckitt Benckiser spent approximately $150 million on supply chain compliance in 2024.

- Regulatory changes can cause up to a 20% fluctuation in raw material prices.

Supplier power for Reckitt Benckiser is a mix of factors. Commodity inputs limit supplier control, as seen by a £7.7B cost of goods sold in 2024. Specialized materials and regulations can boost supplier influence. Supply chain resilience remains crucial, especially amid disruptions.

| Factor | Impact | 2024 Data |

|---|---|---|

| Commodity Inputs | Limits Supplier Power | Cost of Goods Sold: £7.7B |

| Specialized Materials | Increases Supplier Power | - |

| Regulations | Can Increase Costs | $150M spent on supply chain compliance |

Customers Bargaining Power

Reckitt Benckiser (RB) faces substantial customer bargaining power, mainly due to concentrated retail channels. Major retailers like Walmart and Tesco, which account for a significant portion of RB's sales, wield considerable influence. These retailers can negotiate aggressively for lower prices and better terms. For example, in 2024, Walmart's revenue was approximately $600 billion, giving it significant leverage. RB must manage these relationships carefully to protect its margins.

Reckitt Benckiser's (RB) strong brand loyalty for products like Dettol and Lysol somewhat mitigates customer bargaining power. Loyal consumers are often less price-sensitive. Yet, in 2024, RB faced increased competition. Even loyal customers may switch due to aggressive pricing. RB's revenue in 2024 was approximately £14.6 billion, a decrease compared to the previous year.

Reckitt Benckiser faces customer price sensitivity, especially in cleaning and OTC medicines. Consumers readily switch brands based on price, intensifying competition. This compels Reckitt Benckiser to offer competitive pricing. In 2024, consumer price sensitivity remained a key factor, with inflation influencing purchasing decisions. The company's Q3 2024 results highlighted strategies to manage pricing amid these pressures.

E-commerce growth

The surge in e-commerce has significantly amplified customer bargaining power. Consumers now have unprecedented access to product comparisons and price transparency. This shift compels companies like Reckitt Benckiser to maintain competitive pricing and robust online platforms. The e-commerce sector's rapid expansion, with global sales reaching $6.3 trillion in 2023, underscores this dynamic.

- Increased price transparency enables easy comparison shopping.

- Wider product access intensifies competition.

- Requires competitive pricing strategies.

- Necessitates a strong online presence.

Private label competition

The rise of private label brands significantly impacts Reckitt Benckiser's customer power. Retailers increasingly offer their own brands, often at lower prices, challenging Reckitt's market share. For example, in 2024, private label sales in the household cleaning segment grew by 3% in Europe. Differentiation through innovation and strong marketing is key to maintaining a competitive edge. Reckitt must highlight its product advantages to combat this pressure.

- Private label brands offer lower prices.

- Retailers actively promote their own brands.

- Innovation and marketing are essential for differentiation.

- This pressure can erode Reckitt's market share.

Reckitt Benckiser (RB) contends with substantial customer bargaining power, especially from concentrated retailers. Major retailers like Walmart and Tesco can significantly influence pricing and terms. The e-commerce surge further boosts customer power through price transparency. In 2024, RB's revenue was approximately £14.6 billion, affected by these factors.

| Factor | Impact | Example/Data |

|---|---|---|

| Concentrated Retailers | High Bargaining Power | Walmart's $600B revenue in 2024 |

| E-commerce | Increased Price Transparency | Global e-commerce sales $6.3T (2023) |

| Customer Price Sensitivity | Brand switching based on price | RB's 2024 revenue decline |

Rivalry Among Competitors

The consumer goods sector is highly competitive, with major players like Reckitt Benckiser, Procter & Gamble, and Unilever vying for market share. This rivalry results in price wars and boosted marketing investments. For example, Reckitt Benckiser's marketing expenses in 2024 were approximately £2.1 billion. This constant pressure pushes for innovation, reflected in Reckitt's product launches and acquisitions.

The consumer goods sector has seen significant consolidation. In 2024, major players like Unilever and Procter & Gamble continue to dominate. This intensifies competition, as these giants vie for market share, impacting companies like Reckitt Benckiser. Mergers and acquisitions further reshape the landscape, creating even stronger rivals. For instance, M&A activity in 2023 reached $3.2 trillion globally.

Companies in the consumer goods industry must constantly innovate. Reckitt Benckiser invests heavily in R&D to develop new products, spending £294 million in 2023. Failure to innovate leads to market share loss. This focus helps RB compete effectively.

Marketing and advertising

Marketing and advertising are vital for Reckitt Benckiser, helping its products stand out and build brand recognition. The company invests heavily in marketing to promote its brands and stay competitive. These campaigns are crucial for boosting sales and keeping customers loyal. In 2023, Reckitt Benckiser's marketing spend was approximately £2.1 billion, showcasing its dedication to brand promotion.

- Marketing and advertising are key to brand differentiation.

- Reckitt Benckiser invests significantly in marketing.

- Effective campaigns drive sales and loyalty.

- In 2023, marketing spend was around £2.1 billion.

Global reach

Reckitt Benckiser faces intense competition due to the global reach of its rivals. Companies like Procter & Gamble and Unilever operate worldwide, intensifying the competitive landscape. This global presence forces Reckitt Benckiser to navigate diverse consumer demands and regulatory frameworks. Adapting to these varied conditions is crucial for maintaining market share. In 2024, P&G's net sales reached $82 billion, highlighting the scale of competition.

- Global competitors include P&G and Unilever.

- Diverse markets demand flexible strategies.

- Regulatory environments vary across regions.

- P&G's 2024 net sales: $82 billion.

Reckitt Benckiser faces fierce competition from global giants like Procter & Gamble and Unilever. Intense rivalry leads to price wars and increased marketing spending. RB's 2024 marketing expenses were about £2.1B, reflecting this pressure.

| Key Competitor | 2024 Revenue (USD Billions) | Focus |

|---|---|---|

| Procter & Gamble | 82 | Diversified Consumer Goods |

| Unilever | 60 | Food and Home Care |

| Reckitt Benckiser | 14 | Health, Hygiene, Home |

SSubstitutes Threaten

Reckitt Benckiser faces substitute threats, mainly in cleaning and OTC medicines. Consumers can easily switch to alternatives. This restricts Reckitt's pricing power. For example, in 2024, generic drugs and store brands gained market share, impacting branded products like those from Reckitt.

The price-performance ratio significantly impacts the threat of substitutes for Reckitt Benckiser. Consumers often switch to substitutes if they offer comparable performance at a lower price. For instance, in 2024, generic brands in the over-the-counter medicine market grew by 5%, indicating price sensitivity. Reckitt Benckiser must ensure competitive pricing and demonstrate superior value to retain customers. This could involve strategic cost management or emphasizing unique product features.

Changing consumer preferences pose a significant threat to Reckitt Benckiser. The rising demand for natural and sustainable products challenges traditional offerings. In 2024, the global green cleaning products market was valued at around $4.5 billion, showing consumer shift. Reckitt must adapt to maintain its market share. Understanding evolving trends is vital to stay competitive.

Technological advancements

Technological advancements pose a threat to Reckitt Benckiser as new substitutes emerge. Innovations in healthcare, like advanced wound care, could replace Dettol. The company must adapt to stay competitive. In 2024, R&D spending was around £400 million, showing its commitment to innovation.

- Medical devices can replace some OTC medicines.

- Reckitt Benckiser must monitor tech developments.

- Adaptation of product offerings is vital.

- R&D spending in 2024 was approximately £400M.

DIY solutions

Consumers sometimes turn to do-it-yourself (DIY) options, which serve as substitutes for Reckitt Benckiser's products. Homemade cleaning solutions, for instance, compete with commercial cleaners. This threat is greater when DIY options seem cheaper or greener. In 2024, the DIY cleaning product market is estimated to be worth $2 billion.

- DIY cleaning product market is valued at $2 billion.

- Homemade solutions can be a substitute for commercial cleaning products.

- Cost-effectiveness and environmental friendliness drive this trend.

- Consumers are increasingly seeking DIY alternatives.

Reckitt Benckiser faces substitute threats, especially from generics and DIY options. Consumer price sensitivity drives switching, impacting branded products. In 2024, the DIY cleaning market was $2B, showing consumer shifts. Adaptability and innovation are vital for staying competitive.

| Substitute Type | Example | 2024 Market Data |

|---|---|---|

| Generics | OTC drugs | 5% growth in generic OTC market |

| DIY | Homemade cleaners | $2B DIY cleaning market |

| Tech | Medical devices | R&D spending £400M |

Entrants Threaten

The consumer goods sector, including Reckitt Benckiser, demands considerable upfront investment. Manufacturing, distribution networks, and marketing campaigns require substantial capital. For instance, in 2024, Reckitt Benckiser's marketing spend was approximately £2.3 billion. This high initial cost deters new competitors.

Reckitt Benckiser (RB) benefits from robust brand recognition. This gives them a significant edge over new competitors. Creating similar brand awareness demands substantial marketing investments. New entrants face a tough challenge to win over customers. In 2024, RB's marketing spend was roughly £2.3 billion, highlighting the scale of this barrier.

Reckitt Benckiser (RB) leverages economies of scale across production, distribution, and marketing. This advantage allows RB to offer competitive pricing, a significant barrier to new entrants. For instance, RB's marketing spend in 2024 was substantial, making it hard for newcomers to match. New entrants must find innovative ways to compete, such as niche products or superior branding, to overcome this hurdle.

Access to distribution channels

Access to distribution channels is a significant hurdle for new entrants. Established companies like Reckitt Benckiser (RB) have strong ties with retailers, potentially limiting shelf space for newcomers. RB's global presence and existing supply chains offer a distinct advantage. New entrants might need to rely on online platforms, which can be costly.

- RB's 2024 revenue reached approximately £14.6 billion, reflecting its strong distribution network.

- Online sales accounted for a significant portion of consumer goods revenue in 2024, highlighting the importance of alternative channels.

- Building a robust distribution network can take years and substantial investment.

Regulation

The consumer goods sector, including Reckitt Benckiser, faces strict regulations concerning product safety, labeling, and advertising. These regulations, which vary by region, significantly raise the cost of market entry for new competitors. Compliance requires considerable investment in testing, certification, and legal expertise. This regulatory burden acts as a deterrent, protecting established companies from new entrants.

- Product safety standards require extensive testing and approval processes.

- Labeling laws dictate specific information that must be included on packaging.

- Advertising regulations restrict the claims companies can make about their products.

- Failure to comply can result in hefty fines, product recalls, and reputational damage.

The threat of new entrants to Reckitt Benckiser (RB) is moderate due to high barriers.

Substantial capital investments in manufacturing, distribution, and marketing, like RB's £2.3B marketing spend in 2024, are needed.

RB's brand recognition, economies of scale, and distribution network create advantages, alongside regulatory compliance costs.

| Barrier | Impact | Example |

|---|---|---|

| High Capital Costs | Discourages Entry | £2.3B Marketing (2024) |

| Brand Recognition | Competitive Advantage | RB's established brands |

| Regulation | Increased Costs | Product safety standards |

Porter's Five Forces Analysis Data Sources

Our analysis leverages annual reports, industry benchmarks, and competitive intelligence reports to build a precise competitive environment view.