SAP Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SAP Bundle

What is included in the product

Identifies disruptive forces, emerging threats, and substitutes that challenge market share.

Quickly gauge competitive intensity and profitability with dynamic charts for better strategic choices.

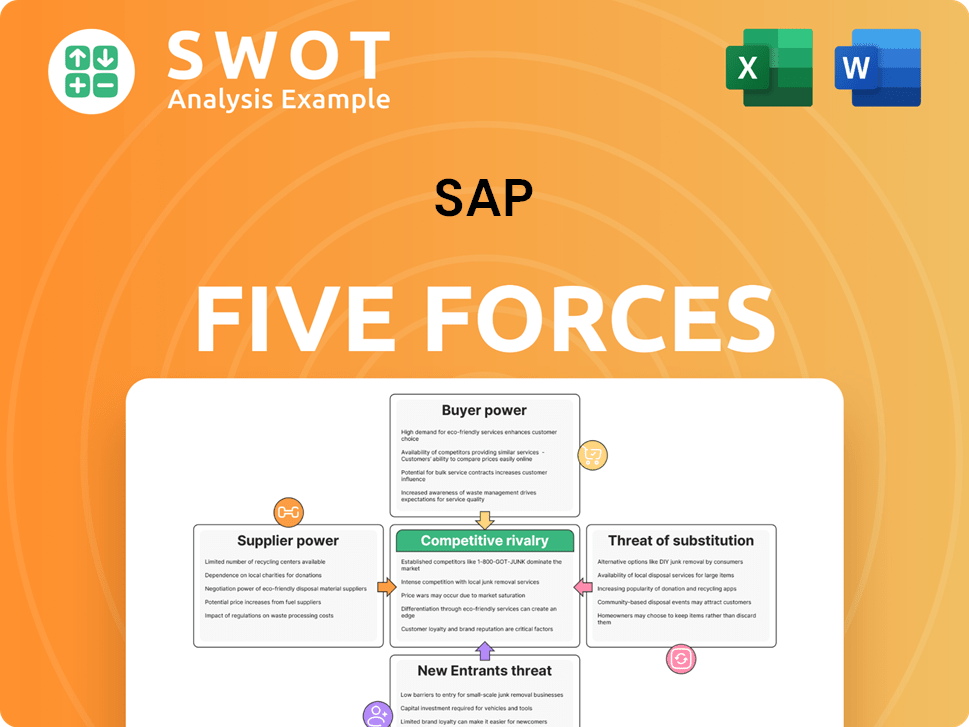

Preview the Actual Deliverable

SAP Porter's Five Forces Analysis

This preview reveals the complete SAP Porter's Five Forces Analysis. You're seeing the identical, professionally crafted document. After purchase, you'll instantly receive this fully formatted analysis. It's ready for your review and use immediately. The document is exactly as presented.

Porter's Five Forces Analysis Template

SAP's competitive landscape is shaped by Porter's Five Forces, revealing its market dynamics. Supplier power impacts costs, while buyer power influences pricing strategies. Threat of new entrants challenges market share, and substitute products offer alternatives. Competitive rivalry between SAP and its competitors is another key factor. The complete report reveals the real forces shaping SAP’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

SAP's reliance on a few key suppliers, especially for software components and cloud infrastructure, concentrates power. This limited supplier base provides significant leverage to these vendors. SAP's dependency on proprietary tech further strengthens their bargaining position. For example, in 2024, SAP's cost of revenue increased, partially due to supplier pricing.

High switching costs significantly empower suppliers in SAP's ecosystem. Complex integration, a key factor, makes changing suppliers a costly and time-consuming endeavor for SAP. These costs, encompassing financial and logistical challenges, solidify the dominance of current suppliers. This reduces SAP's ability to negotiate favorable terms. For example, in 2024, SAP's cloud revenue reached €14.09 billion, highlighting reliance on specific vendors and their pricing strategies.

Suppliers with specialized expertise or unique offerings wield significant bargaining power. Those providing crucial technology or tools hold a stronger position, especially if deeply integrated into SAP's products. For instance, in 2024, SAP spent a substantial amount on R&D, highlighting its reliance on cutting-edge tech. The cost of switching suppliers can be high, further strengthening their position.

Cloud infrastructure dependency

SAP's reliance on cloud infrastructure significantly empowers providers like Microsoft Azure, AWS, and Google Cloud. These providers have substantial bargaining power due to their control over the infrastructure that supports SAP's cloud services. This dependency affects SAP's operational costs and service delivery capabilities. In 2024, SAP's cloud infrastructure distribution was: Microsoft Azure (40%), AWS (35%), and Google Cloud (25%).

- Microsoft Azure: 40% of SAP's cloud infrastructure.

- AWS: 35% of SAP's cloud infrastructure.

- Google Cloud: 25% of SAP's cloud infrastructure.

Labor Market for Skilled Professionals

The labor market significantly influences SAP's supplier power, particularly for skilled professionals like software developers and engineers. The availability and cost of these specialized talents directly affect SAP's operational costs and innovation capabilities. In 2024, the average salary for a software engineer in the US was around $110,000, reflecting the high demand and, consequently, the potential bargaining power of these 'suppliers' of expertise. SAP’s employees have less negotiation power.

- High demand for tech skills increases labor costs.

- SAP faces competition for talent.

- Employee bargaining power is generally lower within large corporations.

- Labor costs impact SAP's profitability.

SAP's suppliers, particularly for tech and cloud infrastructure, possess considerable bargaining power. Switching costs and specialized expertise further amplify this leverage, affecting SAP's operational costs. Cloud providers like Azure, AWS, and Google Cloud have substantial influence over SAP's infrastructure, influencing pricing.

| Supplier Type | Bargaining Power | 2024 Data Impact |

|---|---|---|

| Cloud Infrastructure | High | Azure (40%), AWS (35%), Google (25%) control key infrastructure, impacting SAP's cloud revenue of €14.09B. |

| Software & Tech | Medium-High | R&D spending high, indicating reliance on specialized tech, increased cost of revenue. |

| Labor Market | Medium | High demand for software engineers, with salaries around $110,000 in US, affecting operational costs. |

Customers Bargaining Power

SAP faces substantial bargaining power from its large enterprise customers. These customers, which include major corporations, wield considerable influence due to the substantial volume of software and services they procure. SAP's top 100 customers account for a significant portion of its revenue, enhancing their ability to negotiate favorable pricing and contract terms. In 2024, SAP's cloud revenue grew by 24%, showing the importance of retaining these key clients.

SAP's deeply integrated solutions create high switching costs for customers, potentially reducing their bargaining power. However, customers can still exert pressure; they aren't entirely locked in. Consider that a 2024 report showed that the average cost to switch ERP systems can range from $500,000 to over $1 million. This integration, while making switching expensive, doesn't eliminate buyer influence.

Customers' bargaining power grows when they can easily compare vendors. The cloud and open-source options increase choices. Clients now effortlessly compare offerings. In 2024, the SaaS market hit $208 billion, fueling vendor competition. This empowers customers with more leverage.

Demand for customization

The demand for SAP's customizable solutions greatly impacts pricing strategies, providing customers with substantial bargaining power. Customers are increasingly seeking tailored solutions to meet their unique business requirements. This trend necessitates SAP to offer flexible pricing models, influencing the company's profitability. The ability to customize gives clients leverage in negotiations, potentially affecting SAP's revenue margins.

- In 2024, the market for customized enterprise software solutions is projected to reach $150 billion, reflecting the growing demand for tailored offerings.

- SAP's revenue from cloud subscriptions and support in Q3 2024 was €7.59 billion, a 25% increase, indicating the importance of customer-centric solutions.

- Approximately 70% of SAP's new customers in 2024 request some form of customization during the implementation phase.

- Customer retention rates for SAP solutions with high customization options exceed 90%, highlighting the impact of tailored products.

Rise of AI-powered solutions

The bargaining power of SAP's customers is evolving with the rise of AI-powered solutions. Customers are increasingly demanding AI integration, which could reshape the competitive landscape. Agentic AI might become the primary user interface for many applications, potentially devaluing traditional enterprise software interfaces. This shift could empower customers to seek more tailored and cost-effective solutions.

- Gartner forecasts that by 2026, over 80% of enterprises will have used cloud-based AI services.

- The global AI market is projected to reach $1.81 trillion by 2030.

- AI adoption in enterprise software is expected to increase customer expectations for user-friendly interfaces.

- SAP's stock price has fluctuated, reflecting market anticipation of these technological shifts.

SAP's enterprise clients have significant bargaining power. Large customers, such as major corporations, influence pricing and terms, and retention is critical. However, high switching costs and customization options balance customer power. AI integration further shifts this dynamic.

| Factor | Impact | Data |

|---|---|---|

| Customer Size | Higher bargaining power | Top 100 clients: Significant revenue share |

| Switching Costs | Lower bargaining power | ERP switch costs: $500K - $1M+ |

| Customization | Higher bargaining power | 2024 custom software market: $150B |

| AI Adoption | Evolving power | Cloud AI usage by 2026: 80%+ |

Rivalry Among Competitors

SAP operates in a fiercely competitive ERP market, contending with major rivals. Oracle and Microsoft are key competitors, intensifying the battle for market share. As of 2023, SAP leads with about 23% of the global ERP market. Oracle and Microsoft trail with approximately 13% and 11%, respectively, highlighting the intense rivalry.

The competitive rivalry in cloud solutions is heating up, with vendors aggressively pursuing market share. SAP's cloud revenue growth hit 23.4% in 2024, slightly outpacing the industry benchmark of 22.7%. This signals a robust and competitive landscape for cloud services.

High R&D investment intensifies competitive rivalry. SAP, like its rivals, dedicates significant resources to R&D. In 2023, SAP's R&D spending reached $5.6 billion. This represented 16.2% of their revenue, driving innovation. SAP filed 1,247 patents in 2023.

AI integration as a differentiator

The incorporation of AI is reshaping the competitive landscape for ERP systems. As of late 2024, companies like SAP are aggressively integrating AI to automate tasks and enhance decision-making. This trend is set to intensify in 2025, with AI offering more sophisticated insights and process automation. Competitors must invest in AI to stay relevant.

- AI-driven automation is projected to reduce operational costs by up to 20% by 2026 for companies using advanced ERP systems.

- The global AI in ERP market is expected to reach $8.5 billion by 2025, highlighting the importance of AI integration.

- Companies that successfully integrate AI into their ERP systems can see a 15% increase in operational efficiency.

Market Share Volatility

The enterprise software market is known for its volatility, with market shares frequently changing. New technologies and business models can rapidly reshape the competitive environment. SAP competes fiercely with Oracle, Microsoft, and Salesforce in this market. This constant competition forces companies to innovate and adapt quickly to maintain their position.

- SAP's revenue in 2023 was approximately €30.8 billion.

- Oracle's cloud revenue grew 22% in fiscal year 2024.

- Microsoft's commercial cloud revenue reached $35.1 billion in Q3 2024.

- Salesforce's revenue for fiscal year 2024 was $34.86 billion.

Competitive rivalry in the ERP market is intense, with SAP, Oracle, and Microsoft vying for market dominance. SAP currently leads with about 23% market share, yet constant innovation is crucial. AI integration and cloud solutions are key battlegrounds, intensifying the competition.

| Metric | SAP | Competitors |

|---|---|---|

| 2023 R&D Spending | $5.6B (16.2% of revenue) | Significant investments by Oracle, Microsoft |

| Cloud Revenue Growth (2024) | 23.4% | Industry benchmark: 22.7% |

| Market Share (approx. 2023) | 23% | Oracle (13%), Microsoft (11%) |

SSubstitutes Threaten

Open-source software poses a threat to SAP by offering alternative solutions. The open-source enterprise software market is projected to reach $32.95 billion by the end of 2025. This growth indicates a viable substitute for some SAP offerings. The 2024 projection for this market is already significant.

Cloud-native platforms pose a significant threat to SAP. These platforms provide viable alternatives to traditional enterprise software. Gartner projects 95% of new digital workloads will use cloud-native platforms by 2025, rising from 30% in 2021. This shift could erode SAP's market share.

Digital transformation platforms, such as Microsoft Dynamics 365 and Salesforce, present a significant threat to SAP. Microsoft Dynamics 365 generated $3.5 billion in quarterly revenue. Salesforce achieved $8.38 billion in quarterly revenue. Oracle Cloud ERP holds a 12.3% market share, intensifying the competitive landscape.

AI and machine learning alternatives

AI and machine learning pose a threat as substitutes by optimizing business operations, potentially replacing certain ERP functions. The global AI market was valued at $207 billion. Enterprise AI adoption hit 64%. These alternatives could reduce reliance on traditional ERP systems. This shift could alter the competitive landscape.

- Global AI Market Size: $207 billion

- Enterprise AI Adoption Rate: 64%

- Potential for Function Replacement: ERP functions.

- Impact: Shift in competitive landscape.

Agile, specialized software

Agile, specialized software, like Workday and ServiceNow, poses a threat to SAP. These providers offer solutions that can replace parts of SAP's suite. Workday's recent quarterly revenue hit $1.93 billion, while ServiceNow's reached $2.22 billion, showing their market strength. Switching costs for enterprise software average 3-5% of the annual IT budget. This makes it easier for companies to consider alternatives.

- Workday's quarterly revenue: $1.93 billion (2024).

- ServiceNow's quarterly revenue: $2.22 billion (2024).

- Average enterprise software switching cost: 3-5% of annual IT budget.

Open-source, cloud-native platforms, and digital transformation platforms threaten SAP. Microsoft Dynamics 365 and Salesforce's significant revenues highlight this threat. Agile software like Workday and ServiceNow add to the competition, offering specialized solutions.

| Threat | Example | 2024 Data |

|---|---|---|

| Open Source | Various | Market projected to $32.95B by 2025. |

| Cloud-native | AWS, Azure | 95% new digital workloads by 2025. |

| Digital Transformation | Microsoft Dynamics 365 | Quarterly revenue: $3.5B. |

Entrants Threaten

High capital requirements pose a significant threat to new entrants in the enterprise software market. Substantial investment in research and development acts as a major barrier. Technology development demands considerable spending, with cloud infrastructure costing approximately €2.3 billion yearly. Enterprise software development for each product line ranges from €750-950 million. Talent acquisition adds another €450 million annually.

SAP benefits from strong brand recognition and customer loyalty. As a market leader in enterprise resource planning (ERP) software, SAP held a 23% market share in 2023. This established presence creates customer trust and preference. New entrants find it difficult to gain market share against SAP's established base.

The threat from new entrants is amplified by comprehensive platform demands. Customers increasingly seek integrated platforms; 92% of enterprises require end-to-end business solution integration. This raises the bar significantly. Enterprises invest an average of €1.2 million annually on software platforms, making it costly. The goal is to reduce integration complexity by 40% by 2025.

Stringent regulatory environment

Stringent regulatory environments pose a significant threat to new entrants in the SAP market. Compliance with data privacy and security regulations, such as NIST and the EU's NIS2 directive, increases the complexity and cost of entry. The NIS2 directive, for instance, imposes personal liability on board members who fail to ensure compliance, making robust governance and risk management crucial. This necessitates increased investments in SAP Security, which is becoming a strategic priority for businesses.

- NIST compliance costs can range from $10,000 to over $1 million depending on the size and complexity of the organization.

- The global cybersecurity market is projected to reach $345.7 billion in 2024.

- The EU's NIS2 directive came into effect in October 2024.

Talent Acquisition

Attracting and retaining top talent is a significant hurdle for new entrants in the software and AI sectors. The competition for skilled labor, including software developers and engineers, is intense, impacting startup costs. The availability and cost of this specialized talent directly affect a company's ability to compete. This is crucial, as the success of new entrants highly depends on their ability to secure and retain skilled employees.

- The global AI market is projected to reach $1.81 trillion by 2030.

- The average salary for software engineers in the US was $116,652 in 2024.

- Employee turnover rates in the tech industry average around 13% annually.

- The cost of replacing an employee can be up to twice their annual salary.

New entrants face high barriers due to SAP's market dominance and high integration demands. Regulatory compliance, like the NIS2 directive effective in October 2024, adds costs. Intense competition for skilled tech talent also raises hurdles. The cybersecurity market is projected to hit $345.7 billion in 2024.

| Barrier | Impact | Data Point |

|---|---|---|

| Capital Requirements | High R&D costs | Cloud infrastructure: €2.3B annually |

| Brand Recognition | Customer preference | SAP's 23% market share in 2023 |

| Platform Integration | Complex & costly | Enterprises spend €1.2M annually |

Porter's Five Forces Analysis Data Sources

SAP Porter's Five Forces leverages financial reports, market analyses, industry surveys, and competitor data. Data from these sources inform competitive insights.