Ross Stores Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ross Stores Bundle

What is included in the product

Tailored exclusively for Ross Stores, analyzing its position within its competitive landscape.

Tailor Ross's competitive landscape analysis to changing economic climates; quickly pivot your strategy.

Same Document Delivered

Ross Stores Porter's Five Forces Analysis

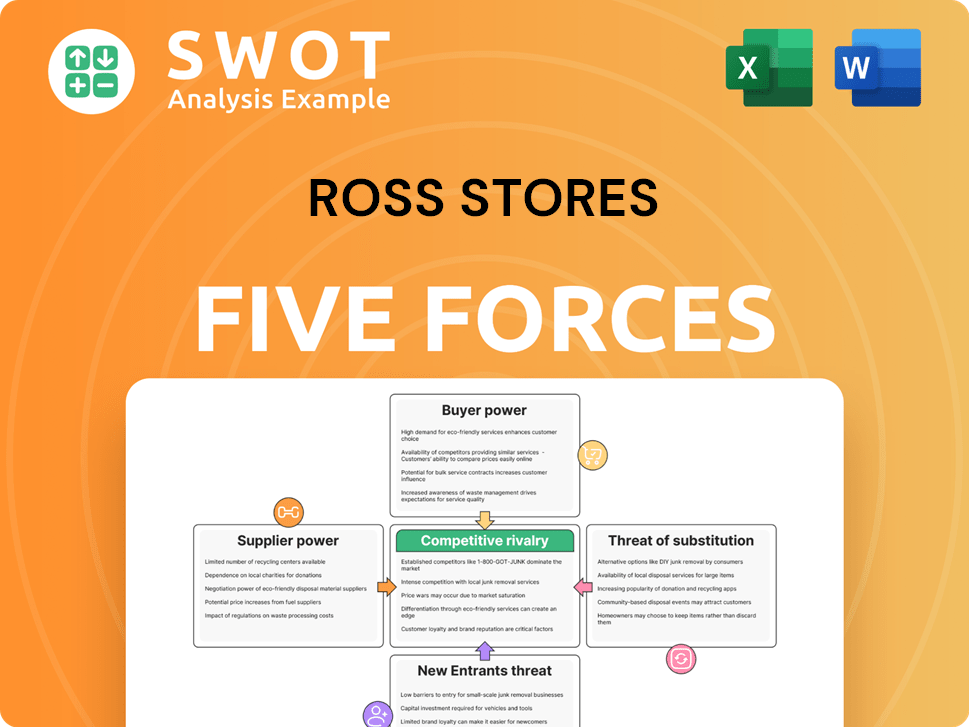

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This Ross Stores Porter's Five Forces analysis examines competitive rivalry, threat of new entrants, supplier power, buyer power, and threat of substitutes. Each force is thoroughly assessed, providing a complete strategic overview. The analysis is professionally written and ready for your immediate use. This means no surprises when you purchase!

Porter's Five Forces Analysis Template

Ross Stores faces moderate competition, with strong buyer power due to numerous retail options. Bargaining power of suppliers is relatively low, thanks to diverse sourcing. The threat of new entrants is moderate, considering the established brand and scale of existing players. Substitute products, like online retailers, pose a constant, low-to-moderate threat. The competitive rivalry within the off-price retail sector remains intense.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ross Stores’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Ross Stores benefits from limited supplier power due to its vast vendor network. The company's sourcing from around 21,000 vendors globally dilutes supplier influence. No single vendor accounts for over 5% of purchases, providing leverage. In 2023, Ross Stores' cost of goods sold was approximately $13.4 billion, reflecting its strong negotiating position.

Ross Stores' supplier power is generally low due to its ability to easily switch vendors. This strategic flexibility helps Ross negotiate better terms. In 2024, Ross's gross margin was about 27.5%, reflecting effective cost management. The company's approach ensures a consistent flow of goods at competitive prices, enhancing its market position.

Ross Stores wields considerable power over its suppliers, primarily due to its enormous purchasing volume. In 2024, with around $5.4 billion in annual purchases, Ross can dictate more favorable terms. This bulk buying allows for better pricing, improving profitability. Ross's scale gives it an edge over smaller competitors.

Opportunistic Purchasing

Ross Stores' off-price model significantly diminishes supplier power through opportunistic purchasing. The company buys excess inventory and closeout merchandise. This strategy enables Ross to secure brand-name items at substantial discounts. The ability to capitalize on supply chain inefficiencies strengthens Ross's position.

- Ross Stores' net sales in 2023 were $19.7 billion.

- The company's merchandise buying strategy helps maintain high profit margins.

- Ross's opportunistic approach allows for competitive pricing.

- This strategy supports a diverse and rapidly changing product assortment.

Global Sourcing Network

Ross Stores' global sourcing network significantly impacts its bargaining power with suppliers. The company strategically diversifies its sourcing across numerous countries. This approach includes major hubs like China (37%), Vietnam (22%), and Bangladesh (15%) as of the latest data. This diversification reduces dependence on single suppliers.

- Geographic Diversification: Access to a wide range of suppliers across multiple countries.

- Reduced Dependency: Less reliance on any single supplier or region.

- Negotiating Leverage: Enhanced ability to secure favorable deals on merchandise.

- Risk Mitigation: Protection against supply chain disruptions.

Ross Stores exhibits low supplier power due to extensive vendor relationships. The company's global sourcing includes a vast network, with no single supplier dominating purchases. In 2023, Ross's cost of goods sold was approximately $13.4 billion, showcasing its negotiating strength. The off-price model further enhances its position.

| Aspect | Details | 2023 Data |

|---|---|---|

| Vendors | Number of Vendors | ~21,000 |

| Sourcing | Geographic Diversification | China (37%), Vietnam (22%), Bangladesh (15%) |

| Purchases | Annual Purchases | ~ $5.4 billion (2024 est.) |

Customers Bargaining Power

Ross Stores faces high customer price sensitivity, as its value-focused shoppers actively seek deals. The company's discounts, ranging from 20% to 60%, attract bargain hunters. In 2024, retail sales showed that consumers remain highly price-conscious, with value retailers like Ross seeing sustained demand. This price sensitivity enhances buyer power, encouraging customers to seek better deals.

Customers wield significant power due to a wide array of alternatives to Ross Stores. Competitors like T.J. Maxx and Burlington offer similar off-price selections. Traditional department stores' sales and online platforms also compete. In 2024, the off-price retail sector saw a 7% growth, highlighting these alternatives' impact on buyer power.

Customers face minimal switching costs due to the ease of choosing alternative retailers. This freedom allows them to effortlessly compare prices and selections. In 2024, Ross Stores' customer base could readily shift to off-price competitors like TJX Companies. This dynamic gives customers considerable power. Their decisions significantly influence Ross's pricing and strategies.

Strong Customer Loyalty

Ross Stores' customers exhibit considerable loyalty, yet their bargaining power remains moderate. The company benefits from a high repeat customer rate of 67%, demonstrating strong customer retention. Customers visit stores frequently, averaging 4.3 times per quarter, which boosts sales. However, this loyalty is contingent on continued value.

- Repeat customer rate: 67%

- Average customer lifetime value: $425

- Store visits per quarter: 4.3

Growing Consumer Demand for Value

The bargaining power of Ross Stores' customers is significantly influenced by their increasing demand for value. The off-price retail sector is expected to expand, fueled by consumers seeking affordable options. Economic instability and changing shopping habits amplify the need for cost-effective, high-quality goods. This dynamic strengthens customer power, pushing retailers to consistently meet value and convenience expectations.

- Off-price retail is predicted to grow, reflecting a shift towards value-focused shopping.

- Consumer preference for affordability is heightened by economic uncertainties.

- Retailers must adapt to meet evolving customer demands for value and convenience.

Customers' strong price sensitivity boosts their power, pushing Ross Stores to offer deals. Alternatives like T.J. Maxx and online platforms increase this power. With minimal switching costs and a focus on value, customers influence Ross's strategies.

| Factor | Impact | Data (2024) |

|---|---|---|

| Price Sensitivity | High | Value retail sales grew 7%. |

| Alternatives | Numerous | TJX Companies' revenue: $54.7B. |

| Switching Costs | Low | Customer retention: 67%. |

Rivalry Among Competitors

Ross Stores operates in a highly competitive off-price retail market. Key rivals include TJX Companies, with brands like T.J. Maxx and Marshalls, and Burlington. The off-price market is fragmented, involving many regional competitors. In 2024, TJX Companies reported net sales of approximately $54.2 billion, highlighting the scale of competition. This competitive pressure requires Ross to continually innovate.

The off-price retail sector exhibits notable market share concentration. TJX Companies and Ross Stores, the leading entities, collectively control a significant portion of the market. Specifically, TJX holds roughly 50% of the market, while Ross Stores accounts for around 30%. This concentration fuels intense rivalry among key players striving for market dominance within the estimated $200 billion total addressable market.

Ross Stores distinguishes itself through deep discounts, offering merchandise 20-60% below department stores. They refresh inventory weekly with 10,000+ new items. In 2024, Ross Stores reported net sales of $20.3 billion. The company plans to open around 90 new stores in fiscal 2025, supporting its competitive edge.

Store Expansion Strategies

Competitive rivalry is high due to aggressive store expansion by Ross Stores and its competitors. Ross Stores intends to open around 90 new stores in 2025, increasing the competition for prime retail locations. TJX Companies also plans expansions, further intensifying the battle for market share. This growth strategy directly challenges existing players and impacts profitability.

- Ross aims for 2,900 "Ross Dress for Less" stores long-term.

- Ross plans 700 "dd's DISCOUNTS" stores in the long run.

- TJX Companies also has expansion plans.

- Store expansion is a key competitive strategy.

Impact of E-commerce

E-commerce significantly impacts Ross Stores, even with its limited online presence. The growth of online discount platforms intensifies competition. Retailers like Amazon and ThredUp now vie for the same budget-conscious shoppers. To stay competitive, Ross Stores needs to improve its online and in-store shopping experience.

- Amazon's revenue reached $574.8 billion in 2023, a significant competitor.

- ThredUp's 2023 revenue was $336.4 million.

- Ross Stores' 2023 sales were $19.7 billion.

Competitive rivalry in off-price retail is fierce, driven by aggressive store expansions. Ross Stores and TJX Companies are key rivals, vying for market share. E-commerce further intensifies competition, requiring strategic adaptation.

| Metric | Ross Stores | TJX Companies |

|---|---|---|

| 2024 Net Sales | $20.3B | $54.2B |

| Market Share (approx.) | 30% | 50% |

| Planned New Stores (2025) | ~90 | Expanding |

SSubstitutes Threaten

Online discount shopping platforms present a notable threat to Ross Stores. Amazon's off-price marketplace competes directly by offering a wide array of discounted goods. These platforms appeal to value-conscious consumers seeking convenience. In Q4 2023, online discount shopping platforms hit $218.5 billion in annual revenue. This highlights the growing consumer shift toward online shopping options.

Traditional department stores like Macy's and Nordstrom, which frequently feature sales, pose a threat to Ross Stores. These sales draw customers seeking discounted brand-name items, acting as substitutes. Macy's reported that 35% of its sales come from promotional periods, impacting Ross. Nordstrom Rack, a discount division, generated $4.3B in revenue, highlighting the competition.

The secondhand clothing market, including platforms like Poshmark and ThredUp, poses a growing threat. These platforms provide consumers with discounted apparel and accessories. The global secondhand clothing market hit $53.4 billion in 2023. It's expected to reach $77.6 billion by 2025, offering a cost-effective alternative.

E-commerce Platforms

E-commerce platforms like Walmart and Target pose a threat by offering alternative shopping options. These platforms compete for consumer spending, particularly in areas like apparel and home goods. They often provide competitive pricing and convenient online shopping experiences. Walmart's e-commerce sales reached $73.2 billion in 2023, and Target's digital sales grew to $25.6 billion.

- E-commerce platforms offer alternative shopping experiences.

- They compete for consumer spending on apparel and home goods.

- They often provide competitive pricing.

- Walmart's e-commerce sales reached $73.2 billion in 2023.

Private Label Brands

The threat of substitutes for Ross Stores, particularly from private label brands, is a notable concern. Full-price retailers like Macy's are expanding into the off-price sector, which directly competes with Ross. These retailers offer their private label brands at competitive prices, providing a value-focused alternative for consumers. This intensifies the pressure on Ross to differentiate its product offerings and maintain its market position.

- Macy's reported a 2024 net sales decrease of 1.5%, indicating challenges in the retail sector.

- Private label brands account for a significant portion of sales in full-price retailers, increasing their competitiveness.

- Ross Stores' net sales increased 8% to $20.3 billion in fiscal 2023, showing resilience.

Substitutes like online platforms and department store sales pose a threat to Ross. The secondhand market, valued at $53.4B in 2023, offers another alternative. E-commerce platforms also compete for consumer spending. Private labels further intensify competition for Ross.

| Substitute Type | Market Size/Impact | 2024 Data |

|---|---|---|

| Online Discount Platforms | $218.5B (Annual Revenue) | Growth expected |

| Secondhand Clothing | $53.4B (2023) | Projected $77.6B by 2025 |

| E-commerce | Walmart $73.2B (2023 sales) | Target digital sales $25.6B (2023) |

Entrants Threaten

The retail industry, especially brick-and-mortar stores, demands substantial upfront capital. Ross Stores needs roughly $3.5 to $4.2 million for each new store. This financial barrier significantly limits new competitors. The high capital needed to build a competitive store network protects Ross Stores.

Ross Stores has built strong brand recognition and customer loyalty over time. New entrants face an uphill battle against Ross's established brand equity. The company spent $268.9 million on advertising in 2023, showcasing their commitment. Building brand awareness and trust requires significant marketing investment. Therefore, the threat of new entrants is moderate.

Ross Stores leverages significant economies of scale, stemming from its extensive store network and substantial purchasing volume. This scale enables the company to secure advantageous terms with suppliers, boosting operational efficiency. In 2024, Ross Stores operated over 1,700 stores, highlighting its vast retail presence. New entrants would struggle to match Ross Stores' cost advantages, facing a competitive disadvantage due to their smaller size.

Supply Chain Relationships

Ross Stores benefits from its established supply chain, a significant barrier for new entrants. Its strong relationships with about 21,000 vendors globally ensure access to diverse, competitively priced merchandise. Replicating this extensive network is difficult and time-consuming. New competitors face a steep challenge in matching Ross's supply chain efficiency.

- Established vendor relationships provide competitive advantages.

- Sourcing from around 21,000 vendors worldwide.

- Building a similar supply chain is a major hurdle.

Operational Expertise

Operating an off-price retail business successfully demands considerable operational expertise, especially in inventory management, merchandising, and cost control. Ross Stores' long-standing presence has allowed it to build this expertise, creating a barrier for newcomers. Efficient inventory management and offering attractive value are key advantages for the company. In fiscal year 2023, Ross Stores reported a net sales increase of 8% to $19.7 billion, highlighting its operational effectiveness.

- Inventory Turnover: In 2023, Ross Stores' inventory turnover rate was approximately 4.2 times, indicating efficient inventory management.

- Merchandising: Ross Stores' ability to curate a constantly changing selection of merchandise at discounted prices is a core competency, driving customer traffic.

- Cost Control: The company's disciplined approach to cost management is evident in its operating margin, which was around 11.6% in fiscal year 2023.

- Market Position: As of 2024, Ross Stores operates over 1,700 stores, demonstrating its established market position and operational scale.

The threat of new entrants for Ross Stores is moderate due to several factors. High capital requirements, such as the $3.5-4.2 million per store, limit new competitors. Strong brand recognition and extensive supply chains also pose significant challenges. Economies of scale further protect Ross Stores.

| Barrier | Impact | Data |

|---|---|---|

| Capital Needs | High | $3.5-$4.2M per store |

| Brand Equity | Strong | $268.9M advertising (2023) |

| Economies of Scale | Advantage | 1,700+ stores (2024) |

Porter's Five Forces Analysis Data Sources

Our analysis of Ross Stores utilizes financial reports, market share data, and industry research publications for competitive landscape insights.