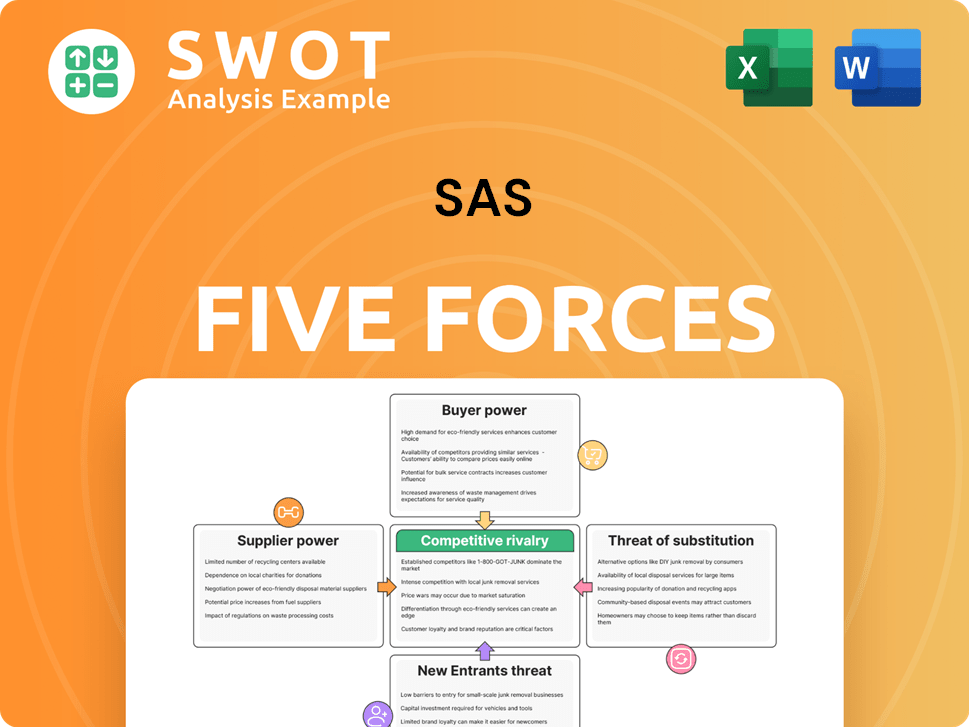

SAS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SAS Bundle

What is included in the product

Tailored exclusively for SAS, analyzing its position within its competitive landscape.

No more generic templates—adapt the analysis to any industry sector with dynamic charts.

What You See Is What You Get

SAS Porter's Five Forces Analysis

This SAS Porter's Five Forces analysis preview is the same complete document you'll download immediately after purchase. It's fully formatted, with no hidden content. See the real, in-depth insights now—what you see is what you get. No surprises, just immediate access to this strategic analysis.

Porter's Five Forces Analysis Template

SAS operates within a complex industry landscape, shaped by competitive rivalries and external pressures. Analyzing these forces is crucial for understanding SAS's market position. Supplier power impacts SAS's cost structure, while buyer power influences pricing strategies. The threat of new entrants and substitutes presents ongoing challenges. Competitive rivalry determines the intensity of market competition.

The complete report reveals the real forces shaping SAS’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration significantly impacts SAS's bargaining power. In 2024, the analytics software market saw a few major players controlling key technologies. If SAS depends on a limited number of suppliers for crucial components, these suppliers can dictate terms.

Suppliers with specialized expertise, like those providing advanced algorithms vital to SAS's analytics, have strong bargaining power. This allows them to potentially inflate prices. To counter this, SAS should diversify its vendor base and invest in internal development. In 2024, the market for specialized AI components grew by 20%, highlighting their importance.

High switching costs boost supplier power. If SAS faces major costs or disruptions when switching, it's more reliant on vendors. This includes tech integration, staff retraining, or data migration costs. SAS should aim for system flexibility to cut these costs. In 2024, the average cost to switch enterprise software was about $50,000 for small businesses, increasing vendor power.

Data Providers

For SAS, access to unique, high-quality data is critical. Suppliers with exclusive data sources wield significant bargaining power. In 2024, the cost of premium data rose by 7%, impacting analytics firms. To counter this, SAS should diversify its data sources.

- Explore partnerships for data sharing.

- Negotiate favorable terms with existing suppliers.

- Invest in alternative data acquisition methods.

- Analyze cost-benefit of proprietary data development.

Cloud Infrastructure

In the realm of cloud infrastructure, SAS faces considerable supplier power. Major providers like AWS, Azure, and Google Cloud hold substantial sway due to the industry's reliance on their services. This dependence can impact SAS's operational costs and flexibility, making it critical to address this dynamic strategically. For example, in 2024, AWS, Azure, and Google Cloud collectively controlled over 66% of the cloud infrastructure market.

- The cloud market is highly concentrated, with a few key players dominating.

- SAS's reliance on these providers gives them significant leverage in pricing and service terms.

- A multi-cloud strategy can help mitigate this risk by diversifying infrastructure.

- Optimizing infrastructure to reduce dependence on any single provider is crucial.

SAS's bargaining power is lessened when suppliers are concentrated or possess specialized expertise. High switching costs also weaken SAS's position in negotiations. Exclusive data providers, critical for analytics, further elevate supplier influence.

| Factor | Impact on SAS | 2024 Data Point |

|---|---|---|

| Supplier Concentration | Increases Supplier Power | Top 3 cloud providers control 66% of market |

| Specialized Expertise | Raises Costs | AI component market grew 20% |

| Switching Costs | Reduces Flexibility | Avg. switching cost for small biz: $50K |

Customers Bargaining Power

Customer concentration significantly impacts SAS's bargaining power with customers. If a few major clients generate a large percentage of SAS's revenue, these customers gain considerable leverage. They can negotiate better pricing, tailor-made services, and advantageous contract terms. In 2024, SAS reported that its top 10 customers accounted for approximately 15% of its total revenue. To mitigate this, SAS should broaden its customer portfolio, ensuring no single client dominates the revenue stream.

Customer bargaining power rises when switching costs are low. In 2024, the analytics market saw increased competition, making it easier for clients to change vendors. SAS must continually prove its worth to retain clients. This means excellent service, innovation, and customization. High switching costs, like deep system integration, help SAS.

The availability of alternative analytics solutions significantly impacts customer power. Customers gain leverage when numerous options exist, enabling them to negotiate favorable terms. In 2024, the analytics market saw over 1000 vendors. SAS must differentiate itself to remain competitive.

Price Sensitivity

Customer price sensitivity significantly influences their bargaining power. In sectors where analytics solutions are perceived as interchangeable, clients often prioritize cost. SAS must showcase the value and ROI of its offerings, stressing the advantages of superior decision-making and business results. Demonstrating measurable outcomes is crucial for maintaining a competitive edge. For instance, in 2024, the global business analytics market was valued at approximately $82 billion.

- Highlighting the cost-effectiveness of SAS solutions can help reduce price sensitivity.

- Showcasing successful case studies with quantifiable results can demonstrate value.

- Providing flexible pricing models to cater to different customer needs.

- Investing in advanced analytics to offer unique benefits.

Information Availability

Customers armed with comprehensive data on pricing, performance, and competitors wield significant bargaining power. SAS must prioritize transparent pricing strategies and clearly articulate its value proposition. This involves providing detailed case studies, ROI analyses, and customer testimonials to justify pricing and foster customer loyalty. Offering such information can strengthen customer relationships. This is crucial in the current market, where 70% of customers research products online before purchasing.

- Transparency in pricing is key.

- Showcase the value of SAS services.

- Use case studies and ROI data.

- Build customer loyalty through information.

SAS faces customer bargaining power due to concentration and market alternatives. In 2024, top clients made up about 15% of revenue. Low switching costs and over 1000 vendors in the analytics market also amplify customer influence.

| Factor | Impact | 2024 Data/Insight |

|---|---|---|

| Customer Concentration | High concentration boosts power. | Top 10 clients = ~15% revenue |

| Switching Costs | Low costs increase power. | Increased competition in 2024 |

| Alternatives | Many options increase power. | Over 1000 vendors in 2024 |

Rivalry Among Competitors

The analytics software market is saturated, intensifying competition. With many similar solutions, differentiation is tough. In 2024, the global market was valued at $76.4B, with a projected CAGR of 10.8% from 2024-2032. SAS must innovate to maintain its market share amidst this rivalry.

Intense rivalry in the software market can trigger pricing pressure, potentially shrinking profit margins. Competitors might use aggressive pricing to gain customers, compelling SAS to cut prices too. In 2024, the average profit margin for software companies was about 25%, illustrating the impact of pricing. SAS must prioritize cost efficiency and value-based pricing to stay profitable.

Companies differentiate through unique features, solutions, or service. SAS must invest in R&D to stay ahead. Strong branding and marketing are crucial for SAS. In 2024, the analytics market is highly competitive, with SAS facing rivals like IBM and Microsoft. SAS's revenue in 2023 was around $3.2 billion.

Consolidation

The analytics software market is seeing consolidation. Larger firms acquire smaller ones to grow their capabilities and market share. SAS must watch these trends, considering partnerships or acquisitions. Staying agile is crucial for SAS. The data from 2024 shows this trend is ongoing.

- Market consolidation intensifies competition.

- Acquisitions reshape the competitive landscape.

- Strategic alliances offer growth opportunities.

- Adaptability is essential for SAS.

AI Integration

The competitive landscape in analytics is intensifying with the rise of AI integration. Companies like SAS are heavily investing in AI and machine learning to provide sophisticated insights and automation capabilities, which is a critical battleground. In 2024, the global AI market in analytics is estimated at $25 billion, indicating a strong growth trajectory. SAS needs to prioritize AI and ML to stay competitive and satisfy customer expectations, focusing on responsible AI.

- Global AI market in analytics estimated at $25 billion in 2024.

- Increasing demand for AI-powered solutions.

- Focus on responsible AI practices.

- Continuous investment in AI and ML is essential.

Competitive rivalry in the analytics software market is fierce, with many players vying for market share. Pricing pressure and intense competition could compress profit margins. SAS must differentiate through innovation, as the market is set to reach $76.4B in 2024, with a 10.8% CAGR until 2032.

| Aspect | Details | Impact on SAS |

|---|---|---|

| Market Size (2024) | $76.4 billion | Opportunity for growth, but also intense competition. |

| Projected CAGR (2024-2032) | 10.8% | Indicates robust market growth, requires strategic investment. |

| SAS Revenue (2023) | $3.2 billion | SAS must defend its market share. |

SSubstitutes Threaten

Open-source alternatives like R and Python present a notable threat to SAS. These tools offer powerful analytics capabilities at a lower cost, appealing to budget-conscious users. The open-source market grew, with Python's usage increasing by 25% in 2024. SAS must highlight its value, including ease of use and enterprise features, to compete effectively.

Some companies opt for in-house analytics, posing a threat to SAS. This suits firms with technical prowess and unique demands. In 2024, about 30% of large enterprises favored internal development. SAS must focus on organizations lacking this capability. Consider that internal projects often face budget overruns; in 2023, these averaged 27%.

Spreadsheet software like Microsoft Excel presents a threat as a substitute for basic analytics, given its widespread availability. In 2024, Excel remains a dominant tool, with over 750 million users globally. SAS must differentiate by offering advanced analytics beyond spreadsheets. Focus on areas like predictive modeling, where Excel's capabilities are limited. This strategy helps SAS compete effectively.

Consulting Services

Consulting services pose a threat to SAS. Businesses might choose consultants over software, especially with infrequent data analysis needs. This shift impacts SAS's market share. The consulting market was valued at $168.1 billion in 2024. SAS should offer consulting to compete, enhancing its overall value.

- Consulting services provide an alternative to SAS software.

- This is particularly true for companies with limited analytics requirements.

- The global consulting market size was significant in 2024.

- SAS can mitigate this threat by offering its own consulting.

Business Intelligence Tools

Business intelligence (BI) tools, such as Tableau and Microsoft Power BI, pose a threat to SAS by offering substitute data visualization and reporting features. SAS must integrate its solutions with these BI tools to stay competitive. In 2024, the BI market is valued at over $29 billion, showing substantial growth. Emphasizing advanced analytics and predictive modeling is crucial for SAS to differentiate itself.

- Market growth: The BI market is projected to reach $33.3 billion by the end of 2024.

- Integration: SAS needs to offer seamless integration with popular BI platforms.

- Differentiation: Focus on advanced analytics to maintain a competitive edge.

- User shift: Many businesses are adopting BI tools for data analysis needs.

Open-source analytics, like Python, challenge SAS with lower costs; Python usage rose 25% in 2024. In-house analytics is a substitute, favored by 30% of large firms; internal projects saw 27% budget overruns in 2023. Spreadsheets like Excel, with 750M+ users, offer basic analytics, so SAS must offer advanced features.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Open-source | Cost & Capabilities | Python usage up 25% |

| In-house | Internal Expertise | 30% large firms |

| Spreadsheets | Basic analytics | 750M+ Excel users |

Entrants Threaten

High development costs pose a significant threat to new entrants. Building robust analytics software needs substantial investment in R&D, infrastructure, and skilled personnel. This financial hurdle makes it hard for new firms to compete. SAS, with its existing tech and know-how, holds a strong advantage. For instance, SAS spent $1.25 billion on R&D in 2023, showcasing the scale of investment required.

SAS benefits from a strong brand reputation, essential in the analytics market. New entrants find it difficult to gain customer trust. SAS's established name is a significant barrier. Its reputation helps retain customers, as seen in its $3.05 billion revenue in 2023.

The analytics software market faces rising regulatory hurdles, especially concerning data privacy and security. New companies must comply with these complex rules, creating an entry barrier. In 2024, the cost of GDPR compliance alone can exceed $1 million for some businesses. SAS, with its existing compliance programs, holds an advantage.

Network Effects

Network effects significantly influence the threat of new entrants in the analytics sector. Solutions like SAS gain value as user adoption grows, creating a strong barrier for newcomers. In 2024, the analytics market is estimated to be worth over $270 billion, highlighting the scale of the opportunity and the importance of established user bases. SAS must leverage its existing community to fortify its market position against new competitors.

- Network effects increase a solution's value with more users.

- The analytics market was over $270 billion in 2024.

- SAS should focus on community building.

Access to Talent

Attracting and retaining skilled professionals is a significant hurdle for new entrants in the analytics market. Established companies like SAS have a competitive advantage in securing top talent. For example, SAS invested $100 million in employee training and development in 2023. New firms face challenges in competing for these data scientists, software engineers, and analytics experts. A positive work environment is key to retaining employees.

- SAS invested $100 million in employee training and development in 2023.

- New entrants struggle to compete with established players for talent.

- Attracting skilled professionals is crucial.

- Positive work environment is key for retention.

New analytics software entrants face hurdles due to high costs and established brand reputation, hindering market entry. Regulatory compliance, such as GDPR, creates financial strain. SAS, with existing advantages, is well-positioned against these threats. In 2024, the analytics market size was over $270 billion.

| Barrier | Impact | SAS Advantage |

|---|---|---|

| High R&D Costs | Requires significant investment | $1.25B R&D in 2023 |

| Brand Reputation | Difficult to build trust | $3.05B revenue in 2023 |

| Regulatory Compliance | Costly, complex compliance | Existing compliance programs |

Porter's Five Forces Analysis Data Sources

The SAS Porter's Five Forces uses company financials, market reports, industry analyses, and regulatory filings for its strategic insights.