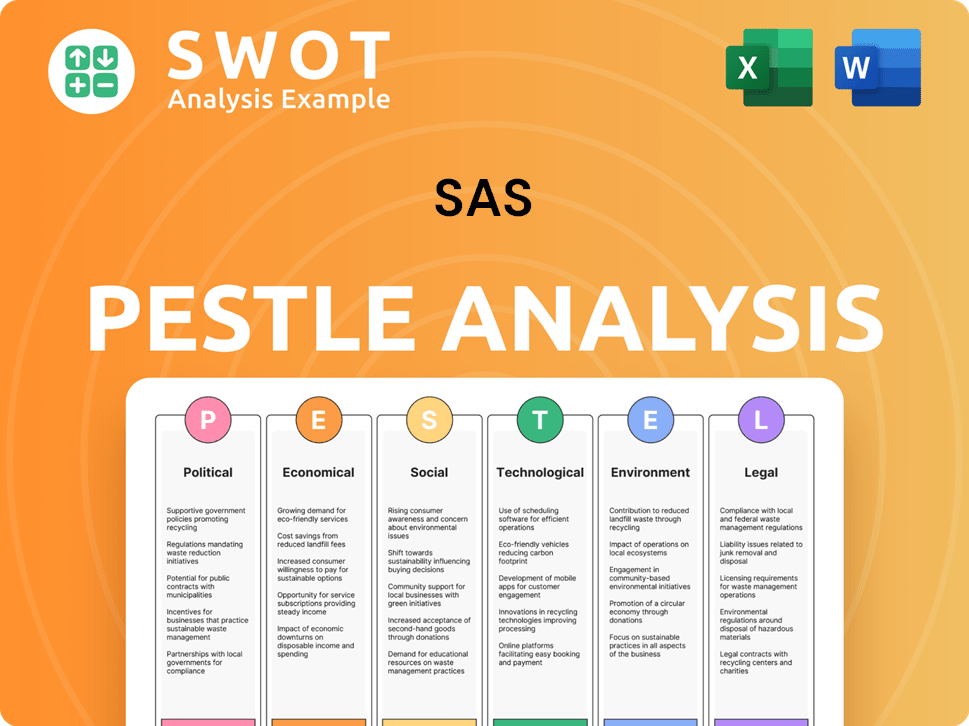

SAS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SAS Bundle

What is included in the product

Evaluates SAS via Political, Economic, Social, Technological, Environmental & Legal factors.

Provides a concise version for quickly identifying market opportunities and threats, aiding in faster, more informed decision-making.

What You See Is What You Get

SAS PESTLE Analysis

Explore the SAS PESTLE Analysis preview! The content & formatting are complete here. See the factors assessed across different environments? This is the document that will be delivered after purchase.

PESTLE Analysis Template

Explore SAS through the lens of our PESTLE Analysis, offering a clear view of external factors. We examine Political, Economic, Social, Technological, Legal, and Environmental influences impacting the company. Identify potential opportunities and threats to guide your decisions effectively. This analysis is designed for strategic planning, competitive analysis, and market research. Get deeper insights—download the full PESTLE Analysis today.

Political factors

Governments worldwide are intensifying data privacy regulations, impacting SAS's data handling. GDPR in Europe is a key example, influencing data collection and usage in SAS analytics. Compliance with evolving legal frameworks is crucial for SAS to maintain customer trust and avoid penalties. The global AI market is projected to reach $2 trillion by 2030, highlighting the importance of regulatory compliance for SAS.

Government use of analytics is a key political factor for SAS. Public sector organizations heavily use analytics for social programs, fraud detection, and policy. SAS software supports these applications, influencing its market. In 2024, government spending on analytics is projected to reach $25.7 billion globally. The U.S. federal government's IT budget for 2025 includes significant allocations for data analytics and AI, reflecting the importance of these tools.

International trade policies and data flow regulations significantly influence SAS's global operations. Data localization mandates, like those in the EU's GDPR, require businesses to store data within specific regions, impacting SAS's infrastructure and operational costs. For instance, the global data governance market is projected to reach $9.7 billion by 2025, highlighting the importance of compliance. Cross-border data transfer restrictions can also hinder SAS's ability to serve international clients efficiently, adding operational complexities.

Political Stability in Operating Regions

Political stability is crucial for SAS's operations, ensuring market demand and business continuity. Geopolitical events and political shifts can significantly impact technology investment decisions. For example, instability in regions like Eastern Europe has affected tech spending. According to Gartner, global IT spending is projected to reach $5.06 trillion in 2024, reflecting sensitivity to global political and economic climates.

- SAS's operations rely heavily on stable political environments.

- Geopolitical events can directly influence customer investment in technology.

- Unstable regions often see reduced tech spending.

- Gartner's data highlights the impact of global events on IT spending.

Government Investment in Technology and Digital Transformation

Government investments in technology and digital transformation present opportunities for SAS. These initiatives, including spending on data infrastructure and analytics, boost demand for SAS products. For instance, the U.S. government allocated over $20 billion for IT modernization in 2024, supporting data-driven solutions. Such spending aligns with SAS's offerings, increasing its market potential.

- U.S. government allocated over $20 billion for IT modernization in 2024.

- European Union's Digital Decade targets include significant investments in data and AI.

SAS must navigate data privacy regulations and government analytics use. Data localization mandates and cross-border restrictions impact operations and costs. Political stability and government tech investments also significantly influence market demand.

| Aspect | Impact | Data |

|---|---|---|

| Data Privacy | Compliance; market trust | Global AI market ~$2T by 2030. |

| Govt. Analytics | Increased demand | US IT spending ~$20B in 2024. |

| Trade Policies | Operational Costs; efficiency | Data governance market ~$9.7B by 2025. |

Economic factors

Global economic health is crucial for SAS. In 2024, global GDP growth is projected at around 3.2%, influencing IT spending. A stable economy encourages investment in analytics. Conversely, recessions, like the 2020 downturn, can curb software purchases. Economic forecasts impact SAS's sales.

SAS caters to diverse sectors like finance, healthcare, and government. The financial services sector is projected to grow by 4.3% in 2024. Healthcare spending is expected to increase by 5.2% in 2025. These trends affect the need for SAS's analytics.

Currency exchange rate volatility poses financial risks for SAS. As a global entity, SAS is exposed to currency fluctuations impacting revenue and costs. For instance, a stronger US dollar can decrease the value of international sales when converted. In 2024, currency impacts are a key consideration for SAS's financial planning.

Inflation and Cost of Operations

Inflation significantly impacts SAS's operational expenses. Rising costs for salaries, energy, and IT infrastructure directly affect the company's bottom line. SAS must carefully manage these costs to preserve profitability, particularly as inflation may influence client spending on software. In 2024, the U.S. inflation rate was around 3.1%, potentially increasing operational costs.

- Increased operational costs due to inflation.

- Potential impact on customer software investments.

- Need for strategic cost management.

- 2024 U.S. inflation rate around 3.1%.

Competitive Landscape and Pricing Pressure

The analytics and AI market's competitive landscape, featuring giants and niche players, intensifies pricing pressure. SAS must keep its pricing competitive, especially with cloud and consumption-based models gaining traction. For example, the global AI market is projected to reach $1.81 trillion by 2030, highlighting the stakes. SAS's move towards flexible pricing is crucial.

- Market competition includes Google, Microsoft, and specialized vendors.

- Cloud-based pricing models are becoming increasingly important.

- The AI market is expected to grow significantly by 2030.

- SAS needs to balance value with competitive pricing.

SAS faces economic shifts like GDP and IT spending changes. Stable growth boosts analytics investment, while downturns cut software sales. Diverse sector growth in finance (4.3% in 2024) and healthcare (5.2% in 2025) impacts SAS.

Currency risks from exchange rates influence revenues; a stronger dollar affects international sales. Inflation raises operational costs, impacting profits, with a 2024 U.S. rate around 3.1%.

Competition intensifies pricing pressures, especially with cloud models. SAS must stay competitive in the growing AI market, expected to reach $1.81 trillion by 2030, emphasizing flexible pricing.

| Factor | Impact on SAS | 2024-2025 Data/Trends |

|---|---|---|

| GDP Growth | Influences IT spending and analytics demand | Global GDP ~3.2% (2024) |

| Sector Growth | Affects demand across various industries | Finance: +4.3% (2024), Healthcare: +5.2% (2025) |

| Currency Exchange | Impacts revenue and costs | Strong USD reduces international sales value |

| Inflation | Raises operational costs | US Inflation ~3.1% (2024) |

| Market Competition | Drives need for competitive pricing | AI market expected to $1.81T by 2030 |

Sociological factors

Societal demand for data literacy is surging, boosting the need for analytics skills across industries. This trend boosts the potential user base for SAS. Research indicates a 23% rise in data analyst roles since 2020. This growth highlights the need for accessible platforms and comprehensive training programs.

Changing work norms, including remote and hybrid models, shape software use. SAS adapts with cloud solutions and accessibility features. Remote work's growth, with 30% of U.S. workers remote in 2024, boosts demand for SAS's collaborative tools. This shift affects SAS's market approach and product development.

Societal concerns about AI ethics, including algorithmic bias, are increasing, influencing the demand for responsible AI. SAS addresses these concerns with trustworthy AI solutions and governance frameworks. A 2024 study showed 60% of consumers worry about AI bias. Ethical AI is becoming a key market driver.

Privacy Expectations of Individuals

Privacy expectations are evolving rapidly, with individuals highly concerned about data collection and usage. This impacts customer demands for robust privacy features in software. A 2024 survey showed 79% of consumers are very or somewhat concerned about data privacy. This concern drives the need for transparent data practices. Companies like SAS must prioritize user privacy to maintain trust and competitiveness.

- 79% of consumers are concerned about data privacy (2024).

- Increased demand for data protection features.

- Importance of transparent data handling.

- Impacts customer trust and loyalty.

Social Impact and Corporate Social Responsibility

There's increasing pressure on businesses to be socially responsible. SAS actively works on sustainability, education, and using data for social good, reflecting these values. In 2024, global ESG investments hit $40.5 trillion, showing the importance of corporate social responsibility. SAS's efforts include programs that promote STEM education, aligning with the growing societal emphasis on corporate citizenship and ethical practices.

- 2024: ESG investments hit $40.5T globally.

- SAS focuses on STEM education programs.

- Societal values emphasize corporate citizenship.

Evolving societal expectations significantly affect SAS. Privacy concerns drive demand for robust data protection, with 79% of consumers worried in 2024. SAS adapts by prioritizing user privacy, essential for trust. Corporate social responsibility is key; 2024's ESG investments totaled $40.5T.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Data Privacy | Demand for privacy features | 79% consumer concern |

| Ethical AI | Trustworthy AI demand | 60% AI bias concern |

| Corporate Social Responsibility | Focus on ESG | $40.5T ESG investment |

Technological factors

SAS heavily relies on AI and machine learning. In 2024, the global AI market was valued at approximately $200 billion. SAS's ability to innovate with AI, including generative AI, is key. This helps them stay ahead in the competitive analytics market. SAS invests significantly in R&D, with over 25% of revenue allocated in 2024.

Cloud computing significantly influences the software industry, with SAS actively expanding its cloud offerings. SAS Viya, for instance, is available on major cloud platforms. In 2024, the global cloud computing market was valued at $670 billion, projected to reach $1.6 trillion by 2030. This shift allows SAS to offer scalable solutions.

The surge in big data requires advanced data management. SAS excels in handling, integrating, and analyzing extensive, varied datasets. In 2024, the big data analytics market reached $280 billion, growing 13%. SAS's data capabilities are central to its offerings. This is supported by a 10% increase in SAS's revenue in 2024.

Development of Synthetic Data

The rise of synthetic data is a significant technological factor for SAS. This is especially true given the growing importance of data privacy. SAS's strategic move to acquire Hazy Data demonstrates its proactive approach. This acquisition allows for the integration of synthetic data generation, aligning with current market demands. In 2024, the synthetic data market was valued at $1.9 billion, and is projected to reach $3.7 billion by 2029.

- Market growth: The synthetic data market is expanding rapidly.

- Privacy focus: Synthetic data helps meet stringent data privacy rules.

- SAS strategy: SAS is actively integrating synthetic data solutions.

Internet of Things (IoT) and Edge Computing

The Internet of Things (IoT) and edge computing are rapidly expanding, creating vast amounts of data that demand immediate analysis. SAS excels in offering analytics solutions tailored for data from connected devices, presenting a significant technological opportunity. This capability allows SAS to capitalize on the increasing need for real-time insights. The global IoT market is projected to reach $2.4 trillion in 2025.

- Real-time Analytics: SAS solutions enable immediate data analysis.

- Market Growth: IoT market expected to hit $2.4T by 2025.

- Data Volume: IoT generates massive data streams.

SAS utilizes AI and machine learning, benefiting from the $200 billion AI market (2024). Cloud computing, part of the $670 billion market in 2024, allows scalability, with growth to $1.6T by 2030. SAS manages big data in the $280 billion analytics market, growing by 13%. Its proactive steps are focused on the expanding synthetic data arena.

| Technology Aspect | Market Size (2024) | SAS's Strategy/Action |

|---|---|---|

| AI | $200 Billion | Innovation in Generative AI and R&D spend (25%+ of revenue) |

| Cloud Computing | $670 Billion (growing to $1.6T by 2030) | Expanding cloud offerings, e.g., SAS Viya |

| Big Data Analytics | $280 Billion (13% growth) | Focus on data handling and integration, with revenue growth of 10% |

| Synthetic Data | $1.9 Billion (projected to $3.7B by 2029) | Acquisition of Hazy Data |

Legal factors

SAS must comply with data privacy regulations like GDPR and CCPA. These laws impact how SAS collects, processes, and stores personal data. Failing to comply can lead to hefty fines; for example, GDPR fines can reach up to 4% of annual global turnover. As of early 2024, the global data privacy market is valued at over $70 billion, reflecting the significance of these regulations.

SAS heavily relies on protecting its software through patents, copyrights, and trademarks, crucial for its market presence. Recent legal battles over software copyrights and functionality can significantly affect SAS's operations. In 2024, software copyright infringement cases saw a 15% rise, impacting tech firms like SAS. The company's ability to defend its intellectual property is crucial for maintaining its competitive edge and revenue, which reached $3.2 billion in 2024.

Software licensing agreements and customer compliance remain crucial legal aspects for SAS. In 2024, the software industry faced approximately $46.7 billion in losses due to unlicensed software use. Managing intricate licensing models and addressing non-compliance are vital for revenue protection. SAS must navigate these legalities to avoid penalties, which, in severe cases, can exceed $100,000 per instance of infringement.

Government Contracting Regulations

SAS faces stringent government contracting regulations when bidding for projects. These regulations, which vary by region, can significantly impact SAS's operational costs and project timelines. Non-compliance can lead to hefty penalties and loss of contracts. The U.S. government alone spent over $700 billion on contracts in fiscal year 2023.

- Compliance Costs: Meeting regulatory requirements increases administrative and operational expenses.

- Contractual Risks: Failure to adhere to regulations can result in contract termination and legal challenges.

- Market Access: Understanding and navigating these laws are essential to accessing government contracts.

- Competitive Advantage: Effective compliance can provide a competitive edge by ensuring contract eligibility.

Export Control Regulations

SAS, as a global software provider, is heavily impacted by export control regulations. These regulations, such as those enforced by the U.S. Department of Commerce's Bureau of Industry and Security (BIS), dictate where and to whom SAS software and related technologies can be exported. Non-compliance can lead to severe penalties, including significant fines and restrictions on future exports. In 2024, the BIS imposed over $100 million in penalties for export control violations across various industries.

- Export controls limit software distribution to sanctioned countries, impacting SAS's market reach.

- Regulations also cover specific technologies and end-users, requiring SAS to screen all transactions.

- SAS must maintain robust compliance programs, including due diligence and training, which adds to operational costs.

SAS's legal landscape includes data privacy laws like GDPR and CCPA; non-compliance could cost a fortune. Protecting its software IP through patents, copyrights, and trademarks is essential for market competitiveness; recent infringement cases rose 15% in 2024. Licensing and customer compliance, coupled with government contract regs and export controls, profoundly impact operations.

| Legal Factor | Impact | 2024/2025 Data |

|---|---|---|

| Data Privacy | Non-compliance fines and costs. | Data privacy market valued at $70B+. |

| IP Protection | Litigation costs & loss of revenue. | Software copyright infringement up 15%. |

| Licensing & Compliance | Losses due to unlicensed software. | Industry losses ~$46.7B in 2024. |

Environmental factors

Data centers are vital for cloud-based analytics, but they use vast amounts of energy. In 2023, data centers globally consumed about 2% of total electricity. SAS is working to cut its environmental impact. This includes boosting data center energy efficiency and using renewables. For example, Google aims for 24/7 carbon-free energy in all data centers by 2030.

Growing climate concerns and sustainability pushes affect all sectors. SAS tackles its carbon footprint with emission reduction targets. The company invests in clean energy, supporting global goals like the Paris Agreement. In 2024, SAS aims to reduce emissions by 50% compared to 2019 levels. This aligns with sustainability trends.

Environmental reporting and disclosure standards are increasing, especially concerning greenhouse gas emissions. SAS must accurately track and report its environmental performance to meet these requirements. In 2024, the SEC finalized rules mandating climate-related disclosures for public companies. SAS leverages its software for environmental data management and reporting. The global market for environmental, social, and governance (ESG) reporting software is projected to reach $1.5 billion by 2025.

Customer Demand for Sustainable Solutions

Customer demand for sustainable solutions is surging, and SAS is well-positioned to capitalize on this trend. Clients are actively seeking tools to meet their environmental targets, creating a significant market opportunity. SAS's software provides capabilities for environmental data analysis, resource optimization, and impact reporting. This enables businesses to make data-driven decisions that support sustainability initiatives and gain a competitive edge.

- The global green technology and sustainability market is projected to reach $74.6 billion by 2025.

- A 2024 study found that 70% of consumers are willing to pay more for sustainable products.

Resource Consumption and Waste Management

SAS addresses resource consumption and waste management beyond energy use. This involves water usage and recycling initiatives at its facilities. For instance, in 2024, SAS reported a 15% reduction in water consumption across its global sites. The company's waste diversion rate, including recycling and composting, reached 70% in the same year. These efforts reflect SAS's commitment to minimizing its environmental footprint.

- Water usage reduction of 15% in 2024.

- Waste diversion rate of 70% in 2024.

- Implementation of recycling and composting programs.

Environmental factors significantly shape SAS’s operations. Data centers, crucial for cloud services, require substantial energy; Google targets carbon-free energy by 2030. SAS is committed to emissions reduction and aims for a 50% reduction compared to 2019 levels. Regulatory standards are increasing; the ESG reporting software market could hit $1.5 billion by 2025. Consumers increasingly demand sustainability, creating market opportunities for companies like SAS.

| Environmental Aspect | SAS Initiative | 2024 Data |

|---|---|---|

| Energy Use | Data Center Efficiency, Renewables | Data centers consume 2% of global electricity |

| Emissions | Emission Reduction Targets | 50% reduction target from 2019 levels |

| Resource Management | Water Reduction & Recycling | 15% water reduction, 70% waste diversion |

PESTLE Analysis Data Sources

Our SAS PESTLE Analysis leverages data from financial markets, regulatory bodies, industry research, and government statistics. We ensure accurate, current information.