Samsung Electronics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Samsung Electronics Bundle

What is included in the product

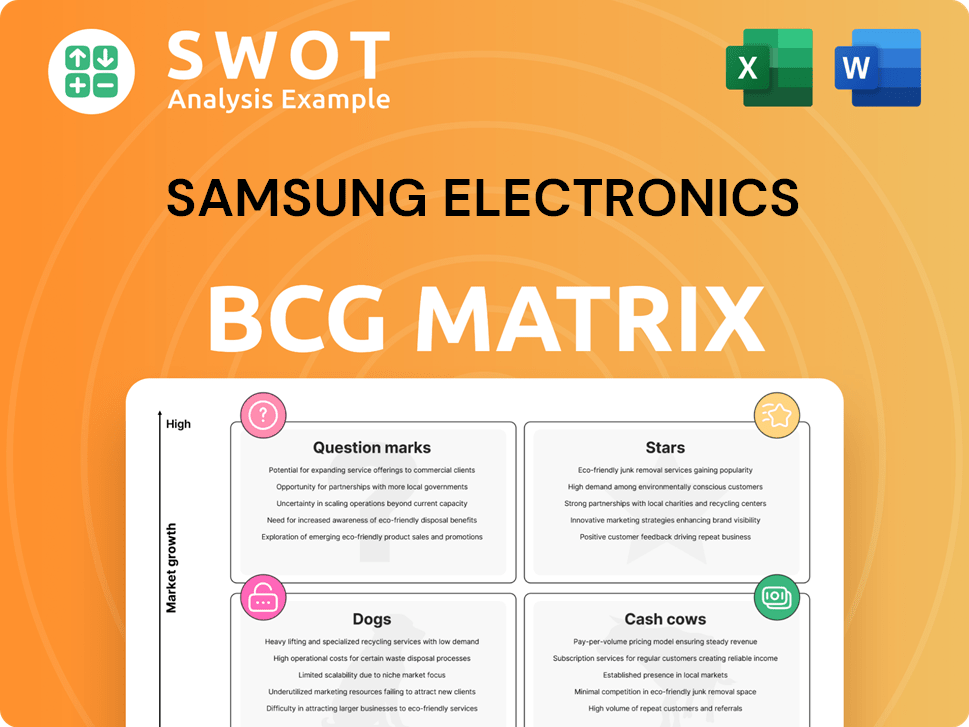

Samsung's BCG Matrix analysis reveals strategic directions for its diverse portfolio. It covers investment, holding, or divestiture decisions.

Printable summary optimized for A4 and mobile PDFs, offering a succinct overview of Samsung's portfolio.

What You See Is What You Get

Samsung Electronics BCG Matrix

The BCG Matrix preview mirrors the final document you'll own after purchase, tailored for Samsung Electronics. You'll receive the full, ready-to-implement strategic analysis upon download. The downloadable version offers comprehensive insights, perfectly formatted for presentations. This means the precise analysis you're seeing is what you'll get, no changes.

BCG Matrix Template

Samsung's diverse portfolio, from smartphones to home appliances, presents a complex strategic landscape.

This preview scratches the surface of how Samsung's products fit into the BCG Matrix: Stars, Cash Cows, Dogs, or Question Marks.

Understanding this framework is vital for effective resource allocation and strategic planning.

Where do their latest foldable phones stand? What about their TVs?

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks.

Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Samsung's AI-powered smartphones, like the Galaxy S25 series, are poised for substantial growth. They are expected to boost sales and market share, solidifying their "Star" status. In Q4 2023, Samsung held 19% of the global smartphone market. The focus on personalized AI experiences aims to attract consumers.

Samsung's premium TVs, including QLED and OLED models, are key "Stars" in its BCG matrix. Samsung led the global TV market for 19 years. Premium TVs ($2,500+) and ultra-large screens (75"+) boost revenue. AI upscaling and integration enhance market position.

Samsung's memory business thrived in Q4 2024, hitting record revenue due to strong HBM sales and high-density DDR5 for servers. With AI memory product demand surging, HBM is a significant growth driver for Samsung. The company aims to boost HBM shipments and speed up the shift to advanced process nodes. In 2024, the memory sector saw a remarkable 35% growth.

Advanced Semiconductor Solutions

Samsung's Advanced Semiconductor Solutions is positioned as a Star in its BCG Matrix, reflecting its strong growth and market share. The company is heavily investing in advanced technologies, particularly for AI and high-value-added products. This strategy includes the development of 2nm process nodes, crucial for next-generation devices. Samsung aims to recapture market share by focusing on innovation and attracting key clients.

- Samsung plans to invest $230 billion over the next 20 years in its semiconductor business.

- The company aims to increase its foundry capacity by 2025.

- Samsung's revenue from semiconductors reached $67.3 billion in 2023.

Bespoke AI Home Appliances

Samsung's "Bespoke AI Home Appliances" represent a rising star in its BCG matrix. The company is deeply integrating AI into its appliances, creating new functionalities to address user needs. This includes an AI Home display, now available on many products, acting as a central control hub. This strategy helps drive growth in the home appliance market.

- Samsung's home appliance sales reached $16.5 billion in 2023.

- AI-enabled appliances are projected to increase market share by 15% by the end of 2024.

- The AI Home display feature has seen a 20% adoption rate among new appliance purchasers.

- Samsung invested $1 billion in AI and IoT research in 2024.

Samsung's "Stars" like AI smartphones and premium TVs drive growth. They command substantial market share and high revenue. Semiconductors, led by HBM, also shine, with memory sales up 35% in 2024.

| Product Category | Market Share/Growth | 2024 Performance |

|---|---|---|

| AI Smartphones | 19% global (Q4 2023) | Galaxy S25 launch, focus on AI |

| Premium TVs | Market leader (19 years) | Revenue boost from AI upscaling |

| Memory (HBM) | Significant Growth | 35% growth in 2024 |

Cash Cows

Samsung SDI's consumer electronics batteries represent a Cash Cow. These batteries generate consistent revenue, supported by their widespread use in devices. Despite slower market growth, the established position secures steady demand and cash flow. In 2024, Samsung SDI reported a stable revenue stream from its battery business. The company's battery segment saw a revenue of approximately $10 billion in 2024.

Samsung's DRAM chips are a cash cow. It is the leading DRAM supplier, but its market share dipped to 40.7% in Q1 2024. DRAM chips generate steady revenue. Samsung's focus on DDR5 and advanced nodes ensures competitiveness.

Samsung Display's OLED panels remain a cash cow, fueled by flagship smartphone sales. Despite a slowdown in the overall smartphone market and increasing competition, the demand for high-end OLEDs is steady. In 2024, Samsung Display's revenue was around $25 billion, with OLEDs contributing significantly. This segment offers a stable revenue stream for Samsung.

Home Appliances (Washing Machines, Refrigerators)

Samsung's home appliances, including washing machines and refrigerators, are cash cows, providing consistent profits with low investment. These products hold a substantial market share in the mature appliance market, leading to strong cash flow. Samsung's brand reputation for quality and reliability is a key factor in sustaining its market position.

- Samsung's global appliance market share reached approximately 16% in 2024.

- Revenue from Samsung's home appliance division was around $18 billion in 2024.

- Profit margins for appliances typically range from 8-12%.

- R&D investment in appliances is relatively low compared to other sectors.

Soundbars

Samsung's soundbars are a cash cow in its BCG matrix, consistently generating substantial revenue. In 2024, Samsung led the global soundbar market by value, demonstrating strong market dominance. Soundbars are popular for enhancing TV audio, ensuring a steady income stream for the company. Ongoing innovation in audio quality will likely maintain Samsung's leadership.

- Market Share: Samsung held a significant market share in the global soundbar market in 2024.

- Revenue Stream: Soundbars provide a consistent revenue source due to their popularity.

- Innovation: Continued focus on audio quality supports market leadership.

- Strategy: Focus on premium and mid-range soundbars.

Samsung's cash cows offer stable revenue with low investment needs. They generate consistent profits due to their strong market positions and brand recognition.

These products include batteries, DRAM chips, OLED panels, home appliances, and soundbars. In 2024, these segments contributed significantly to Samsung's overall financial performance.

This stability allows Samsung to invest in growth areas. Continuous product innovation and strategic market positioning will continue to drive Samsung's success.

| Cash Cow | 2024 Revenue (Approx.) | Key Feature |

|---|---|---|

| Consumer Electronics Batteries | $10B | Steady demand and cash flow |

| DRAM Chips | Stable, part of overall $60B Semiconductor revenue | Leading market share |

| OLED Panels | $25B | High-end smartphone sales |

| Home Appliances | $18B | Strong market share |

| Soundbars | Significant, market leader | Enhance TV audio |

Dogs

Samsung's printer business, classified as a "Dog" in the BCG matrix, faced low growth and market share. Conventional printers, like those from Samsung, are not projected to gain significance. Samsung divested its printer division to HP in 2017 for about $1.05 billion, a move to focus on more profitable sectors. This strategic decision helped avoid losses and reallocate resources to higher-potential areas.

Samsung SDI's polarizer films business, listed under discontinued operations, signals a strategic shift. This move likely stems from low growth potential and marginal profitability. In 2024, Samsung SDI's focus shifted towards EV batteries and energy storage systems. The polarizer films segment, therefore, doesn't align with core future plans.

Some of Samsung's general-purpose DRAM chips face declining prices due to increased competition from Chinese manufacturers. In 2024, the average selling price (ASP) of DRAM decreased, impacting profitability. Facing headwinds, Samsung needs to shift focus. The company should prioritize high-value products like HBM. This strategic shift aims to offset the price pressure and maintain market share.

Traditional Feature Phones

In Samsung's BCG matrix, traditional feature phones are often categorized as 'Dogs'. They have low market share and growth as smartphones dominate. Samsung should focus on transitioning users to smartphones. The company's smartphone revenue in 2024 was $180 billion.

- Low Growth: Feature phone market shrinks annually.

- Declining Share: Samsung's feature phone share is minimal.

- Smartphone Focus: Prioritize smartphone innovation and sales.

- Financial Shift: Reallocate resources from feature phones.

Outdated or Less Innovative Accessories

Some of Samsung's less innovative accessories, such as certain older chargers or basic phone cases, could be considered "Dogs" in their BCG Matrix. These products likely have low market share and minimal growth potential. In 2024, the accessories segment accounted for only a small percentage of Samsung's overall revenue. Samsung might consider discontinuing or restructuring these items to streamline its portfolio.

- Low Growth: Accessories market growth slowed in 2024.

- Market Share: Limited market share in competitive accessory categories.

- Revenue: Accessories contribute less to total Samsung revenue.

- Strategy: Focus on innovative accessories to boost sales.

Samsung's "Dogs" include feature phones and older accessories due to low growth. Feature phones face shrinking markets; smartphones are prioritized. In 2024, feature phone sales were minimal compared to smartphones.

| Product | Market Share | Growth |

|---|---|---|

| Feature Phones | Low | Negative |

| Older Accessories | Limited | Slow |

| Smartphones | High | Positive |

Question Marks

Samsung's laptop segment resides in the Question Mark quadrant of the BCG Matrix, indicating high growth potential but a small market share. The global laptop market was valued at $80.81 billion in 2023. Samsung faces fierce competition, necessitating substantial investments in marketing and innovation to gain ground. To advance to the Star category, Samsung must successfully differentiate its laptops and capture significant market share.

Samsung is heavily investing in AI and robotics, including a humanoid robot, showing strong commitment to these emerging fields. These technologies currently have a low market share but offer high growth potential. For example, Samsung invested $20 billion in AI and robotics by 2023. To succeed, Samsung needs substantial R&D and marketing investments.

Samsung SDI, within the BCG Matrix, sees potential in renewable energy storage (ESS) batteries. The market is growing, and Samsung SDI can leverage its lithium-ion tech. However, its market share is currently small. To lead, it must boost production and secure contracts. In 2024, the global ESS market was valued at over $15 billion.

Automotive Electronics (Digital Cockpit)

The digital cockpit, a critical segment within Samsung's automotive electronics, primarily through its subsidiary Harman, experienced a decline in market share during 2024. The automotive electronics market is poised for substantial expansion, fueled by the growth of electric vehicles and connected car technologies. To solidify its position, Samsung must prioritize investments in innovation and forge strategic partnerships. Samsung's automotive component business reported a revenue of $14 billion in 2024, with Harman contributing significantly.

- Harman's digital cockpit market share decreased in 2024.

- The automotive electronics market is seeing significant growth.

- Samsung needs to invest and partner to regain market share.

- Samsung's automotive component revenue was $14B in 2024.

System LSI Business (SoC)

Samsung's System LSI business, focusing on System-on-a-Chip (SoC) development, encounters hurdles. The SoC market is fiercely competitive, requiring substantial investment in product optimization and technological advancements, especially for flagship models. Samsung aims to enhance its SoCs to compete effectively, yet delayed entries into the flagship market pose challenges. Success in developing competitive SoCs could lead to significant market share gains.

- Samsung's System LSI division competes with companies like Qualcomm and MediaTek.

- The global SoC market was valued at approximately $157.4 billion in 2023.

- Samsung has invested heavily in advanced chip manufacturing technologies.

- Achieving higher yields and performance is critical for profitability.

Samsung's System LSI faces challenges in the competitive SoC market. The global SoC market hit $157.4B in 2023. Samsung must boost its product optimization and tech advancements.

| Category | Details | 2023 Value |

|---|---|---|

| Market Size | Global SoC Market | $157.4 Billion |

| Key Challenge | Competition and Investment | High |

| Samsung's Focus | Product Optimization | Critical |

BCG Matrix Data Sources

This Samsung BCG Matrix utilizes company financials, market research, and analyst reports for robust sector and product insights.