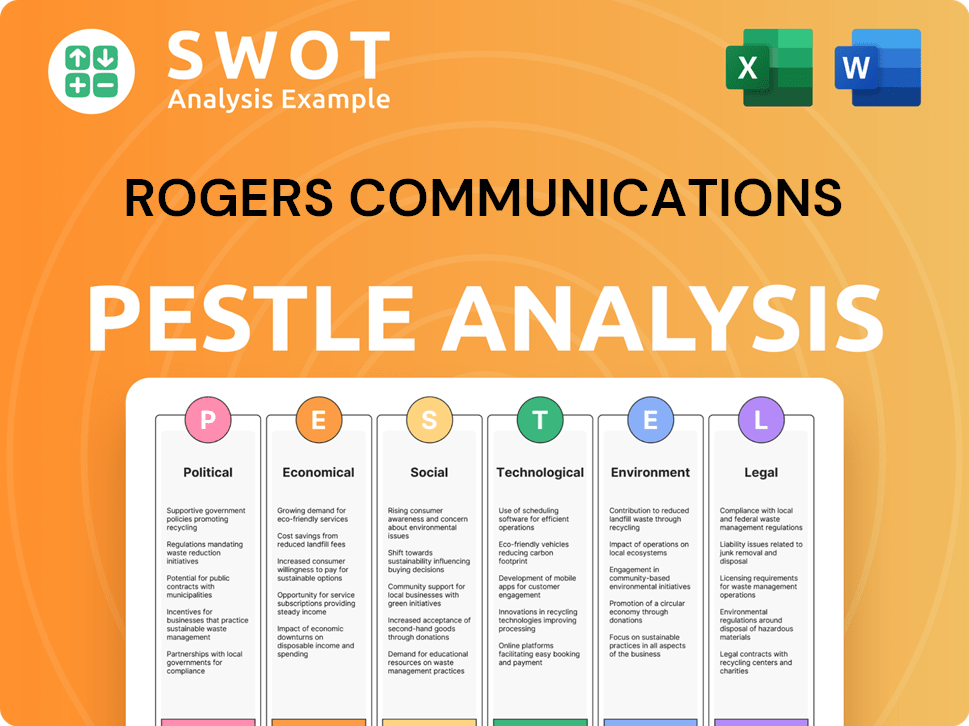

Rogers Communications PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rogers Communications Bundle

What is included in the product

Analyzes how external macro-environmental factors impact Rogers across six dimensions. Reflects market & regulatory dynamics.

Aids in identifying external forces affecting Rogers for robust strategic planning and market alignment.

What You See Is What You Get

Rogers Communications PESTLE Analysis

This preview presents Rogers Communications' PESTLE Analysis document. It covers the Political, Economic, Social, Technological, Legal, and Environmental aspects. The content you see in the preview reflects the complete document.

PESTLE Analysis Template

Uncover the external forces shaping Rogers Communications's future with our PESTLE Analysis. We delve into political, economic, social, technological, legal, and environmental factors. Understand regulatory impacts and evolving consumer trends. Ready to analyze their market strategies and foresee opportunities? Get the full analysis and get ahead.

Political factors

The Canadian Radio-television and Telecommunications Commission (CRTC) heavily regulates the telecommunications industry, directly impacting Rogers Communications. These regulations influence Rogers' service quality, pricing, and overall market conduct. In 2024, the CRTC continued its focus on enhancing competition and affordability. Recent CRTC decisions, for example, impacted wholesale rates, affecting how Rogers structures its offerings.

Innovation, Science and Economic Development Canada (ISED) manages and allocates spectrum, vital for Rogers' network expansion. Government spectrum auction decisions directly impact Rogers' infrastructure investments and tech deployments, including 5G. In 2024, Canada's 3.5 GHz spectrum auction saw significant bids, influencing Rogers' 5G rollout plans. These auctions directly affect the company's capital expenditures.

Canadian regulations currently limit foreign ownership in major telecom companies like Rogers. However, these policies are subject to review, and changes could occur. For instance, in 2024, the Canadian government explored modifications to foreign investment rules. Any shift in these regulations could affect Rogers' ability to attract foreign investment. This might alter its capital structure and strategic partnerships.

Government Immigration Policies

Changes in Canadian immigration policies significantly impact Rogers' subscriber base. Canada aims to welcome 500,000+ immigrants annually, influencing wireless market growth by attracting new customers. Any reduction in immigration targets could decrease the potential subscriber pool for Rogers. Such shifts directly affect the size of the market Rogers can tap into for wireless and other services.

- Canada's immigration levels plan aims for 500,000+ permanent residents annually.

- International students are a key demographic for new subscribers.

- Policy changes can directly affect Rogers' market size.

Trade and Tariff Threats

Trade and tariff threats, particularly from the U.S., pose indirect risks to Rogers. These threats could affect the broader macroeconomic environment, influencing Rogers' operational costs and strategic planning. For instance, changes in trade policies might impact the cost of equipment or services Rogers imports. This necessitates careful monitoring and adaptive financial strategies.

- U.S. tariffs on telecom equipment could increase Rogers' capital expenditure.

- Changes in trade agreements might alter the competitive landscape.

- Fluctuations in currency exchange rates, driven by trade tensions, could impact Rogers' financial performance.

- Increased costs could lead to adjustments in pricing strategies.

CRTC regulations shape Rogers' services; focus is on competition and affordability. Government spectrum auctions (like 3.5 GHz) influence infrastructure and 5G. Immigration policies also affect Rogers, with Canada aiming for over 500,000 immigrants yearly, boosting subscriber potential. Trade tensions (U.S. tariffs) impact operational costs and capital expenditure.

| Factor | Impact | Data Point (2024-2025) |

|---|---|---|

| CRTC Regulations | Service, pricing adjustments | CRTC focus on wholesale rates impacted offerings in 2024. |

| Spectrum Auctions | Network investments (5G) | 2024 3.5 GHz auction influenced 5G rollout plans. |

| Immigration Policies | Subscriber base size | Canada's goal is 500,000+ immigrants annually. |

| Trade Tensions | Operational Costs, Capital Exp. | U.S. tariffs on telecom equipment affected costs. |

Economic factors

Economic conditions, like inflation and interest rates, affect Rogers. High inflation in 2024, around 3.3% in Canada, may curb spending. Rising interest rates, currently 5% in Canada, increase borrowing costs. This impacts subscriber growth and pricing strategies. Rogers must adapt investment decisions to these financial realities.

The Canadian telecom market, including Rogers Communications, faces heightened competition due to recent mergers. This increased rivalry could pressure service revenue. For example, in Q1 2024, Rogers reported a slight decrease in wireless service revenue per user. Increased competition may also lead to higher customer churn rates.

Subscriber growth and churn rates are critical economic indicators for Rogers. These rates are influenced by competitive pricing and the economic climate. In Q1 2024, Rogers reported a net subscriber addition of 160,000, showing growth. The churn rate was around 1.15%, indicating customer retention challenges. These figures reflect the impact of economic pressures and market competition.

Capital Expenditures and Investment

Rogers Communications consistently makes substantial capital expenditures, especially in network infrastructure. These investments are vital for staying competitive and driving future expansion. In 2024, Rogers allocated billions to 5G deployment and upgrades to its hybrid fibre-coaxial network. These upgrades enhance service quality and capacity.

- Rogers' capital expenditures for 2024 are projected to be in the billions.

- 5G network expansion is a primary focus.

- Hybrid fibre-coaxial network upgrades are also a priority.

Revenue and EBITDA Growth

Rogers Communications' financial health, gauged by revenue and EBITDA growth, mirrors the economic climate and its operational efficiency. In Q4 2023, Rogers reported consolidated revenue of $5.23 billion, a 2% increase. Its adjusted EBITDA grew by 4% to $2.03 billion. These figures show the company's resilience. However, future growth rates are subject to market competition and economic shifts.

- Q4 2023 Revenue: $5.23 billion

- Q4 2023 Adjusted EBITDA: $2.03 billion

- Revenue Growth (Q4 2023): 2%

- Adjusted EBITDA Growth (Q4 2023): 4%

Economic factors significantly shape Rogers Communications. Inflation at 3.3% and interest rates at 5% in Canada impact spending and borrowing costs. The company's Q1 2024 financial results reflect these pressures. The telecom market's competitive intensity also plays a key role.

| Economic Factor | Impact | Recent Data (2024) |

|---|---|---|

| Inflation | Curbing consumer spending | 3.3% (Canada) |

| Interest Rates | Higher borrowing costs | 5% (Canada) |

| Wireless Revenue | Affected by competition | Slight decrease Q1 2024 |

Sociological factors

Consumer behavior is shifting, boosting demand for Rogers' services. High-speed internet and mobile connectivity are crucial. Remote work and online learning are increasing this demand. In 2024, Canadians spent an average of 6.5 hours daily online, increasing demand. Streaming and digital content are also key drivers.

Consumers' embrace of mobile payments and embedded finance is reshaping the mobile services sector. This shift necessitates a strong mobile infrastructure to support increased transaction volumes. Rogers must adapt its services to meet evolving consumer expectations. In 2024, mobile payment adoption grew by 25% in Canada, highlighting this trend.

The surge in demand for digital content, including streaming and sports media, significantly shapes Rogers' media strategy. In 2024, streaming subscriptions continued to rise, with over 170 million subscribers in North America alone. Rogers must adapt its content acquisition to meet this demand. This shift impacts its media business model and content delivery methods.

Impact of Immigration on Subscriber Base

Immigration significantly influences Rogers' subscriber base by expanding the potential market. Canada's increasing immigration targets, aiming for 500,000+ new permanent residents annually through 2025, directly correlate with subscriber growth. This influx boosts demand for telecommunications services, presenting opportunities for Rogers to acquire new customers. Changes in immigration policies and levels can thus directly impact Rogers' subscriber acquisition and overall revenue.

- Canada aims to welcome over 500,000 new permanent residents per year through 2025.

- Newcomers are a key demographic for subscriber growth.

Workforce and Employment Trends

Workforce changes at Rogers, such as restructuring, affect employees and communities. Economic pressures and efficiency needs drive these changes. For example, in 2024, companies like Rogers faced market shifts, potentially leading to layoffs or altered roles. These shifts influence employee morale and local economies.

- In 2024, the Canadian unemployment rate was around 6%.

- Restructuring can lead to job losses, impacting employee well-being.

- Community support programs may see increased demand.

Societal shifts impact Rogers. Consumer behavior favoring digital services and mobile payments shapes its business strategies. Canada's immigration policies directly affect Rogers' subscriber base, as the country welcomes many newcomers annually. Changes in the workforce through restructuring also play a role.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Digital Demand | Boosts service usage | Canadians online 6.5 hrs/day. |

| Immigration | Subscriber base expands | 500k+ new residents/yr. |

| Workforce Changes | Restructuring effects | Unemployment ~6% in Canada. |

Technological factors

Rogers Communications is heavily invested in 5G. In 2024, Rogers invested billions in 5G infrastructure. This expansion aims to boost network speed and reliability. Data from 2024 indicates a significant rise in 5G coverage across Canada. This impacts service quality and market competitiveness.

Rogers is actively upgrading its network infrastructure. They are investing in their hybrid fibre-coaxial network to boost performance and reliability. This supports technologies like DOCSIS 4.0. This enhancement is crucial for handling rising data demands. In Q1 2024, Rogers reported a 1% increase in wireless service revenue, partially due to these infrastructure upgrades.

Rogers Communications is actively investing in Artificial Intelligence (AI). This investment aims to streamline operations, potentially improving customer service and boosting overall efficiency. This aligns with the telecom sector's growing trend of AI integration. For instance, in 2024, AI spending in telecom reached $15 billion globally, with an expected rise to $25 billion by 2025.

Development of Smart Home Technology

Rogers sees smart home tech as a key tech opportunity. They can offer integrated services, using their network. This aligns with the growing smart home market. The global smart home market was valued at $85.8 billion in 2023 and is expected to reach $148.5 billion by 2028. This growth presents a chance for Rogers to boost revenue and customer loyalty through bundled services.

- Market size in 2023: $85.8 billion.

- Expected market size by 2028: $148.5 billion.

Cybersecurity Advancements and Threats

Cybersecurity is a crucial technological factor for Rogers Communications. With the growing dependence on digital services, Rogers needs to reinforce its cybersecurity measures. This includes protecting its network and customer data against emerging threats. According to a 2024 report, cyberattacks cost Canadian businesses an average of $1.8 million.

- Data breaches are up 15% year-over-year (2024).

- Ransomware attacks increased by 20% in the first half of 2024.

- Rogers must invest heavily in cybersecurity to mitigate risks.

Technological advancements heavily influence Rogers. Investment in 5G and network upgrades are essential for competitiveness. Cybersecurity remains crucial, given the rising cyber threats. The company leverages AI and smart home technology.

| Technological Aspect | Details | 2024 Data |

|---|---|---|

| 5G Infrastructure | Expansion of 5G network | Significant investment; increased coverage |

| Network Upgrades | Hybrid fibre-coaxial upgrades; DOCSIS 4.0 support | Q1 2024 wireless service revenue up 1% |

| AI Integration | Streamlining operations and improving customer service | Telecom AI spending reached $15B (Global) |

| Smart Home Tech | Integrated services with network | $85.8B market size (2023) |

| Cybersecurity | Protection against threats and data breaches | Attacks cost $1.8M (Avg/Canadian biz) |

Legal factors

Rogers Communications faces stringent regulations from the Canadian Radio-television and Telecommunications Commission (CRTC). These regulations govern service quality, pricing, and competitive practices within the telecommunications sector. For instance, as of 2024, CRTC fines for non-compliance can reach millions of dollars. Failure to adhere to these rules can lead to legal battles and significant financial penalties. The CRTC's oversight ensures fair competition and consumer protection in the Canadian market.

Rogers is under the Competition Bureau's scrutiny, particularly concerning pricing transparency and market dominance. The Bureau's investigations can result in legal challenges. In 2024, the Competition Bureau's budget was approximately $60 million. This reflects the government's commitment to competition oversight.

Rogers Communications must comply with data privacy laws like PIPEDA. This covers breach notifications, customer consent, and data encryption. Breaches can lead to hefty fines; for example, in 2024, companies faced penalties up to $100,000 per violation under PIPEDA. Strong data protection is crucial.

Spectrum Licensing and Regulations

Rogers faces legal hurdles from spectrum licensing and regulations set by ISED. These rules dictate how Rogers acquires and uses spectrum, crucial for its wireless services. Non-compliance with auction rules and license stipulations can lead to penalties. In 2024, Rogers participated in spectrum auctions, spending billions to secure vital bandwidth.

- ISED's role in spectrum allocation significantly impacts Rogers' operations.

- Compliance with licensing terms is critical for avoiding fines or service disruptions.

- Spectrum auctions are a key expense for Rogers, with billions spent in 2024.

- Regulatory changes can affect network capabilities and expansion plans.

Legal Disputes and Litigation

Rogers Communications frequently faces legal challenges. These often stem from content licensing and marketing practices. Recent cases highlight these ongoing issues. Legal battles can impact financial performance and reputation.

- In 2024, Rogers faced lawsuits over billing practices.

- Legal fees and potential settlements could reach millions.

- Deceptive marketing claims have led to regulatory scrutiny.

Rogers Communications navigates a complex legal landscape. The CRTC's fines for non-compliance reached millions in 2024. Data privacy breaches under PIPEDA may lead to up to $100,000 in penalties per violation. Legal challenges impacted financial performance, with ongoing costs.

| Legal Aspect | Regulation/Law | Impact |

|---|---|---|

| Service Quality & Pricing | CRTC Regulations | Fines up to millions, as seen in 2024 |

| Market Competition | Competition Bureau | Potential legal challenges, $60M budget (2024) |

| Data Privacy | PIPEDA | Fines up to $100,000 per violation (2024) |

Environmental factors

Rogers Communications is dedicated to decreasing its carbon footprint. They've established science-based targets for GHG emissions, which are approved by the SBTi. This involves initiatives focused on boosting energy efficiency. Furthermore, Rogers aims to transition to electric vehicles and increase its use of renewable energy sources.

Rogers Communications prioritizes sustainable technology, aiming for energy-efficient, eco-friendly network operations. In 2024, Rogers invested significantly in green initiatives, reducing its carbon footprint. The company's environmental commitments are supported by data showing progress in reducing energy consumption. They are committed to a sustainable future.

Rogers acknowledges climate change as a key environmental issue. They're actively managing climate-related risks and opportunities. In 2024, Rogers reduced its carbon emissions by 15% compared to 2020. The company is investing in energy-efficient technologies and renewable energy sources. This supports business resilience and lessens environmental impacts.

Supplier Engagement on Environmental Targets

Rogers Communications actively involves its suppliers in its environmental initiatives, a key part of its PESTLE analysis. This involves encouraging suppliers to adopt science-based environmental targets, directly impacting Rogers' Scope 3 emissions. In 2024, Rogers reported that 60% of its key suppliers had set or committed to science-based targets. This approach helps to create a more sustainable value chain.

- 60% of key suppliers had set or committed to science-based targets in 2024.

- Focus on reducing Scope 3 emissions across the value chain.

- Encourages supplier accountability and environmental responsibility.

Environmental Reporting and Disclosure

Rogers Communications is enhancing its environmental reporting. It's aligning with frameworks like ISSB and TCFD. This offers transparent disclosure of climate-related risks and opportunities. This commitment reflects a broader trend. Companies are increasingly prioritizing environmental transparency.

- Rogers aims to reduce its Scope 1 and 2 emissions by 50% by 2030.

- In 2023, Rogers invested $100 million in energy-efficient infrastructure.

- The company's 2024 ESG report will detail these initiatives.

- Rogers is working to improve its water usage efficiency.

Rogers is cutting its carbon footprint with SBTi-approved targets. They are using energy-efficient tech, renewable energy, and EVs. They’ve reduced emissions by 15% since 2020, targeting a 50% reduction in Scope 1 & 2 emissions by 2030. In 2024, they reported 60% of key suppliers with science-based targets.

| Initiative | Target | Status (2024) |

|---|---|---|

| Emissions Reduction (Scope 1 & 2) | 50% Reduction by 2030 | On Track |

| Supplier Engagement | 60% of Key Suppliers with Science-Based Targets | Achieved |

| Green Infrastructure Investment | $100 Million | Completed in 2023 |

PESTLE Analysis Data Sources

Rogers' PESTLE analysis draws on government stats, financial reports, and industry studies for current insights. Market research data and tech adoption rates complete the analysis.