Rite Aid Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rite Aid Bundle

What is included in the product

Analyzes Rite Aid's market position by evaluating competitive forces, including buyer power and new entrants.

Easily compare scenarios like "post-merger" or "facing a key competitor" to simulate future conditions.

Preview the Actual Deliverable

Rite Aid Porter's Five Forces Analysis

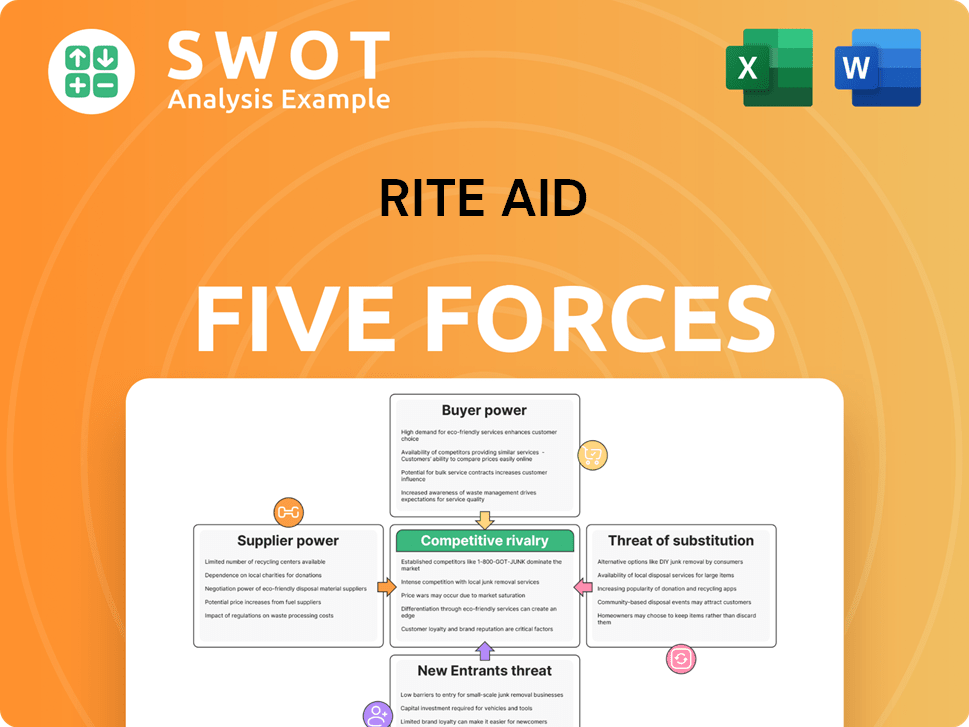

You're previewing a complete Porter's Five Forces analysis of Rite Aid. This document meticulously examines the competitive landscape. The analysis covers all five forces: rivalry, supplier power, buyer power, threats of substitutes, and new entrants. The final document is exactly as you see it now, ready for download.

Porter's Five Forces Analysis Template

Rite Aid faces a complex competitive landscape. Buyer power is moderate due to accessible pharmacy choices. Supplier power is high, especially from drug manufacturers. The threat of new entrants is low, but substitutes like online pharmacies exist. Rivalry is intense, with major players like CVS and Walgreens. Understanding these forces is key.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Rite Aid’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Rite Aid faces high supplier power, especially from pharmaceutical companies. The limited number of these suppliers allows them to set prices. This concentration, coupled with the need for essential drugs, increases Rite Aid's costs. In 2024, drug costs represented a significant portion of Rite Aid's expenses, impacting profitability.

Rite Aid faces high switching costs, impacting its supplier power. Changing suppliers is expensive and disruptive, increasing reliance on current ones. This weakens Rite Aid's negotiation position. Switching costs include new contracts and supply chain adjustments. For example, in 2024, Rite Aid's cost of goods sold was substantial, highlighting supplier impact.

Suppliers of unique or specialized products, like prescription medications, wield considerable power. Rite Aid relies on these products, giving suppliers pricing leverage. For instance, in 2024, generic drug prices rose, impacting Rite Aid's costs. Securing essential pharmaceuticals allows suppliers to dictate terms, affecting Rite Aid's profitability.

Supplier Power 4

Supplier power significantly impacts Rite Aid. Suppliers' ability to integrate forward, potentially entering the retail pharmacy market, boosts their leverage. This threat diminishes Rite Aid's capacity to secure advantageous terms. Forward integration offers suppliers an alternative distribution channel, increasing their bargaining strength. This dynamic can affect Rite Aid's profitability and operational efficiency.

- Manufacturers like Johnson & Johnson and Pfizer have the resources for forward integration, posing a threat.

- Rite Aid's dependence on these suppliers for essential pharmaceuticals weakens its negotiating position.

- In 2024, the pharmaceutical industry's revenue reached approximately $600 billion.

- The bargaining power of suppliers can lead to higher costs for Rite Aid.

Supplier Power 5

Rite Aid's supplier power is significantly shaped by its contracts. Long-term contracts can either bolster or diminish Rite Aid's position, depending on the agreed-upon terms. Favorable contracts secure stable pricing and supply, while unfavorable ones expose Rite Aid to inflated costs. Evaluating contract details is critical for managing these supplier relationships effectively. In 2024, Rite Aid's cost of goods sold was approximately $17.6 billion, highlighting the substantial impact of supplier costs.

- Contract terms dictate the impact on bargaining power.

- Favorable contracts provide pricing stability.

- Unfavorable contracts lead to higher costs.

- Cost of goods sold was approximately $17.6 billion.

Supplier power critically affects Rite Aid, particularly in drug procurement. Key players like pharmaceutical giants hold significant pricing influence. High switching costs further limit Rite Aid's leverage in negotiations. In 2024, this dynamic substantially impacted Rite Aid’s costs.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Supplier Concentration | High supplier power | Pharma revenue ~$600B |

| Switching Costs | Reduced negotiation power | Cost of goods sold ~$17.6B |

| Contract Terms | Determines cost | Generic drug price rises |

Customers Bargaining Power

Buyer power is significant for Rite Aid. Price sensitivity is high, particularly for generic drugs and OTC items. This drives customers to seek lower prices, increasing their influence. Rite Aid navigates this by balancing pricing with profitability. In 2024, generic drugs made up a large portion of prescriptions.

The availability of substitutes significantly boosts buyer power. Customers have numerous options, including competitors like CVS and Walgreens, along with online retailers. This abundance of choices gives customers leverage in negotiating prices and services. In 2024, Rite Aid's revenue was $17.1 billion, signaling the importance of retaining customers. To stay competitive, Rite Aid must differentiate itself to maintain customer loyalty.

Customers wield considerable power due to readily available information. Online platforms and comparison tools enable easy price and service comparisons. Informed customers actively seek the best deals, influencing Rite Aid's pricing strategies. For example, in 2024, online pharmacy sales grew, increasing buyer influence. Transparency in pricing and services is thus vital for Rite Aid to remain competitive.

Buyer Power 4

Buyer power assesses customers' influence on pricing and terms. Brand loyalty can significantly reduce buyer power. If customers are committed to Rite Aid, they're less likely to switch. Building strong customer relationships is key for retaining loyalty, like personalized service. According to 2024 reports, Rite Aid's loyalty program saw a 15% increase in member engagement.

- Loyalty programs boost customer retention rates.

- Personalized service enhances customer satisfaction.

- Brand reputation influences customer choices.

- Competitive pricing is essential to stay competitive.

Buyer Power 5

Rite Aid faces strong buyer power from Pharmacy Benefit Managers (PBMs). PBMs negotiate drug prices for large groups, impacting Rite Aid's profitability. These negotiations affect prescription volumes and reimbursement rates. Rite Aid needs to manage these relationships carefully to maintain financial health. In 2024, PBMs controlled a significant portion of prescription drug spending.

- PBMs negotiate prices for millions of customers.

- This concentration gives PBMs significant leverage.

- Rite Aid's revenue is heavily influenced by PBM agreements.

- Poor negotiation can lead to lower profit margins.

Customer power is high for Rite Aid, particularly due to price sensitivity for generic drugs. Availability of substitutes like CVS and online retailers strengthens buyer influence. Customers' informed decisions, aided by online tools, affect pricing. In 2024, Rite Aid's revenue reached $17.1 billion, highlighting customer impact.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High, especially for generics | Generic drugs share a large portion of prescriptions. |

| Substitutes | Numerous options (CVS, Walgreens, online) | Online pharmacy sales grew. |

| Customer Information | Easy price comparisons | Revenue: $17.1B. |

Rivalry Among Competitors

Intense competition marks the pharmacy sector. CVS and Walgreens are key rivals to Rite Aid. This rivalry sparks price wars, impacting profit margins. Rite Aid's 2024 revenue was about $17.6 billion. Innovation is crucial for Rite Aid's differentiation.

Market saturation significantly escalates competition within the pharmacy sector. Rite Aid, along with its rivals, grapples with intense rivalry due to the high concentration of pharmacy locations, especially in urban areas. The company faces challenges in customer acquisition and retention, given the abundance of choices. Strategic location planning is crucial for survival, as evidenced by the closure of approximately 500 stores in 2023, reflecting efforts to optimize market presence.

Competition in the pharmacy industry is fierce, with differentiation being crucial for Rite Aid. Rite Aid needs to stand out through unique services, products, or customer experiences. This could mean offering specialized health services or exclusive product lines. In 2024, CVS and Walgreens controlled a significant market share, highlighting the need for Rite Aid to innovate to stay competitive. For instance, in Q3 2024, Walgreens reported a revenue of $34.0 billion, showing the scale of competition.

Competitive Rivalry 4

Competitive rivalry in the pharmacy sector is fierce, with high advertising and promotional spending. Pharmacy chains constantly invest in marketing to attract customers, increasing costs and intensifying competition. Effective marketing is crucial for maintaining market share. Rite Aid, for example, spent $171 million on advertising in 2023. This shows the intensity of the competition.

- Advertising costs are a significant burden, impacting profitability.

- Intense rivalry leads to price wars and margin pressures.

- Marketing strategies are critical for differentiation.

- Market share is constantly contested in the industry.

Competitive Rivalry 5

Competitive rivalry in the pharmacy industry is significantly influenced by consolidation. Mergers and acquisitions, like the 2024 Walgreens' acquisition of 800 Rite Aid stores, reshape the competitive landscape. Rite Aid needs to adapt to these shifts to stay relevant. Larger companies often gain increased efficiency and bargaining power. The U.S. pharmacy market reached $560 billion in 2024.

- Rite Aid's market share decreased due to store closures and acquisitions.

- Walgreens and CVS Health are major competitors, constantly evolving.

- Consolidation impacts pricing strategies and market access.

- Smaller chains face challenges competing with larger entities.

The pharmacy market's rivalry is extremely competitive. Rite Aid faces tough competition from giants like CVS and Walgreens. Intense price wars and marketing battles are commonplace, impacting profitability and market share. Consolidation, with Walgreens' acquisition of Rite Aid stores in 2024, further reshapes the landscape.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue | Rite Aid's 2024 total revenue | Approx. $17.6B |

| Competitor Revenue (Q3 2024) | Walgreens' quarterly revenue | $34.0B |

| Advertising Spend (2023) | Rite Aid's marketing investment | $171M |

SSubstitutes Threaten

Mail-order pharmacies present a significant threat to Rite Aid. Customers can easily order prescriptions online for home delivery, often at competitive prices. This convenient option directly challenges Rite Aid's traditional retail model. In 2024, online pharmacy sales are expected to reach $55 billion, highlighting the growing substitution. These services are especially appealing to those managing chronic conditions.

The threat of substitutes for Rite Aid is significant, particularly from online retailers. Amazon and other e-commerce platforms offer a vast selection of health and wellness products, including over-the-counter medications. These online options often provide more competitive pricing and greater convenience for consumers. To counter this, Rite Aid needs to focus on enhancing its in-store experience and expanding its product offerings.

Alternative medicine and wellness practices are becoming more popular. This shift presents a threat as customers might opt for these over traditional medications. Such trends can decrease demand for prescription drugs, impacting companies like Rite Aid. In 2024, the global wellness market was valued at over $7 trillion. Rite Aid can adapt by offering complementary health products and services.

Threat of Substitution 4

The threat of substitutes for Rite Aid comes from supermarkets and mass merchandisers that also have pharmacies. Walmart and Kroger, for example, provide pharmacy services alongside groceries. This one-stop-shop convenience is a big draw for customers wanting to combine shopping with prescription refills. Rite Aid must excel in service and expertise to compete effectively. In 2024, the pharmacy market is highly competitive, with these retailers constantly vying for market share.

- Walmart's pharmacy sales reached over $15 billion in 2023.

- Kroger's pharmacy revenue was approximately $7 billion in 2023.

- Rite Aid's revenue was about $21.1 billion in 2023.

- CVS Health's pharmacy sales were around $100 billion in 2023.

Threat of Substitution 5

Telehealth services pose a significant threat to Rite Aid, acting as substitutes. Virtual consultations and online prescription fulfillment are becoming increasingly popular, potentially decreasing the need for in-person pharmacy visits. This shift is especially relevant for routine prescriptions and addressing minor health issues. In 2024, the telehealth market is estimated to reach $6.5 billion. Rite Aid needs to integrate telehealth to stay competitive.

- Telehealth market size in 2024: $6.5 billion.

- Impact: Reduced in-person pharmacy visits.

- Focus: Routine prescriptions, minor ailments.

- Strategy: Integrate telehealth services.

The threat of substitutes for Rite Aid is substantial, with several alternatives emerging.

Online pharmacies, such as those offered by Amazon, offer convenience and competitive pricing, threatening traditional retail. Alternative healthcare practices, like wellness programs, also draw customers away from conventional prescriptions.

Supermarkets and telehealth services further intensify the competitive landscape.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Online Pharmacies | Convenience, Price | $55B in sales |

| Wellness Practices | Alternative Treatments | $7T global market |

| Telehealth | Virtual Consultations | $6.5B market |

Entrants Threaten

The threat of new entrants for Rite Aid is moderate. High capital requirements, including real estate and inventory, are a significant barrier. Regulatory compliance adds to the financial burden, deterring new competitors. Rite Aid's market share in 2024 was approximately 2.5%. This makes it harder for new entrants to gain a foothold.

Rite Aid faces a moderate threat from new entrants. Strong brand loyalty to competitors like CVS and Walgreens poses a challenge. Newcomers need significant marketing investment to compete. Rite Aid's market share was about 3.5% in 2024, showing the difficulty in breaking in. Overcoming brand loyalty is a key hurdle for new pharmacies.

The pharmacy industry faces a high threat from new entrants due to stringent regulations and licensing. New companies must navigate complex regulatory landscapes, increasing the cost of market entry. The regulatory burden, including compliance with federal and state laws, protects established businesses. Rite Aid, for instance, must adhere to numerous rules, which limits the ease with which new competitors can emerge. These barriers make it difficult for new players to compete effectively.

Threat of New Entrants 4

The threat of new entrants for Rite Aid is moderate due to significant barriers. Established pharmacy chains, like Rite Aid, benefit from long-standing supply chain relationships, making it difficult for newcomers to compete. These relationships with drug manufacturers and distributors are crucial for securing inventory and favorable pricing. New entrants face the challenge of building these relationships from the ground up, which is a time-consuming and costly process. Securing advantageous supply agreements is vital for profitability and market entry, but it's a hurdle for potential competitors.

- Rite Aid's 2023 revenue was $24.1 billion, showcasing established market presence.

- New pharmacies face high initial capital expenditures, including real estate and inventory.

- The pharmaceutical industry is heavily regulated, adding complexity for new entrants.

- Existing chains have brand recognition, a key advantage in the competitive market.

Threat of New Entrants 5

The threat of new entrants in the pharmacy market is moderate. Existing large pharmacy chains, like CVS and Walgreens, benefit from significant economies of scale. These advantages include bulk purchasing, efficient distribution networks, and large-scale marketing capabilities. New entrants face difficulties in competing on cost due to these established efficiencies, requiring substantial market share to achieve similar economies.

- Rite Aid, as of May 2024, is closing additional stores as part of its bankruptcy plan.

- Large chains can negotiate better prices with suppliers.

- Economies of scale make it challenging for smaller entrants to match pricing.

- Achieving significant market share is crucial for new entrants to compete effectively.

The threat of new entrants to Rite Aid is moderate, influenced by high barriers. Significant capital and regulatory compliance deter new competitors. Rite Aid’s market share in 2024 was around 2.5%, making it challenging for newcomers.

| Factor | Impact | Data |

|---|---|---|

| Capital Needs | High | Real estate, inventory costs |

| Regulations | Complex | Compliance costs |

| Market Share (2024) | Low | Approx. 2.5% |

Porter's Five Forces Analysis Data Sources

This Porter's Five Forces analysis draws data from SEC filings, market reports, and industry databases.