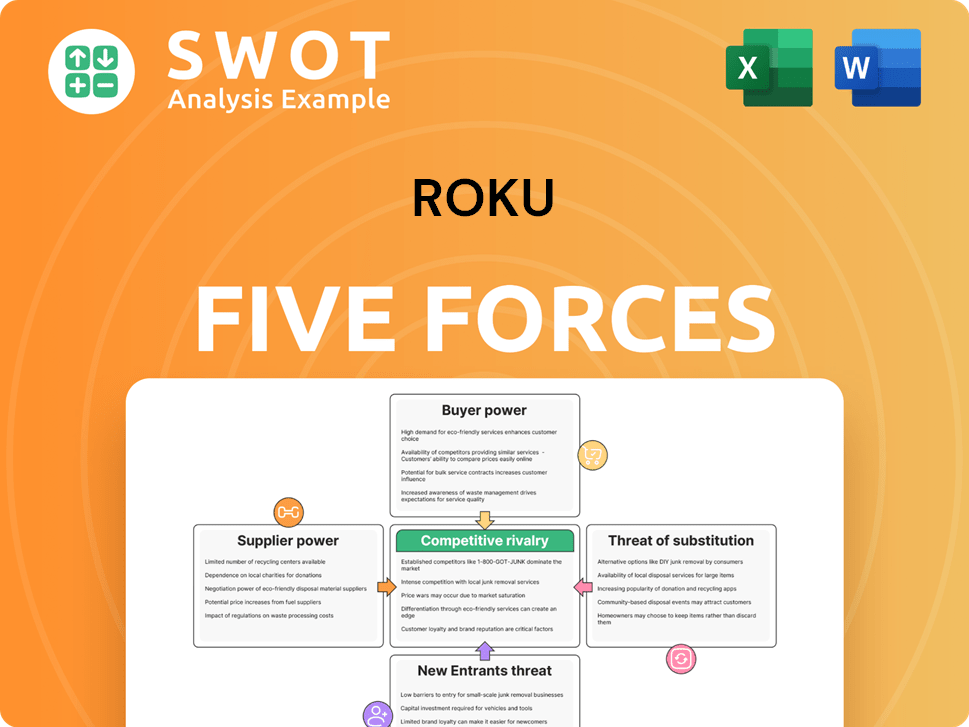

Roku Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Roku Bundle

What is included in the product

Tailored exclusively for Roku, analyzing its position within its competitive landscape.

Easily identify key areas—helping Roku to strategize against competitive threats.

Preview the Actual Deliverable

Roku Porter's Five Forces Analysis

This preview presents the comprehensive Roku Porter's Five Forces Analysis you'll receive. It's the complete, ready-to-use report, professionally written and formatted. The content you're viewing is the same document available for immediate download post-purchase. No alterations, no substitutions—just the full, detailed analysis. This is the final deliverable, fully prepared for your needs.

Porter's Five Forces Analysis Template

Roku faces significant competitive rivalry in the streaming device market, battling established giants and nimble competitors. The threat of new entrants remains moderate, with high barriers like content deals and brand recognition. Bargaining power of buyers is considerable, driven by readily available alternatives and price sensitivity. Supplier power, specifically content providers, impacts Roku's profitability. The threat of substitutes, like smart TVs with integrated platforms, is ever-present.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand Roku's real business risks and market opportunities.

Suppliers Bargaining Power

Content providers, including studios and networks, wield considerable influence due to the high demand for their content. Roku depends on these providers for a wide array of streaming options; without them, user engagement could suffer. In 2024, securing content deals remains vital for Roku's success, especially amid rising content costs. For instance, Netflix spent nearly $17 billion on content in 2024, which highlights the industry's competitive landscape.

Roku's dependence on semiconductor suppliers is a significant factor. The company's streaming devices rely heavily on these components. Limited supplier options can lead to cost pressures. In 2024, the chip shortage impacted tech firms. This increased hardware costs for Roku.

Suppliers of cutting-edge tech, like advanced processors for Roku, wield significant bargaining power. Roku's need for constant innovation, facing rivals like Amazon, strengthens this. Technological progress is quick, with new display tech emerging. In 2024, Roku invested heavily in R&D, around $300 million, to secure these suppliers.

Licensing Agreements

Roku's bargaining power of suppliers is significantly influenced by its licensing agreements with TV manufacturers. Roku's revenue from platform is now more than half of the total revenue. These agreements dictate terms impacting Roku's profitability. Building strong relationships with TV manufacturers and retailers is crucial for success in new markets. Roku can replicate its North American success through strategic partnerships.

- Roku's platform revenue accounted for 88% of its total revenue in Q1 2024.

- The company has expanded its partnerships with various TV manufacturers.

- Roku's international expansion strategy involves replicating its North American success.

- Roku's licensing model allows it to negotiate terms that affect its profitability.

Advertising Partners

Roku's advertising revenue stream depends on advertising partners to fill ad spaces. Major advertising partners, due to their significant ad spending, can negotiate advantageous terms. This dynamic influences Roku's profitability within the digital advertising market. Roku can expand its advertising platform to capitalize on the growth of digital advertising and offer targeted solutions. In 2024, digital ad spending is projected to reach $275 billion in the U.S.

- Negotiated terms can impact Roku's revenue.

- Digital advertising is a growing market.

- Targeted advertising solutions are key.

- Roku aims to expand its advertising platform.

Roku's supplier power varies. Content providers have significant power due to content demand.

Semiconductor suppliers and tech providers also hold sway, especially in a competitive landscape. Roku's licensing model and advertising partners further shape its bargaining dynamics.

Roku's platform revenue rose, with 88% of total revenue in Q1 2024. Digital ad spending hit $275B in the U.S.

| Supplier Type | Bargaining Power | 2024 Impact |

|---|---|---|

| Content Providers | High | Increased content costs, deals vital |

| Semiconductor Suppliers | Moderate | Chip shortages, hardware cost increases |

| Tech Suppliers | High | R&D investment, competition |

| TV Manufacturers | Moderate | Licensing terms, market expansion |

| Advertising Partners | Moderate | Negotiated terms, ad revenue |

Customers Bargaining Power

Customers in the streaming market are indeed highly price-sensitive. Many are willing to switch platforms to save money. This willingness puts pressure on Roku. Roku must offer competitive pricing and value. In 2024, the average streaming service cost was around $14 per month, with many consumers actively seeking cheaper bundles or free, ad-supported options to cut costs.

Switching costs for streaming services are incredibly low. Consumers can effortlessly switch between platforms like Netflix and Disney+ with minimal hassle. This ease of switching empowers customers, allowing them to favor services providing the best content and value. In 2024, the average churn rate in the streaming industry was around 5-7% monthly, reflecting this fluidity.

Customers wield considerable power due to content availability. Roku faces competition from platforms like Netflix and Disney+, making it easy for users to switch. Roku's strength lies in its vast content library. In 2024, Roku had over 80 million active accounts, showcasing its content appeal.

Platform Alternatives

Customers wield considerable bargaining power due to the abundance of streaming options. Tech giants like Amazon, Apple, and Google offer competitive platforms, intensifying the competition. This competitive landscape allows consumers to switch providers easily, pressuring Roku to offer better deals and services. The rise of platforms like Netflix and Disney+ further diversifies choices, giving consumers more leverage. In 2024, the streaming market saw over 150 million subscriptions across various services, highlighting the vast alternatives available.

- Multiple alternative streaming platforms exist, enhancing customer choice.

- Tech giants pose strong competition, increasing consumer options.

- Consumers can easily switch services, boosting their bargaining power.

- The market's diversity, fueled by services like Netflix, strengthens consumer advantage.

Bundling Options

Customers' desire for bundled streaming services, offering multiple options at reduced prices, is growing. Roku must adjust to this shift by either providing or enabling appealing bundling deals. In 2024, the demand for bundled entertainment packages increased significantly, with over 60% of consumers showing interest. Roku leverages its position as a primary TV entry point to assist media and entertainment advertisers in promoting their streaming services, thus increasing user engagement.

- Bundling popularity increased in 2024, with over 60% of consumers expressing interest.

- Roku can use its position as a primary TV entry point.

- Roku needs to adapt to this trend by offering or facilitating attractive bundling opportunities.

Customers have significant bargaining power in the streaming market due to ample choices. The ease of switching services and the availability of numerous platforms, like Netflix and Disney+, amplify consumer influence. Roku faces pressure to offer competitive pricing and attractive bundles to retain its user base. In 2024, the average monthly churn rate in the streaming industry was approximately 5-7%, indicating consumer mobility.

| Aspect | Impact on Roku | 2024 Data |

|---|---|---|

| Switching Costs | Low; Users can easily switch | Churn Rate: 5-7% monthly |

| Content Availability | High competition | 80M+ active Roku accounts |

| Bundling | Growing consumer demand | 60%+ consumers interested |

Rivalry Among Competitors

The streaming device market is incredibly competitive, with giants like Amazon's Fire TV, Apple TV, and Google Chromecast battling for dominance. This fierce rivalry forces Roku to constantly innovate and enhance its offerings to stay ahead. Roku's revenue in Q3 2023 was $902 million, a 19% increase year-over-year, showing its ability to compete. The competition pressures Roku to offer competitive pricing and attractive features.

Market saturation intensifies competitive rivalry for Roku. The streaming market is crowded, hindering Roku's customer acquisition. Roku's strategic moves, like OS enhancements and Roku Channel expansion, are vital. In Q3 2023, Roku had 75.8 million active accounts. Roku's ad revenue grew 18% YoY in Q3 2023.

Technological advancements significantly impact competitive rivalry in the streaming industry. Roku must constantly innovate, updating its products to stay ahead. The streaming market saw significant growth in 2024, with global revenue projected to reach $98.8 billion. This rapid pace forces companies like Roku to invest heavily in R&D to maintain relevance and market share.

Advertising Revenue Competition

Roku's advertising revenue faces intense rivalry. Netflix, Meta, and Alphabet are significant competitors, aggressively investing in streaming ads. Roku is entering its next monetization phase, aiming for revenue and profit growth.

- Netflix's ad tier reached 40 million monthly active users by Q1 2024.

- Meta's ad revenue grew by 27% in Q1 2024, indicating strong market presence.

- Alphabet's Q1 2024 ad revenue was $61.66 billion.

Consolidation

Consolidation in the streaming market could heighten competition. Larger entities gain more leverage in content and tech investments. Combining forces, like Fubo with Hulu + Live TV, boosts negotiating power. This could reshape the competitive landscape. Overall sector revenues in 2024 are estimated at $100 billion.

- Mergers and acquisitions are anticipated.

- Bigger players will dominate.

- Content costs will likely increase.

- Consumers might face price changes.

Roku faces intense competition from major players like Amazon, Apple, and Google. This rivalry demands continuous innovation and competitive pricing strategies. The streaming market's growth, projected to $98.8B in 2024, fuels the need for rapid adaptation. Advertising revenue competition is also fierce, with Netflix, Meta, and Alphabet heavily invested.

| Metric | Competitor | Data (2024) |

|---|---|---|

| Ad Revenue | Meta | 27% growth in Q1 |

| Ad Revenue | Alphabet | $61.66B in Q1 |

| Active Users | Netflix (Ad Tier) | 40M monthly (Q1) |

SSubstitutes Threaten

Smart TVs present a considerable substitute for Roku's streaming devices, with built-in streaming capabilities. This integrated approach offers consumers a streamlined, all-in-one entertainment experience. The smart TV market is highly competitive. In 2024, smart TVs accounted for roughly 70% of TV sales in North America.

Gaming consoles pose a notable threat to Roku, offering streaming services alongside gaming capabilities. PlayStation and Xbox consoles, for example, provide access to streaming apps, potentially diverting users. This competition is significant, especially considering the declining sales of dedicated streaming devices; for instance, in 2024, sales decreased by 15%. Smart TVs and game consoles together capture a large share of the streaming market.

Smartphones and tablets pose a threat to Roku as they can stream content directly to TVs. In 2024, mobile streaming accounted for a significant portion of overall streaming hours. Roku needs to offer unique value to stay competitive. Data shows that in Q3 2024, mobile streaming grew by 15% year-over-year.

Piracy

Piracy poses a significant threat to Roku by offering unauthorized access to content, potentially luring away consumers who might otherwise subscribe to paid streaming services. The appeal of free, ad-supported content, especially for budget-conscious viewers, strengthens this threat. This is particularly relevant as the cost of streaming services increases. The availability of pirated content impacts Roku's revenue streams.

- In 2024, it's estimated that digital piracy costs the entertainment industry billions of dollars annually.

- A 2024 survey indicated a rise in consumers using illegal streaming sites due to cost concerns.

- Roku's revenue could be impacted by a shift towards free, unauthorized content.

Traditional Media

Traditional media, such as cable TV, acts as a substitute for Roku, especially for those liking live TV and bundles. Linear TV usage dipped below 50% of total TV consumption. This shift highlights the ongoing competition between streaming and traditional TV. The availability of alternatives impacts Roku's market position.

- Linear TV usage fell below 50% of total TV consumption.

- Traditional media offers bundled packages.

- Roku faces competition from established players.

- The shift reflects consumer preferences.

Roku faces strong substitutes, including smart TVs, gaming consoles, smartphones, and tablets that offer streaming options. Smart TVs remain a dominant substitute, capturing about 70% of TV sales in North America in 2024. Piracy and traditional media further challenge Roku's market position. As of Q3 2024, mobile streaming grew by 15% YoY, intensifying the competition.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Smart TVs | High | 70% of TV sales in North America |

| Gaming Consoles | Medium | Dedicated streaming device sales decreased by 15% |

| Smartphones/Tablets | Medium | Mobile streaming grew 15% YoY (Q3 2024) |

Entrants Threaten

Tech giants like Amazon, Apple, and Google pose a significant threat due to their vast resources. Their brand recognition allows for easy market entry and expansion in the streaming device sector. For example, Amazon's Fire TV has a substantial market share. The intense competition from these rivals, backed by unlimited financial resources, creates a challenging landscape for Roku. In 2024, the streaming device market saw continued consolidation, with tech giants driving innovation and price wars.

The streaming market's low barriers to entry mean new platforms can emerge easily. This intensifies competition for Roku. Tech giants with vast resources, like Amazon and Apple, are entering this space. In 2024, Netflix, Amazon, and Disney+ dominated, showing the challenge Roku faces. Roku must innovate to stay ahead.

New content aggregators pose a threat to Roku, potentially offering bundled streaming packages that rival Roku's offerings. Content, alongside distribution, forms a key competitive advantage in the streaming landscape. In 2024, the streaming market saw significant shifts, with new aggregators constantly vying for market share. Recent data indicates that companies like Amazon and Apple are investing heavily in content aggregation, which could intensify competition.

Hardware Manufacturers

New hardware manufacturers pose a threat to Roku, potentially eroding its market share. These entrants might offer cheaper or more innovative streaming devices. Roku needs to innovate to stay competitive. They can also leverage digital advertising, a growing trend. Roku's advertising platform expansion is a key strategy.

- In 2024, the streaming device market saw increased competition, with new entrants like Google and Amazon.

- Roku's advertising revenue grew, accounting for over 80% of its total revenue in Q3 2024.

- The average revenue per user (ARPU) for Roku increased by 20% in 2024, showing the effectiveness of their advertising solutions.

- Roku's market share in the US was approximately 30% in late 2024, facing pressure from competitors.

Platform Innovation

New streaming platforms, potentially with innovative features, pose a threat to Roku. These platforms could lure users away, impacting Roku's market share. Roku must leverage its position as a primary entry point to TV to retain users and attract media advertisers. In 2024, Roku's active accounts reached 81.6 million, demonstrating its large user base which could be vulnerable to new entrants.

- Roku's active accounts reached 81.6 million in 2024.

- New platforms with innovative features could attract users.

- Roku can use its position to attract media advertisers.

- The streaming market is competitive.

New entrants threaten Roku. Giants like Amazon with Fire TV compete, fueled by vast resources. Streaming's low barriers mean easy entry. Content aggregators and innovative platforms could challenge Roku's position.

| Threat | Impact | 2024 Data |

|---|---|---|

| Tech Giants | Intense Competition | Amazon, Apple expanding; Roku market share ~30%. |

| Content Aggregators | Bundled Packages | Netflix, Disney+ dominance; Amazon invests in content. |

| Hardware Manufacturers | Erosion of Market Share | New devices; Roku's advertising revenue growth. |

Porter's Five Forces Analysis Data Sources

Roku's Porter's Five Forces assessment utilizes company filings, industry reports, and market analysis from credible research firms.