Rogers Communications Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rogers Communications Bundle

What is included in the product

Tailored analysis for Rogers' product portfolio, examining its units across the BCG Matrix for strategic decisions.

Printable summary optimized for A4 and mobile PDFs, eliminating information overload for quick reviews.

What You’re Viewing Is Included

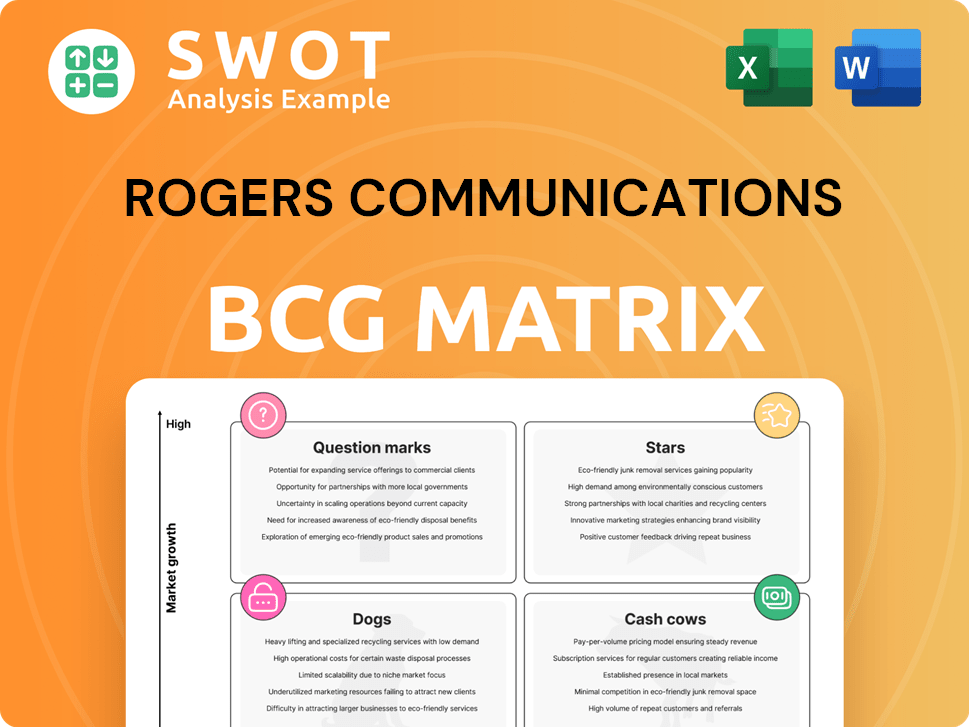

Rogers Communications BCG Matrix

The Rogers Communications BCG Matrix you're previewing mirrors the complete report you'll obtain upon purchase. It's the fully realized document, offering in-depth strategic insights, ready for your review and application.

BCG Matrix Template

Rogers Communications navigates a complex market. Its BCG Matrix reveals the performance of its diverse offerings, from media to telecom. Stars shine with high growth potential, while cash cows generate steady revenue. Question Marks pose challenges and opportunities for strategic decisions. Dogs may need to be reevaluated or divested.

This sneak peek gives you a taste, but the full BCG Matrix delivers deep, data-rich analysis, strategic recommendations, and ready-to-present formats—all crafted for business impact.

Stars

Rogers' Wireless Services shines as a star in its BCG matrix. The segment boasts a robust subscriber base, fueling consistent revenue growth. In Q3 2024, wireless service revenue increased by 5% year-over-year. Investments in 5G and infrastructure boosts its leading market position. High EBITDA margins further cement its star status.

Rogers' internet services are a Star, showing robust performance with steady subscriber growth. Investments in DOCSIS 4.0 and collaborations with Comcast boost its market standing. High demand for fast internet drives this segment's expansion. Rogers reported 209,000 net internet subscriber additions in 2024. This growth is supported by its investments in network upgrades.

Rogers' sports content, including the Toronto Blue Jays and MLSE, is a Star. Revenue growth is strong due to increased viewership and advertising. Sports-related content drives subscriber engagement, a valuable asset. In 2024, sports media revenue saw a notable increase, reflecting its strong performance. This segment remains a key growth driver for Rogers.

Rogers Xfinity Products

Rogers' collaboration with Comcast to introduce Xfinity products in Canada signifies a strategic move towards growth. This partnership provides Rogers with innovative offerings, like streaming and storm-ready WiFi, to attract customers. The integration of Xfinity products boosts the value for current subscribers, responding to the demand for advanced home internet. This strategic move is reflected in the company's financials.

- In 2024, Rogers' revenue increased, partly due to its expanded service offerings.

- Xfinity's advanced WiFi and streaming services have enhanced customer satisfaction.

- The partnership has led to a rise in Rogers' market share.

- Rogers' capital expenditure in 2024 included investments in its Xfinity infrastructure.

5G Cloud RAN Technology

Rogers Communications' adoption of Ericsson's 5G Cloud RAN technology makes it a star in its BCG matrix. This technology boosts network reliability and customer experience, crucial for competitive advantage. The 5G Cloud RAN supports Rogers' commitment to advanced wireless services, vital in the evolving telecom landscape. As of Q3 2024, Rogers reported a 2% increase in wireless service revenue, reflecting the impact of such technological advancements.

- Leading in network innovation with Ericsson 5G Cloud RAN.

- Enhances network reliability and customer experience.

- Supports commitment to cutting-edge wireless services.

- Contributes to positive revenue growth.

Rogers' diverse stars include wireless, internet, sports, and strategic partnerships. These segments demonstrate strong revenue growth and market leadership. Investments in 5G and infrastructure drive future expansion.

| Segment | Key Metric | 2024 Data |

|---|---|---|

| Wireless | Service Revenue Growth | 5% YoY (Q3) |

| Internet | Net Subscriber Additions | 209,000 |

| Sports Media | Revenue Increase | Notable Growth |

Cash Cows

Rogers' cable services, excluding internet, are a cash cow, although traditional TV and satellite subscribers are declining. This segment is still a major revenue generator with high EBITDA margins. In 2024, Rogers reported a 3% decline in TV subscribers. Operational efficiency and synergies from the Shaw acquisition support profitability. Cable services remain financially significant for Rogers.

Home phone services at Rogers, though shrinking, are cash cows. They generate revenue from a loyal customer base. Efficient infrastructure and cost management are key. In 2024, Rogers reported a consistent revenue stream from its home phone segment, despite subscriber declines. The focus is on maintaining existing customers and minimizing costs to maximize cash flow.

Rogers' Legacy Business Services, including network and data center offerings for various sectors, act as a cash cow. These services generate consistent revenue, crucial for financial stability. Maintaining service quality and operational efficiency is key to preserving their cash-generating ability. In 2024, Rogers' business services contributed significantly to overall revenue.

Smart Home Monitoring

Smart home monitoring is a cash cow for Rogers Communications, thanks to its growing subscriber base and recurring revenue. The demand for home security solutions is on the rise, boosting growth and cash flow. Strategic investments in technology and partnerships enhance the value of these services. In 2024, the smart home security market is estimated to reach $5.7 billion.

- Recurring revenue from subscriptions provides a stable income stream.

- Increased demand for home security drives market growth.

- Technological advancements and partnerships boost service value.

- Market size in 2024 is approximately $5.7 billion.

Wholesale Business

Rogers Communications' wholesale business is a cash cow, offering services to other telecom companies. This segment leverages existing infrastructure and partnerships, generating steady revenue. It's not a high-growth area, but it ensures consistent income. In 2024, wholesale revenue contributed significantly to overall financial stability. Maintaining strong relationships and optimizing network infrastructure are key to ongoing profitability.

- Steady revenue stream from established partnerships.

- Leverages existing infrastructure for cost efficiency.

- Focus on relationship management for revenue retention.

- Not a high-growth segment, but provides consistent cash flow.

Cash cows at Rogers are stable, high-margin businesses generating consistent revenue with low growth. These segments include cable, home phone, legacy business services, smart home monitoring, and wholesale services. In 2024, these segments contribute significantly to financial stability. They prioritize operational efficiency and customer retention.

| Segment | Revenue Source | Key Strategy |

|---|---|---|

| Cable Services | Subscriptions | Operational efficiency |

| Home Phone | Subscriptions | Customer retention |

| Business Services | Contracts | Service quality |

| Smart Home | Subscriptions | Market growth |

| Wholesale | Partnerships | Network Optimization |

Dogs

Satellite TV, a part of Rogers Communications' BCG Matrix, is facing a decline. Its subscriptions have decreased due to streaming services. This segment struggles to keep customers. In 2024, satellite TV revenues decreased by 10% for Rogers.

Legacy cable TV, a "Dog" in Rogers' BCG Matrix, faces a tough battle. Traditional cable subscriptions are falling as streaming gains popularity. This segment struggles against the flexibility and content variety of online platforms. Rogers saw a 2.9% decrease in its cable TV subscribers in Q3 2023. Reducing investments and exploring new content delivery is crucial for this segment.

The home phone segment is a "Dog" in Rogers' portfolio. Demand for traditional landlines is declining as mobile phone use rises. Rogers faces challenges retaining customers in this area. Focusing on cost-cutting and minimizing investments are key strategies. In 2024, Rogers saw a further decline in home phone subscribers, reflecting market trends.

Multi-Platform Shopping

Rogers' multi-platform shopping segment, categorized as a "Dog" in the BCG matrix, grapples with intense competition. This segment struggles to gain traction against established online retailers. Revenue streams might be limited, requiring strategic overhaul. In 2024, the sector experienced a 5% decline in sales.

- Declining sales figures signal the need for immediate action.

- The crowded market makes customer retention difficult.

- Exploring new revenue models is crucial for survival.

- Re-evaluating the business model is essential.

Radio Broadcasting

Radio broadcasting, a part of Rogers Communications' BCG matrix, encounters hurdles from digital music platforms and evolving listener preferences. This segment struggles against online music services' convenience and personalization. Exploring fresh content formats and revenue models might revitalize this sector. In 2024, traditional radio ad revenue dipped, reflecting these challenges.

- Radio ad revenue faces decline.

- Digital platforms offer tough competition.

- Content innovation is crucial for growth.

- Revenue model adjustments are needed.

Dogs represent segments with low market share and growth. These businesses often require restructuring or divestiture. Rogers' "Dogs" include home phone and multi-platform shopping. Immediate action is needed to address declining sales and market challenges.

| Segment | Market Share | Growth Rate |

|---|---|---|

| Home Phone | Low | Negative |

| Multi-Platform Shopping | Low | Negative |

| Radio | Moderate | Negative |

| Cable TV | Moderate | Negative |

Question Marks

Rogers' Xfinity App TV, a recent addition, bundles live and on-demand TV with streaming. Its growth potential is currently uncertain, yet it could draw in cord-cutters. To boost adoption, investment in content and marketing is essential. In 2024, the cord-cutting trend continues, with approximately 7.6 million households in the US cutting the cord.

Rogers' 5G Home Internet, launched across its network, is positioned as a question mark in its BCG Matrix. This relatively new service has high growth potential but currently holds a low market share. In 2024, Rogers invested significantly in expanding 5G coverage, with over 99% population coverage. To boost adoption, marketing and infrastructure investments are crucial; for example, Rogers spent $1.3 billion in wireless capital expenditures in 2023.

Rogers tested cloud-based network tech with Nokia and AWS for added resilience. This tech could boost network performance, though its market effect is unclear. In 2024, Rogers' capital expenditures were about CAD 3.9 billion. Further development is needed to fully unlock its potential. The tech's success hinges on ongoing investment.

Satellite-to-Mobile Technology

Rogers is exploring satellite-to-mobile technology, a move that could enhance connectivity in underserved areas. This initiative aligns with the broader trend of expanding network reach, with companies like Starlink also making strides in satellite communications. The market for this technology is evolving, and its success hinges on factors like cost-effectiveness and regulatory approvals. Further investment is crucial to fully unlock its potential, as evidenced by the $3.3 billion in capital expenditures Rogers made in 2023.

- Market size of satellite-based services expected to reach $7.1 billion by 2028.

- Rogers' 2023 capital expenditures were $3.3 billion.

- Satellite internet user base grew by 40% in 2023.

- Global satellite capacity revenue reached $14.6 billion in 2023.

AI-Driven Services

AI-driven services represent a Question Mark for Rogers Communications, indicating high growth potential but also requiring significant investment and uncertainty. This area focuses on personalized services and enhancing customer experiences through AI. Rogers can leverage AI to improve customer service, optimize network performance, and generate new revenue streams. However, successful implementation necessitates investment in AI technology, talent, and data infrastructure.

- AI-driven services could boost customer satisfaction.

- Network optimization may improve efficiency.

- New revenue streams are possible through AI.

- Significant investment is needed in AI.

AI-driven services are a Question Mark due to high growth potential but require significant investment and face uncertainty. Rogers aims to use AI for customer service improvements, network optimization, and new revenue streams. Investment is needed in AI tech and infrastructure.

| Aspect | Details | 2024 Data |

|---|---|---|

| Customer Service | AI for personalized services | Increased customer satisfaction |

| Network Optimization | AI to improve performance | Enhanced network efficiency |

| Revenue Streams | New AI-driven services | Potential for growth |

BCG Matrix Data Sources

The Rogers BCG Matrix uses reliable data from company reports, market share figures, and industry analyses for actionable strategies.