Roku Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Roku Bundle

What is included in the product

Tailored analysis for Roku's product portfolio, considering its diverse offerings.

Printable summary optimized for A4 and mobile PDFs, enabling easy sharing across teams and stakeholders.

What You See Is What You Get

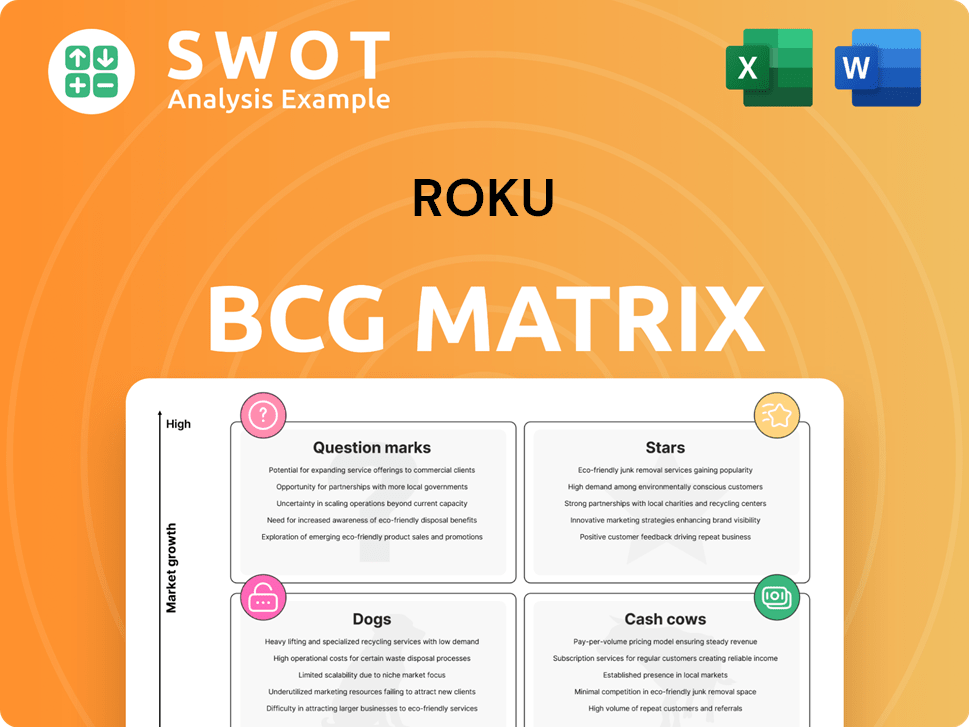

Roku BCG Matrix

The preview showcases the complete Roku BCG Matrix you'll receive post-purchase. This fully formatted report is ready for immediate application in strategic planning and decision-making, offering clarity and actionable insights.

BCG Matrix Template

Roku's BCG Matrix offers a glimpse into its product portfolio. This quick analysis shows how its various offerings—like streaming devices and its OS—compete. Discovering their Stars, Cash Cows, Dogs, or Question Marks is key. This simplified view is just a taste.

Unravel Roku's full strategic landscape. Get the complete BCG Matrix for detailed quadrant placements, data-driven recommendations, and actionable insights. Purchase now for instant strategic advantage.

Stars

Roku's platform revenue, fueled by ads and subscriptions, is a star. It reached $1.035 billion in Q4 2024, up 25% year-over-year. Roku is effectively monetizing users and expanding its reach. They focus on the Home Screen, integrations, and partnerships.

Roku shines as a "Star" in the CTV market, holding a dominant position, especially in North America. In Q4 2024, Roku dominated the open programmatic CTV device market. It boasted a 39% share in the US, 35% in Canada, and a massive 74% in Mexico. This strong market presence fuels its ongoing growth and brand recognition.

Roku's platform shows strong user engagement. Total streaming hours hit 34.1 billion in Q4 2024, up 18% year-over-year. The Roku Channel's streaming hours jumped 82% year-over-year. This boosts monetization potential.

Roku TV OS Dominance

Roku's TV operating system continues its reign. It's been the top-selling TV OS in the U.S. for six years straight. Roku-branded TVs are also doing well, with over 1 million sold in 2024. This success boosts Roku's overall ecosystem.

- #1 TV OS in the U.S. for six years.

- Over 1 million Roku-branded TVs sold in 2024.

- Strengthens Roku's market position.

Strategic Partnerships and Integrations

Roku is focusing on strategic partnerships and integrations to boost its platform and user experience. It's strengthening programmatic advertising ties to increase revenue. Standardization of audience-buying is also a key focus for growth. Roku's moves aim to create a better ecosystem for both users and advertisers. These collaborations are expected to drive growth.

- Roku's ad revenue grew 18% in Q1 2024.

- Partnerships help expand content and user reach.

- Standardized buying simplifies ad processes.

- These initiatives align with Roku's strategic goals.

Roku's platform revenue is a "Star", achieving $1.035 billion in Q4 2024. Its dominance in the CTV market, especially in North America, is evident. User engagement is strong, with streaming hours reaching 34.1 billion in Q4 2024, and the Roku Channel up 82%.

| Metric | Q4 2024 Data | Year-over-Year Change |

|---|---|---|

| Platform Revenue | $1.035 billion | +25% |

| Total Streaming Hours | 34.1 billion | +18% |

| Roku Channel Streaming Hours | N/A | +82% |

Cash Cows

Roku boasts a substantial and expanding user base, reaching 89.8 million streaming households by the close of 2024, marking a 12% year-over-year rise. This extensive user base generates consistent revenue from advertising, subscriptions, and content distribution fees. Roku is prioritizing revenue and profitability, indicating a strategy to leverage its established user base.

Advertising is a major revenue source for Roku. The company is boosting its ad capabilities. Roku's ad business is doing well, even in the U.S. OTT market. Roku's ad base is growing beyond media, including retail and auto. For instance, in Q3 2023, platform revenue increased by 18% to $767 million.

Roku's platform is a cash cow, and The Roku Channel is a key driver. Streaming hours on The Roku Channel surged 82% year-over-year in Q4 2024. This growth boosts platform revenue, including ad inventory. Roku's content attracts viewers, solidifying its market advantage. The Roku Channel's success supports its cash flow.

Licensing Revenue

Roku's licensing revenue stream is a key cash generator. Roku licenses its operating system to TV manufacturers. This approach enables capital-efficient growth. The Roku TV program has expanded significantly. It powers a large percentage of US smart TVs. This strategy yields consistent platform revenue.

- In Q3 2023, Roku's platform revenue, which includes licensing, grew 18% year-over-year.

- Roku OS powers over 40% of smart TVs sold in the US.

- This licensing model reduces marketing expenses.

- Roku has partnerships with major TV brands.

Brand Recognition and Customer Loyalty

Roku shines as a Cash Cow due to its robust brand recognition and loyal customer base. In North America, Roku holds the top spot in streaming platforms, a testament to its market dominance. Its user-friendly design, vast content selection, and attractive pricing have significantly boosted its popularity. This focus on a smooth streaming experience nurtures customer loyalty and drives consistent usage.

- Roku had over 80 million active accounts as of Q4 2023.

- Roku's platform revenue grew by 18% in Q4 2023.

- Roku's average revenue per user (ARPU) was $46.50 in Q4 2023.

- Roku's brand recognition is high, with strong customer retention rates.

Roku functions as a Cash Cow due to its established user base and strong revenue streams. The platform leverages advertising, subscriptions, and content distribution for consistent profits. Roku's licensing model further boosts its revenue.

| Metric | Q4 2023 | Q4 2024 (Projected) |

|---|---|---|

| Active Accounts | 80 million | 90 million (Est.) |

| Platform Revenue Growth | 18% YoY | 15% YoY (Est.) |

| ARPU | $46.50 | $48.00 (Est.) |

Dogs

Roku's hardware margins face challenges. In Q4 2024, the devices segment had negative gross margins. Competition and promotions pressure profitability. Roku aims to boost margins, but faces aggressive pricing.

Roku's ARPU, though improving, has seen stagnation. Stagnant ARPU can hinder revenue growth. In Q3 2023, ARPU was $41.09, up 14% YoY, but growth needs boosting. Roku must enhance monetization for growth.

The streaming device market is fiercely contested, with Amazon, Google, and Apple dominating. Roku competes with these giants, each backed by vast resources and strong ecosystems. In 2024, Roku's market share was challenged. Roku's 2024 revenue was $3.48 billion.

Reliance on Third-Party Content

Roku's success hinges on third-party content, creating a dependency that poses risks. Content availability and licensing agreements are critical for user engagement and revenue. A shift by major providers could harm Roku's platform. To mitigate this, Roku must diversify content and strengthen partnerships.

- In Q3 2023, Roku's platform revenue reached $748.5 million, reflecting its reliance on content.

- The company faces challenges from content providers negotiating terms, as seen in past disputes.

- Diversifying content is crucial, with an increasing focus on original programming.

Discontinuation of Key Metrics

Roku's move to cease reporting streaming households and ARPU from Q1 2025 is under scrutiny. This decision could obscure Roku's financial clarity for investors. Without these metrics, evaluating Roku's growth becomes challenging. The change potentially impacts investor confidence and market analysis.

- Roku's ARPU in Q3 2024 was $41.09, a 13% increase year-over-year.

- The company had 80.0 million active accounts as of Q3 2024.

- The stock price has seen fluctuations, reflecting investor reactions to strategic shifts.

- The discontinuation was announced in late 2024, causing immediate market reactions.

Roku's "Dogs" are the hardware and the streaming devices segments. These segments face low growth and market share. In 2024, hardware margins were negative. Roku must innovate to revitalize these areas.

| Category | Details |

|---|---|

| Hardware Margin (2024) | Negative |

| Market Share (2024) | Challenged |

| Revenue (2024) | $3.48 billion |

Question Marks

Roku is expanding internationally, eyeing Canada, Mexico, and the U.K. This creates growth chances, but also regulatory and content challenges. Competition with established firms adds complexity, making international success uncertain. In 2024, international revenue was a key focus, with 20% of revenue from outside the U.S.

Roku's foray into smart home integration, with products like Roku Smart Home, places it in a competitive market. Success hinges on Roku's ability to differentiate its offerings and attract consumers. The smart home market's growth, estimated at $147.6 billion in 2024, presents a significant opportunity, but also challenges. Roku must create a strong value proposition to succeed.

Roku's content strategy is a "question mark" in its BCG Matrix. The company invests in original and exclusive content to boost user engagement. Success hinges on competing with rivals with vast libraries. Roku must create or acquire content that resonates with its users. In 2024, Roku's content spend was about $2 billion.

Technology Innovation

Roku, positioned as a Question Mark in the BCG matrix, heavily relies on technology innovation to compete. The company must constantly upgrade its streaming devices and user interface to attract and retain users. Innovation is key, with Roku spending $2.8 billion on R&D in 2024. Roku's future hinges on its ability to develop new features and services to meet evolving consumer demands.

- Roku's R&D spending in 2024 was $2.8 billion.

- User interface enhancements are critical for retaining users.

- Developing new features and services is a priority.

- Roku needs to adapt to changing consumer preferences.

Monetization of Data

Roku's "Question Mark" status in the BCG matrix highlights its potential in data monetization. The company gathers user data, which could be highly valuable for targeted advertising and personalized content. However, successfully monetizing this data is uncertain due to privacy concerns and regulatory hurdles.

Roku must balance data utilization with user privacy to avoid legal issues and maintain consumer trust. The future profitability of Roku heavily depends on its ability to navigate these challenges effectively.

- Roku's advertising revenue grew 18% year-over-year in Q1 2024.

- The company faces increasing scrutiny regarding user data privacy.

- Successful monetization requires robust privacy measures and compliance.

- Roku's stock performance reflects investor uncertainty about data monetization.

Roku's content strategy is a "question mark" due to the high stakes involved in original content. To compete with established streaming services, Roku spent $2 billion on content in 2024. Success depends on creating content that resonates with users.

| Aspect | Details | 2024 Data |

|---|---|---|

| Content Spend | Investment in original and exclusive content. | $2B |

| Challenge | Competition with streaming giants. | Vast content libraries. |

| Strategy | Acquire or create user-engaging content. | Focus on user preferences. |

BCG Matrix Data Sources

The Roku BCG Matrix leverages diverse data, including financial statements, market analyses, and industry reports, for strategic insights.