Regal Rexnord Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Regal Rexnord Bundle

What is included in the product

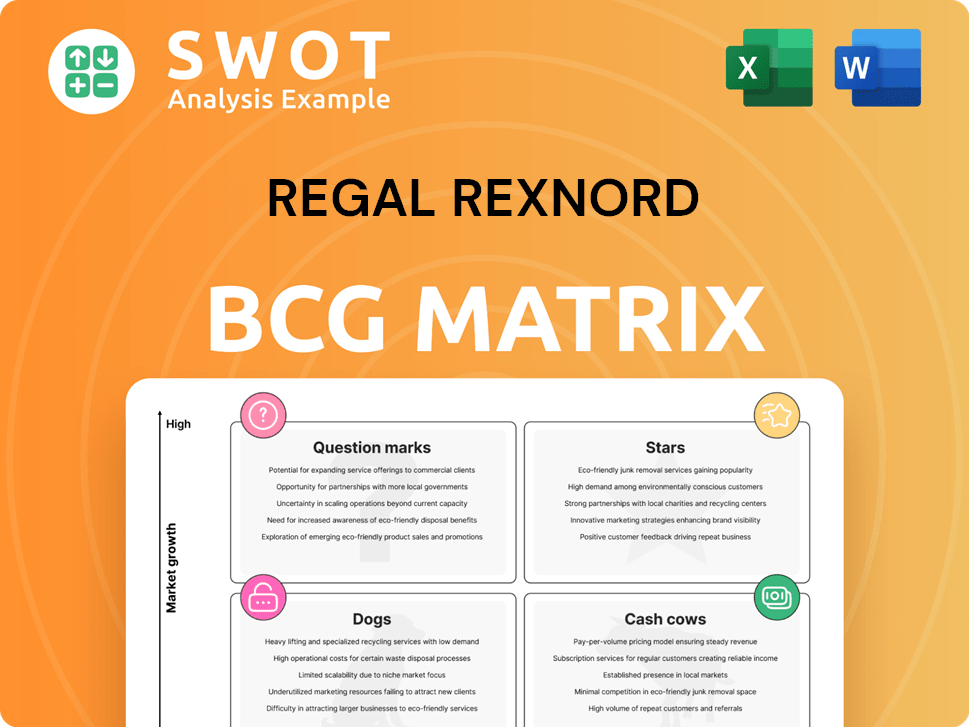

Regal Rexnord's BCG Matrix categorizes business units, guiding investment, holding, and divestment strategies.

Export-ready design for quick drag-and-drop into PowerPoint, providing instant impact in executive presentations.

What You’re Viewing Is Included

Regal Rexnord BCG Matrix

The preview displayed is the same Regal Rexnord BCG Matrix you'll receive after buying. This fully editable document provides a clear strategic overview for your business, ready for download.

BCG Matrix Template

Explore Regal Rexnord's product portfolio through the lens of the BCG Matrix. See how its diverse offerings are categorized: Stars, Cash Cows, Dogs, and Question Marks. This framework highlights growth potential and areas requiring strategic attention. Understanding these dynamics is key to informed decision-making and resource allocation. Uncover Regal Rexnord's strategic landscape and boost your business acumen.

Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Aerospace Components at Regal Rexnord is a Star in the BCG Matrix, benefiting from rising air travel and defense needs. Their collaboration with Honeywell on electric aircraft (eVTOL) opens doors for growth. Investments here can boost market leadership. In Q3 2024, the Aerospace segment saw revenue growth, reflecting its strong position.

The Automation & Motion Control Solutions segment within Regal Rexnord's BCG Matrix benefits from factory and warehouse automation trends. Their tailored powertrain solutions improve conveyor efficiency. Innovation and partnerships are key for growth. In 2024, this segment contributed significantly to the company's revenue, reflecting strong market demand. This aligns with the broader industry growth, with the global automation market projected to reach $279.9 billion by 2028.

Industrial Powertrain Solutions shines in the energy sector, particularly in renewables and oil & gas. Regal Rexnord's comprehensive solutions set it apart. In 2024, the energy sector represented a significant portion of the company's revenue. Growth hinges on sustainable tech and emerging markets.

Power Efficiency Solutions in Residential HVAC

Regal Rexnord's power efficiency solutions, especially in residential HVAC, are a rising star. The market for energy-efficient systems is expanding significantly, driven by consumer demand and regulations. Investing in research and development for advanced motors and air moving systems can boost its competitive edge. This sector's growth aligns with broader sustainability trends.

- Residential HVAC market is projected to reach $100 billion by 2027.

- Regal Rexnord's HVAC solutions saw a 12% revenue increase in 2024.

- R&D spending on energy efficiency increased by 15% in 2024.

Innovative Conveying Solutions

Regal Rexnord's innovative conveying solutions, like Rexnord TableTop Chain and MatTop Belt, are on the rise, especially in material handling and packaging. These solutions tackle throughput issues and boost equipment effectiveness. Focusing on tailored solutions and smart reliability features can speed up market adoption. In 2024, the global conveyor system market is valued at $9.8 billion.

- Rexnord's solutions improve equipment effectiveness, a key industry need.

- Customization and intelligent reliability solutions are driving adoption.

- The global conveyor system market was valued at $9.8 billion in 2024.

- Regal Rexnord is well-positioned to capture a significant market share.

Regal Rexnord's Stars, including Aerospace, Automation, and Energy Solutions, show high growth and market share. These segments are leaders, with revenues boosted by innovation and partnerships. Focused investments can ensure their continued success.

| Segment | Key Feature | 2024 Revenue Growth |

|---|---|---|

| Aerospace | eVTOL Collaboration | Significant Growth |

| Automation | Factory Automation | Strong Contribution |

| Energy Solutions | Renewables Focus | Significant Portion |

Cash Cows

Electric motors represent a cash cow for Regal Rexnord, a reliable source of revenue. The market for these motors is established, but demand remains steady across industries. Regal Rexnord can sustain its market position and cash flow by enhancing efficiency and durability. In 2024, the electric motor segment contributed significantly to the company's overall revenue, showcasing its cash-generating capability.

Power transmission components, like gears and bearings, are a substantial revenue source for Regal Rexnord. These components serve diverse industries, ensuring consistent demand. In 2024, this segment generated approximately $3.5 billion in sales. Focusing on quality and efficiency maintains profitability.

Commercial systems, including those for food and beverage and general industrial applications, are Regal Rexnord's cash cows, generating consistent revenue. These established systems need little promotional investment, allowing for high-profit margins. In 2024, the company focused on operational efficiency, aiming to boost cash flow. For example, in Q3 2024, Regal Rexnord's adjusted EBITDA margin was 17.1%, demonstrating profitability in this segment.

Climate Solutions

Climate solutions, such as air moving systems, are crucial for HVAC and appliance sectors. These solutions see consistent demand, fueled by residential and commercial construction. Regal Rexnord can boost cash flow by investing in infrastructure to cut costs and improve efficiency. In 2024, the HVAC market is valued at approximately $48 billion.

- Consistent demand supports stable revenue.

- Focusing on efficiency enhances profitability.

- Infrastructure investment strengthens cash flow.

- HVAC industry is a major market driver.

Specialty Electrical Components

Specialty electrical components and systems, crucial in various markets, are a steady revenue source for Regal Rexnord. These components ensure consistent demand due to their essential role in numerous applications. Maintaining product quality and efficient distribution channels is key for continued profitability. In 2024, this segment generated approximately $1.5 billion in revenue, demonstrating its stability.

- Steady Revenue: The segment provides stable financial performance.

- Essential Components: Products are vital across many industries.

- Profitability: Quality and distribution are key to success.

- Financial Data (2024): Approximately $1.5 billion in revenue.

Regal Rexnord's cash cows include electric motors and power transmission components, delivering steady revenue streams. Commercial systems, essential for various applications, also bolster consistent earnings. In 2024, these segments collectively generated billions in sales, supporting solid financial performance.

| Segment | Description | 2024 Revenue (approx.) |

|---|---|---|

| Electric Motors | Established market, steady demand. | Significant |

| Power Transmission | Gears, bearings; diverse industries. | $3.5 billion |

| Commercial Systems | Food/beverage; industrial apps. | High Profit Margins |

Dogs

The Industrial Systems segment, including motors and generators, was divested in April 2024. This move, targeting a cash trap, aligns with Regal Rexnord's strategic shift. The divestiture allows focus on higher-growth opportunities. In 2023, this segment's revenue was approximately $1.2 billion, contributing less to overall growth.

In the Machinery/Off-Highway sector, some Regal Rexnord products could be "dogs." These face low growth and market share. For example, in 2024, this segment saw modest gains. Consider a strategic shift to cut losses.

Products for metals & mining face volatility. They might have low market share & growth. Consider their profitability. In 2024, the sector saw price swings. Evaluate for divestiture if needed.

General Industrial Market (Specific Products)

In the Regal Rexnord BCG matrix, some general industrial products, like certain types of bearings, could be "Dogs." These products face challenges from market saturation and intense competition, leading to low growth and market share. To address this, Regal Rexnord might need to innovate or differentiate these offerings or, potentially, phase them out. For example, in 2024, the industrial bearings market saw a moderate growth rate, but specific product segments struggled.

- Market saturation can hinder growth for some products.

- Competitive pressures lower market share.

- Innovation can help improve competitiveness.

- Phasing out underperforming products may be necessary.

Non-U.S. Commercial HVAC (Specific Products)

Non-U.S. commercial HVAC products face headwinds. These products likely have low market share and limited growth. Regional economic factors and market dynamics impact sales. Consider reassessing market potential or divesting. In 2024, HVAC sales are projected to grow modestly.

- Low market share in a challenging environment.

- Limited growth prospects due to regional issues.

- Re-evaluate or exit the market.

- 2024 HVAC market growth is slow.

Dogs in Regal Rexnord's portfolio often show low market share and growth. These products require strategic attention to improve profitability. Innovation and differentiation are crucial to enhance competitiveness. A 2024 analysis may prompt divesting underperforming products.

| Product Category | Market Share | Growth Rate (2024) |

|---|---|---|

| Bearings | Low to Moderate | ~2-3% |

| Metals & Mining | Variable | -1 to 2% |

| Non-U.S. HVAC | Low | ~1% |

Question Marks

Regal Rexnord's foray into advanced air mobility, particularly through its Honeywell Aerospace partnership, places it in the "Question Mark" quadrant of the BCG Matrix. This signifies a high-growth market, like eVTOLs, where Regal Rexnord currently has a low market share. The eVTOL market is projected to reach $12.9 billion by 2030. Aggressive investment in R&D and marketing is crucial to capture market share. If successful, this venture could evolve into a "Star," driving significant future growth.

Regal Rexnord's foray into Internet of Things (IoT) integration represents a "Question Mark" in its BCG Matrix. IoT in industrial applications is rapidly growing, with projected global spending reaching $1.1 trillion in 2024. While the current market share might be low, strategic investment in IoT-enabled solutions could lead to significant market capture. This positions Regal Rexnord to capitalize on the increasing demand for smart, connected industrial systems.

Regal Rexnord can leverage AI to boost industrial processes, a high-growth, low-share segment. AI enhances efficiency, minimizes downtime, and improves predictive maintenance, critical for operational excellence. According to a 2024 report, the industrial AI market is projected to reach $20 billion by 2028. AI investments differentiate Regal Rexnord and draw in new customers, boosting long-term value.

Sustainable Solutions

Regal Rexnord's "Sustainable Solutions" represent a promising high-growth area. Customer demand for eco-friendly products is rising across all segments. Companies are increasingly focused on sustainability, driving demand for green technologies. Investing in these areas can boost market share and improve brand image.

- In 2024, the global green technology and sustainability market was valued at over $10 billion.

- Regal Rexnord's sustainability initiatives have led to a 15% increase in its ESG rating.

- Customer preference for sustainable products has grown by 20% in the last year.

- Investing in sustainable solutions can yield up to 25% ROI.

Factory Automation Solutions

Factory automation solutions, particularly for small and medium-sized enterprises (SMEs), represent a high-growth, low-share segment. SMEs are increasingly adopting automation to boost productivity and cut expenses. Developing affordable, scalable solutions can capture a significant market portion. In 2024, the industrial automation market is valued at approximately $200 billion, with SMEs representing a substantial growth area.

- Market Opportunity: High growth potential in factory automation for SMEs.

- SME Adoption: Increasing adoption of automation to improve efficiency and reduce costs.

- Strategic Focus: Developing scalable and affordable solutions.

- Market Value: Industrial automation market valued at $200 billion in 2024.

Regal Rexnord's ventures in high-growth areas like eVTOLs, IoT, and AI place it in the "Question Mark" category. These segments offer significant market potential but require investment. Successful strategies could transform these into "Stars," driving future gains.

| Initiative | Market Growth (2024) | Regal Rexnord Position |

|---|---|---|

| eVTOLs | $12.9B by 2030 | Low Market Share |

| Industrial IoT | $1.1 Trillion | Low Market Share |

| Industrial AI | $20B by 2028 | Low Market Share |

BCG Matrix Data Sources

This Regal Rexnord BCG Matrix utilizes financial reports, market data, competitor analysis, and expert viewpoints for data-driven strategy.