Ross Stores Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ross Stores Bundle

What is included in the product

Tailored analysis for Ross Stores' product portfolio with strategic insights.

Printable summary optimized for quick sharing with investors or internal stakeholders.

What You See Is What You Get

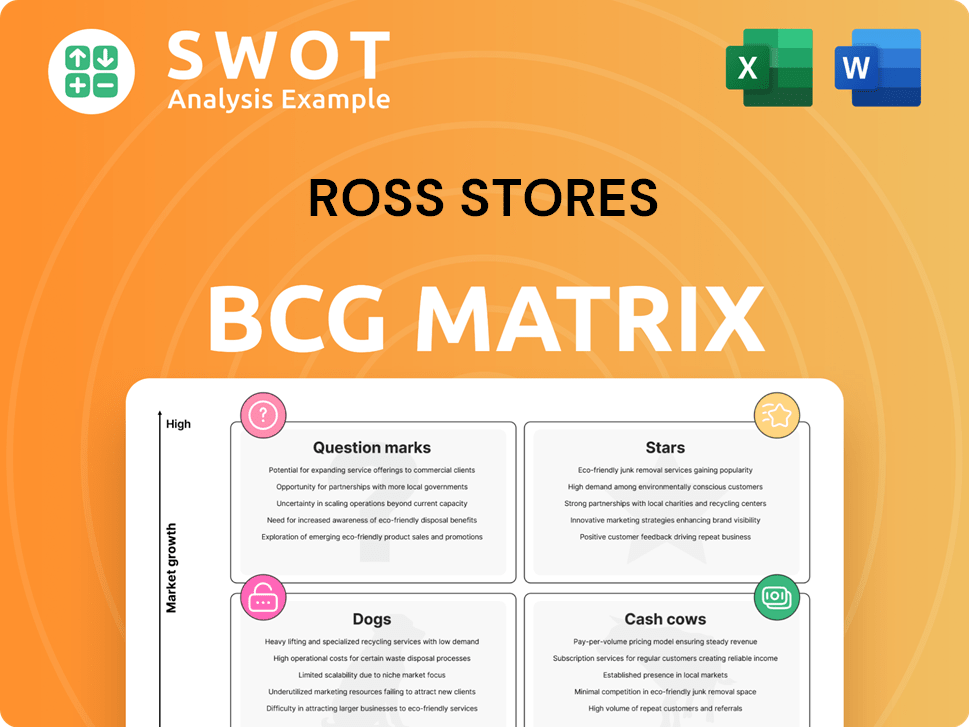

Ross Stores BCG Matrix

This preview is identical to the Ross Stores BCG Matrix you'll receive post-purchase. It's a fully developed, ready-to-use report, complete with analysis and strategic insights, delivered directly after checkout.

BCG Matrix Template

Ross Stores thrives in the value retail sector, but its BCG Matrix reveals a complex portfolio. Expect to see cash cows from established brands and question marks as they chase new trends.

The company's strategy shows investment decisions and strategic moves. This sneak peek gives you a taste, but the full BCG Matrix delivers deep, data-rich analysis, strategic recommendations, and ready-to-present formats—all crafted for business impact.

Stars

Ross Dress for Less is the cash cow for Ross Stores, generating substantial revenue. In 2024, Ross Stores reported net sales of $20.3 billion. Its strong brand and customer loyalty, alongside off-price deals, contribute to its success. As the largest off-price apparel chain, Ross maintains a competitive edge. The company's growth strategy focuses on store expansion and same-store sales increases.

Ross Stores' consistent expansion, especially with Ross Dress for Less, is vital. In 2024, they opened about 100 new stores. For fiscal 2025, around 80 new Ross stores are planned. This strategy reinforces their market presence.

Ross Stores excels in inventory management, a key strength in its BCG Matrix. Their unique procurement method and scale allow top-line expansion. In 2024, Ross reported net sales of $20.3 billion. This strategy secures quality products at prices enabling markdowns.

The business model thrives on competitive bargains, drawing customers. Ross's Q1 2024 same-store sales increased by 3%. This success is a testament to their effective inventory strategy.

Strong Financial Performance

Ross Stores shines as a "Star" in the BCG Matrix, showing strong financial health. In fiscal 2024, the company's revenue hit $21.1 billion, proving its market position. The company's strong financial standing is further highlighted by its unrestricted cash balances, totaling $4.7 billion at the end of fiscal 2024. A solid sign of confidence is the Board's approval of a 10% dividend increase to $0.405 per share, set for March 31, 2025.

- Revenue: $21.1 billion in fiscal 2024.

- Unrestricted Cash: $4.7 billion at the end of fiscal 2024.

- Dividend: Quarterly cash dividend increased to $0.405 per share.

Off-Price Retail Model

Ross Stores operates an off-price retail model, offering value to shoppers through micro-merchandising. This approach helps in better product allocation and enhanced margins. The company excels by purchasing excess merchandise from established brands. In 2023, Ross Stores reported sales of $19.7 billion.

- Value Proposition: Offers brand-name merchandise at discounted prices.

- Micro-Merchandising: Efficient product allocation and margin improvement.

- Sourcing: Purchases excess inventory from various brands.

- Financials: In 2023, comparable store sales increased by 4%.

Ross Stores is a "Star" in the BCG Matrix. Its financial health is shown by the fiscal 2024 revenue of $21.1 billion. The company's unrestricted cash totaled $4.7 billion at the end of fiscal 2024. The board has approved a 10% dividend increase to $0.405 per share for March 31, 2025.

| Key Metric | Value (2024) | |

|---|---|---|

| Revenue | $21.1 billion | |

| Unrestricted Cash | $4.7 billion | |

| Dividend per Share | $0.405 (March 31, 2025) |

Cash Cows

Ross Stores excels as a cash cow, holding a solid market position in off-price retail. It's the biggest off-price apparel and home fashion chain in the U.S. Its brand and scale generate consistent cash flow, fueling its financial health. In Q3 2024, sales rose 7.8% to $5.2 billion, highlighting its strong performance.

Ross Stores excels with a value-driven customer base focused on affordability. In 2024, the company's strategy of offering discounts on brand-name items generated substantial customer traffic. This approach helped Ross achieve a 7.8% increase in same-store sales. Their well-balanced merchandise assortment further caters to their target demographic.

Ross Stores' efficient operations are central to its status as a Cash Cow. The company's lean model and cost control measures ensure profitability, with a gross margin of 30.4% in 2024. Its streamlined supply chain and inventory management enhance cash generation. The supply chain strategy is designed to cut costs and boost inventory turnover, which was 4.8 times in 2024.

Packaway Strategy

Ross Stores' "packaway" strategy is key in its BCG Matrix. This approach involves storing off-season merchandise for later sales, capitalizing on favorable buying conditions. This strategy bolsters margins and cash flow. They use this to seize lucrative market opportunities. For instance, in 2024, Ross Stores reported a 7.5% increase in same-store sales, showing the strategy's effectiveness.

- Packaway involves storing merchandise.

- It helps maintain healthy margins.

- The strategy boosts cash flow generation.

- It allows them to benefit from market opportunities.

Share Repurchase Program

Ross Stores' share repurchase program is a key strategy, reflecting its dedication to enhancing shareholder value. In fiscal year 2024, the company bought back 7.3 million shares, spending $1.05 billion. This underscores its financial strength. The plan is to complete the remaining $1.05 billion in fiscal 2025. This action is a sign of confidence.

- Share repurchases return capital to shareholders.

- $1.05 billion spent on buybacks in 2024.

- Remaining $1.05 billion buyback planned for 2025.

- Indicates confidence in future performance.

Ross Stores' cash cow status is driven by its solid market position in the off-price retail sector. The company's efficient operations and cost control measures ensure consistent profitability. In 2024, the retailer saw a 7.8% increase in sales to $5.2 billion.

| Aspect | Details | 2024 Data |

|---|---|---|

| Sales Growth | Increase | 7.8% |

| Total Sales | Revenue | $5.2 billion |

| Gross Margin | Efficiency | 30.4% |

Dogs

A potential economic slowdown could hurt Ross Stores. Consumer spending could decrease, lowering demand for their products. The company faces macroeconomic and retail industry risks. Changes in the economy and markets can impact consumer confidence. In 2024, consumer spending growth slowed to 2.2%, indicating potential headwinds.

Increased competition is a significant challenge for Ross Stores. The off-price retail sector faces pressure from various competitors, impacting margins and market share. Online retailers and department stores are among the rivals, adding to the competitive landscape. Success hinges on Ross Stores' ability to provide substantial discounts on brand-name products. In 2024, the off-price retail market grew, but competition intensified, affecting profitability.

Shifting consumer preferences and fashion trends present challenges for Ross Stores. The company's success hinges on its buyers' ability to predict consumer tastes and secure desirable brand-name merchandise. In 2024, the off-price retail sector, where Ross operates, faced increasing competition. This made it harder to source attractive goods. If Ross fails to adapt, its performance may suffer, as seen in the fluctuating same-store sales reported throughout 2024.

Unfavorable Weather Conditions

Unfavorable weather, like extreme heat or cold, can deter shoppers. This impacts foot traffic and demand for seasonal items at Ross Stores. Unseasonable weather in 2024 could lead to inventory challenges. Lower sales figures might result if customers delay seasonal purchases.

- Extreme weather can reduce store visits.

- Seasonal apparel sales are weather-dependent.

- Inventory management becomes more complex.

- Sales could decrease due to weather-related shifts.

Underperformance of dd's DISCOUNTS

dd's DISCOUNTS, a segment of Ross Stores, could be categorized as a 'Dog' in its BCG Matrix if it consistently underperforms. Ross Stores aims for 2,900 Ross locations and 700 dd's DISCOUNTS. In 2024, Ross saw a 6% same-store sales increase. dd's DISCOUNTS focused on existing markets, potentially limiting growth.

- Ross Stores' 2024 same-store sales increased by 6%.

- The company plans to open 100 new stores in 2024.

dd's DISCOUNTS could be a "Dog" if growth lags. Focusing on existing markets might limit expansion opportunities. Ross Stores' same-store sales rose 6% in 2024, contrasting with the potential for slower growth at dd's DISCOUNTS.

| Metric | Ross Stores (2024) | dd's DISCOUNTS (2024) |

|---|---|---|

| Same-Store Sales Growth | 6% | Potentially Lower |

| Expansion Strategy | New Stores | Existing Markets |

Question Marks

Ross Stores' foray into new geographic markets, like Connecticut, Minnesota, New Jersey, and New York, positions them as a 'Question Mark' in the BCG Matrix. These areas present growth prospects but also carry uncertainties. Success hinges on effective market penetration. In 2024, Ross continued its expansion, aiming to capitalize on these opportunities. The company's strategy involves careful market analysis to mitigate risks.

E-commerce initiatives for Ross Stores are 'Question Marks.' As of late 2024, Ross's online presence is minimal compared to competitors. This strategy could unlock growth, but needs investment and has risks. In 2023, Ross's sales were $19.7B, while online sales were a small fraction.

Supply chain issues represent a 'Question Mark' for Ross Stores. The company relies heavily on international sourcing, making it vulnerable. In 2024, global supply chains faced volatility. Shipping delays and rising freight costs can impact profitability. These factors create uncertainty for Ross Stores' future performance.

Changing Trade Policies

Changing trade policies pose a risk to Ross Stores. The company relies on imported apparel and home goods. U.S. tax, tariff, and trade policy shifts can impact its costs. These changes could affect profitability and competitiveness.

- Tariffs on Chinese imports: In 2024, tariffs on goods from China could increase costs.

- Trade agreements: Changes to existing trade deals like NAFTA/USMCA could disrupt supply chains.

- Tax policies: Any changes to corporate tax rates could influence the company's financial performance.

- Import regulations: Stricter import rules could cause delays and increase expenses.

New Store Formats

Introducing new store formats positions Ross Stores as a 'Question Mark' in the BCG matrix. These formats, potentially targeting new customer segments or offering novel shopping experiences, require careful evaluation. The company must assess the viability of these formats before committing substantial resources. This strategic move could lead to significant growth or potential losses.

- New store formats could include smaller, more specialized stores.

- Ross Stores' net sales in 2023 were $19.7 billion.

- The success of new formats hinges on market acceptance and operational efficiency.

- Significant investment decisions will follow successful pilot programs.

Ross Stores faces uncertainty in new markets, online sales, and supply chains, classifying them as 'Question Marks' in the BCG Matrix. E-commerce remains minimal compared to competitors, with $19.7B in 2023 sales. Global events, like trade policies changes, pose risks, impacting costs and supply chains.

| Area | Impact | 2024 Data |

|---|---|---|

| Expansion | Uncertain growth | Continued expansion in new states |

| E-commerce | Investment needed | Small fraction of sales |

| Supply Chain | Volatility | Freight cost increased |

BCG Matrix Data Sources

The Ross Stores BCG Matrix relies on market analysis, company filings, industry reports, and financial data to create data-driven insights.