Rite Aid PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rite Aid Bundle

What is included in the product

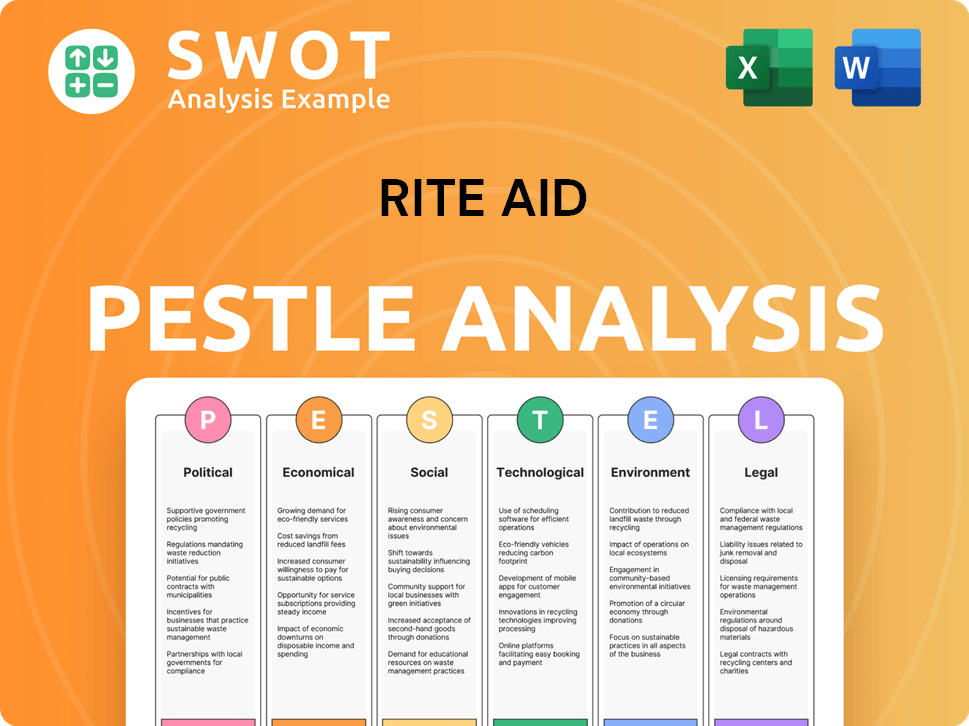

This analysis examines external influences on Rite Aid, covering political, economic, social, tech, environmental, and legal factors.

A clean, summarized version of the full analysis for easy referencing during meetings or presentations.

What You See Is What You Get

Rite Aid PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis of Rite Aid covers key political, economic, social, technological, legal, and environmental factors. Gain a comprehensive view ready for your strategic decision-making. Download this valuable analysis immediately!

PESTLE Analysis Template

Analyze Rite Aid's future with our PESTLE analysis, detailing key external influences. Discover how political changes and economic shifts affect operations. Uncover social trends and technological advancements impacting the company. This ready-to-use analysis offers comprehensive insights. Download the full version for a strategic advantage!

Political factors

Government healthcare policies critically affect Rite Aid. Regulations on drug pricing and reimbursement rates, influenced by the Inflation Reduction Act, directly impact its finances. Changes from a new US administration or existing laws can shift revenue. In Q1 2024, drug costs rose, reflecting policy impacts.

The pharmaceutical sector faces a complex regulatory landscape. Changes to laws about controlled substances and dispensing practices are common. These shifts create compliance challenges, potentially leading to legal issues. For instance, in 2024, Rite Aid faced scrutiny over opioid prescriptions. Such issues can result in significant financial settlements.

Political instability affects trade, tariffs, and supply chains. Rite Aid must adjust sourcing and distribution. For example, in 2024, trade policy shifts impacted pharmaceutical imports. These changes can lead to cost fluctuations and operational challenges.

Lobbying and Political Contributions

Rite Aid actively participates in lobbying and political contributions to shape policies relevant to the pharmacy sector. This strategy aims to influence regulations and legislation impacting its operations and profitability. For example, in 2023, the company spent approximately $300,000 on lobbying efforts. These efforts often target pharmacy benefit manager (PBM) regulations.

- Lobbying spending: roughly $300,000 in 2023.

- Focus: PBM regulations and other industry-specific policies.

- Impact: Influencing legislation to benefit business interests.

Government Investigations and Litigation

Rite Aid faces substantial risks from government investigations and litigation, particularly concerning its role in the opioid crisis. These legal challenges, including potential violations of the False Claims Act, can lead to hefty fines and penalties. The company's financial health is directly impacted by these legal battles, which can divert resources and affect investor confidence. As of late 2024, Rite Aid has faced numerous lawsuits related to opioid distribution practices.

- Legal expenses have increased significantly in recent years.

- Settlements related to opioid claims could reach billions of dollars.

- Ongoing investigations by federal and state agencies continue.

- The outcomes of these cases will shape Rite Aid's future.

Rite Aid navigates a dynamic political landscape that significantly affects its financial performance. Healthcare policies, including drug pricing regulations influenced by the Inflation Reduction Act, directly shape revenue and costs, with Q1 2024 showing these impacts. The company engages in lobbying, spending approximately $300,000 in 2023 to influence pharmacy benefit manager (PBM) regulations. Ongoing opioid-related litigation poses substantial financial risks, and settlements could reach billions.

| Political Factor | Impact | Data |

|---|---|---|

| Drug Pricing Regulations | Affects revenue | Inflation Reduction Act |

| Lobbying | Influences regulations | $300,000 (2023) |

| Opioid Litigation | Financial risk | Potential billions in settlements |

Economic factors

Inflationary pressures, though easing, still affect consumer spending. Data from early 2024 shows a slight increase in spending, but it remains cautious. Consumers may opt for cheaper alternatives for non-essential items. This could drive customers to seek lower-cost pharmacies, impacting Rite Aid's front-end sales.

Decreases in prescription drug reimbursement rates significantly impact pharmacy revenue. Rite Aid, like other pharmacies, faces pressure from lower rates set by insurance providers. Reimbursement cuts directly affect gross profits, squeezing margins in the competitive market. In 2024, these pressures remain a key concern, influencing profitability.

Rite Aid faces tough competition. Major rivals include CVS, Walgreens, and Walmart. In 2024, CVS and Walgreens dominated, holding significant market share. Rite Aid's revenue was affected by this competition, leading to strategic shifts.

Debt Burden and Financial Performance

Rite Aid faces substantial economic pressures due to its high debt load, which is a major concern for its financial health. The company's poor operating performance and continuous net losses further exacerbate these financial challenges. These factors significantly affect its ability to invest in growth and maintain operations. The company's Adjusted EBITDA and future are under pressure.

- Rite Aid's debt was approximately $3.3 billion as of Q4 2024.

- Net losses for 2024 were substantial, indicating ongoing financial strain.

- Adjusted EBITDA has been volatile, reflecting operational challenges.

Bankruptcy and Restructuring

Rite Aid's financial struggles have led to significant economic impacts. The company has a history of bankruptcy filings, with the most recent in 2023. Restructuring efforts involve substantial store closures and asset sales, affecting local economies. These actions reflect broader economic challenges in the pharmacy sector.

- Rite Aid filed for Chapter 11 bankruptcy in October 2023.

- The company plans to close around 400 stores.

- Rite Aid's market capitalization is significantly reduced due to financial instability.

Economic factors critically impact Rite Aid's operations, particularly regarding inflation and reimbursement rates. Despite easing, inflation still influences consumer behavior, possibly shifting demand toward cheaper options. Prescription drug reimbursement rates continue to pressure pharmacy revenue, affecting Rite Aid's profitability.

Debt remains a major challenge, with around $3.3 billion outstanding as of Q4 2024, straining its ability to invest and grow. Store closures and restructuring, post-bankruptcy filing in October 2023, reflect economic instability in 2024, with approximately 400 stores planned for closure.

| Economic Factor | Impact on Rite Aid | Data/Details (2024) |

|---|---|---|

| Inflation | Affects consumer spending | Consumer spending slightly up, cautious; may seek cheaper alternatives. |

| Reimbursement Rates | Reduces revenue | Lower rates from insurers squeeze margins. |

| Debt | Financial strain | Approx. $3.3B as of Q4 2024. |

Sociological factors

Consumer behavior is shifting, with a focus on affordability and convenience. Rite Aid must adapt to meet these demands. Digital healthcare experiences are increasingly important; consumers want easy access. In 2024, online pharmacy sales surged by 20%, showing this trend's strength.

The aging population fuels demand for healthcare services and pharmaceuticals. Rite Aid can capitalize on this demographic by offering specialized care and medication management. Data from 2024 indicates a rise in chronic diseases among seniors, boosting prescription needs. This trend presents growth opportunities, but also requires strategic adjustments.

Public perception of Rite Aid and the pharmaceutical industry, particularly regarding drug pricing and the opioid crisis, significantly influences customer trust. The pharmaceutical industry's reputation took a hit; in 2024, only 36% of Americans trusted it. Rite Aid's involvement in opioid-related lawsuits has further damaged its image. Consequently, customer loyalty is affected, impacting sales and brand value.

Health and Wellness Trends

Consumer focus on health and wellness is rising, shaping pharmacy offerings. Preventative care and personalized medicine are key trends. Rite Aid adapts by providing related products and services. The global wellness market reached $7 trillion in 2023, showing huge growth. This drives changes in the products available.

- Preventative care is becoming more popular, with a 10% increase in demand for related services.

- Personalized medicine is on the rise, with a projected market value of $600 billion by 2025.

- Rite Aid is expanding its offerings in these areas to meet consumer demand.

Healthcare Accessibility and Disparities

Rite Aid's store closures, especially in underserved areas, significantly impact healthcare accessibility. This issue can worsen existing health disparities. Residents in these areas may face longer travel times and transportation costs to obtain medications. This can lead to poorer health outcomes.

- In 2024, Rite Aid announced plans to close additional stores, potentially affecting access in vulnerable communities.

- Data from the CDC shows disparities in chronic disease management and medication adherence, which can be worsened by limited pharmacy access.

Changing consumer behaviors highlight affordability and convenience. The aging population's need for healthcare and pharmaceuticals continues to rise, with prescription needs increasing. Rite Aid's public image affects customer trust and loyalty, impacted by the opioid crisis and pricing concerns.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Consumer Behavior | Demand for affordability and convenience | Online pharmacy sales +20% in 2024 |

| Aging Population | Increased demand for healthcare | Chronic diseases among seniors up |

| Public Perception | Customer trust & loyalty hit | 36% trust in pharma (2024) |

Technological factors

AI and machine learning are revolutionizing drug discovery, clinical trials, and operational efficiency. The global AI in the pharmaceutical market is projected to reach $7.6 billion by 2025. Rite Aid can leverage these technologies for innovation and cost savings. This includes optimizing supply chains and personalizing customer experiences.

Digital health and telehealth are reshaping healthcare delivery, impacting pharmacies like Rite Aid. Telehealth adoption surged, especially during 2020-2023, with a projected 20% annual growth rate. Rite Aid could leverage these technologies to enhance patient care and expand service offerings. Remote patient monitoring, a key digital health aspect, is expected to reach a $30+ billion market by 2025.

Rite Aid must adapt to data analytics in healthcare. Big data, analytics, and genomic sequencing advance personalized medicine. This requires pharmacies to adjust services and products. The personalized medicine market is projected to reach $600 billion by 2025. This shift impacts Rite Aid's strategy.

E-commerce and Online Pharmacy Platforms

E-commerce and online pharmacy platforms are significantly impacting Rite Aid. The shift towards digital channels intensifies competition. According to a 2024 report, online pharmacy sales grew by 15% in the last year. Rite Aid must adapt to compete effectively.

- Digital sales are expected to account for 20% of all pharmacy sales by 2025.

- Amazon Pharmacy has captured 5% of the online prescription market as of early 2024.

- Rite Aid's investments in its online platform are crucial for future growth.

Supply Chain Technology

Rite Aid can leverage supply chain technology to improve its operations. Blockchain, for example, can boost transparency and traceability in drug distribution. This can help reduce errors and ensure product integrity. In 2024, the global supply chain management market was valued at approximately $52.2 billion, and is projected to reach $86.3 billion by 2029.

- Blockchain technology adoption in healthcare supply chains is expected to grow significantly by 2025.

- Investments in supply chain tech by pharmaceutical companies increased by 15% in 2024.

- Improved efficiency could lead to a 10-15% reduction in supply chain costs.

Technological advancements reshape Rite Aid. AI in pharma is set to hit $7.6B by 2025, boosting innovation and cutting costs. Digital health's rise, with 20% growth in telehealth, alters patient care and services. Adapting to data analytics is essential; the personalized medicine market will reach $600B by 2025.

| Technology | Impact on Rite Aid | 2024-2025 Data Points |

|---|---|---|

| AI & Machine Learning | Enhances drug discovery, improves efficiency | AI in pharma market: $7.6B by 2025 |

| Digital Health/Telehealth | Boosts patient care and service expansion | Telehealth: 20% annual growth rate |

| E-commerce & Online Pharmacies | Shifts competition to digital platforms | Online pharmacy sales grew 15% (2024); digital sales 20% of all by 2025. Amazon Pharmacy holds 5%. |

Legal factors

Rite Aid's restructuring, including its 2023 Chapter 11 bankruptcy, is governed by U.S. bankruptcy laws. This involves debt restructuring and asset sales. In 2024, the company is navigating this process, aiming to reorganize successfully. The company's legal strategies and outcomes will be shaped by these proceedings.

Rite Aid must adhere to intricate and changing pharmaceutical regulations at both federal and state levels. These regulations govern drug registration, dispensing practices, and handling of controlled substances. Non-compliance can result in significant legal issues, including hefty fines and operational restrictions. In 2024, the FDA issued over 400 warning letters to pharmaceutical companies. These issues highlight the critical importance of stringent regulatory compliance for Rite Aid.

Rite Aid must strictly adhere to healthcare compliance laws, including HIPAA, to protect patient data privacy and security. Non-compliance can lead to hefty penalties and reputational damage. In 2024, HIPAA violations resulted in fines ranging from $100 to $50,000 per violation. Rite Aid's ability to maintain patient trust hinges on robust data protection measures.

Opioid Litigation and Settlements

Rite Aid faces substantial legal challenges due to its role in the opioid crisis. These legal battles have resulted in major financial settlements. The company has been actively working to resolve these litigations. In 2024, Rite Aid reached settlements in various states, allocating significant funds for remediation efforts. These settlements continue to impact the company's financial performance and strategic decisions.

- In March 2024, Rite Aid reached a $57.5 million settlement with the state of West Virginia.

- Rite Aid's total opioid-related liabilities are estimated to be in the billions.

- Ongoing litigation continues to pose financial risks.

Labor Laws and Union Agreements

Rite Aid's operations are significantly shaped by labor laws and union agreements, particularly impacting its cost structure and labor relations. These factors dictate employee compensation, including wages and benefits, and also influence working conditions. Any failure to comply with labor standards can lead to legal challenges, fines, or reputational damage. In 2024, labor costs represented a substantial portion of Rite Aid's operational expenses.

- Unionized employees constitute a significant portion of Rite Aid's workforce.

- Changes in minimum wage laws directly affect labor costs.

- Negotiations with unions can lead to wage increases and benefit adjustments.

- Labor disputes, such as strikes, can disrupt operations and impact profitability.

Rite Aid's legal landscape includes complex bankruptcy proceedings, with 2023's Chapter 11 restructuring impacting its financial and operational strategies. Strict adherence to pharmaceutical regulations and healthcare compliance laws, like HIPAA, are crucial. Opioid crisis litigations, alongside settlements, create significant financial and legal risks. Labor laws and union agreements also substantially affect costs.

| Legal Area | Key Aspects | 2024/2025 Data |

|---|---|---|

| Bankruptcy | Restructuring, asset sales | Chapter 11 ongoing. In Q1 2024, Rite Aid closed over 70 stores. |

| Regulations | Drug registration, dispensing | FDA issued >400 warnings in 2024. |

| Healthcare | HIPAA compliance, data protection | HIPAA fines up to $50K per violation. |

| Opioid Litigation | Financial settlements | West Virginia settlement $57.5M. Total liabilities: billions. |

| Labor Laws | Union agreements, costs | Labor costs substantial. |

Environmental factors

Proper disposal of pharmaceutical waste, like unused meds, chemicals, and packaging, is a major environmental issue. It's regulated by environmental laws and affects water/soil quality. The EPA reports that improper disposal can contaminate drinking water. In 2024, the pharmaceutical waste disposal market was valued at $5.2 billion, expected to reach $7.8 billion by 2029.

Rite Aid, like other pharmaceutical companies, faces environmental scrutiny due to its carbon footprint. Manufacturing and transportation processes significantly contribute to greenhouse gas emissions. In 2024, the pharmaceutical industry's emissions were estimated at 55 million metric tons of CO2e. Companies must reduce emissions. Investing in renewables is crucial.

Rite Aid's extensive use of plastic packaging for pharmaceuticals significantly contributes to environmental waste. The pharmaceutical packaging market is projected to reach $159.6 billion by 2024. This reliance underscores the need for sustainable alternatives. Exploring biodegradable or reusable packaging options could reduce waste and enhance Rite Aid's environmental profile.

Water Usage and Wastewater Treatment

Rite Aid's operations, particularly in pharmaceutical aspects, are significantly influenced by water usage and wastewater treatment regulations. Manufacturing processes demand substantial water, necessitating efficient water management strategies to minimize environmental impact. Proper wastewater treatment is crucial to remove pharmaceutical residues, aligning with environmental protection standards. The pharmaceutical industry faces increasing scrutiny regarding water usage and pollution, with stringent regulations being enforced. These factors directly affect Rite Aid's operational costs and compliance strategies.

- Water scarcity and pollution are major global environmental issues, impacting pharmaceutical companies.

- Stringent regulations are being implemented to control pharmaceutical residues in wastewater.

- Companies are investing in advanced wastewater treatment technologies.

- Compliance costs and operational changes are increasing for pharmaceutical manufacturers.

Supply Chain Environmental Impact

Rite Aid's environmental footprint stretches into its supply chain, encompassing raw material sourcing and distribution networks. This necessitates a strong focus on transparency and the adoption of sustainable practices across all stages. The company must evaluate its suppliers' environmental records, aiming to reduce emissions and waste. In 2024, supply chain emissions accounted for a significant portion of corporate environmental impact.

- In 2024, supply chain emissions accounted for approximately 60% of overall corporate emissions for many retailers.

- Rite Aid's specific data on supply chain emissions reduction targets for 2025 is crucial.

- Sustainable packaging and logistics are key areas for improvement.

- Collaboration with suppliers on environmental initiatives is essential.

Rite Aid tackles environmental issues via waste disposal and a hefty carbon footprint from manufacturing and packaging. In 2024, pharmaceutical waste disposal hit $5.2B; packaging reached $159.6B. Water usage and supply chain emissions are other considerations.

| Environmental Factor | Impact on Rite Aid | Data (2024/2025) |

|---|---|---|

| Waste Disposal | Compliance, costs, and reputation | Pharmaceutical waste disposal market: $5.2B (2024), to $7.8B by 2029 |

| Carbon Footprint | Emissions regulations, sustainability efforts | Pharma industry emissions: 55M metric tons CO2e (2024) |

| Packaging | Waste management and consumer perception | Pharma packaging market: $159.6B (2024), Sustainable packaging crucial |

PESTLE Analysis Data Sources

The Rite Aid PESTLE relies on reputable market research, government reports, and financial data sources. This data supports our industry analysis and insights.