Sage SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sage Bundle

What is included in the product

Analyzes Sage’s competitive position through key internal and external factors.

Provides quick insights by summarizing the complex data from the Sage SWOT.

Same Document Delivered

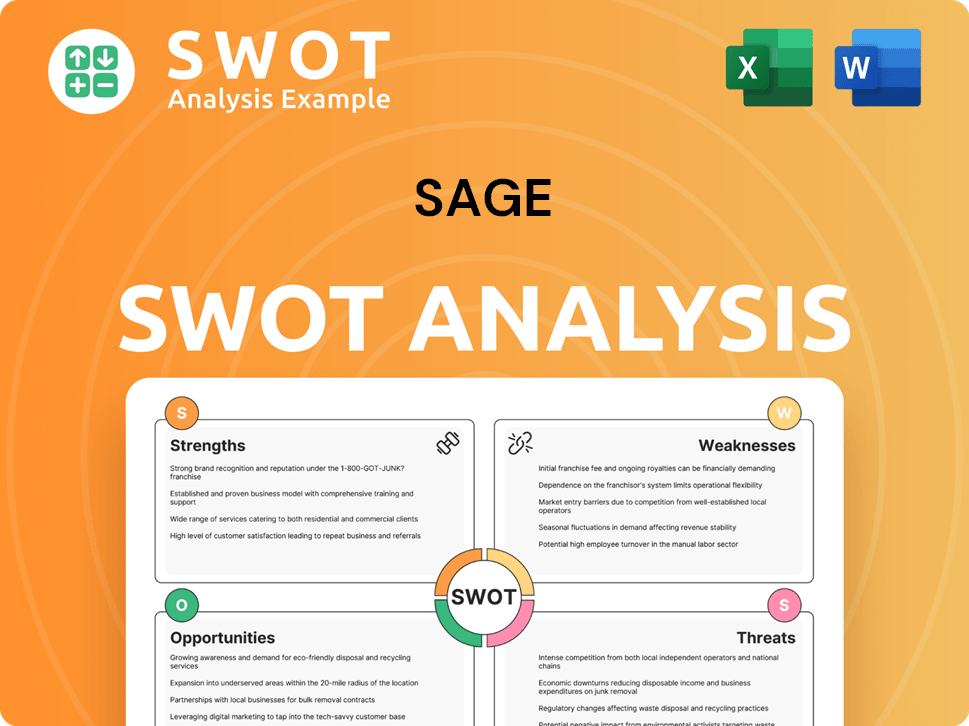

Sage SWOT Analysis

What you see is what you get! This preview showcases the exact SWOT analysis document you'll receive. The complete, comprehensive version is available instantly upon purchase. It's professionally crafted, thorough, and ready for your use. No hidden extras or alterations!

SWOT Analysis Template

The Sage SWOT analysis preview reveals key aspects, but there's so much more. Dive deeper into Sage's financial context, growth potential, and strategic takeaways. Unlock actionable insights and a bonus Excel version. Perfect for those seeking detailed strategic planning or market comparisons.

Strengths

Sage holds a leading position in the accounting software market, especially for SMBs. Its extensive global reach is evident with over 6 million customers. Strong brand recognition enhances its competitive edge. This market leadership has helped Sage achieve a revenue of £2.1 billion in 2024.

Sage's shift to cloud and SaaS is a major strength. The Sage Business Cloud, with Sage Intacct, offers scalable solutions. Cloud offerings are seeing robust growth. In fiscal year 2024, cloud revenue grew significantly. This transition is boosting overall revenue.

Sage's strength lies in its extensive product range, including accounting, payroll, HR, and payment solutions. This broad portfolio supports various business sizes, from startups to large enterprises. Sage's diverse offerings provide a comprehensive, one-stop-shop solution, with 2024 revenues exceeding £2.1 billion. This extensive range helped them achieve a 12% organic revenue growth in the first half of fiscal year 2024.

Strong Financial Performance

Sage's financial performance is a key strength, marked by consistent revenue growth and increasing operating profits. The company benefits from a strong recurring revenue model, primarily through its subscription-based services, which ensures stability and predictability. This financial strength allows for continued investment in product development and strategic acquisitions. Specifically, in the fiscal year 2024, Sage reported a 12% organic revenue growth.

- Revenue Growth: 12% organic growth in FY24

- Recurring Revenue: High percentage of total revenue

- Cash Flow: Strong cash flow generation

- Profitability: Increasing operating profits

Commitment to Innovation and Technology

Sage's dedication to innovation and technology is a key strength. They invest heavily in AI and cloud technology to improve their products. For example, Sage Copilot uses AI to boost efficiency and provide business insights. In 2024, Sage increased R&D spending by 10% to further these initiatives.

- R&D spending increased by 10% in 2024.

- Sage Copilot uses AI to improve efficiency.

- Focus on cloud technology enhances offerings.

Sage's strong market position, particularly for SMBs, supports significant revenue with £2.1B in 2024. The cloud and SaaS shift, driven by Sage Business Cloud, fueled substantial growth in fiscal year 2024. A broad product range covering accounting, payroll, and HR, coupled with a 12% organic revenue rise in H1 FY2024, strengthens its market offering.

| Strength | Details |

|---|---|

| Market Leadership | Dominant in accounting software for SMBs; Over 6M customers |

| Cloud & SaaS Focus | Robust growth in cloud offerings, boosting overall revenue |

| Product Range | Accounting, payroll, HR, and payments solutions, supporting various business sizes |

| Financial Performance | 12% organic revenue growth in FY24, with strong cash flow |

| Innovation & Technology | Increased R&D by 10% in 2024, using AI for enhanced products. |

Weaknesses

Even as a key player, Sage sometimes struggles with brand awareness, especially with specific customer groups. This could mean needing to boost marketing to show potential clients what Sage offers and why it's valuable. In 2024, Sage spent around £1.9 billion on sales and marketing efforts. This highlights the company's commitment to improving visibility.

Sage faces fierce competition in the accounting software market. Competitors such as Microsoft and SAP, hold significant market shares. This crowded landscape makes it challenging for Sage to gain market share. Intense rivalry often leads to price wars, affecting profitability. The global accounting software market is projected to reach $11.8 billion by 2025.

Sage faces reputational risks, especially with data breaches. A 2024 report showed cyberattacks cost businesses globally $5.2 million on average. Maintaining robust cybersecurity is vital. Any data leak could severely damage customer trust. This could lead to lost business and reduced investor confidence.

Integration Complexities

Integration complexities pose a challenge for Sage. Seamlessly connecting various Sage products and third-party applications can be difficult for customers. This can lead to a less-than-ideal user experience. In 2024, reports indicated that around 15% of Sage users experienced integration-related issues. Streamlining these integrations is crucial.

- Integration challenges can affect user satisfaction and efficiency.

- Addressing these complexities is vital for customer retention.

- Investing in improved integration capabilities is a priority.

- Approximately 15% of users faced integration problems in 2024.

Reliance on Specific Geographic Markets

Sage's financial health is closely tied to specific geographical markets, which poses risks. A significant portion of its revenue comes from North America and the UK. Any economic downturn or regulatory changes in these regions could significantly impact Sage's financial performance. Such concentration may limit its ability to diversify revenue streams effectively.

- In fiscal year 2023, North America accounted for approximately 36% of Sage's total revenue.

- The UK and Ireland contributed about 27% of the total revenue.

Geographic revenue concentration exposes Sage to regional economic risks. Reliance on key markets like North America (36% of 2023 revenue) and the UK (27%) creates vulnerabilities. Downturns in these areas can directly hit Sage’s financial performance.

| Issue | Impact | Data Point (2024-2025) |

|---|---|---|

| Geographic Risk | Concentrated revenue; regional economic impact | NA & UK: ~63% of 2023 Revenue |

| Integration | Poor User Experience; affects retention | ~15% of Users Reported Issues |

| Competition | Price Wars, Margin Pressure | Market value ~$11.8 Billion |

Opportunities

The rising demand for cloud and SaaS solutions is a major opportunity for Sage. The global cloud computing market is projected to reach $1.6 trillion by 2025, indicating substantial growth. Sage's focus on Sage Business Cloud positions it well to capture this market share. This strategic alignment allows Sage to offer scalable and accessible solutions.

Sage's strategic acquisitions offer significant growth opportunities. The company has a history of successful acquisitions, enhancing market share. Recent moves, like the 2024 acquisition of CoreHR, show this focus. This approach allows Sage to integrate new technologies and expand into different markets. In 2024, Sage spent roughly £300 million on acquisitions, showing a strong commitment.

Businesses increasingly desire integrated solutions combining accounting, HR, and payroll. Sage's comprehensive product portfolio, including Sage Business Cloud, is well-positioned. In 2024, the global business management software market was valued at $75.3 billion. The demand for unified tools presents a significant growth opportunity for Sage.

Leveraging AI and Machine Learning

Sage can capitalize on opportunities in AI and machine learning. Investments in AI, like Sage Copilot, can boost product capabilities with automation and insights. This could attract more customers. According to recent reports, the global AI market in financial services is projected to reach $27.9 billion by 2025.

- Enhance product capabilities with AI-driven automation and insights.

- Attract new customers with advanced features.

- Capitalize on growing AI market in financial services.

Capturing Market Share in Specific Verticals

Sage can boost its market share by focusing on specific industries. Tailoring solutions for construction, manufacturing, and healthcare can attract more clients. This targeted approach allows Sage to offer specialized services and gain expertise. In 2024, the construction software market was valued at $2.7 billion, showing potential.

- Construction: $2.7B market in 2024.

- Manufacturing: Growing demand for ERP.

- Healthcare: Digital transformation opportunities.

Sage has a significant opportunity with cloud and SaaS solutions, eyeing a $1.6T market by 2025. Strategic acquisitions, such as CoreHR, enhance market share; in 2024, £300M was spent on such ventures. The rising demand for integrated business solutions, along with AI investments, further fuels growth.

| Opportunity Area | Specific Actions | Financial Data (2024) |

|---|---|---|

| Cloud & SaaS | Focus on Sage Business Cloud, scalability. | Global market: $1.6T (by 2025) |

| Strategic Acquisitions | Integrate new tech and markets, target businesses. | £300M spent on acquisitions |

| Integrated Solutions | Provide accounting, HR, and payroll solutions. | Business management software: $75.3B |

Threats

Sage confronts growing competition from niche software providers and fintechs. These rivals provide specialized solutions, potentially disrupting Sage's market share. For instance, in 2024, the fintech sector saw over $150 billion in investments globally, fueling innovation. This competition could pressure Sage's pricing and market positioning. The agility of these smaller firms allows them to quickly adapt to changing customer needs.

Economic downturns pose a significant threat. Macroeconomic uncertainty can curb SMB spending. This impacts software and service revenue. In 2024, global economic growth slowed to 3.2%, impacting tech investments. Sage needs to prepare for potential reduced customer spending.

The escalating sophistication of cyber threats presents a persistent risk to Sage and its clientele. A substantial data breach could critically harm Sage's standing, causing financial setbacks and diminishing customer faith. In 2024, the average cost of a data breach hit $4.45 million globally. Security breaches could lead to legal issues. Sage must invest in robust cybersecurity measures.

Regulatory Changes and Compliance

Sage faces threats from evolving regulations. Changes in accounting standards, such as those from the IASB, and tax laws, like the 2024 US tax code updates, require software adaptations. Data privacy laws, including GDPR and CCPA, necessitate ongoing compliance measures, potentially increasing operational costs. These updates demand continuous investment, with Sage spending approximately £300 million in 2024 on R&D, including compliance.

- Accounting standards updates demand software adjustments.

- Tax law changes require frequent software revisions.

- Data privacy laws necessitate ongoing compliance.

- Continuous investment is needed for updates.

Difficulty in Talent Acquisition and Retention

Sage faces threats in talent acquisition and retention due to the competitive tech market. Attracting skilled professionals in cloud, AI, and cybersecurity is tough. Losing talent could hinder innovation and strategic execution. The IT sector sees high turnover rates, with some studies showing rates up to 20% annually. This impacts project timelines and expertise.

- High demand for tech skills.

- Competition from larger tech firms.

- Impact on innovation and project delivery.

- Potential for increased recruitment costs.

Sage’s SWOT analysis identifies multiple threats. Intense competition from agile fintechs and niche providers pressures market share and pricing, especially amid $150B fintech investments in 2024. Economic downturns pose financial risks, given the 3.2% global growth slowdown in 2024, potentially curtailing SMB spending. Additionally, evolving regulations like the 2024 US tax updates and data privacy laws, along with talent acquisition challenges in a competitive IT market, all present substantial hurdles.

| Threat | Description | Impact |

|---|---|---|

| Market Competition | Fintechs and niche software disruptors. | Pressure on pricing and market share |

| Economic Downturn | Slowed economic growth curbing SMB spend. | Reduced software & service revenue. |

| Cybersecurity | Sophisticated data breaches. | Financial setbacks, loss of customer trust |

SWOT Analysis Data Sources

This SWOT leverages public financials, market reports, and expert opinions to create a well-rounded analysis for Sage.