Sage Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sage Bundle

What is included in the product

Clear descriptions & strategic insights for Stars, Cash Cows, Question Marks, & Dogs

Quickly visualize business unit performance with a dynamic quadrant map.

What You See Is What You Get

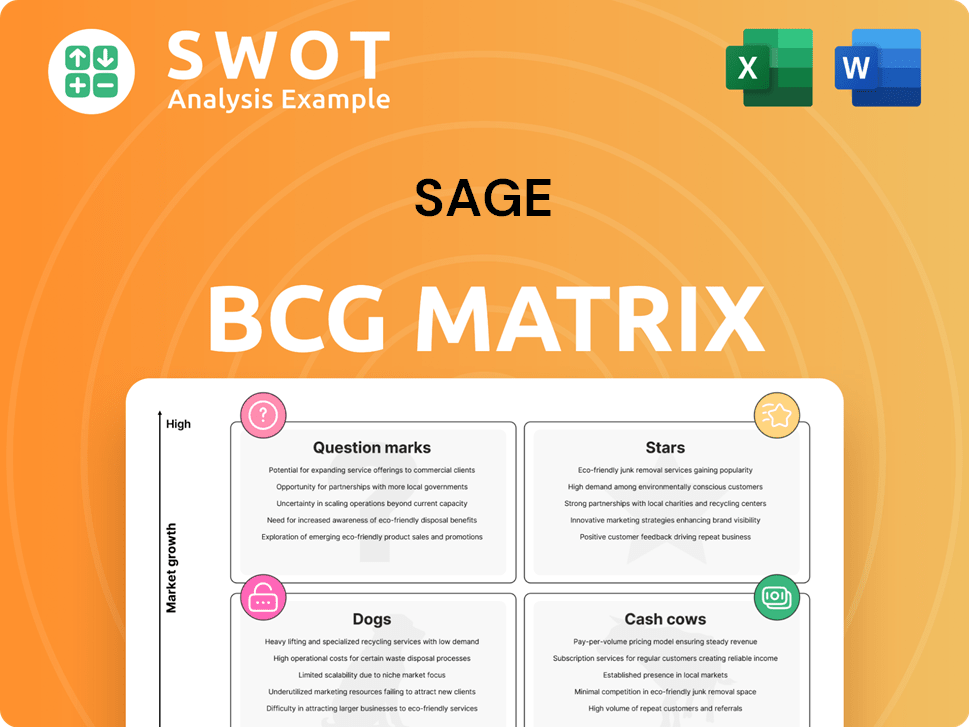

Sage BCG Matrix

The BCG Matrix previewed is identical to the purchased document. Upon buying, you'll receive the complete, ready-to-use report – fully formatted, and suitable for strategic decisions. No alterations or extras, just a clear, professional analysis.

BCG Matrix Template

The BCG Matrix categorizes products based on market growth and share, offering a snapshot of a company's portfolio. This preview helps you understand product positioning: Stars, Cash Cows, Dogs, or Question Marks. See the full BCG Matrix report to get strategic guidance and actionable insights to boost your market position and make informed investments. Uncover detailed quadrant placements and data-driven recommendations. Purchase now and start strategizing with confidence!

Stars

Sage Intacct shines as a star in the Sage BCG Matrix due to its robust revenue growth. It's gaining traction, especially with mid-sized businesses. The platform's cloud capabilities and international expansion highlight its growth potential. In 2024, Sage reported strong growth in its cloud business, with a 22% increase in recurring revenue.

Sage Copilot, an AI-powered assistant, is experiencing a surge in user adoption. This tool automates tasks, boosting efficiency for users. Sage's strategic investment in AI integration makes it a "star" in the BCG Matrix. Continued AI development is vital for sustained growth.

Sage Business Cloud is a star in the Sage BCG Matrix, demonstrating strong revenue growth. Cloud-native revenue is a significant driver, reflecting the company's shift to cloud-based solutions. In 2024, Sage reported a 12.1% organic revenue growth, with cloud revenue up 22.7%. Continued investment is crucial for attracting customers.

North American Operations

Sage's North American operations shine as a star within its BCG Matrix, fueled by strong performances in key accounting solutions. This region's impressive revenue growth and strategic significance solidify its position as a top performer. Focusing on expanding market presence and tailoring solutions to the specific needs of North American businesses is critical for sustained success.

- Revenue growth in North America for Sage has been notably strong, with a significant portion driven by cloud-based solutions.

- Strategic investments are ongoing to enhance product offerings and customer service in the North American market.

- The focus is on capturing a larger market share by catering to the unique demands of North American businesses.

- Key accounting solutions are driving the momentum, contributing substantially to the overall revenue.

Subscription Model

Sage's subscription model shines, reflecting its "Star" status. This model fuels consistent revenue, a key advantage in 2024. The shift to subscriptions and strong renewals boost financial predictability. Customer retention and subscription expansion are crucial for Sage's continued success.

- Subscription revenue grew 18% in fiscal year 2023.

- Renewal rates are above 90%.

- Over 75% of Sage's revenue is recurring.

Sage's stars, like Sage Intacct and Business Cloud, show robust revenue growth, particularly in the cloud sector. Sage Copilot's AI integration boosts efficiency and user adoption. The North American market and subscription model are key drivers.

| Category | Metric | 2024 Data |

|---|---|---|

| Cloud Revenue Growth | Organic Revenue | 22.7% |

| Subscription Revenue | Growth | 18% (Fiscal Year 2023) |

| Overall Revenue Growth | Organic Revenue | 12.1% |

Cash Cows

Sage 50 Cloud, a cash cow in Sage's portfolio, shows steady performance. Growth primarily stems from its existing customer base, ensuring consistent revenue streams. This product line is a dependable source of cash flow for Sage, crucial for funding other ventures. By investing in infrastructure and efficiency, Sage can boost profitability, as seen in its stable 2024 financial reports.

Sage 200 Cloud, like its counterpart, Sage 50, is a reliable cash cow. It consistently generates strong cash flow due to its established customer base. The focus is on extracting maximum profit. In 2024, Sage reported a revenue of £2.25 billion.

The UKIA region, a cash cow for Sage, generates substantial revenue. It is fueled by Sage Intacct and cloud solutions, especially for small businesses. In fiscal year 2024, this region delivered robust financial results. The strategy focuses on maximizing profits while minimizing investment.

Europe Region

The European region remains a key cash cow for Sage, delivering substantial revenue. In 2024, Europe accounted for approximately 35% of Sage's total revenue, with strong performances in accounting, payroll, and HR solutions. The focus in Europe is on extracting maximum profit from its established market position. This involves strategic pricing and cost management.

- Revenue Contribution: Europe represents about 35% of Sage's total revenue in 2024.

- Key Solutions: Accounting, payroll, and HR solutions drive growth.

- Strategic Focus: Maximizing profitability through pricing and cost efficiency.

Accountancy Practice Management Tools

Sage's accountancy practice management tools are cash cows, supported by sustained adoption and revenue growth. These tools cater to a defined market segment, ensuring a stable income stream. Focus on high customer satisfaction and profitability optimization is crucial for this segment. In 2024, Sage reported a 12% increase in recurring revenue from its cloud-based solutions, highlighting the continued success of these offerings.

- Revenue Growth: Sage's recurring revenue from cloud solutions increased by 12% in 2024.

- Market Segment: The tools target a specific market, ensuring stable revenue.

- Customer Focus: Customer satisfaction is vital for maintaining profitability.

Cash cows like Sage 50 Cloud and Sage 200 Cloud consistently provide strong cash flow due to their established customer bases. The UKIA and European regions are major cash cows, with Europe contributing approximately 35% of Sage's 2024 total revenue. Accountancy practice tools also contribute, with cloud solutions showing a 12% increase in recurring revenue in 2024.

| Cash Cow | Revenue Source | Key Strategy |

|---|---|---|

| Sage 50/200 Cloud | Established Customer Base | Maximize Profit |

| UKIA Region | Sage Intacct & Cloud Solutions | Profit Maximization, Minimal Investment |

| European Region | Accounting, Payroll, HR | Pricing and Cost Management |

| Accountancy Tools | Cloud Solutions | Customer Satisfaction & Profitability |

Dogs

On-premise software, like traditional ERP systems, often faces challenges in today's market. These solutions are considered "dogs" in the BCG Matrix. Their growth is typically low. In 2024, the on-premise software market is estimated to shrink by 2% to 3% annually. Consider reducing investments.

SAGE-324, following Biogen's exit, faces an uncertain future, potentially labeling it a 'Dog' in the BCG matrix. Sage Therapeutics is re-evaluating its path, including potential new indications for the drug. The company is expected to announce its next steps regarding SAGE-324 by mid-2025. In 2024, Sage's R&D expenses were significant, reflecting ongoing evaluations.

Perpetual licenses, like those previously offered by Adobe, are becoming less common as customers shift to subscription models. This shift can lead to declining revenue streams. In 2024, companies focused on migrating perpetual license holders to subscription-based plans. For example, Microsoft's shift to Office 365 demonstrates this trend.

Areas In Evaluation

Sage Therapeutics is assessing its position in the "Dogs" quadrant of the BCG Matrix, focusing on its less promising assets. The company is currently evaluating potential uses for its products, including treating seizures in developmental and epileptic encephalopathies (DEEs). They plan to announce their next steps, if any, by mid-2025. Sage's stock performance has been volatile, reflecting the challenges of this segment.

- Market analysts show that the average stock price target for Sage Therapeutics in 2024 was around $18.50, with significant variability.

- In 2023, Sage's total revenue was approximately $11.1 million, significantly lower than expenses.

- The company's cash position and debt levels are critical factors, with a reported cash balance of $1.1 billion as of Q3 2023, and a net loss of around $800 million for the same period.

SAGE-319

SAGE-319 is in the "Question Mark" quadrant of the BCG Matrix. It's a potential treatment for neurodevelopmental disorders. Phase 1 data is expected by late 2025. Sage Therapeutics' R&D expenses in 2024 were $678.8 million.

- Development is ongoing, with uncertain market share.

- High investment needed.

- Success depends on clinical trial results.

- Financial risk is significant.

Dogs in the BCG Matrix represent low-growth, low-share businesses. On-premise software and assets like SAGE-324 fall into this category. Perpetual licenses face revenue declines amid subscription shifts. Sage Therapeutics grapples with these challenges.

| Category | Details | 2024 Data |

|---|---|---|

| On-Premise Software | Market contraction | -2% to -3% annual shrink |

| Sage Therapeutics | R&D focus and uncertainty | R&D expenses: $678.8M (2024) |

| Financials | Stock volatility | Avg. target price: $18.50 (2024) |

Question Marks

Sage's Fintech and Payments expansion via partnerships is a question mark in the BCG Matrix. Its current market share and contribution to overall revenue are still unclear. In 2024, the global fintech market was valued at approximately $150 billion, showing potential. Investing and scaling this ecosystem is crucial for gaining market share and driving future revenue growth.

Sage Network, digitizing business processes, shows promise for growth via network effects. Its current market reach and revenue impact may be constrained. In 2024, focus should be on boosting adoption among customers and partners to drive expansion. Consider that successful network effects can significantly increase value, as seen with other platforms. According to recent reports, companies with strong network effects often see higher valuation multiples.

Sage's vertical-specific solutions, like Sage for Construction and Sage for Non-Profits, target specific market segments. The success of these solutions is still evolving, with market share growth being a key focus. For instance, in 2024, the construction software market was valued at over $10 billion. Driving adoption requires focused promotion and development.

Sage HR

Sage HR, a tool suite designed to improve workflows and deliver business insights, currently finds itself in the Question Mark quadrant of the BCG Matrix. Its future performance and market share remain uncertain. Sage Group reported a 12% organic revenue growth for the fiscal year 2024, with its cloud solutions showing strong performance. This suggests potential, but further growth is needed.

- Revenue growth of 12% in fiscal year 2024.

- Cloud solutions are performing well.

- Future market share is uncertain.

- Focus on streamlining workflows.

AI-Powered Solutions beyond Copilot

While Sage Copilot is getting attention, other AI-driven solutions are likely in early development stages. Their effect on revenue and market share is still uncertain, making them question marks in the BCG matrix. Continued AI investment and innovation are vital to unlock their full potential. In 2024, AI spending is projected to reach over $300 billion.

- Early-stage AI solutions may have unknown market impact.

- Investment and innovation are crucial for realizing AI's full potential.

- Projected AI spending for 2024 is over $300 billion.

- Their positioning in the BCG matrix is uncertain.

Sage HR, a tool suite for workflow improvement, sits in the Question Mark quadrant. Its market share and future performance are uncertain. Cloud solutions showed strong performance in 2024, indicating potential growth.

| Metric | 2024 Data | Implication |

|---|---|---|

| Organic Revenue Growth | 12% | Positive, indicating overall health. |

| Cloud Solutions Performance | Strong | Suggests potential for HR growth. |

| Market Share | Uncertain | Requires strategic focus for expansion. |

BCG Matrix Data Sources

This BCG Matrix is built on company financials, market growth rates, and competitive analysis for actionable strategy.