Rumo PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Rumo Bundle

What is included in the product

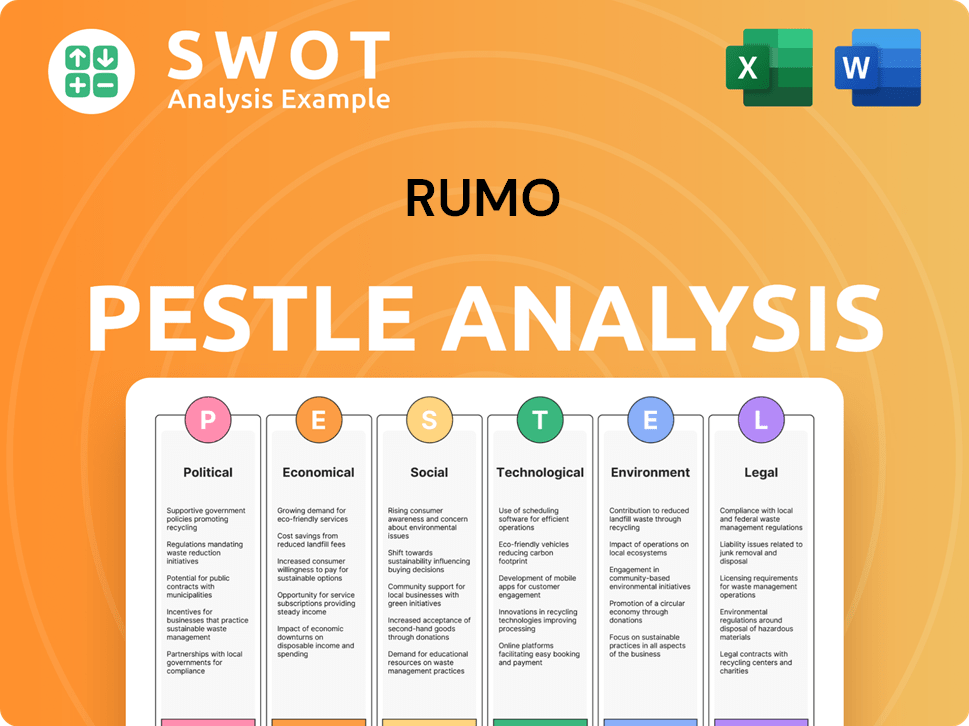

The analysis of Rumo's external factors, considering six dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

What You See Is What You Get

Rumo PESTLE Analysis

The Rumo PESTLE analysis you're viewing details its political, economic, social, technological, legal & environmental aspects. The layout, content & structure are exactly what you'll download after purchase. You’ll instantly get this complete, formatted report. It is designed to give valuable insights.

PESTLE Analysis Template

Navigate the complexities shaping Rumo with our in-depth PESTLE Analysis. Uncover critical political and economic forces at play. Discover social, technological, legal, and environmental influences impacting their strategy. Perfect for investors and business strategists. Get the full, actionable analysis now.

Political factors

Rumo's railway concessions from the Brazilian government are crucial. These concessions determine operational rules and investment strategies. Government infrastructure and transportation policies can create opportunities and risks. For example, in 2024, the company invested heavily, with R$6.3 billion. Regulatory changes impact Rumo's long-term planning.

Political stability is critical for investor confidence and policy predictability in Brazil's logistics sector. Changes in government priorities impact infrastructure investments and Rumo's strategy. Brazil's 2024 political environment, with its focus on economic reforms, influences Rumo's long-term plans. The government's infrastructure spending, totaling BRL 30 billion in 2024, directly affects Rumo's project execution.

Government-led infrastructure investment programs significantly impact Rumo. The New PAC, for example, provides funding for railway expansion and upgrades. These investments aim to boost efficiency in transporting agricultural and industrial goods. In 2024, Brazil invested $10 billion in railway projects, directly benefiting Rumo's operations.

Trade Policies and Agreements

Rumo's operations are significantly influenced by government trade policies and international agreements, which affect the flow of goods, especially agricultural products. Positive trade conditions can boost demand for Rumo's services, while restrictive policies can decrease it. For instance, Brazil's agricultural exports, a key cargo for Rumo, were projected to reach $66.7 billion in 2024. The company benefits from trade deals that facilitate these exports.

- In 2024, Brazil's soybean exports were expected to increase, benefiting Rumo.

- Trade agreements with China are crucial for Brazilian agricultural exports.

- Changes in import tariffs by key trading partners can impact Rumo's volumes.

Relationship with Government Agencies

Rumo's success hinges on its relationship with government agencies, particularly ANTT and ANTAQ. These agencies oversee transport regulations, impacting Rumo's operations and approvals. In 2024, Rumo invested heavily in compliance to meet evolving regulatory demands. Effective communication ensures operational efficiency and mitigates risks.

- Rumo's investments in regulatory compliance increased by 15% in 2024.

- ANTT and ANTAQ approvals directly influence 80% of Rumo's project timelines.

- Successful agency collaboration reduced operational delays by 10% in the last year.

Rumo's reliance on government railway concessions and infrastructure investments is substantial; Brazil's political stability and its focus on economic reforms influence Rumo's strategy. Government-led projects, like the New PAC, provided about $10 billion for railways. Trade policies are crucial, with Brazil's agricultural exports projected at $66.7 billion in 2024, boosted by trade deals and influencing Rumo’s operations.

| Political Factor | Impact on Rumo | 2024 Data |

|---|---|---|

| Infrastructure Spending | Affects project execution and expansion | BRL 30 billion in infrastructure investments |

| Trade Policies | Influence flow of goods and demand | $66.7 billion projected agricultural exports |

| Regulatory Compliance | Operational efficiency and risk mitigation | 15% increase in investments in regulatory compliance |

Economic factors

Rumo's revenue is significantly tied to agricultural exports, especially soybeans and corn. Brazil's agricultural sector is vital to its economy, with exports reaching $66.5 billion in 2024. Good weather and strong global demand boost volumes and revenues for Rumo. In 2024, soybean exports hit a record 101.8 million tons.

Brazil's macroeconomic health significantly impacts Rumo. Inflation, interest rates, and GDP growth directly affect both production and consumer spending. In 2024, Brazil's GDP growth is projected around 2.0%, influenced by fluctuating inflation rates. Higher interest rates can increase operating costs. Economic instability poses risks.

Fluctuations in global commodity prices significantly affect Rumo. Rising agricultural goods prices may boost transport demand, potentially benefiting Rumo's revenue. However, increasing fuel costs can squeeze profit margins. For instance, in 2024, fuel accounted for a substantial portion of operational expenses. In 2025, analysts predict continued volatility in commodity markets, impacting Rumo's financial performance.

Investment in Infrastructure

Investments in logistics infrastructure are vital for Rumo. The Brazilian government and private sector are boosting supply chain efficiency. Rumo itself is investing significantly. For example, in 2024, Rumo invested R$4.8 billion in capex.

- Improved Efficiency: Infrastructure upgrades streamline operations.

- Network Expansion: Investments support Rumo's service growth.

- Rumo's Capex: R$4.8 billion in 2024.

- Supply Chain Boost: Enhances Brazil's logistics capabilities.

Foreign Exchange Rates

For Rumo, changes in foreign exchange rates are critical because they impact the cost of international trade. A weaker Brazilian Real can make exports cheaper, potentially boosting transport volumes and revenues. Conversely, a stronger Real could make exports more expensive. The Brazilian Real has fluctuated, with recent volatility affecting trade dynamics.

- In 2024, the Real experienced fluctuations against the USD, impacting import/export costs.

- Rumo's financial performance is directly linked to these currency movements.

- Hedging strategies are essential to mitigate FX risks.

Rumo's economic success depends on agricultural exports, with Brazil's sector exceeding $66.5B in 2024. Macroeconomic stability, including GDP growth (around 2.0% in 2024), impacts operations and spending. Fluctuating global commodity prices and fuel costs present ongoing challenges, which affects transport demand.

| Factor | Impact on Rumo | Data Point (2024/2025) |

|---|---|---|

| GDP Growth | Affects transport demand | Projected 2.0% growth in 2024. |

| Inflation | Impacts operational costs | Fluctuating, impacting investment and spending |

| Commodity Prices | Influences revenues | Soybean exports hit 101.8M tons |

Sociological factors

Rumo's operations span diverse communities along its railway network. Positive community relations are vital for its operational license. Investments in education and training are key. In 2024, Rumo allocated BRL 15 million for social projects, reflecting its commitment to community development and local support. This included initiatives aimed at enhancing educational opportunities and professional skills within the communities it serves.

Rumo, as a major employer, faces sociological considerations tied to its workforce. Labor relations, including union negotiations, can affect operational continuity. Strikes or disputes could disrupt rail services, impacting revenue. Employee safety and well-being are crucial, with investments in these areas potentially boosting productivity. In 2024, the Brazilian railway sector saw labor negotiations that influenced operational costs.

Railway safety is vital for public trust in Rumo. Accidents harm reputation and raise social concerns. Rumo's safety efforts are thus significant. In 2024, there were 12% fewer accidents. Improved safety boosts public confidence and supports long-term sustainability.

Demographic Shifts and Urbanization

Brazil's demographic shifts and urbanization are key for Rumo. Urban population growth drives freight demand. In 2024, over 87% of Brazilians lived in urban areas. Rumo must adapt to these evolving patterns for effective logistics.

- Urbanization rate: 87.4% in 2024.

- Population growth in major cities: Steady, impacting logistics needs.

Stakeholder Engagement and Corporate Social Responsibility

Rumo's success hinges on engaging with diverse stakeholders and showcasing corporate social responsibility. This includes investors, employees, local communities, and NGOs, all of whom influence the company's reputation and long-term viability. Demonstrating commitment to ethical practices is crucial in today's market. In 2024, companies with strong ESG (Environmental, Social, and Governance) ratings saw, on average, a 10% higher valuation.

- Rumo's 2024 ESG report highlighted a 15% increase in community investment.

- Employee satisfaction surveys showed an 80% approval rate for CSR initiatives.

- Investor relations emphasized transparent reporting on sustainability goals.

Rumo's community ties influence its operational permissions, underscored by substantial investment in education. Labor relations are crucial, as disputes can halt operations, and worker safety affects productivity. Public trust relies on railway safety; improved safety practices contribute to a 12% drop in accidents reported in 2024.

| Factor | Details | 2024 Data |

|---|---|---|

| Community Investment | Social project allocations | BRL 15M, impacting education |

| Labor Relations | Union impacts & disputes | Influenced operational costs |

| Safety | Accident reduction & Public Confidence | 12% decrease in accidents |

Technological factors

Technological advancements are reshaping rail logistics. Rumo's adoption of advanced signaling systems, automation, and data analytics can significantly boost operational efficiency. Investments in technological innovation are vital for Rumo to maintain its competitive edge. For example, in 2024, Rumo invested $150 million in its digital transformation initiatives.

Digitalization is pivotal for Rumo, with logistics processes streamlining operations and enhancing visibility. Effective data management enables route optimization and improved customer service. Rumo invests in technology for monitoring, crucial for its operational efficiency. In 2024, digital transformation spending in the logistics sector reached $300 billion, a key trend for Rumo.

Technological advancements in rolling stock and infrastructure significantly impact Rumo. Developments in locomotive and wagon technology, and innovative maintenance techniques, enhance efficiency. Rumo invests strategically, aiming to improve performance and reduce expenses. For example, Rumo invested BRL 1.5 billion in 2023 to expand its fleet and infrastructure.

Use of Technology for Environmental Monitoring

Rumo utilizes technology for environmental monitoring, crucial for managing emissions and waste. This aids in compliance and reporting, becoming increasingly vital. For instance, in 2024, the company invested $15 million in tech for reducing its carbon footprint. This includes systems for tracking fuel consumption and minimizing pollution.

- Investment in green tech is projected to reach $20 million by 2025.

- Rumo's carbon emissions decreased by 10% in 2024 due to tech implementations.

- Real-time data analysis enhances environmental decision-making.

Cybersecurity and Data Protection

As Rumo increasingly integrates digital systems, robust cybersecurity and data protection measures are paramount. Cyber threats pose significant risks to operational stability and the security of sensitive data, necessitating proactive defense strategies. The cost of cybercrime is projected to reach $10.5 trillion annually by 2025. Investing in advanced cybersecurity tools and protocols is crucial for Rumo to safeguard its operations.

- Cybersecurity breaches can lead to significant financial losses and reputational damage.

- Data protection compliance with regulations like GDPR is essential.

- Regular security audits and employee training are vital.

- Cyberattacks increased by 38% in 2024.

Rumo leverages technology for efficiency gains and environmental compliance, with significant investments in digital transformation. Digitalization streamlines logistics, with an industry investment of $300 billion in 2024, and enables enhanced data-driven decision-making. Cybersecurity is critical; costs are set to hit $10.5 trillion by 2025, prompting proactive defenses. Investment in green tech projected to reach $20 million by 2025.

| Technological Factor | Impact | Data |

|---|---|---|

| Digitalization | Improved efficiency, route optimization | $300B in digital transformation spend (logistics sector, 2024) |

| Cybersecurity | Protect operations, data | Cybercrime costs: $10.5T annually by 2025 |

| Green Technology | Emission reduction | $20M investment by 2025 (projected) |

Legal factors

Rumo's operations hinge on railway concession agreements with the Brazilian government. These legally binding contracts dictate investment obligations and service standards. For instance, Rumo invested BRL 7.9 billion in infrastructure between 2020 and 2023. Non-compliance with these agreements could lead to penalties or even concession revocation. Adherence is crucial for sustained operations.

Rumo faces environmental regulations, including infrastructure project licensing and emissions standards compliance. In 2024, environmental fines for Brazilian companies totaled over BRL 1 billion. Compliance is vital to avoid penalties and ensure operational permits. Failure to comply can lead to significant financial and operational disruptions. The company's sustainability reports detail environmental efforts.

Rumo must adhere to Brazilian labor laws, influencing its employee relations. These laws govern working hours, wages, and safety protocols. Compliance is crucial for operations. In 2024, Brazil saw a 3.8% rise in the minimum wage. Non-compliance can lead to penalties and legal issues. Rumo's adherence to labor laws impacts its operational costs and workforce management.

Antitrust and Competition Laws

Rumo, as a significant entity in Brazil's logistics sector, must adhere to antitrust and competition laws to ensure fair market practices. This compliance is crucial for avoiding legal issues and maintaining its operational integrity. The Administrative Council for Economic Defense (CADE) oversees these regulations, with a focus on preventing monopolies and promoting competition. Penalties for non-compliance can include substantial fines, potentially impacting Rumo's financial performance.

- CADE can impose fines up to 20% of a company's gross revenue.

- In 2023, CADE investigated 120+ cases involving antitrust violations.

- Rumo's market share in rail transport is approximately 35%.

Corporate Governance Regulations

Rumo, as a publicly traded company, is subject to stringent corporate governance regulations and must adhere to listing requirements set by the Brazilian Securities and Exchange Commission (CVM). These regulations dictate the structure and operations of the company's board of directors, audit committee, and other key governance bodies. Good governance practices, like transparency in financial reporting, are crucial for maintaining investor confidence and ensuring legal compliance. For instance, in 2024, companies with good governance saw a 15% higher valuation.

- Compliance with CVM regulations is mandatory.

- Transparency in reporting fosters investor trust.

- Sound governance can lead to higher valuations.

- Non-compliance can result in penalties and loss of investor confidence.

Rumo's operations face a complex legal landscape. Railway concessions require substantial investment and adherence to service standards, with potential penalties for non-compliance. Antitrust laws, overseen by CADE, limit market dominance; penalties can reach up to 20% of gross revenue. Corporate governance dictates transparency to maintain investor trust and ensure regulatory compliance; better governance can increase valuation.

| Legal Aspect | Impact | Data |

|---|---|---|

| Concession Agreements | Obligations and compliance | Rumo invested BRL 7.9B (2020-2023) |

| Antitrust | Fair market practices | CADE investigated 120+ cases (2023) |

| Corporate Governance | Investor confidence, compliance | Companies with good governance had a 15% higher valuation (2024) |

Environmental factors

Climate change presents significant challenges for Rumo, potentially affecting its infrastructure and operations due to extreme weather events. For instance, in 2024, Brazil experienced severe droughts and floods, impacting railway transport. Adapting to these physical climate risks is crucial; Rumo invested $50 million in 2024 for climate resilience measures.

The transportation sector heavily contributes to greenhouse gas emissions, a key environmental factor for Rumo. Rumo faces pressure to reduce its carbon footprint, aligning with national and international goals. Brazil aims to cut emissions by 50% by 2030 compared to 2005 levels. Energy efficiency improvements and exploring alternative fuels are critical strategies for Rumo.

Railway construction and operations inherently affect biodiversity and necessitate considerable land use. For instance, Rumo's projects in 2024 involved significant land acquisitions for track expansions. Effective environmental impact management regarding infrastructure and land practices is crucial. Rumo's 2024 sustainability report highlights initiatives to mitigate these impacts, including reforestation efforts. In 2024, Rumo invested approximately R$20 million in environmental preservation programs.

Waste Management and Pollution Control

Rumo must prioritize effective waste management and pollution control. This involves handling operational waste responsibly and preventing soil/water contamination. Failure to comply can lead to fines, reputational damage, and operational disruptions. In 2024, environmental regulations in Brazil, where Rumo operates, became stricter, increasing the need for robust strategies.

- Compliance with environmental regulations is crucial.

- Investment in sustainable practices is necessary.

- Minimizing environmental impact is a key goal.

Water Resource Management

Water is crucial for railway operations and infrastructure upkeep. Efficient water use and conservation are key environmental factors for Rumo. The company must manage water resources responsibly to minimize its environmental footprint. This involves strategies like water recycling and leak detection to ensure sustainable practices. In 2024, Brazilian railways transported approximately 480 million tons of cargo, highlighting the scale of operations impacting water usage.

- Water is essential for railway activities like cleaning and maintenance.

- Rumo should implement water-saving technologies.

- Water management is critical for environmental compliance.

- Sustainable water practices can lower operational costs.

Environmental factors significantly impact Rumo. Climate change poses operational risks, with investments like $50 million in 2024 for resilience. Emissions reductions are critical to align with Brazil’s 2030 targets, requiring efficient practices.

| Environmental Aspect | Impact on Rumo | 2024/2025 Data |

|---|---|---|

| Climate Change | Infrastructure damage, operational disruption | $50M invested for climate resilience in 2024 |

| Emissions | Need to reduce carbon footprint | Brazil targets a 50% emissions cut by 2030 (vs. 2005 levels) |

| Land Use/Biodiversity | Requires mitigation efforts | R$20M invested in environmental preservation in 2024 |

PESTLE Analysis Data Sources

Our Rumo PESTLE leverages industry reports, economic databases, legal frameworks, and governmental publications. This approach guarantees thoroughness and up-to-date insights.