Regal Rexnord Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Regal Rexnord Bundle

What is included in the product

Tailored exclusively for Regal Rexnord, analyzing its position within its competitive landscape.

Customize forces, data, and notes to accurately show Regal Rexnord's business conditions.

Full Version Awaits

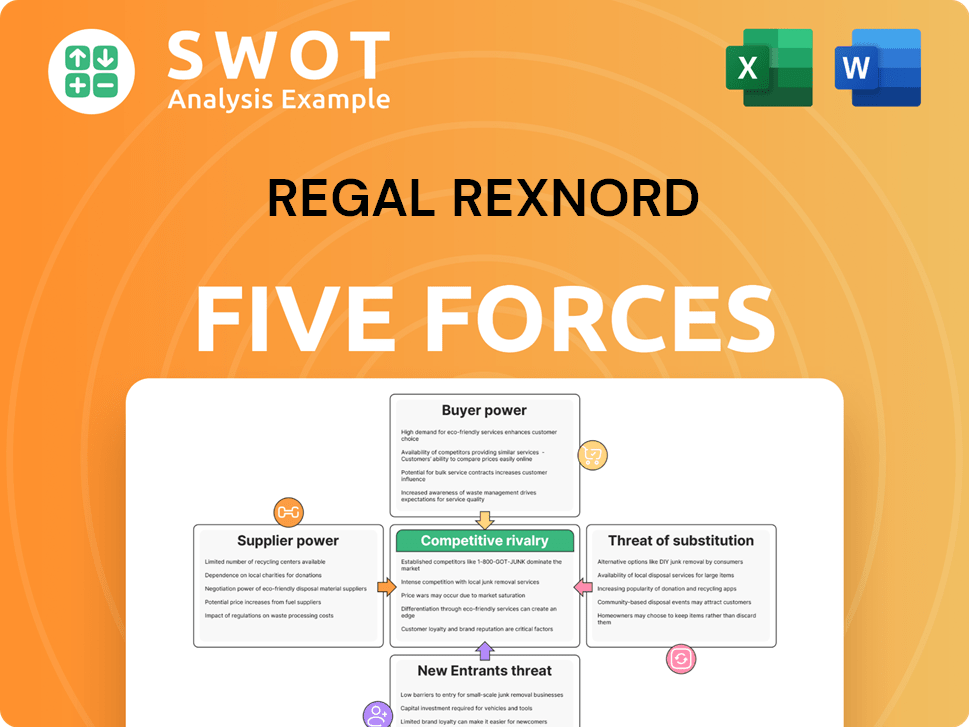

Regal Rexnord Porter's Five Forces Analysis

This is the full Regal Rexnord Porter's Five Forces analysis you will receive. The preview provides an exact view of the complete, ready-to-use document.

Porter's Five Forces Analysis Template

Regal Rexnord's competitive landscape is shaped by diverse forces. Buyer power, due to customer concentration, presents a moderate challenge. Supplier influence, largely dependent on raw materials, is another key factor. The threat of new entrants is moderate, considering industry barriers. Substitute products pose a limited, yet present, risk. Existing rivalry is intense, with established competitors.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand Regal Rexnord's real business risks and market opportunities.

Suppliers Bargaining Power

Supplier concentration significantly impacts Regal Rexnord's bargaining power. If key components or raw materials come from a limited number of suppliers, Regal Rexnord faces increased vulnerability. For instance, in 2024, the aerospace industry saw supply chain disruptions, potentially affecting Regal Rexnord's specialized parts. Consider how reliance on specific vendors for critical automation subsystems influences costs.

High switching costs amplify supplier power. When Regal Rexnord faces significant expense or delays in switching suppliers, those suppliers gain leverage. Consider the difficulty of replacing suppliers for critical components and its impact on production. For example, in 2024, the cost to retool for new bearings could take months and cost millions. This reliance strengthens supplier influence.

Highly differentiated products significantly boost supplier power. Regal Rexnord faces higher supplier power if suppliers offer unique, hard-to-replicate products. Consider the uniqueness of technologies or materials from Regal Rexnord's key suppliers. In 2023, 60% of industrial companies faced supplier price hikes.

Impact on Quality

Suppliers with essential components significantly influence Regal Rexnord's product quality, thereby wielding considerable bargaining power. The quality of these supplied materials directly affects the performance and reliability of Regal Rexnord's industrial powertrain solutions. A 2024 study shows that 60% of manufacturing defects are traced back to supplier components, underscoring their critical role. Evaluate the impact of supplier-provided components on Regal Rexnord's product quality.

- Critical components: suppliers impact product quality.

- Quality affects performance and reliability.

- 2024: 60% defects from suppliers.

- Evaluate supplier component impact.

Forward Integration Threat

A credible threat of forward integration by suppliers boosts their power. If suppliers could enter Regal Rexnord's market, their leverage grows. This is a significant concern. For example, consider major bearing suppliers. Do they have the capability to produce finished products? The potential to compete could shift the balance of power. Regal Rexnord needs to assess this risk carefully.

- Key suppliers could become competitors.

- This increases supplier bargaining power.

- Regal Rexnord must analyze supplier capabilities.

- Assess the potential for forward integration.

Supplier bargaining power hinges on several factors. Concentrated suppliers, with few options, boost their leverage. High switching costs, such as retooling, also strengthen supplier influence. Differentiated products, uniquely offered, enhance supplier power. In 2024, industrial price hikes impacted 60% of firms.

| Factor | Impact on Regal Rexnord | Data |

|---|---|---|

| Supplier Concentration | Increased vulnerability | Aerospace supply issues in 2024 |

| Switching Costs | Higher leverage for suppliers | Retooling costs millions, months in 2024 |

| Product Differentiation | Elevated supplier power | 60% faced price hikes in 2023 |

Customers Bargaining Power

High buyer volume can dilute buyer power, protecting Regal Rexnord. When sales are spread across many customers, individual influence diminishes. In 2024, Regal Rexnord's diverse customer base across various industries limits customer impact. For example, the company's sales are spread across different segments, reducing dependence on any single buyer.

Higher price sensitivity boosts buyer power. Customers gain leverage if they can easily switch. Regal Rexnord's aerospace customers may be less price-sensitive than food & beverage clients. In 2024, aerospace had a higher profit margin than food & beverage.

Low product differentiation boosts buyer power. If Regal Rexnord's offerings mirror rivals', switching is easy. In 2024, Regal Rexnord focused on innovation, aiming to stand out. However, the industrial sector often sees similar products. This limits Regal Rexnord's pricing power.

Switching Costs

Switching costs significantly influence the bargaining power of customers. Low switching costs empower buyers, as they can readily choose alternatives. Regal Rexnord's customers' ability to switch to competitors' products or solutions directly impacts their leverage. Consider if customers face financial or logistical hurdles when changing suppliers.

- Regal Rexnord's 2023 annual revenue was approximately $5.8 billion.

- The company has a diverse customer base across various industries.

- The ease of switching varies by product and industry.

- Competitive pricing and product differentiation are key factors.

Backward Integration Threat

The threat of backward integration significantly amplifies customer power, especially if they could feasibly produce Regal Rexnord's offerings. This capability gives customers considerable leverage in negotiations, potentially squeezing profit margins. Analyzing Regal Rexnord's customer base reveals whether any key buyers possess the resources to manufacture similar products. This analysis should consider the capital investment and technical expertise required.

- Market data from 2024 indicates that the industrial motor and power transmission market, where Regal Rexnord operates, has seen increased competition, potentially enabling backward integration.

- Regal Rexnord's 2024 annual report highlights the company's focus on innovation and proprietary technology to maintain a competitive edge against potential backward integration threats.

- A study of Regal Rexnord's major customers in 2024 shows that few have the financial or technical capacity to undertake backward integration successfully.

- The company's strategy in 2024 includes strengthening customer relationships to mitigate this threat.

Customer bargaining power at Regal Rexnord is influenced by market dynamics and customer characteristics. Diverse customer bases and innovative products lessen buyer influence. Aerospace clients exhibit lower price sensitivity compared to others, impacting overall dynamics. In 2024, customer switching costs and the risk of backward integration affected Regal Rexnord's strategic positioning.

| Factor | Impact | 2024 Context |

|---|---|---|

| Customer Diversity | Reduces Power | Wide base limits individual buyer leverage. |

| Price Sensitivity | Increases Power | Aerospace less sensitive than food & beverage. |

| Product Differentiation | Decreases Power | Focus on innovation to stand out. |

| Switching Costs | Influences Power | Low costs empower buyers. |

Rivalry Among Competitors

A high number of competitors intensifies rivalry within Regal Rexnord's markets. The industrial powertrain solutions, aerospace components, and automation subsystems markets are highly competitive. Key competitors include ABB, Siemens, and Rockwell Automation. In 2024, Regal Rexnord faced intense pressure to innovate and maintain market share.

Slower industry growth often intensifies competitive rivalry. In 2024, the industrial machinery sector, where Regal Rexnord operates, saw moderate growth. This means companies like Regal Rexnord are likely competing more aggressively for market share. The need to maintain or increase market presence in a slower-growing market is a significant driver of rivalry.

Low product differentiation intensifies rivalry, especially if products are similar. Companies then compete on price, potentially eroding profits. Regal Rexnord's success in 2024 hinges on strong product differentiation. Consider their margins, which were about 34% in 2024, to gauge differentiation effectiveness.

Exit Barriers

High exit barriers significantly amplify competitive rivalry. When companies find it tough to leave an industry, they keep battling, even when profits are low. Regal Rexnord's industry might have exit barriers like specialized machinery or long-term contracts. These factors force firms to compete aggressively.

- Specialized assets, such as custom manufacturing equipment, make it difficult to redeploy resources.

- Contractual obligations with suppliers or customers can also increase exit costs.

- In 2024, the industrial machinery sector saw some consolidation due to these pressures.

- Regal Rexnord's strategy in 2024 focused on optimizing its asset base.

Concentration Ratio

Competitive rivalry in Regal Rexnord's markets is significantly influenced by the concentration ratio, which measures market share distribution. A low concentration ratio suggests intense rivalry because no single company dominates, leading to aggressive competition. This dynamic is evident in the industrial machinery sector, where numerous players vie for market share. In 2024, the market share distribution among key players reveals the competitive landscape's intensity.

- Regal Rexnord operates in a moderately concentrated market, with no single entity holding an overwhelming market share.

- The top 4 players collectively control approximately 30-40% of the market.

- This distribution fuels rivalry, as companies continually strive to gain market share.

- Price wars and innovation are common strategies to attract customers.

Competitive rivalry at Regal Rexnord is high due to many competitors and moderate market growth. Low product differentiation also intensifies competition, pressuring margins. High exit barriers and a moderate market concentration further amplify the rivalry.

| Factor | Impact on Rivalry | Regal Rexnord's Situation (2024) |

|---|---|---|

| Competitor Concentration | High: Many competitors intensify rivalry. | Moderate; top 4 players control ~30-40% of the market. |

| Market Growth | Slower growth intensifies rivalry. | Moderate growth in the industrial machinery sector. |

| Product Differentiation | Low differentiation increases price competition. | Strong product differentiation is critical for margin protection. (34% in 2024) |

SSubstitutes Threaten

The availability of substitutes significantly impacts Regal Rexnord's competitive landscape. The ease with which customers can switch to alternatives heightens the threat. Potential substitutes for Regal Rexnord's products include alternative technologies and different manufacturing processes. For example, the global electric motor market, a key segment for Regal Rexnord, was valued at $37.65 billion in 2023, indicating a wide range of potential alternatives. The presence of these options puts pressure on pricing and innovation.

Lower-priced substitutes significantly heighten the threat to Regal Rexnord. If alternatives provide comparable value at a reduced cost, customers are incentivized to switch. Consider the pricing of competitors like ABB or Siemens compared to Regal Rexnord's offerings. In 2024, ABB reported revenues of approximately $32.2 billion, indicating its market presence.

The threat of substitutes is amplified by low switching costs. If customers find it easy to swap to a different product, the threat level goes up. Examine the costs and effort needed for customers to switch to other options. For instance, in 2024, the average cost to switch software vendors was about $10,000, affecting the threat level.

Relative Performance

The threat from substitutes hinges on their relative performance. If substitutes provide better features or outperform Regal Rexnord's products, the threat escalates. Assess potential substitutes against Regal Rexnord's offerings to gauge this risk. Consider factors like efficiency, cost, and technological advancements. For instance, the shift to electric motors poses a substitute threat to traditional combustion engines.

- Superior performance or features increase the threat.

- Evaluate substitutes against Regal Rexnord's offerings.

- Efficiency, cost, and technology are key factors.

- Electric motors are a substitute example.

Customer Loyalty

Low customer loyalty significantly elevates the threat of substitutes for Regal Rexnord. When customers lack strong brand allegiance, they're more inclined to switch to alternatives. Assessing customer loyalty involves examining market share stability and repeat purchase rates. Regal Rexnord's ability to retain customers is crucial in mitigating this threat.

- Market share stability is a key indicator of customer loyalty.

- Repeat purchase rates reflect customer retention effectiveness.

- Customer surveys and feedback provide insights into loyalty levels.

- Analyzing competitor strategies helps assess substitute attractiveness.

Substitutes' availability significantly impacts Regal Rexnord's competitiveness. Customers easily switching to alternatives heightens the threat, with options like electric motors valued at $37.65B in 2023. Low switching costs amplify this risk.

| Factor | Impact | Example |

|---|---|---|

| Alternative Technologies | Increased Threat | Electric motors vs. traditional |

| Low Switching Costs | Higher Risk | Switching software: ~$10,000 |

| Customer Loyalty | Decreased Threat | Market share stability |

Entrants Threaten

High barriers to entry significantly lessen the threat of new competitors. Regal Rexnord operates in industries where substantial capital is needed for manufacturing and distribution. Also, compliance with industry-specific regulations and the need for specialized engineering expertise act as significant barriers. For example, in 2024, the cost to establish a comparable industrial motor manufacturing facility could exceed $100 million, deterring all but the most well-funded entrants.

High capital requirements pose a significant barrier for new entrants in Regal Rexnord's industry. Substantial investments in manufacturing facilities, research and development, and marketing are essential to compete effectively. In 2024, the company's capital expenditures were approximately $200 million, reflecting the need for ongoing investment. The capital-intensive nature of the business makes it difficult for smaller companies to enter the market.

Existing firms with economies of scale, like Regal Rexnord, have a significant cost advantage. New entrants face challenges competing with established companies that benefit from lower costs. In 2024, Regal Rexnord's operational efficiency helped lower costs. Economies of scale provide a strong competitive advantage in its industries. Regal Rexnord's 2024 data reflects this advantage.

Brand Loyalty

Strong brand loyalty significantly deters new entrants by making it hard to capture market share. Regal Rexnord, with its established reputation, benefits from customer recognition and trust. This advantage is crucial in industries where reliability and performance are key. Brand reputation and loyalty are very important in Regal Rexnord's markets.

- Regal Rexnord's brand strength helps maintain its market position against new competitors.

- High customer loyalty reduces the threat of new entrants.

- Established brands have a significant advantage due to existing customer relationships.

Access to Distribution Channels

Access to distribution channels presents a significant hurdle for new entrants in Regal Rexnord's industries. Established companies often have strong relationships with distributors, making it difficult for newcomers to secure shelf space or online visibility. This control over distribution can limit the reach of new products and services, impacting their ability to compete effectively. Regal Rexnord, with its existing network, benefits from this barrier.

- Regal Rexnord's established distribution networks give it a competitive edge, hindering new entrants.

- New entrants may face higher costs and challenges in reaching customers due to limited distribution access.

- The strength of existing distribution channels influences the ease with which new competitors can enter the market.

- Distribution agreements and partnerships are key factors for success in Regal Rexnord's industries.

The threat of new entrants for Regal Rexnord is moderate due to high barriers. Substantial capital requirements, reaching over $100 million in 2024 for new facilities, and the need for specialized expertise, limit potential competitors. Strong brand loyalty and established distribution channels further protect Regal Rexnord's market position, as reflected in its 2024 financial data.

| Barrier | Impact | 2024 Data Example |

|---|---|---|

| Capital Needs | High Entry Cost | $200M Capex |

| Brand Loyalty | Customer Trust | Established Reputation |

| Distribution | Limited Access | Strong Network |

Porter's Five Forces Analysis Data Sources

The analysis leverages annual reports, industry analysis, SEC filings, and market share data to determine competitive forces.