Rumo Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rumo Bundle

What is included in the product

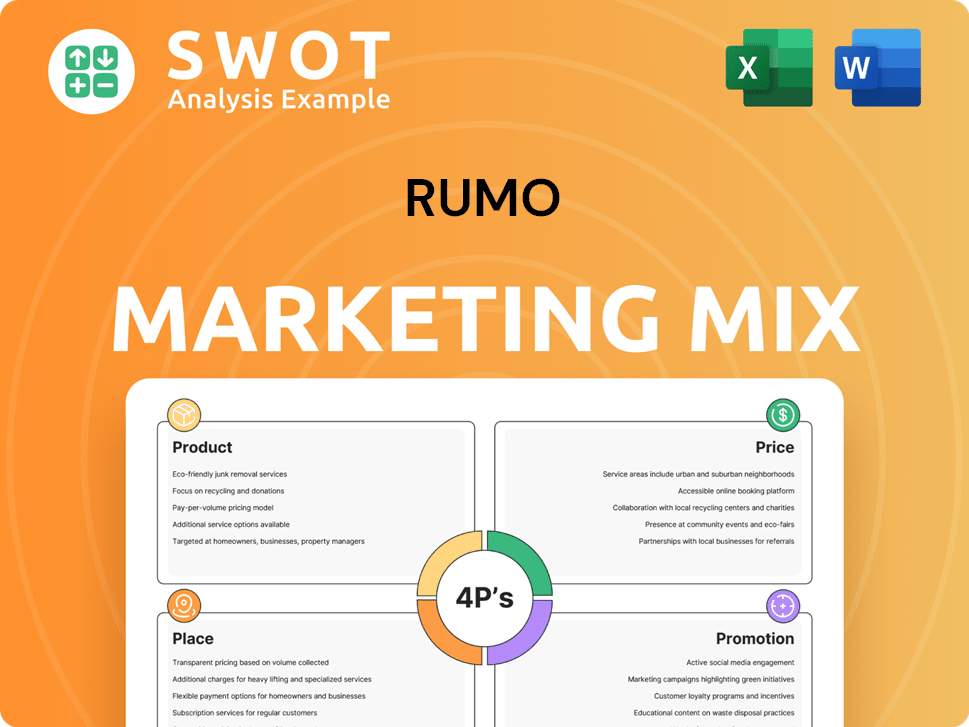

Deep dives into Rumo's Product, Price, Place, & Promotion, using brand practices.

Serves as a clean summary of 4Ps, boosting team discussion & offering rapid alignment.

What You Preview Is What You Download

Rumo 4P's Marketing Mix Analysis

The 4Ps Marketing Mix analysis you see here is the exact, comprehensive document you'll receive upon purchase.

4P's Marketing Mix Analysis Template

Want to decode Rumo's marketing brilliance? Their product range, pricing tiers, distribution reach, and promotional campaigns create a winning formula. See how they connect with their audience and build their brand. Uncover real-world examples, actionable insights, and a clear, presentation-ready template. Save time, get results, and understand the whole picture instantly.

Product

Rumo's primary offering is rail transportation, essential for moving goods across Brazil. They transport commodities such as grains and sugar, plus industrial items like fuels. The company operates about 14,000 km of railway lines. In 2024, Rumo transported a record 85.6 million tons.

Rumo's port handling services are essential, complementing its rail operations. They handle cargo transfers, especially agricultural exports, from trains to ships. Rumo owns stakes in port terminals, streamlining this process. In 2024, Rumo handled about 75 million tons of cargo through its port terminals.

Rumo's warehousing and storage services are integral, offering temporary storage for goods before or after rail transport. This integrated logistics solution is crucial, as demonstrated by Rumo's handling of over 70 million tons in 2024. The company manages its own storage facilities and transshipment terminals. This ensures efficient handling and control of commodities.

Intermodal Transport

Rumo's intermodal transport strategically blends rail with road transport, enhancing its logistics reach. This integrated approach provides flexible solutions, crucial for serving diverse locations beyond the direct rail network. In 2024, intermodal solutions contributed significantly to Rumo's revenue, representing about 15% of total logistics services. This strategy is key for capturing a broader market and optimizing supply chains.

- Revenue Contribution: Intermodal transport accounted for 15% of logistics revenue in 2024.

- Flexibility: Enables access to areas not directly served by rail.

- Complete Logistics: Offers end-to-end supply chain solutions.

Logistics Services and Consulting

Rumo's logistics services extend beyond transport and storage. They offer consulting, optimizing supply chains and providing customized solutions. This integrated approach targets efficient and comprehensive logistics management for clients. In 2024, the logistics sector in Brazil saw a revenue of approximately BRL 350 billion. Rumo's consulting services are crucial for clients seeking to streamline operations and reduce costs.

- Customized solutions for clients.

- Supply chain optimization.

- Expertise in transportation and distribution.

- Comprehensive logistics management.

Rumo’s products include rail transportation, port handling, warehousing, and intermodal transport. These offerings facilitate comprehensive logistics solutions. In 2024, they transported 85.6 million tons and handled around 75 million tons via port terminals. Integrated logistics consulting completes their service suite.

| Service | Description | 2024 Performance |

|---|---|---|

| Rail Transport | Moving goods across Brazil via rail. | 85.6 million tons transported |

| Port Handling | Cargo transfer from trains to ships. | 75 million tons handled |

| Warehousing | Temporary storage of goods. | Over 70 million tons handled |

| Intermodal Transport | Blending rail and road transport. | 15% of logistics revenue |

Place

Rumo's extensive railway network is its primary "place," crucial for transporting goods across Brazil. This network, stretching through states like Mato Grosso and São Paulo, connects production areas to ports. In 2024, Rumo transported over 80 million tons of cargo, highlighting the network's significance. This infrastructure is key to Rumo's logistics strategy.

Strategic Port Terminals are essential for Rumo 4P's place strategy. Presence at major Brazilian ports like Santos and Paranaguá is key. In 2024, Santos handled over 140 million tons, crucial for exports. These terminals link rail transport to global markets, boosting efficiency.

Rumo's transshipment terminals are vital for its marketing mix. These terminals facilitate the seamless transfer of goods. In 2024, Rumo handled approximately 60 million tons of cargo through these facilities. They connect rail, road, and storage. This enhances logistics efficiency.

Operational Regions Across Brazil

Rumo's marketing mix strategically targets key operational regions across Brazil. Their operations are predominantly in the central-west, southern, southeastern, and northern regions. This geographic concentration is essential for serving major production areas and facilitating exports via active ports. Rumo's logistics network handled approximately 83.8 million tons in 2024, showcasing its importance.

- Central-west region: Focus on agricultural commodities transport.

- Southern region: Key for grains and industrial products.

- Southeastern region: Connects to major consumer markets and ports.

- Northern region: Expanding to tap into new logistics opportunities.

Integrated Logistics Footprint

Rumo's integrated logistics footprint is a key element of its marketing strategy. They combine railway lines, port terminals, and transshipment facilities across Brazil. This integration allows Rumo to provide comprehensive logistics solutions. In 2024, Rumo handled over 80 million tons of cargo, showcasing its extensive operational reach.

- Rumo operates over 12,000 km of railway lines.

- They manage multiple port terminals.

- Rumo's integrated network reduces transportation costs.

Rumo's "place" strategy relies heavily on its expansive railway network, critical for freight transport throughout Brazil, including states like Mato Grosso. Strategic port terminals and transshipment facilities also form integral parts of the company’s marketing mix. In 2024, Rumo’s network handled approximately 83.8 million tons, underscoring its logistics importance.

| Component | Description | 2024 Performance |

|---|---|---|

| Railway Network | Primary transportation across Brazil. | >80 million tons cargo. |

| Port Terminals | Key for exports, e.g., Santos. | Santos handled >140M tons. |

| Transshipment Terminals | Transfer goods between transport modes. | ~60 million tons cargo. |

Promotion

Rumo strategically employs investor relations and financial reporting to engage with stakeholders. They regularly publish earnings releases and comprehensive sustainability reports. In Q1 2024, Rumo reported a net revenue of R$2.5 billion. This transparent communication showcases financial health and strategic initiatives, vital for investor trust.

Rumo emphasizes sustainability in its marketing. They publish sustainability reports and participate in initiatives like the Dow Jones Sustainability Index. This highlights their commitment to reducing emissions and promoting sustainable transport solutions. In 2024, Rumo allocated approximately $50 million towards environmental initiatives, showing their investment in sustainability. Their ESG rating improved to B+ by the end of 2024, reflecting these efforts.

Rumo can boost visibility by attending industry events. This enables face-to-face interaction with clients and partners. Such events offer chances to present services and network. In 2024, logistics events saw a 15% rise in attendance.

Strategic Partnerships and Joint Ventures

Announcements about strategic partnerships and joint ventures, like the one with CHS for a grain terminal, are promotional. These partnerships boost Rumo's capacity and service quality, showcasing collaboration. Such moves highlight Rumo's growth strategies and market position.

- Rumo's revenue in Q1 2024 was R$2.5 billion.

- The CHS partnership expands Rumo's grain handling capabilities.

- Joint ventures improve service offerings and market reach.

Website and Digital Presence

Rumo leverages its website and digital channels to disseminate key information. This includes details on services, network updates, company news, and investor relations, crucial for stakeholder engagement. A robust online presence enhances accessibility and reach, vital in today's digital landscape. Consider that in 2024, digital marketing spending hit $830 billion globally, indicating its importance.

- Website serves as a central hub for information.

- Digital channels are used for communication and updates.

- Essential for reaching a broad audience effectively.

- Online presence is key to accessible information.

Promotion at Rumo involves transparent communication, highlighting financial health through reports and strategic initiatives. Sustainability marketing underscores its commitment, backed by substantial investments, reflected in improved ESG ratings. Industry events, partnerships, and a strong digital presence, as seen by digital marketing's $830B global spend in 2024, all bolster Rumo's visibility.

| Promotion Strategy | Details | Impact |

|---|---|---|

| Investor Relations | Earnings reports, stakeholder engagement | Builds trust and transparency. |

| Sustainability Marketing | ESG focus, reports, initiatives (approx. $50M spend) | Enhances brand value and attracts ESG-focused investors. |

| Industry Events | Networking and service promotion | Increase brand visibility and potential leads. |

Price

Rumo's rail transport pricing uses tariffs based on distance, cargo type, and volume. Tariff growth has been significant; in Q1 2024, revenue rose due to tariff increases. For example, in 2024, average revenue per ton-kilometer increased by 8%. These increases reflect Rumo's pricing strategy.

Rumo's pricing for port and warehousing services is independent of rail tariffs. It considers cargo type, volume, and storage duration. Specific services at terminals also influence the cost. In 2024, port handling fees averaged $1.50 per ton, warehousing around $0.80 per ton monthly. These prices are subject to market fluctuations.

Rumo likely employs competitive pricing, essential in logistics. Rail transport efficiency could provide a cost edge. In 2024, Brazil's rail freight volume was about 180 billion ton-kilometers. This strategy helps Rumo stay competitive. Effective pricing attracts and keeps customers.

Investment in Efficiency to Influence Pricing

Rumo's ongoing investments in its infrastructure are designed to boost efficiency. These improvements, including expanded rail networks and upgraded terminals, aim to reduce operational costs. This cost efficiency could then be reflected in Rumo's pricing, enhancing its market competitiveness.

- Rumo invested BRL 3.5 billion in 2023.

- Efficiency gains could lower transport costs by 10-15%.

- Modern terminals can increase cargo handling by 20%.

Market Demand and Economic Conditions

Pricing strategies for Rumo are significantly impacted by market demand and Brazil's economic state. Commodity price shifts and export volumes directly affect the need for Rumo's logistics. For instance, in 2024, Brazil's agricultural exports reached record levels, influencing freight demand. This demand shift, in turn, affects pricing decisions.

- Brazil's GDP growth in 2024 was approximately 2.9%.

- Agricultural exports surged by 15% in the first half of 2024.

- The price of iron ore, a key export, fluctuated significantly.

Rumo strategically sets prices based on distance, cargo, and volume, with tariffs increasing to boost revenue. Port and warehousing costs consider cargo type and storage. Competition is fierce, yet efficiency investments may trim transport expenses.

| Metric | Data (2024) |

|---|---|

| Average Revenue per Ton-Kilometer Increase | 8% |

| Port Handling Fees (per ton) | $1.50 |

| Warehousing (per ton/month) | $0.80 |

4P's Marketing Mix Analysis Data Sources

The Rumo 4P's analysis leverages company data, pricing structures, distribution, and marketing campaigns.