Samsung Electronics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Samsung Electronics Bundle

What is included in the product

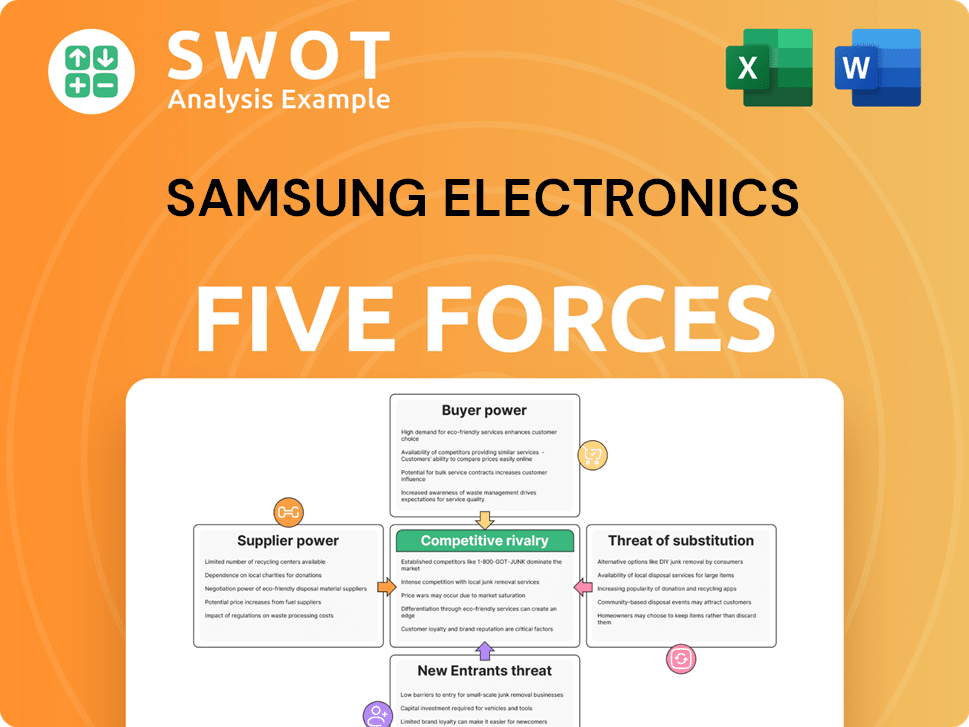

Analyzes Samsung's position, competition, and risks using Porter's Five Forces.

Effortlessly visualize and communicate complex market dynamics with an intuitive color-coded system.

Preview Before You Purchase

Samsung Electronics Porter's Five Forces Analysis

You are currently viewing the comprehensive Porter's Five Forces analysis for Samsung Electronics. This preview allows you to see the complete, ready-to-use document.

Porter's Five Forces Analysis Template

Samsung Electronics faces intense competition, especially from rivals like Apple and Chinese manufacturers. Buyer power is significant, with consumers having many choices. Supplier power, particularly for components, can impact profitability. The threat of new entrants is moderate, offset by high capital requirements. Substitute products, like software and services, pose a threat.

Ready to move beyond the basics? Get a full strategic breakdown of Samsung Electronics’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Samsung heavily depends on suppliers for semiconductors and display panels, granting them considerable power. These components' pricing and availability directly affect Samsung's costs and product quality. Samsung's massive purchasing volume helps mitigate supplier power, as seen in 2024, with component costs fluctuating due to market dynamics. Despite this, supplier negotiations remain crucial for cost management.

Samsung faces substantial supplier power, especially from specialized tech providers. These suppliers, concentrated in sectors like semiconductors, hold significant leverage. For instance, in 2024, the top three semiconductor companies controlled over 50% of the market. Suppliers of unique, patented components can set terms, impacting Samsung's costs and innovation.

Samsung's supplier power is a crucial aspect. Switching costs are significant, especially with complex tech. Adapting production lines and retraining staff is costly. This dependency boosts supplier power. In 2024, Samsung's supply chain costs were about $150B.

Supplier Power 4

Samsung's supplier power is generally moderate due to its vertical integration. The company's semiconductor manufacturing, for example, reduces reliance on external vendors. This internal supply chain helps buffer against price increases and supply disruptions.

- Samsung's in-house chip production covers a significant portion of its needs, around 50% in 2024.

- This strategy helps control costs and ensures a stable supply chain.

- By 2024, Samsung's internal semiconductor revenue reached $100 billion.

Supplier Power 5

Samsung's supplier power is moderate, influenced by supply chain dynamics. Global disruptions can spike supplier power, increasing costs and lead times. Samsung combats this through diversification and strategic alliances. In 2024, Samsung's reliance on key suppliers for components like semiconductors and displays remains significant.

- Geopolitical events and natural disasters can disrupt supply chains.

- Samsung's diversification strategy includes multiple suppliers for critical components.

- Strategic partnerships help secure supply and manage costs.

- Fluctuations in raw material prices impact supplier power.

Samsung navigates moderate supplier power, particularly for specialized tech components. Its reliance on suppliers impacts costs and innovation. Internal semiconductor production and diversification strategies, as shown in 2024, help mitigate risks. Despite challenges, Samsung aims for stable supply chains.

| Aspect | Details | 2024 Data |

|---|---|---|

| Key Suppliers | Semiconductors, Displays | Semiconductor market share: Top 3 over 50% |

| Mitigation | Vertical Integration, Diversification | Internal semiconductor revenue: $100B |

| Impact | Costs, Supply Chain | Supply chain costs: ~$150B |

Customers Bargaining Power

Samsung faces strong buyer power due to the vast consumer electronics market. Consumers can readily choose from various brands, increasing their leverage. This competition forces Samsung to maintain competitive pricing and features. For instance, in 2024, Samsung's global market share in smartphones was around 20%, facing constant pressure from Apple and others.

Samsung's brand loyalty offers protection against buyer power, though it's not foolproof. In 2024, Samsung held a significant share of the global smartphone market. However, the market is competitive, and consumers compare value. Continuous innovation and marketing are crucial to maintain this brand loyalty.

Customers wield significant power, amplified by online product reviews and comparisons. This allows for informed, data-driven purchasing decisions. Samsung must excel in meeting or exceeding customer expectations. In 2024, Samsung's customer satisfaction scores are pivotal. For example, according to Statista, Samsung's customer satisfaction in North America was at 79% in 2023.

Buyer Power 4

Samsung faces considerable buyer power due to large retailers and distributors. These entities, wielding significant purchasing volumes, can pressure Samsung for better pricing and terms. This dynamic is crucial, as these intermediaries control consumer access and product placement. Samsung's reliance on these partners necessitates strong relationship management to ensure sales.

- Walmart, a major Samsung distributor, reported $648.1 billion in revenue for fiscal year 2024, highlighting their purchasing power.

- Best Buy, another key distributor, generated $43.4 billion in revenue in 2024, showcasing their influence.

- Samsung's 2024 sales are heavily influenced by these retailers' decisions on product placement.

- Negotiating favorable terms is essential for Samsung to maintain profitability.

Buyer Power 5

Buyer power significantly impacts Samsung. Price sensitivity varies; budget smartphones see higher switching based on price. Samsung must offer competitive pricing and promotions to retain customers. In 2024, the global smartphone market's ASP (Average Selling Price) fluctuated, with price wars common in entry-level segments.

- Price wars in entry-level smartphones.

- Fluctuating ASP in the global smartphone market.

- Customer sensitivity to pricing.

Samsung contends with robust buyer power, intensified by diverse options and price sensitivity. This is fueled by high consumer access to competitive brands and online comparisons. Retail giants' purchasing volumes further pressure Samsung's pricing and sales terms.

| Factor | Impact | Data (2024) |

|---|---|---|

| Consumer Choice | High | 20% market share (Samsung), diverse competitors. |

| Retailer Power | Significant | Walmart ($648.1B Revenue), Best Buy ($43.4B Revenue). |

| Price Sensitivity | Elevated | ASP fluctuations; entry-level price wars. |

Rivalry Among Competitors

Samsung operates in highly competitive consumer electronics and semiconductor markets. It contends with Apple, Intel, and TSMC, among others. This rivalry fuels innovation, but also squeezes profit margins. For instance, Samsung's semiconductor business saw revenue fluctuations in 2023, reflecting market pressures. In 2024, the battle continues, with pricing strategies and new product releases shaping the competitive landscape.

Product differentiation significantly shapes competitive rivalry. Samsung's focus on unique features and performance fuels this rivalry. Samsung's R&D spending hit $20.6 billion in 2023, driving innovation. This helps Samsung stand out in a crowded market. Such efforts intensify competition.

Competitive rivalry is fierce in Samsung's markets. Price wars, particularly in segments like smartphones, are common. For instance, in 2024, Samsung faced aggressive pricing from competitors, impacting margins. Samsung's revenue in 2024 was around $250 billion, but profit margins were squeezed. Samsung's pricing strategy needs careful management to maintain profitability amidst intense competition.

Competitive Rivalry 4

Competitive rivalry is fierce in the electronics market, with Samsung constantly battling for market share. Companies like Apple and other competitors are consistently launching new products, intensifying the competition. Securing and retaining market share necessitates significant investments in marketing and distribution channels. Samsung closely tracks its market share, adapting its strategies to stay competitive.

- Samsung's market share in the global smartphone market was around 20% in Q4 2023.

- Apple's market share was approximately 25% during the same period.

- R&D spending is crucial; Samsung invested $20.3 billion in R&D in 2023.

- Marketing expenses are substantial; Samsung spent $3.7 billion on advertising in 2023.

Competitive Rivalry 5

Competitive rivalry in the tech industry is fierce, driven by rapid technological advancements. Samsung faces constant pressure to innovate and adapt. Staying ahead requires quick product launches and continuous improvement. Samsung's success hinges on its ability to compete effectively. In 2024, Samsung invested $15.3 billion in R&D to maintain its competitive edge.

- Intense competition among smartphone brands.

- The speed of innovation forces quick product cycles.

- Samsung's R&D spending is vital.

- Market share battles are common.

Samsung faces intense competition in electronics. Rivalry drives innovation and squeezes margins. Price wars and new product launches are constant threats.

| Metric | 2023 | 2024 (est.) |

|---|---|---|

| R&D Spending (USD billions) | 20.6 | 15.3 |

| Marketing Spend (USD billions) | 3.7 | 3.9 |

| Revenue (USD billions) | 250 | 255 |

SSubstitutes Threaten

The threat of substitutes significantly impacts Samsung. Consumers can easily switch to alternatives like other smartphones, TVs, or appliances. For instance, the growing popularity of streaming services poses a threat to Samsung's media players. In 2024, the global streaming market is estimated at over $80 billion, showing this shift. This competition forces Samsung to innovate and offer unique features.

The threat of substitutes significantly impacts Samsung. If competitors like Xiaomi or Oppo offer similar smartphones at lower prices, they become attractive alternatives. In 2024, the average selling price (ASP) for smartphones varied, with premium models from Samsung facing pressure from value-driven options. Samsung must innovate and differentiate its offerings. This includes features, software, and brand value to retain customers.

The threat of substitutes for Samsung varies across its product lines. Switching costs can be low for commodity products like basic phones, making it easy for consumers to choose alternatives. Samsung must foster customer loyalty to combat this, especially in competitive markets. In 2024, the smartphone market saw intense competition, with Samsung facing rivals like Apple and Xiaomi.

Threat of Substitution 4

The threat of substitutes for Samsung Electronics is significant, particularly with rapid technological changes. Emerging technologies can quickly replace existing products. For instance, the growth of foldable phones challenges traditional smartphone designs. Samsung's ability to innovate and adapt is crucial to mitigate this threat.

- Foldable phones market reached $20 billion in 2024.

- Global smartphone sales declined by 4% in 2024.

- Samsung's R&D spending increased by 10% in 2024.

Threat of Substitution 5

The threat of substitutes for Samsung Electronics is heightened by open-source options. These alternatives, including software and hardware platforms, allow competitors to offer similar products at reduced prices. To counter this, Samsung needs to focus on differentiating its offerings. This includes using its own technologies and improving services to maintain its competitive edge.

- Open-source software market is projected to reach $32.9 billion by 2024.

- Samsung's R&D spending in 2023 was approximately $21.5 billion, focusing on differentiation.

- The global smartphone market saw a 3.2% decrease in shipments in Q1 2024, increasing the need for Samsung to stand out.

The threat of substitutes is high for Samsung Electronics, particularly due to rapid technological advancements. Emerging technologies like foldable phones, which reached a $20 billion market size in 2024, challenge traditional designs. Open-source options also pose a threat, enabling competitors to offer similar products at lower prices. To stay competitive, Samsung focuses on innovation and differentiation, increasing R&D spending by 10% in 2024.

| Aspect | Details | 2024 Data |

|---|---|---|

| Foldable Phones Market | Growth impact. | $20 billion |

| R&D Spending Increase | Samsung's Investment. | 10% |

| Smartphone Sales Decline | Market Pressure. | -4% |

Entrants Threaten

The threat of new entrants for Samsung is moderate due to high barriers. Significant capital is needed for manufacturing and R&D. Samsung's brand and scale present a formidable challenge for newcomers. In 2024, Samsung invested billions in R&D to maintain its market position, showing the high entry costs.

The threat of new entrants for Samsung is moderate due to significant barriers. Samsung's vast economies of scale in manufacturing and distribution give it a pricing edge. New companies find it challenging to compete with these advantages. In 2024, Samsung's revenue reached approximately $230 billion, showcasing its scale.

The threat of new entrants is moderate. Samsung's proprietary tech and intellectual property, including patents, act as barriers. New entrants require significant R&D investment to compete. In 2024, Samsung's R&D spending was about $20 billion, showcasing the scale needed.

Threat of New Entrants 4

The threat of new entrants for Samsung Electronics is moderate due to significant barriers. Samsung's strong brand recognition and customer loyalty provide a competitive advantage. New entrants face substantial challenges in building brand awareness and trust. In 2024, Samsung's brand value was estimated at over $90 billion, highlighting its market dominance.

- Brand Recognition: Samsung's strong global presence.

- Customer Loyalty: High customer retention rates.

- Marketing Costs: Significant investment needed.

- Market Share: Samsung's substantial share.

Threat of New Entrants 5

The threat of new entrants for Samsung Electronics is moderate, given the high barriers to entry in the tech industry. Government regulations and industry standards present significant hurdles, especially for newcomers. Samsung's established position allows it to more easily navigate these complex regulatory environments. This advantage helps protect its market share.

- Samsung's revenue in 2023 was approximately $200.5 billion.

- R&D spending in 2023 was around $20 billion, indicating a strong commitment to innovation and staying ahead of competitors.

- Samsung holds numerous patents, offering a competitive edge against new entrants.

- The consumer electronics market is highly competitive, with established brands.

The threat of new entrants for Samsung is moderate due to substantial hurdles. High initial capital investment, including manufacturing and R&D, is required. Samsung’s brand power and market share present significant barriers to new competitors.

| Barrier | Description | 2024 Data |

|---|---|---|

| Capital | Requires significant investment. | R&D spending: $20B+ |

| Brand | Strong brand recognition. | Brand value: $90B+ |

| Scale | Large manufacturing scale. | Revenue: ~$230B |

Porter's Five Forces Analysis Data Sources

The analysis uses company reports, industry databases, and market research to evaluate competition. It also integrates data from financial publications for market assessments.