Robinhood Markets PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Robinhood Markets Bundle

What is included in the product

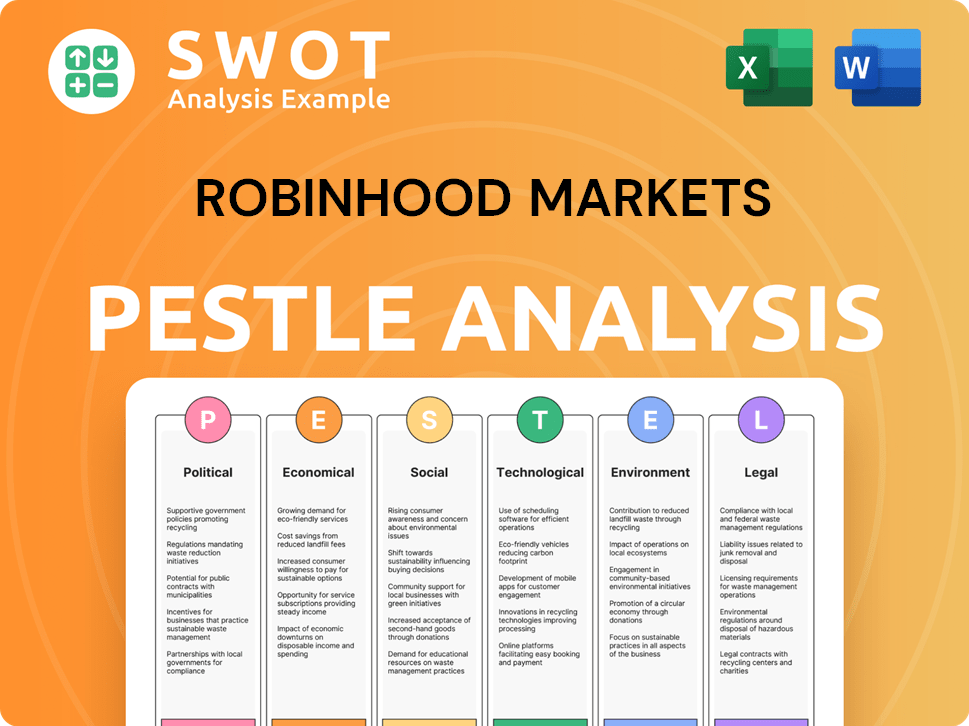

Analyzes macro-environmental factors affecting Robinhood, spanning Political, Economic, Social, Technological, Environmental, and Legal aspects.

Allows users to modify or add notes specific to their own context, region, or business line.

Preview Before You Purchase

Robinhood Markets PESTLE Analysis

The layout, content, and structure visible here are exactly what you’ll be able to download immediately after buying the Robinhood Markets PESTLE analysis.

PESTLE Analysis Template

Navigate the complex landscape surrounding Robinhood Markets with our comprehensive PESTLE analysis. We examine the political factors, like regulatory scrutiny, shaping its trajectory.

Explore the economic implications, including market volatility, affecting Robinhood's profitability.

Understand the social influences, such as changing investor behavior, on its user base.

Assess the technological disruptions, like cybersecurity risks, impacting platform stability.

Identify the legal constraints, including compliance requirements, that Robinhood faces.

Delve into environmental factors, and how they relate to their ESG initiatives.

Ready to gain a decisive edge? Download the full, in-depth PESTLE analysis today for immediate strategic advantage!

Political factors

Robinhood navigates intense regulatory scrutiny from the SEC and FINRA. In 2024, the SEC fined Robinhood $7.5 million for crypto-related violations. This pressure impacts its operational practices. The evolving regulatory landscape poses risks to its business model and could affect profitability, with potential for further fines or restrictions.

Proposed regulations pose a significant risk to Robinhood. Changes to payment for order flow, a major revenue stream, could drastically alter its financials. Increased transparency or minimum fees may decrease income and inflate compliance expenses. In Q1 2024, Robinhood's net revenue was $618 million. This highlights the regulatory impact.

Robinhood faces political scrutiny over its gamified trading platform. Congressional hearings have addressed concerns about potential overtrading by younger investors. These discussions could result in stricter regulations. In 2024, the SEC increased its focus on broker-dealer practices and investor protection. New rules could impact Robinhood's platform design.

Market Democratization Discussions

Robinhood's mission of democratizing finance aligns with political goals of financial inclusion. Policymakers often view increased market access positively. However, this also attracts regulatory scrutiny. The debate includes discussions on investor protection and market fairness. This is particularly relevant given the rise of retail trading.

- In 2024, 26% of U.S. adults used online brokers.

- Robinhood's user base grew by 18% in Q1 2024.

- Discussions intensified following the GameStop saga in early 2021.

- The SEC continues to propose rules affecting retail trading.

Influence of Political Stability on Investor Confidence

Political factors significantly influence investor confidence, impacting market activity, trading volumes, and user engagement on platforms like Robinhood. Instability can erode trust, leading to decreased trading and investment. Consumer sentiment, closely linked to political events, directly affects Robinhood's business performance. For instance, during periods of heightened political uncertainty, trading volumes may decline.

- Political stability correlates with higher market participation.

- Investor sentiment is a key driver of platform activity.

- Political events can cause volatility in trading patterns.

Robinhood contends with extensive SEC and FINRA oversight, facing fines and operational constraints due to crypto violations and other regulatory issues.

Proposed regulatory changes, particularly regarding payment for order flow, jeopardize its revenue, potentially reducing income and increasing expenses significantly. These evolving rules could alter Robinhood's platform design and compliance costs.

The platform is under political scrutiny. Increased focus on investor protection following events such as the GameStop saga further impacts trading activities. This can lead to decline in trading volumes during periods of uncertainty.

| Metric | Data | Period |

|---|---|---|

| SEC Fine for Crypto Violations | $7.5 million | 2024 |

| Q1 2024 Net Revenue | $618 million | Q1 2024 |

| User Base Growth | 18% | Q1 2024 |

Economic factors

Robinhood's revenue is closely tied to market volatility and trading volumes. Economic downturns or market shifts can reduce trading, impacting engagement. In Q1 2024, trading revenue was $129 million, up 59% YoY, yet sensitive to market trends. Volatility can drive user churn and affect financial performance.

Robinhood's fortunes are tightly linked to economic health. The platform's revenue and user activity are susceptible to economic downturns. In 2023, trading volumes were affected by market volatility. For example, Robinhood's Q4 2023 revenue was $613 million.

Robinhood's zero-commission model, though innovative, has spurred a race to the bottom. Competitors like Charles Schwab and Fidelity also offer commission-free trading. This intensified pressure forces Robinhood to innovate beyond basic trading. In Q4 2023, Robinhood's transaction-based revenues were $202 million.

Ongoing Challenge of Generating Sustainable Revenue Streams

Robinhood's commission-free model, while popular, poses a continuous challenge in securing sustainable revenue. The company relies on revenue streams like payment for order flow (PFOF), interest earned on customer cash, and premium subscriptions. These revenue sources are vulnerable to market fluctuations and regulatory adjustments, impacting financial stability.

- PFOF accounted for 34% of Robinhood's revenue in Q1 2024.

- Interest earned on customer cash contributed to 30% of revenue in Q1 2024.

- Robinhood Gold subscriptions brought in $58 million in Q1 2024.

Impact of Interest Rates

Changes in interest rates significantly influence borrowing costs and investor behavior. Higher interest rates can make fixed-income securities more attractive, potentially diverting funds away from equities and impacting trading volumes on platforms like Robinhood. For instance, the Federal Reserve's actions in 2024, with interest rate hikes, aimed to combat inflation, influencing investor decisions. This shift could lead to reduced trading activity on Robinhood, affecting its revenue streams, which are tied to transaction volumes.

- Federal Reserve interest rate decisions in 2024.

- Impact on investor preferences towards fixed-income securities.

- Potential decrease in trading volumes on Robinhood.

- Effect on Robinhood's revenue streams.

Economic conditions significantly shape Robinhood's performance, with market volatility directly affecting trading revenues. Changes in interest rates influence investor behavior, potentially impacting trading volumes on the platform. For instance, a notable portion of revenue is derived from sources sensitive to economic shifts.

| Economic Factor | Impact on Robinhood | Data Point |

|---|---|---|

| Market Volatility | Drives trading activity and revenue | Q1 2024 trading revenue up 59% YoY |

| Interest Rate Hikes | Influence investor decisions; can reduce trading | Federal Reserve actions in 2024 |

| Economic Downturns | May decrease trading and user engagement | Trading volumes affected in 2023 |

Sociological factors

Robinhood's platform resonates with younger investors, especially millennials and Gen Z, who are tech-savvy and prefer easy-to-use interfaces. This appeal has fueled significant user growth; for instance, in Q4 2023, Robinhood reported 23.6 million monthly active users. This demographic's comfort with mobile technology and appetite for accessible investment tools have proven pivotal. The company's success highlights a shift in how younger generations engage with financial markets.

Societal attitudes are changing, with more people embracing digital financial services. This shift favors mobile investing platforms like Robinhood. In 2024, mobile banking users in the U.S. reached approximately 200 million, showcasing this trend. Robinhood's mobile-first strategy directly benefits from this increasing digital adoption. This aligns with the broader consumer preference for accessible, tech-driven financial solutions.

Social media significantly influences younger investors' decisions. Platforms like TikTok and X (formerly Twitter) drive trading trends. Robinhood's appeal is tied to this social media-driven market. In 2024, 67% of Gen Z and Millennials used social media for investment info, impacting asset popularity.

Changing Attitudes Towards Wealth Management

Younger generations are reshaping wealth management preferences. They prioritize transparency and control, a shift away from traditional services. This trend strongly favors platforms like Robinhood. In 2024, 60% of Gen Z and Millennials preferred digital investment tools. Robinhood's user base reflects this change.

- 60% of Gen Z and Millennials prefer digital investment tools.

- Robinhood's user base growth.

Focus on Financial Inclusion and Education

Robinhood's focus on financial inclusion aligns with societal trends. The platform aims to democratize finance, which resonates with the public's desire for broader access. Offering educational tools and simplified investing addresses the need for financial literacy. This approach can help reduce wealth inequality and promote economic stability.

- In 2024, Robinhood launched "Learn," an educational platform.

- Over 22 million users are on the platform.

- Robinhood's user base skews younger compared to traditional brokerages.

Robinhood's user base, especially Millennials and Gen Z, favor user-friendly interfaces. The societal shift towards digital finance favors mobile investment platforms. Social media drives investment decisions among young investors, with many using platforms for info.

| Factor | Details | Impact |

|---|---|---|

| Digital Adoption | 200M U.S. mobile banking users in 2024. | Boosts Robinhood's mobile strategy. |

| Social Media Influence | 67% Gen Z/Millennials use social media for investment info. | Affects asset popularity and trading trends. |

| User Preferences | 60% of Gen Z and Millennials prefer digital tools. | Aligns with Robinhood's digital focus. |

Technological factors

Robinhood's success hinges on its tech. Its user-friendly interface and advanced algorithms are key. In 2024, Robinhood invested $200 million in tech upgrades. This helps maintain a competitive edge and enhances user experience. Continuous improvement is vital for attracting and keeping customers.

Robinhood's technological landscape is heavily shaped by cybersecurity. As a financial platform, they must protect user data and transactions. In 2024, cybersecurity spending is projected to reach $215 billion globally. Robinhood invests in advanced cybersecurity infrastructure to safeguard sensitive information. This includes measures like encryption and fraud detection systems.

Robinhood's success hinges on its mobile app, with most users trading on their phones. The app's performance and features are crucial for user satisfaction and trading activity. In Q4 2023, 93% of Robinhood's net revenues came from transaction-based revenues, highlighting the importance of a smooth mobile experience. As of December 31, 2023, Robinhood had 16.1 million monthly active users, showing the app's widespread use. Any technical issues or feature limitations on the app could directly impact trading volume and revenue.

Cloud-Based Infrastructure

Robinhood heavily depends on cloud-based infrastructure, mainly Amazon Web Services (AWS). This approach enables scalability and adaptability to meet the demands of its growing user base. However, this reliance also means managing cloud security and expenses are critical.

- AWS reported $25 billion in revenue for Q1 2024.

- Cloud security breaches are a growing concern, with costs rising annually.

Integration of AI and New Technologies

The financial tech sector is rapidly integrating AI and new technologies. Robinhood actively develops and deploys AI-driven features and tech upgrades to boost its platform. This includes personalized investment advice and improved trading tools. In Q1 2024, Robinhood reported a 40% increase in technology and development expenses. This investment aims to enhance user experience and expand services.

Robinhood’s technology strategy involves heavy investments in cybersecurity, projected to cost $215B globally in 2024. The mobile app is vital, with 93% of Q4 2023 revenue tied to it, having 16.1M monthly active users in December 2023. Reliance on cloud services, like AWS, generates $25B in revenue in Q1 2024, impacting the company's success.

| Area | Impact | Data (2024/2025) |

|---|---|---|

| Cybersecurity | Data protection & Trust | $215B global spending |

| Mobile App | Revenue generation | 93% Q4 2023 revenue, 16.1M active users |

| Cloud (AWS) | Scalability & Cost | $25B Q1 2024 revenue |

Legal factors

Robinhood grapples with legal issues and must adhere to fintech regulations. This involves lawsuits, regulatory probes, and customer disagreements. In 2024, Robinhood settled a lawsuit for $9.9 million concerning system outages. It continually adjusts to regulatory changes.

Robinhood has been involved in several settlements tied to operational failures and misleading communications. In December 2023, Robinhood agreed to pay $7.5 million to settle a class-action lawsuit. These settlements underscore the potential legal and financial risks the company faces.

The regulatory landscape for financial technology is constantly evolving, posing ongoing compliance challenges for Robinhood. The company must adapt to new rules around anti-money laundering, cybersecurity, and cryptocurrency trading, all areas of increased regulatory scrutiny. In 2024, the SEC and FINRA continued to increase oversight, reflected in higher compliance costs for firms like Robinhood. Recent data shows that compliance expenses rose by 15% in the last year.

Potential Legal Risks Associated with Cryptocurrency Trading Features

Offering cryptocurrency trading exposes Robinhood to legal risks due to the uncertain and changing regulations for digital assets at federal and state levels. The SEC has increased scrutiny, exemplified by the $30 million fine against Kraken in February 2023. Legal disputes concerning token classifications and exchange operations are ongoing. Robinhood must navigate compliance with evolving KYC/AML rules and potential enforcement actions. For example, in 2024, the SEC is expected to intensify its focus on crypto enforcement.

Adherence to App Use Standards and User Agreements

Robinhood's operations are heavily influenced by its adherence to app use standards and user agreements, which are legally binding. These agreements dictate how users interact with the platform and outline the responsibilities of both Robinhood and its users. Legal challenges can emerge when enforcing these standards, particularly concerning issues like unauthorized account access or violations of trading rules. Robinhood faced multiple lawsuits in 2023 and 2024 related to trading restrictions and user account security breaches. These legal battles underscore the importance of clear, enforceable terms of service.

- In Q1 2024, Robinhood reported a 12% increase in legal and regulatory expenses.

- The firm has been involved in over 50 legal cases related to user disputes and trading practices since 2022.

- User agreements are updated annually, with the latest version released in January 2024.

Legal factors significantly impact Robinhood through regulatory compliance and user agreements. The company faces ongoing legal risks, with increased expenses reported in Q1 2024, a 12% rise. Numerous lawsuits, exceeding 50 since 2022, address user disputes and trading practices, impacting operational costs.

| Issue | Impact | Data |

|---|---|---|

| Regulatory Scrutiny | Higher Compliance Costs | 15% rise in compliance expenses |

| User Disputes | Litigation Expenses | 50+ cases since 2022 |

| Crypto Regulation | Uncertainty & Risk | SEC focus increased in 2024 |

Environmental factors

Robinhood provides ESG-themed investment choices, responding to the rising investor demand for sustainable investing. This reflects the financial sector's growing emphasis on sustainability. In Q4 2023, sustainable funds saw over $20 billion in inflows, highlighting this trend. This commitment could attract environmentally conscious investors.

Robinhood is spotlighting green investments like solar and wind energy. This caters to environmentally-conscious investors. In Q4 2024, renewable energy investments saw a 15% increase. This aligns with growing ESG interest. Data indicates rising demand for sustainable options.

Robinhood is assessing its environmental impact. This includes measuring greenhouse gas emissions. The company is focusing on energy efficiency. They aim to reduce their carbon footprint. Specifically, they are working on emissions reduction strategies.

Procurement of Renewable Energy Credits

Robinhood demonstrates environmental responsibility by acquiring renewable energy credits (RECs). This action supports renewable energy projects, reducing its carbon footprint. In 2024, the REC market saw increased demand, with prices varying based on location and source. Companies like Robinhood are increasingly using RECs to offset emissions, aligning with sustainability goals. For example, the average cost per REC in the U.S. ranged from $1 to $5 in 2024.

- RECs support renewable energy projects.

- Demand for RECs increased in 2024.

- Prices vary based on location and source.

- Average REC cost in the U.S.: $1-$5 (2024).

Engagement in Corporate Responsibility Initiatives

Corporate social responsibility (CSR) is increasingly important. It covers environmental concerns. Investors are more interested in companies with strong CSR. A 2024 study showed 77% of investors consider CSR when investing. This impacts Robinhood's reputation and appeal.

- Investor interest in CSR is growing.

- Companies with strong CSR may perform better.

- Robinhood's CSR affects its market value.

- 77% of investors consider CSR when investing (2024).

Robinhood offers ESG investments and renewable energy options, aligning with rising investor demand for sustainability. In Q4 2024, renewable energy investments saw a 15% increase, showing growing interest. The company focuses on reducing its carbon footprint. For example, the average cost per REC in the U.S. ranged from $1 to $5 in 2024.

| Environmental Aspect | Robinhood's Actions | Impact |

|---|---|---|

| ESG Investments | Offers ESG-themed options | Attracts sustainable investors |

| Renewable Energy | Spotlights green investments | Catters to eco-conscious users |

| Carbon Footprint | Measures, assesses, and buys RECs | Reduces emissions, supports green initiatives |

PESTLE Analysis Data Sources

Our analysis is based on credible financial reports, regulatory updates, technology assessments, and economic data from global sources. Each element relies on validated, current data.