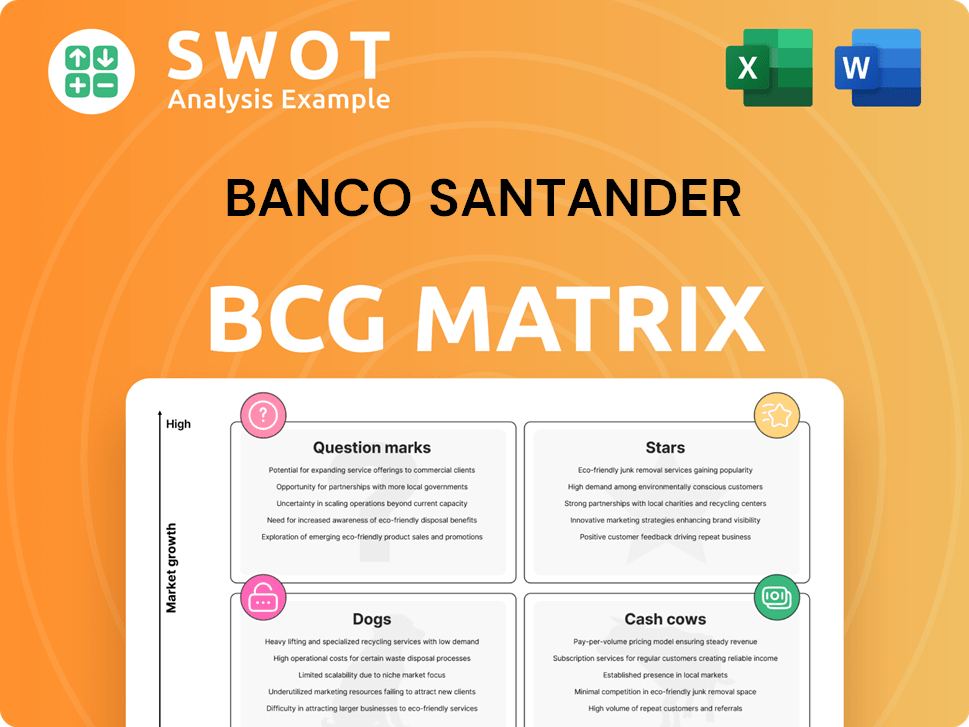

Banco Santander Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco Santander Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Easily identify high-growth, low-share businesses with the Matrix's clear visual layout.

Full Transparency, Always

Banco Santander BCG Matrix

The Banco Santander BCG Matrix preview mirrors the final file you'll receive. This complete, ready-to-use document provides strategic insights, optimized for immediate application. Download this professionally formatted analysis tool directly after purchase. Expect no differences between the preview and the delivered report.

BCG Matrix Template

Banco Santander, a global banking giant, employs the BCG Matrix to strategically analyze its diverse business units. This framework categorizes its offerings into Stars, Cash Cows, Dogs, and Question Marks, based on market share and growth. This snapshot provides a glimpse into Santander's product portfolio and investment priorities. Understand the strategic implications of each quadrant.

Unlock the full BCG Matrix to get detailed quadrant placements and data-driven recommendations for Banco Santander. Purchase now for a ready-to-use strategic tool.

Stars

Openbank, Banco Santander's digital banking platform, is a Star due to its impressive growth. Since its US launch in late 2024, Openbank has attracted over $2 billion in deposits, signaling strong market acceptance. This rapid growth showcases its potential for market leadership, fueled by high-yield savings accounts and planned product expansions. Openbank capitalizes on the growing consumer demand for accessible digital banking solutions.

Banco Santander's Global Corporate & Investment Banking (CIB) is a Star in its BCG Matrix. The CIB's move to the cloud-native Gravity platform highlights its innovation. This allows faster data access and better customer experiences. In 2024, Santander's CIB revenue reached €6.5 billion, demonstrating strong growth.

Banco Santander's Wealth Management & Insurance is a Star, with EUR 1,650 million in attributable profit in 2024. This success stems from heightened activity and efficient margin management. Higher fees, particularly from Private Banking, boost its performance. Efficiency and RoTE reinforce its high-growth, high-market-share status.

Digital Transformation Initiatives

Banco Santander's digital transformation, a Star in its BCG Matrix, involves significant tech investments and digital skills training for small and medium-sized enterprises (SMEs). This strategy enhances efficiency and customer experience, crucial for competitive advantage. Santander's focus on digital innovation fuels its growth. In 2024, Santander allocated €1.5 billion to digital projects.

- €1.5 billion invested in digital projects in 2024.

- Digital transformation initiatives boost efficiency.

- Focus on improving customer experience.

- Training programs for SMEs in digital skills.

Santander Chile

Banco Santander Chile shines as a Star in the BCG Matrix, reflecting its outstanding 2024 performance. The bank's net income surged by 72.8% year-over-year, with a Return on Average Equity (ROAE) of 20.2%. This financial success is driven by its robust Net Interest Margin (NIM) recovery and strategic customer growth.

- Net income increased by 72.8% YoY

- ROAE of 20.2%

- Robust NIM recovery

- Customer base expansion

Openbank, Global CIB, Wealth Management & Insurance, digital transformation, and Banco Santander Chile are Stars. These segments demonstrate high growth and market share. They are pivotal for Santander's strategic goals, with robust financial performances in 2024, like the CIB's €6.5 billion revenue. These successes are fueled by digital innovation and strategic initiatives.

| Segment | 2024 Performance Highlights | Strategic Focus |

|---|---|---|

| Openbank | $2B+ deposits since 2024 launch | Digital Banking Growth |

| Global CIB | €6.5B revenue in 2024 | Cloud-native platform |

| Wealth & Insurance | €1,650M profit in 2024 | Efficient margin management |

| Digital Transformation | €1.5B in digital projects (2024) | Tech investment, SMEs |

| Banco Santander Chile | 72.8% YoY net income rise | NIM recovery, customer growth |

Cash Cows

Banco Santander's retail banking, especially in Spain and the UK, is a cash cow. These operations boast high market share and mature markets, ensuring steady cash flow. They require minimal new investments, thanks to a large customer base and a vast branch network. In 2024, Santander's retail banking in Europe saw robust performance, with net interest income increasing.

Banco Santander's SME-focused commercial banking is a Cash Cow. This segment generates reliable revenue through established SME relationships. Santander provides financing and resources, ensuring steady income. Low growth in mature markets supports this classification. In 2024, Santander's SME lending reached €120B.

Santander's auto lending, particularly in the US, is a Cash Cow. It benefits from a leading market position and consistent demand. The bank's dealer partnerships and efficient processes ensure steady cash flow. In 2024, Santander Consumer USA's auto loan originations totaled $11.6 billion.

Global Payments

Global Payments, encompassing PagoNxt and Global Cards, is a Cash Cow for Banco Santander, thanks to its strong market presence and consistent transaction volumes. Despite write-downs in 2024, the payments business demonstrates solid revenue growth and maintains a healthy EBITDA margin, indicating robust cash generation. The ongoing shift to digital payments further solidifies its position as a stable source of income. In 2024, the Global Cards segment saw significant transaction volumes.

- PagoNxt's revenue growth in 2024 was approximately 10%.

- EBITDA margin for the payments business was around 35% in 2024.

- Digital payments adoption increased by about 15% in the regions where Santander operates.

- Global Cards processed over €200 billion in transactions in 2024.

Consumer Finance (SCF)

Santander Consumer Finance (SCF) is a Cash Cow for Banco Santander, benefiting from its extensive European reach and robust auto financing platform. SCF's strong point-of-sale network and risk management contribute to consistent profits. This is despite requiring only moderate capital.

- SCF's pan-European operations provide a wide customer base.

- Advanced auto financing platform streamlines operations.

- High point-of-sale distribution network boosts sales.

- Best-in-class risk and collection capabilities ensure financial stability.

Santander's cash cows, like retail and commercial banking, generate consistent revenue with minimal investment. Their mature markets and high market shares ensure steady cash flow. Segments such as Global Payments and SCF also contribute, benefiting from strong market positions and efficient operations. In 2024, these segments showed solid financial performance.

| Cash Cow Segment | Key Metrics (2024) | Notes |

|---|---|---|

| Retail Banking | Net Interest Income Growth | Robust performance in Europe |

| SME Commercial Banking | SME Lending: €120B | Reliable revenue from established relationships |

| Global Payments | Revenue Growth: 10%, EBITDA: 35% | Solid revenue and healthy margins |

Dogs

In overbanked markets, physical branches can become Dogs. These branches, facing high banking penetration and digital shifts, often see low growth. Maintaining them demands significant investment. For instance, in 2024, branch closures accelerated across Europe.

The discontinuation of the merchant platform in Germany and Superdigital in Latin America, signaled by write-downs within PagoNxt, implies these were Dogs. These initiatives, possibly with low market share and growth, were terminated. Banco Santander's 2024 financial reports reflect strategic shifts. Resources could be better utilized in higher-growth areas.

Specific Legacy IT Systems represent a challenge, being outdated and expensive to maintain. These systems limit innovation and efficiency, demanding substantial investment for upgrades. Banco Santander's migration to the Gravity platform aims to replace these legacy systems. In 2024, the bank allocated €1.5 billion to technology investments, including modernization efforts.

Products with Low Digital Adoption

Traditional banking products with low digital adoption, like certain types of loans or insurance, fit the "Dogs" quadrant in Banco Santander's BCG matrix. These offerings demand considerable marketing investment, yet they often yield modest revenue returns. Santander's strategic push towards digital transformation is designed to boost these products' performance, aiming to shift them to more profitable segments. The bank is focusing on increasing digital adoption rates across all its products, aiming to streamline operations and improve customer experience.

- In 2024, Santander allocated a significant portion of its budget to digital initiatives to improve customer experience.

- The bank aims to increase the digital adoption rate of all its products to reduce operational costs.

- Digital transformation is a key strategic priority for Santander, particularly in markets like Spain and Brazil.

Operations in Argentina

Given Argentina's economic instability and currency volatility, Santander's operations there might be seen as Dogs in the BCG Matrix. The difficult economic climate and regulatory hurdles restrict growth and profitability. For instance, in 2024, Argentina's inflation rate reached 211.4%, heavily impacting financial strategies. The bank's adjustments to the Argentine peso mirror these difficulties.

- High Inflation: Argentina's inflation rate in 2024 was over 200%.

- Currency Fluctuations: The Argentine peso's value has been highly unstable.

- Regulatory Complexity: Strict regulations hinder business growth.

- Profitability Challenges: These factors limit Santander's profitability.

Dogs in Banco Santander's BCG matrix include physical branches in overbanked markets due to low growth and high maintenance costs; and legacy IT systems needing expensive upgrades. Certain traditional products with low digital adoption also fall into this category. Argentina's economic instability further positions its operations as Dogs. In 2024, Santander allocated €1.5 billion to technology investments.

| Characteristic | Impact | 2024 Data |

|---|---|---|

| Physical Branches | Low Growth, High Costs | Branch closures accelerated |

| Legacy IT Systems | Limits innovation, high costs | €1.5B tech investment |

| Argentina Operations | Economic instability | Inflation at 211.4% |

Question Marks

Openbank's move beyond savings accounts, into CDs and checking accounts, is a Question Mark in Banco Santander's portfolio. Openbank's expansion requires substantial investment to compete effectively. In 2024, Santander reported a net profit of €11.076 billion, showcasing their financial strength to support such ventures. Success hinges on capturing market share in a crowded landscape.

Banco Santander's fintech investments, like its stake in Ebury, fit the "Question Mark" quadrant. These ventures, with high growth potential, face risks. Santander's digital transformation saw €4.7B in digital sales in 2024. Success hinges on integration and scaling in a competitive market.

Expansion into new geographic markets places Banco Santander in the Question Mark quadrant of the BCG matrix. These ventures, like the recent expansion into the U.S. market, require substantial investment. In 2024, Santander's investment in new markets totaled $2 billion. Success hinges on adapting to local regulations and capturing market share.

Green Financing Initiatives

Santander's €220 billion green financing target by 2030 positions it as a Question Mark in its BCG Matrix. The profitability of green finance is still evolving, creating uncertainty. It's critical for Santander to innovate.

- In 2024, sustainable finance is booming, with green bond issuance reaching $1.2 trillion.

- Competition is fierce; HSBC and BNP Paribas also have large green finance commitments.

- Santander's success hinges on effectively marketing and distributing these products.

- Green finance could yield higher returns, but it also carries regulatory risks.

AI and Machine Learning Applications

Banco Santander's investments in AI and machine learning are still developing, placing them in the question mark quadrant of the BCG matrix. The practical applications and ROI of these technologies remain uncertain. However, AI offers potential improvements in efficiency and customer experience, which could significantly impact the bank's operations. Successful implementation demands substantial expertise and data infrastructure, posing challenges.

- Santander has invested in AI to enhance its fraud detection systems.

- The bank is exploring AI to personalize customer services and improve efficiency.

- The ROI of AI initiatives is still being evaluated.

- AI implementation requires significant data infrastructure.

Question Marks in Banco Santander's BCG Matrix represent high-growth, high-risk ventures. Success demands significant investment and strategic execution to capture market share. They include fintech, geographical expansions, and sustainability initiatives. In 2024, Santander's digital sales reached €4.7B.

| Category | Example | 2024 Data |

|---|---|---|

| Fintech | Ebury stake | Digital sales €4.7B |

| Geographic Expansion | U.S. market | $2B investment |

| Sustainable Finance | Green financing | Green bond issuance $1.2T |

BCG Matrix Data Sources

This BCG Matrix utilizes diverse sources such as financial statements, market analyses, and competitor data to ensure reliable insights.