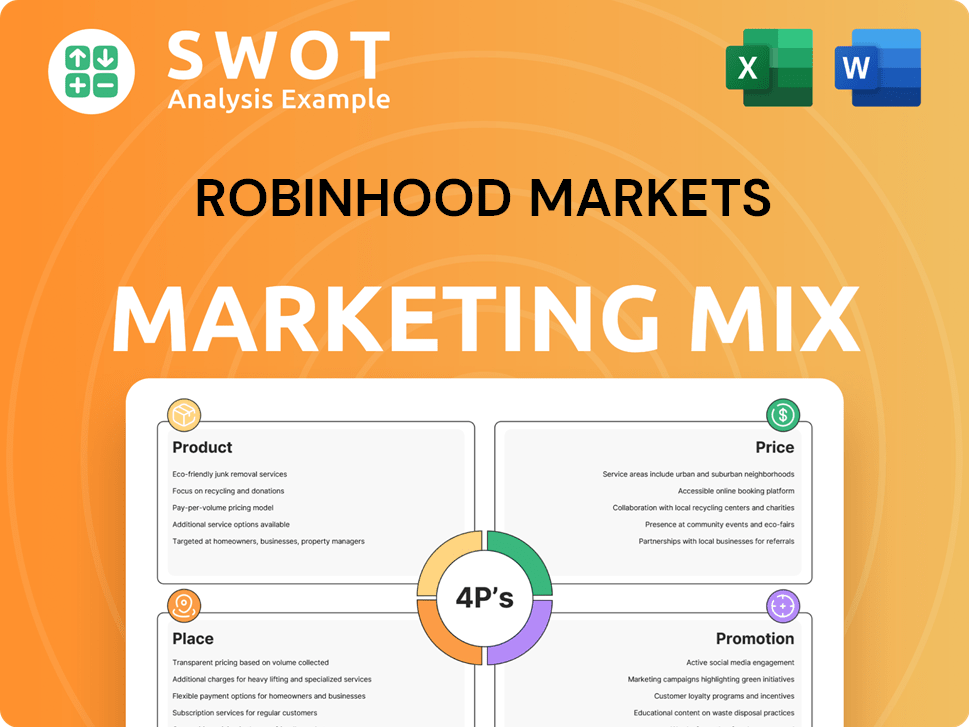

Robinhood Markets Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Robinhood Markets Bundle

What is included in the product

A detailed analysis of Robinhood Markets' Product, Price, Place, and Promotion strategies, ideal for benchmarking.

Summarizes the 4Ps, making complex marketing strategies concise & immediately actionable for busy teams.

What You See Is What You Get

Robinhood Markets 4P's Marketing Mix Analysis

You're looking at the comprehensive Robinhood Markets 4Ps analysis you'll receive. There are no hidden versions or upgraded packages. This fully realized marketing document will be instantly yours after purchase.

4P's Marketing Mix Analysis Template

Robinhood's platform simplifies investing, its product focused on accessibility with commission-free trading. Pricing uses a freemium model, driving user acquisition. Place centers around mobile and web platforms. Promotion leverages digital marketing and social media.

Their success hinges on these core elements. But this is just a glimpse! Get the full analysis to see how the company aligns its marketing for real-world impact, fully editable.

Product

Robinhood's commission-free trading revolutionized the brokerage industry. It offers zero-fee trading for stocks, ETFs, and options. This model attracted over 23 million active users by Q1 2024. Its simplicity and accessibility appealed to younger, first-time investors. This helped Robinhood capture a significant market share.

Robinhood's diverse investment options are a key part of its marketing mix. The platform allows trading in stocks, ETFs, options, and cryptocurrencies, offering users various investment choices. In Q1 2024, crypto trading revenue was $120 million. Robinhood continues to expand, adding more crypto assets and exploring new markets.

Robinhood's mobile-first platform, central to its marketing, provides a user-friendly app, resonating with smartphone-savvy users. In Q1 2024, 75% of Robinhood's funded accounts accessed the platform via mobile. This approach emphasizes accessibility and ease, pivotal to attracting 23.9 million users in Q1 2024. The mobile app's design simplifies finance management, boosting engagement.

Additional Financial Services

Robinhood's product strategy extends beyond core trading, encompassing various financial services designed to boost customer engagement. The platform offers Robinhood Gold, providing premium features for a monthly fee. In Q1 2024, Robinhood reported 1.6 million Gold subscribers. Retirement accounts, including those with matching contributions, and cash management services are also available. Robinhood's credit card further diversifies its product offerings, enhancing its appeal.

- Robinhood Gold had 1.6M subscribers in Q1 2024.

- Offers retirement accounts and cash management.

- Credit card enhances product portfolio.

Educational Resources and Tools

Robinhood's educational resources and tools are designed to support users in their investment journey. They offer in-app learning materials, market data, and charting tools to facilitate informed decision-making. This approach aims to empower both novice and seasoned investors, enhancing their trading capabilities. As of Q1 2024, Robinhood reported over 28 million active users, reflecting the importance of accessible educational resources.

- In Q1 2024, Robinhood's revenue increased by 40% year-over-year, partly due to increased user engagement.

- The platform's educational content includes articles and videos covering various investment topics.

- Advanced charting tools provide users with data for technical analysis.

Robinhood offers commission-free trading on stocks, ETFs, options, and crypto, attracting 23M+ users by Q1 2024. The platform has expanded its services beyond trading. Its features like Robinhood Gold and retirement accounts cater to varied investor needs. The platform continues to innovate, driving up the user base.

| Feature | Description | Q1 2024 Data |

|---|---|---|

| Gold Subscribers | Premium features | 1.6 million |

| Mobile Usage | Mobile platform accessibility | 75% accounts via mobile |

| Crypto Revenue | Income from crypto trading | $120 million |

Place

Robinhood's mobile app is the primary access point for its services, reflecting its mobile-first approach. As of Q1 2024, Robinhood reported 11.3 million monthly active users, heavily reliant on the app. This accessibility enables on-the-go investing and aligns with current user preferences. The app's design focuses on simplicity and ease of use, attracting both novice and experienced investors.

Robinhood's web platform complements its mobile app, catering to users who prefer desktop access. This platform offers advanced charting tools, a key feature for informed trading decisions. In Q4 2023, 23.6 million users actively used Robinhood, highlighting the importance of multiple access points. The web platform's enhanced capabilities support diverse user preferences and trading styles.

Robinhood's online presence is central to its strategy, utilizing its website and app for customer interaction. This digital focus aids in cost efficiency and broad accessibility. As of Q1 2024, Robinhood had 28.5 million active users. Their online platforms are key for acquiring and supporting users. This strategy allows them to offer services at competitive prices.

Targeting Younger Demographics Digitally

Robinhood excels in digital distribution, focusing marketing on platforms popular with younger demographics. This digital-first approach aligns perfectly with their target market's online behavior, ensuring high visibility. In 2024, over 60% of Robinhood's users were under 35, reflecting their digital strategy's success. This focus allows for efficient targeting and cost-effective marketing campaigns, driving user acquisition and engagement.

- Digital marketing spending increased by 40% in 2024.

- Mobile app downloads grew by 25% year-over-year.

- Social media engagement rates are 15% higher than industry average.

Expanding Geographic Reach

Robinhood's expansion involves offering services beyond the US. They've targeted regions like the UK and EU, particularly for crypto trading. This strategic move increases its global presence. In Q1 2024, international expansion plans were emphasized. The company aims to diversify its revenue streams.

- Q1 2024 focus on international growth.

- Services offered in the UK and EU.

- Emphasis on crypto trading.

- Diversifying revenue streams.

Robinhood's primary place strategy focuses on its digital presence through mobile and web platforms, maximizing accessibility and user experience. The mobile app, crucial for its mobile-first strategy, hosted 11.3 million monthly active users by Q1 2024. Moreover, Robinhood expanded globally, eyeing markets like the UK and EU, emphasizing crypto trading, aligning with its diversification goals.

| Aspect | Details |

|---|---|

| Mobile App | 11.3M monthly active users Q1 2024. |

| Web Platform | Advanced tools & supports various users. |

| Online Focus | 28.5M active users in Q1 2024. |

Promotion

Robinhood's promotion heavily emphasizes commission-free trading, a core differentiator. This strategy attracted many new users, especially beginners and those trading smaller amounts. Data from 2024 showed a continued focus on this, with trading volume up significantly. In Q1 2024, Robinhood's revenue was $618 million, demonstrating the impact of this value proposition.

Robinhood's referral programs have been a cornerstone of its growth strategy. They offer incentives, like free stocks, to users who bring in new customers. This approach leverages word-of-mouth marketing, proving highly effective. In Q1 2024, Robinhood's monthly active users (MAU) reached 28.6 million, a 16% increase year-over-year, partly due to these programs.

Robinhood leverages social media for promotions. The company shares market updates and educational content. This fosters brand loyalty and community. As of Q1 2024, Robinhood's monthly active users (MAU) reached 28.6 million. Social media engagement drives user interaction.

Targeted Digital Advertising

Robinhood heavily relies on targeted digital advertising to boost its user base. This strategy involves using data analytics to pinpoint specific demographics, interests, and online behaviors. This approach allows Robinhood to tailor its marketing efforts, increasing efficiency and return on investment. For example, in Q1 2024, marketing spend was $65 million, targeting user acquisition.

- Data-driven targeting enhances ad relevance.

- Marketing spend is optimized by focusing on high-potential users.

- Digital channels provide measurable campaign performance.

- Advertising is crucial for customer acquisition.

Brand Building and Partnerships

Robinhood focuses on brand building through partnerships and campaigns to boost its image and expand its reach. Recent updates to its visual identity and sports sponsorships are key examples of this strategy. These efforts aim to increase brand recognition and attract new users. In 2024, Robinhood's marketing spend reached $200 million, reflecting its commitment to brand growth.

- Marketing Spend: Approximately $200 million in 2024.

- Partnerships: Sports sponsorships and collaborations.

- Brand Updates: Recent changes to visual identity.

Robinhood's promotions stress commission-free trading. Referral programs incentivize new user acquisition, fueling growth. Digital advertising and social media also play critical roles. Targeted strategies drove $200 million marketing spend in 2024.

| Promotion Element | Description | Impact |

|---|---|---|

| Commission-Free Trading | Core differentiator attracting new users. | Increased trading volume, revenue up in Q1 2024 to $618M. |

| Referral Programs | Incentives like free stocks to attract new users. | 16% YoY MAU growth; 28.6M MAU in Q1 2024. |

| Digital Advertising | Targeted ads to reach specific demographics. | Q1 2024 marketing spend: $65M, user acquisition. |

Price

Robinhood's pricing strategy, centered on zero commission fees, revolutionized the investment landscape. This approach eliminated trading costs for stocks, ETFs, options, and cryptos. In Q1 2024, Robinhood reported $618 million in total revenue. This strategy lowered the entry barrier, attracting a broader investor base.

Robinhood's revenue streams go beyond commission-free trading. They earn through payment for order flow, interest from margin loans, and interest on customer cash balances. Subscription fees for Robinhood Gold also contribute. In Q1 2024, transaction-based revenue was $202 million; interest revenue was $182 million, and subscription revenue was $58 million.

Robinhood's pricing strategy includes tiered services via Robinhood Gold. This premium service offers enhanced features for a monthly fee, creating a two-tiered pricing model. As of Q1 2024, Robinhood Gold subscribers totaled 1.6 million. This tiered approach targets users seeking advanced trading tools. The subscription model generated $60 million in revenue in Q1 2024.

Competitive Margin Rates

Robinhood's competitive margin rates are a key part of its pricing strategy, designed to draw in and keep active traders who use margin. This approach provides leverage, allowing users to amplify their buying power, which is a significant draw for those seeking higher returns. For example, in 2024, Robinhood offered margin rates starting as low as 6.75% for Gold members, making it attractive compared to competitors. This strategy helps Robinhood to capture a larger share of the active trading market.

- Margin rates as low as 6.75% for Gold members.

- Attracts active traders.

- Provides leverage for increased buying power.

Potential Future Revenue Streams

Robinhood's pricing strategy is evolving beyond commission-free trading. The company is branching out with new offerings like a credit card and wealth management services, presenting opportunities for diverse revenue streams. These new services are designed to enhance customer value and integrate more deeply into their financial lives. In Q1 2024, Robinhood reported a 40% increase in total revenues year-over-year, driven by higher interest income and transaction-based revenues.

- Credit card and wealth management services are key growth areas.

- Diversifying revenue streams reduces reliance on trading commissions.

- Q1 2024 saw significant revenue growth, indicating successful expansion.

Robinhood's pricing uses commission-free trading to attract users, significantly changing the investment scene. Their strategy includes various revenue streams, such as payment for order flow, interest, and subscriptions. Subscription-based Robinhood Gold provides premium features, while competitive margin rates draw active traders, and in Q1 2024, subscription revenue was $58 million.

| Aspect | Details | Q1 2024 Data |

|---|---|---|

| Commission Structure | Zero-commission trading for stocks, ETFs, options, and crypto | - |

| Revenue Sources | Payment for order flow, margin loans, subscription fees | Transaction-based revenue: $202M |

| Robinhood Gold | Subscription-based premium service | 1.6M subscribers |

4P's Marketing Mix Analysis Data Sources

Robinhood's 4Ps are based on SEC filings, investor materials, press releases, and financial reports.